Along this life journey, we experience times of celebration coupled with moments of challenge. As we process the daily news events and their effect on the stock market, it is easy to feel as though, "We can't see the forest for the trees." During these times, it can be beneficial to pause, step back and consider the situation in its entirety.

Being an investor is not always easy. Especially now, considering the rise in conflict between Russia and Ukraine. Such geopolitical shifts can be the root of anxiety and leave us wondering how they might significantly impact the financial market or personally affect our investment portfolio

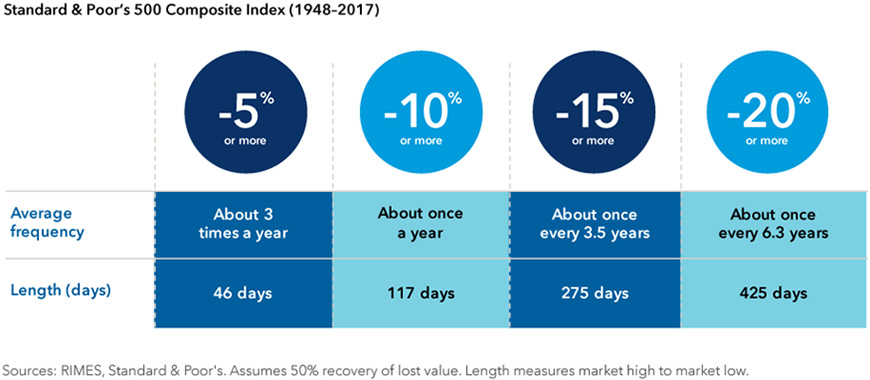

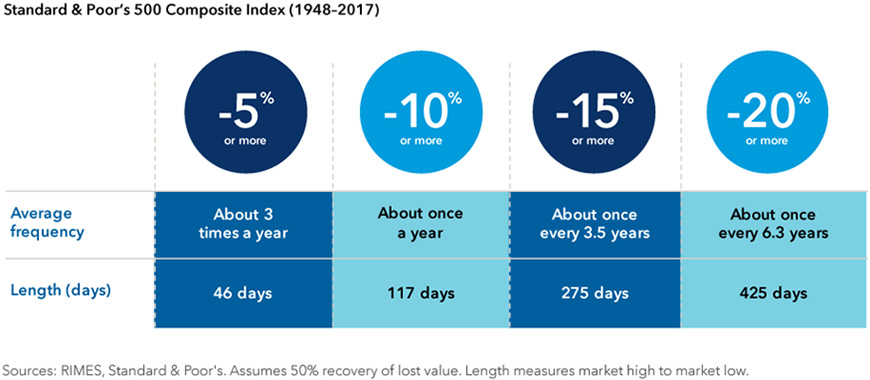

Historically, moderate drops in stocks or commodities are common in most years and tend to be brief. During market downturns of 10%, markets typically recover within four to five months. Maintaining a strategic approach while girding yourself with a winner's outlook can help you to remain calm while maintaining focus on your longer-term financial goals.

Understandably, a common response to periods of market downturns is to safeguard your investments. With that in mind, remember, "time is on your side." Based upon previous market downturns of 10%, here are two investment strategies which I highly recommend for a financially successful outcome.

- Stay the course (No course of action needed)

- Maintain your focus on longer-term investments, as financially feasible, while giving the markets time to recover.

- The US stock market is historically resilient and has a past record of recovering from short-term 10% downturns and typically bounces back quickly (On average 4-5 months). See table below.

- The markets are historically positive 4 out of every 5 years. So, if you can be patient, you will usually be well rewarded for such discipline over time.

- Maintain a broadly diversified portfolio appropriate for your investment objectives and risk profile.

- Take advantage of market dips

- If financial resources allow, purchasing more stock while it's "on sale" (i.e., prices are down) can be beneficial. A rebound to the 10% pre-dip market level means a 10% increase on your investment. That's called "buying the dip."

- A loss will not occur until your stock is sold. Large and established companies will usually rebound. So, one of the best places to be invested to recover from a market decline is to stay invested in the same stock positions.

- Occasionally clients may utilize market dips as an opportunity to shift up the risk in their portfolio by selling out of certain diversified holdings and using those proceeds to buy equities at a lower price. This strategy can work for those investors who don't have additional capital to contribute but are willing to accept more risk in their portfolio.

Based upon my experience, a total withdrawal from a down market has proven to be unsuccessful for clients who chose this route. Oftentimes, the client who exits the market during a downturn is hopeful to reinvest as the market improves. However, I have observed significant market increases which happen suddenly. Thus, leaving the uninvested client excluded from the benefit of a market recovery. Therefore, I do not recommend quitting the market, and then restarting. Quitting the market during a downturn strategy reminds me of a recursive Murphy's Law. Although it may strongly appear that washing your car results in rain, "Washing your vehicle in order to make it rain does not work!" Although a total withdraw from a volatile market may seem tempting, a total withdraw for this reason is a recipe for a "guaranteed loss."

As an investor, I am not immune to having unsettled feelings regarding market fluctuations. In previous articles I have discussed how it can be helpful to "

take your emotions out of investing." For this reason, "I eat what I cook" and have the WTWM Investment Team manage my portfolio so that the investments do not contain bias.

To remain positively focused, it can be a helpful reminder to lessen the amount of time spent following the negative news. Oftentimes, media outlets have an agenda which tends to sensationalize topics which support their cause. So, turn off the negative news!

Please know that during a market fluctuation, I am available to assist you with navigating the journey. Each client portfolio is uniquely tailored to reflect and support the individual based upon their financial goals and risk tolerance. Together, we can reassess your current portfolio and make any needed adjustments to support your financial objectives. If you are interested in taking advantage of option number 2, please reach out so that

we can come up with a game plan custom tailored to you.

If you have any questions about investing or are wondering how you can get started, I would be happy to meet with you for a no-cost consultation. You can e-mail me at

gleest@wtwealthmanagement.com or call

(928) 225-2474.

Sincerely,

Glenn Leest

Senior Investment Advisor