Politicians like to be re-elected. It's how they keep their job. It's always been that way. Decades ago, after analyzing many presidential elections, political strategists worked out what factor appeared to move the vote the most... the answer?: the state of the general economy and/or the labor market in the 6-month run up to the election.

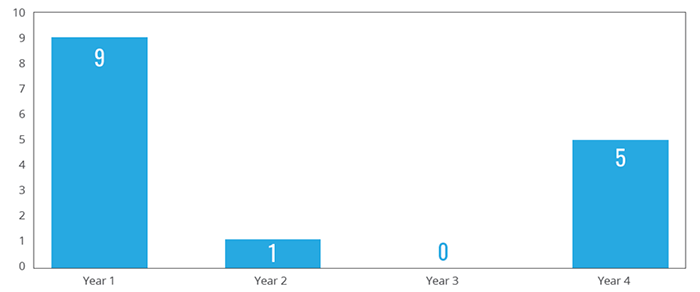

Typically, the first year after the election of a new President is the weakest time in the stock market. The second year is "slightly" better than the first, but not significantly. This historical trend of weakness in the stock market during the first two years of any presidency is due to the fact that political priority is given to tax legislation, social welfare, and the environment rather than efforts to strengthen the economy. This is revealed in typical campaign promises rendered by candidates. In the third and fourth year of a President's administration, the President begins to make laws tailored towards strengthening the economy. The President is back in campaign mode, striving to win votes and endorsements.

(1)

Even brilliant executive performances immediately following an election are apparently lost in the mists of time and do not seem to count as much when Election Day rolls around again. As historical research has shown, "leading" a strong economy is one of the best ways to win votes. Therefore, in the last two years of a Presidency (remember, the economy is large and complicated and has plenty of inertia – like turning a battleship), the President is likely to prioritize programs that aim to slowly and consistently heat up the economy just in time for re-election.

So, almost like clockwork, on December 29, 2022 (i.e., the 4th quarter of year 2 in this Presidential cycle) President Biden signed into law Congress' SECURE 2.0 Act of 2022, containing 92 provisions to promote savings, boost incentives for business, and offer more flexibility to those saving for retirement.

(2)

If such economic stimulus programs succeed, it's reasonable to expect a positive effect on the stock market as well. Interestingly, the stock market is far more sensitive to this additional stimulus than the general economy. We saw this most recently with the Covid stimulus in 2020 and 2021 that ignited an explosion of prices within the equity markets.

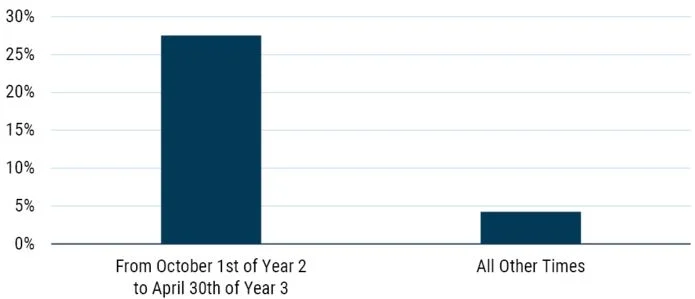

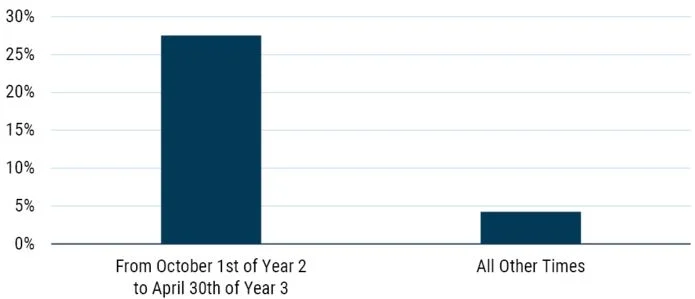

The important facts right now are that for 7 months of the Presidential Election Cycle, from October 1st of the second year (October 1, 2022 in this cycle) through April 30th of the third year (April 30, 2023 in this cycle), the returns, since 1932, equal those of the remaining 41 months of the four-year cycle! This has a less than one-in-a-million probability of occurring by chance, and it has been about as powerful in the last 45 years as the previous 45 years. Pretty remarkable!

(3)

S&P 500 Annualized Real Total Return, 1932-2022

Source: Global Financial Data, GMO

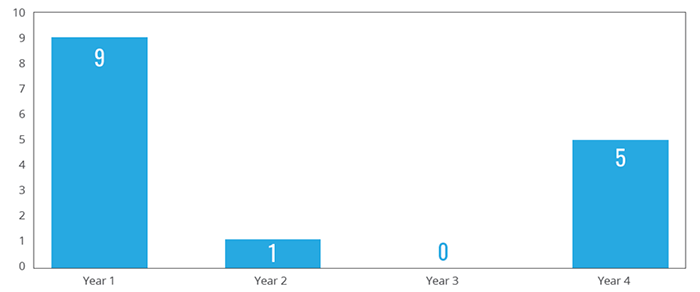

Furthermore, going all the way back to 1929, the US has never experienced a negative year of GDP growth during the third year of a President's term, regardless of who is sitting in the White House (see chart). We find the data point particularly compelling and timely given that most major Wall Street firms and US banks seem to be calling for a recession in 2023.

