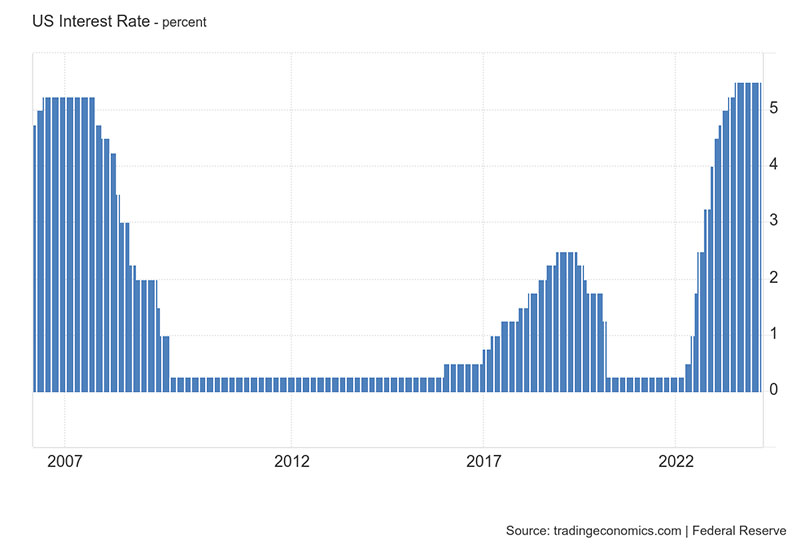

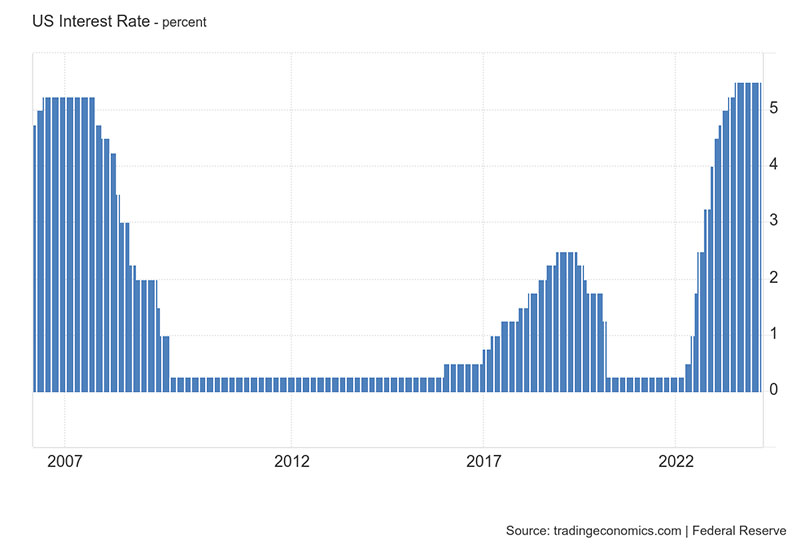

Six months ago, the financial markets were giddy with excitement as economists universally predicted three to six rate cuts in 2024. The game plan was as follows: inflation subsides, the economy slows, unemployment ticks upward and the Central Bank cuts the Fed Funds Rate (FFR) in an effort to achieve its dual mandate of stable prices and full employment. A more accommodating FFR of 4.00-4.50% appeared to be a good landing spot from the current 5.25-5.50%, the highest level since 2006.

(1)

Historical Fed Funds Rate (FFR)

For months, Federal Reserve Chair Jerome Powell offered assurances about rate cuts in 2024, arguing that periodic hotter-than-expected inflation reports were all part of the "bumpy" road to the Fed’s 2% inflation target. In the past several weeks, those proclamations have been tempered.

On Tuesday, April 16

th, while speaking at an event in Washington, D.C., Powell said, "The recent data has clearly not given us greater confidence that inflation is headed towards our 2% target and instead indicates that it's likely to take longer than expected to achieve that confidence." The message from Powell is clear: Rates are going to stay higher for longer than expected.

