An Examination of the Statistical Impact of Presidential and Congressional Party Control on Stock Market Performance.

Have you ever wondered whether the stock market does better if the President of the United States is a Republican or Democrat? What about when the House or the Senate are under Republican or Democratic control?

As if the uncertainty and market turmoil caused by the Covid-19 pandemic weren't enough, a Presidential Election adds one more level of uncertainty to today's market. We are now in the middle of the Presidential debate season, which so far has been contentious yet riveting. Add to that President Trump's recent COVID-19 diagnosis... as you can imagine, election consequences are clearly the most frequently asked questions we hear from investors about the end of the year and 2021.

The Results and Balance of Power

Perhaps surprisingly to many investors, "past research relating U.S. stock market returns to the political party holding the Presidency mostly concludes that the S&P 500 generated higher returns under Democratic presidents than Republican presidents. However, Presidents share power conferred by the electorate with Congress (The House of Representatives and the Senate make up Congress). Does historical data confirm that Democratic control of Congress is also better for stock market returns than Republican control of Congress? Is control of the smaller Senate more decisive than control of the House of Representatives?" (1) The White House is not the entire story and Congressional power could be an even more important factor.

A variety of academic studies emerge every election cycle and seek to examine the relationship of the U.S. stock market (S&P 500 Index) returns to various combinations of party control across the Presidency, the Senate and the House of Representatives. (1)

Party in power data and annual levels of the S&P 500 Index reveal that Republican control of the Senate may be most favorable for U.S. stocks, as the average performance is strongest when Republicans control the Senate.

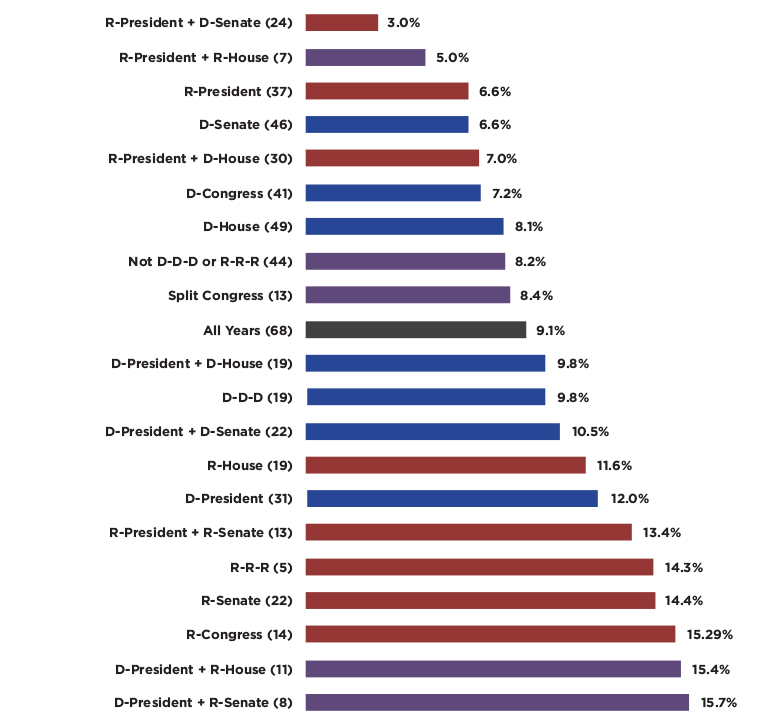

The following chart summarizes average calendar year S&P 500 Index returns for various combinations of party in power from 1952 through 2019, a 68-year sample period. The number in parentheses after each combination is the number of years during which each particular combination occurred. Some sub-samples are extremely small such as a Republican President + Republican House control with only 7 occurrences or Democratic President with Republican Senate with only 8 occurrences. Other sub-samples are quite large, such as Democratic Senate or Democratic House with 46 and 49 occurrences respectively. As a reference point, the average S&P 500 return over all 68 years was 9.1%.

Results broadly suggest that stocks generally perform better under a separation of powers when Democrats control the Presidency and Republicans control the House and/or Senate. Republican control of the Senate may be the most favorable party-in-power indicator for U.S. stocks. In the 8 occurrences there has been a Democratic President and Republican Senate the average S&P 500 return was 15.7%. This is followed closely with 15.4 with a Democratic President and Republican House.

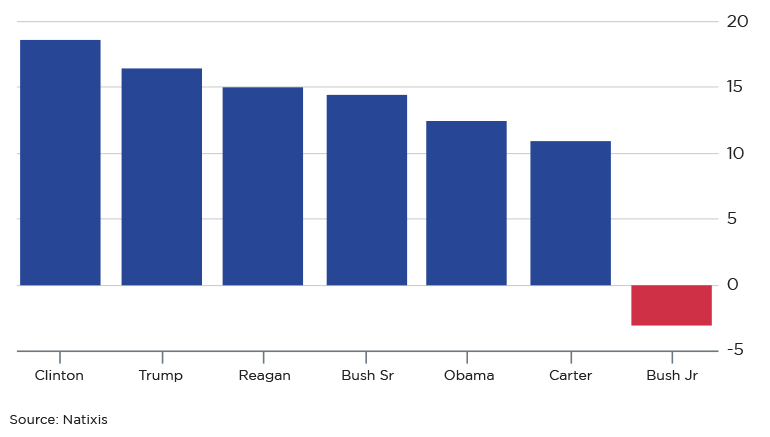

More recent results still seem to favor Democratic White House control. Natixis Investment Managers has compiled numbers since 1976 (i.e., Carter through Trump). They found that the average annualized return under Democratic presidents has been 14.3%, against 10.8% under Republicans.