(4)

# of Recessions Starting in the Year of The Presidential Cycle (1929-2021)

Are the historical results of the Presidential Election Cycle Theory guaranteed? Of course not. But unlike many things in Washington, it does make sense that any sitting President would want a robust economy and low unemployment as they embark on the campaign trail. If either President Biden or Vice President Harris wish to run in 2024, they aren't likely to be successful in the midst of a deep recession and high unemployment.

Every economic cycle is different and fraught with unique challenges. Today we are in the midst of a battle with inflation. Anyone buy eggs lately? Inflation can only be fought by slowing the economy, creating less wage growth and higher unemployment. All of these diminish demand.

The stock market is a forward-looking, anticipatory gauge. As I have stated many times, markets react, evaluate and then re-price. Markets may have overdone their reaction last year, anticipating a deeper, more painful recession than what the economy may actually deliver. . . understandable with peaks in inflation indices above 9% in June 2022. The lengths to which the Fed would need to go to disrupt the employment, labor and economic markets in order to achieve its 2% inflation target remain largely undetermined.

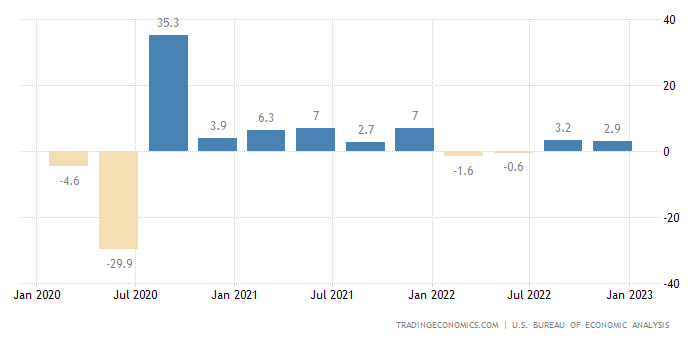

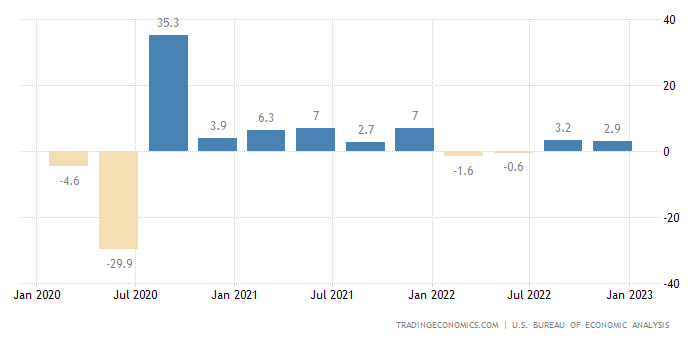

Last fall I was nearly certain we would have a difficult recession as a result of the Fed's battle with inflation. Going from near 0.0% on the Fed Funds Rate to 4.5% in 9 months is a tremendous shock to the US economy. As we near the end of the Fed's tightening cycle it appears more likely that the Fed may just thread the proverbial recession needle. The proof? The last two quarters of US GDP have been exceptional. Q3 2022 resulted in a 3.2% GDP print and Q4 2022's first estimate was 2.9%, both very healthy numbers.

GDP Growth Rate by Quarter

https://tradingeconomics.com/united-states/gdp-growth

Markets will undoubtedly remain volatile until the Fed gives us a clear signal that inflation is beaten, rates have reached their peak and the underlying economy continues to show the strength it has produced over the last two quarters. The last spoke in the hub will be job losses. If unemployment can stay below 4.5%, we could be in store for a very good second half of 2023. The traditional strength of this time period in the Presidential Election Cycle may simply enhance these underlying fundamentals.

The Presidential Election Cycle Theory may sound simple, almost too simple to be believed. But at WT Wealth Management, we like things that are simple in our constant efforts to pay attention to the subtleties of the larger economic and political environment. However, we enjoy even more the chance to pay close attention to you, our client, individually. Please reach out to your advisor with any questions you have as we navigate together the twists and turns that lie ahead.

Sources

- Presidential Election Cycle Theory - Explained

TheBusinessProfessor.com

- SECURE 2.0 Act of 2022

Investopedia.com

- After a Timeout, Back to the Meat Grinder!

GMO.com

- The Other Presidential Cycle

BrinkerCapital.com