(2)

Over the past three months, inflation has proven to be much harder to eradicate than expected. Any consensus on rate cuts from Wall Street observers has evaporated. Currently, rate cut estimates range from two to three rate cuts -- to no rate cuts -- to even a rate hike or two.

(3) (4) The increased uncertainty has led to some additional market volatility, and overall weakness, in the month of April.

There’s an old saying that sums up the various views on rates. It goes "we live in the same building but have vastly different views."

Jerome Powell

Over the past ten years we have written at least a dozen times that the equity markets enjoy low rates like most of us enjoy ice cream. If investors get a simple whiff of a rate cut, markets rally. If investors get a whiff of higher for longer, or even simply higher, the markets sell off.

Need proof? Since November of last year when Jerome Powell first indicated we "could" be at the end of the tightening cycle and the next Fed move would be a cut (although "when" was up for debate) equity markets started a rally that would be composed of five up months in a row (November, December, January, February and March) and would propel the S&P 500 higher by 21.0% and the NASDAQ higher by 22.3%. Now that we have officially entered rate cut uncertainty territory, and the Fed could revive the "higher for longer" mantra, the equity markets softened in April, -4.1% and produced the first negative month since October of 2023 when the S&P 500 declined -2.1%.

Why a rate cut pivot by the Fed? Both the Consumer Price Index (CPI)

(6) and Personal Consumption Expenditures (PCE) Index, which is the Fed’s preferred inflation gauge,

(7) (8) remain above the Fed’s 2.0% target and increased faster than expectations in the most recent month.

(9)

In addition, on April 25th, the initial Q1 2024 estimate of U.S. GDP came in at a noticeably slower, but non-anemic, annualized rate of 1.6%. Accordingly, the WT Wealth Management Investment Committee is carefully weighing the increasing possibility of no rate cuts in 2024 and how the equity markets might react.

Now, do I think an investor would rather have a weak economy, increasing unemployment, and rate cuts OR a good economy, low unemployment, and no rate cuts? I think the latter. The equity markets are forward-looking and just as quickly as prices adjusted to the prospect of rate cuts, they can adjust back.

This is an excellent time to revisit your portfolio with your Advisor and check on progress toward your financial goals. If you have any questions about the Fed, inflation or the economy in general and how WT Wealth Management’s Investment Committee is proactively constructing client portfolios, please don’t hesitate to reach out.

Sources

- Fed Funds Target Rate History (Historical)

fedprimerate.com

- How Jay Powell and the Fed pivoted back to higher for longer

finance.yahoo.com

- In this article a “rate cut” refers to a 0.25% reduction in the FFR, which historically has been the minimum increment that the Fed changes rates. Under certain circumstances, the Fed has the ability to, and has done in the past, change rates by greater than 0.25% at one time.

- Fed Governor Bowman says additional rate hike could be needed if inflation stays high

cnbc.com

- Consumer prices rose 3.5% from a year ago in March, more than expected

cnbc.com

- In a report released April 10th, the CPI accelerated at a faster-than-expected pace in March. The CPI, a broad measure of goods and services costs across the economy, rose 0.4% for the month, putting the 12-month inflation rate at 3.5%, or 0.3% point higher than in February. The “core” CPI, which excludes food & energy components, also accelerated 0.4% on a monthly basis while rising 3.8% from a year ago. Neither of these were moves in the proper direction.

- In a report released Friday, April 26th, the “core” PCE index, which excludes food and energy, increased 2.8% from a year ago in March, the same as in February and above the 2.7% estimate from the Dow Jones consensus. Including food and energy, the All-Items PCE index increased 2.7%, compared with the 2.6% estimate. On a monthly basis, both measures increased 0.3%.

- The Fed favors the PCE Price Index over the Consumer Price Index (CPI) for several reasons. Firstly, the PCE Price Index uses a formula that adapts to changes in spending habits, reducing the upward bias inherent in the CPI’s fixed-weight approach. Secondly, the PCE Price Index’s historical data can be revised to incorporate new information and improvements in measurement techniques.

- Wholesale prices rose 0.2% in March, less than expected

cnbc.com