US equities: annualized return

A compounding of the parties' market performance shows that a continuously held Democratic portfolio outperforms a continuously held Republican portfolio by even more: the Carter-Clinton-Obama Democratic presidencies produced an average annualized return of 14.9%, against 4.9% for the Republican Reagan-Bush Snr-Bush Jr-Trump presidencies. (2)

Looking Ahead to November

The 2020 Election is less than 30 days away and we could very well see a change in the White House. Regardless of the result, the best thing for every American investor is a swift conclusion and a clear winner. Markets despise uncertainty and tend to thrive once uncertainty is eliminated or reduced.

With the current Republican edge of 53-47 in the Senate, investors will certainly closely follow results in states like Arizona and Maine where the incumbent Republican Senator is in for a very difficult fight. Remember, in the event of a 50/50 split in the Senate the Vice President casts the deciding vote - giving Senate control to the party in the White House.

Presidential and Congressional elections are just one factor among many that can influence your investment portfolio. Like all other factors, they are not solely determinant and move in context with many other concurrent influences.

The stock market is a complex adaptive system in which cause and effect are not easy to link. Market movements, particularly over short periods such as a presidential term (yes, four years is a short-term investment period), are influenced by factors too innumerable to identify, including randomness, and can be more effected by the general state of the global and domestic economy, including factors such as optimism, valuations, profits, business cycles, interest rates, tax levels, employment vs unemployment, etc. And, as in the case of 2020/2021, completely unpredictable events such as a global pandemic and the uncertain future of testing, vaccines and continued reoccurrences can have significant impact on the months and even years ahead.

If you would like to discuss more about the impacts of the upcoming elections, or if you have any other questions about your investments, please do not hesitate to reach out to your advisor. We are happy to spend time answering your questions to ensure that your portfolio matches your objectives in the current environment.

SOURCES:

(1) LeCompte, S. (2020, September 18).

CXO Advisory Group.

Retrieved October 06, 2020 from CXO Advisory Group online (cxoadvisory.com)

(2) Vincent, M. (2020, March 05).

Which US president is best for stock markets - a Republican or a Democrat?

Retrieved October 06, 2020 from Financial Times online (ft.com)

WT Wealth Management is an SEC registered investment adviser, with in excess of $100 million in assets under management

(AUM) with offices in Flagstaff, Scottsdale, Sedona and Tucson, AZ along with Jackson Hole, WY and Las Vegas, NV.

WT Wealth Management is a manager of Separately Managed Accounts (SMAs). With SMAs, performance can vary widely

from investor to investor as each portfolio is individually constructed and managed. Asset allocation weightings are

determined based on a wide array of economic and market conditions the day the funds are invested. In an SMA, each

investor may own individual Exchange Traded Funds (ETFs), individual equities or mutual funds. As the manager we have

the freedom and flexibility to tailor the portfolio to address an individual investor's personal risk tolerance and investment

objectives - thus making the account "separate" and distinct from all others we manage.

An investment with WT Wealth Management is not insured or guaranteed by the Federal Deposit Insurance Corporation

(FDIC) or any other government agency.

Any opinions expressed are the opinions of WT Wealth Management and its associates only. Information offered is neither

an offer to buy or sell securities nor should it be interpreted as personal financial advice. Always seek out the advice of

a qualified investment professional before deciding to invest. Investing in stocks, bonds, mutual funds and ETFs carries

certain specific risks and part or all of an account's value can be lost.

In addition to the normal risks associated with investing, narrowly focused investments, investments in smaller companies,

sector and/or thematic ETFs and investments in single countries typically exhibit higher volatility. International, Emerging

Market and Frontier Market ETFs, mutual funds and individual securities may involve risk of capital loss from unfavorable

fluctuations in currency values, from differences in generally accepted accounting principles or from economic or political

instability that other nations experience. Individual bonds, bond mutual funds and bond ETFs will typically decrease in

value as interest rates rise. A portion of a municipal bond fund's income may be subject to federal or state income taxes or

the alternative minimum tax. Capital gains (short and long-term), if any, are subject to capital gains tax.

Diversification and asset allocation may not protect against market risk or investment losses. At WT Wealth Management, we

strongly suggest having a personal financial plan in place before making any investment decisions including understanding

personal risk tolerance, having clearly outlined investment objectives and a clearly defined investment time horizon.

WT Wealth Management may only transact business in those states in which it is registered, or qualifies for an exemption

or exclusion from registration requirements. Individualized responses to persons that involve either the effecting of

transactions in securities, or the rendering of personalized investment advice for compensation, will not be made without

registration or exemption. WT Wealth Management's website is limited to the dissemination of general information

pertaining to its advisory services, together with access to additional investment-related information, publications, and

links.

Accordingly, the publication of WT Wealth Management's website should not be construed by any consumer and/or

prospective client as WT Wealth Management's solicitation to effect, or attempt to effect transactions in securities, or the

rendering of personalized investment advice for compensation, over the internet. Any subsequent, direct communication

by WT Wealth Management with a prospective client shall be conducted by a representative that is either registered or

qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

A copy of WT Wealth Management's current written disclosure statement discussing WT Wealth Management's registrations,

business operations, services, and fees is available at the SEC's investment adviser public information website (www.

adviserinfo.sec.gov) or from WT Wealth Management directly.

WT Wealth Management does not make any representations or warranties as to the accuracy, timeliness, suitability,

completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to WT Wealth

Management's web site or incorporated therein, and takes no responsibility therefor. All such information is provided solely

for convenience purposes and all users thereof should be guided accordingly.

Reach John directly at 480-589-7522

or by using the contact form below.