As summer draws to an end, Labor Day signals cooler days and crisp evenings as fall takes hold.

2020 has been one for the record books – and not the good record books. It doesn't deserve a recap. We all know the struggles people around the world have endured physically, financially, and emotionally. We can only hope the worst days are behind us.

The nearly 31% intra-year decline on the S&P 500 feels like years ago, yet it took place little more than five months back (the S&P 500 reached its intra-day low on March 23rd). At the time, I privately hoped we could get client's accounts back to low-to-mid single-digit losses, thinking that would make the year a success. The uncertainty and scope of Covid-19 at the time was anyone's guess, but we developed a plan to mostly stay the course and went with it.

Over the past several months the financial markets, sparked by an unprecedented amount of fiscal and monetary policy stimulus, have generated a comeback worthy of 1970's icon Rocky Balboa. Since the March 23rd low, the S&P 500 has posted a 52% return, and the NASDAQ has produced a jaw-dropping 70% return. "Yo Adrian!"

YTD, through August 28th, the S&P 500 is higher by 8.5%, and the NASDAQ is higher by 30%. In an industry with often wild bombastic predictions, nobody would have anticipated this comeback last spring: especially when considering only 87,000 travelers crossed a TSA checkpoint on April 14th -- a 97% decline from the same day the year prior.

As a result of this extraordinary rebound we have decided that caution moving ahead is the prudent plan. This past week, we reviewed every client's account. In most accounts, we are now holding record amounts of cash and cash equivalents (non-risk assets) and will continue to do so through the Presidential Election.

This decision was not made lightly. Raising cash and becoming more defensive, when the markets seemingly go up every day, is counter-intuitive to most investors. Decades of experience have shown us that when everyone assumes the coast is clear, bad things can happen. This is by no means a market call of impending doom; it is a cautious pause.

Three factors went into our decision:

- According to Yardeni Research, September and October are 2 of the 3 weakest performing months of the year for the S&P 500 (February is the 3rd). (1)

- The November 3rd Presidential Election will generate higher levels of volatility in the financial markets as investors position themselves against the unknown in a more defensive nature ahead of the election. In fact, in 2016, during the 15 trading days before the election, 14 were negative.

- Our clients' accounts have benefited dramatically from our decisions in March and April. In nearly every case, we are far ahead of where I thought we would be on September 1st. In almost every case, I believe clients would be fully satisfied with their account's performance for the year if today were December 31st. So let's work toward preserving that.

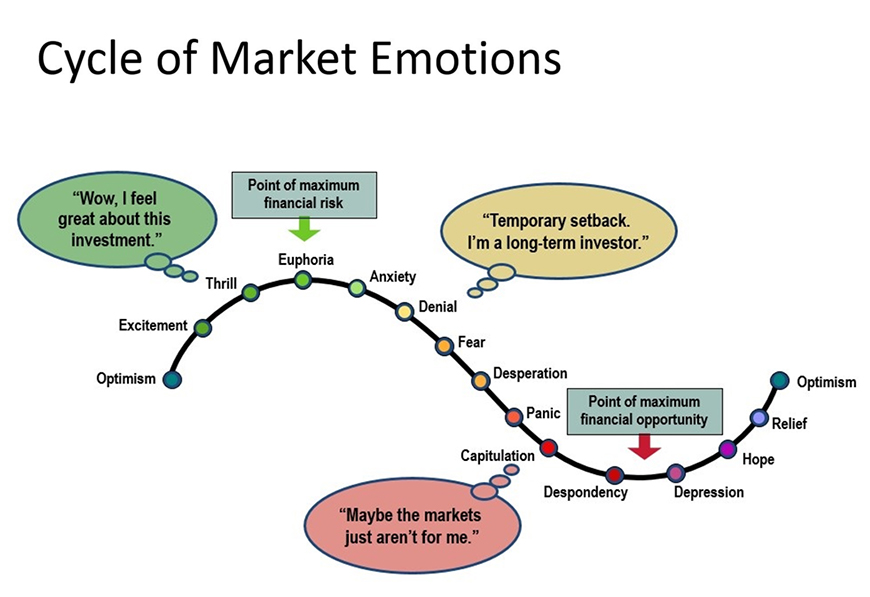

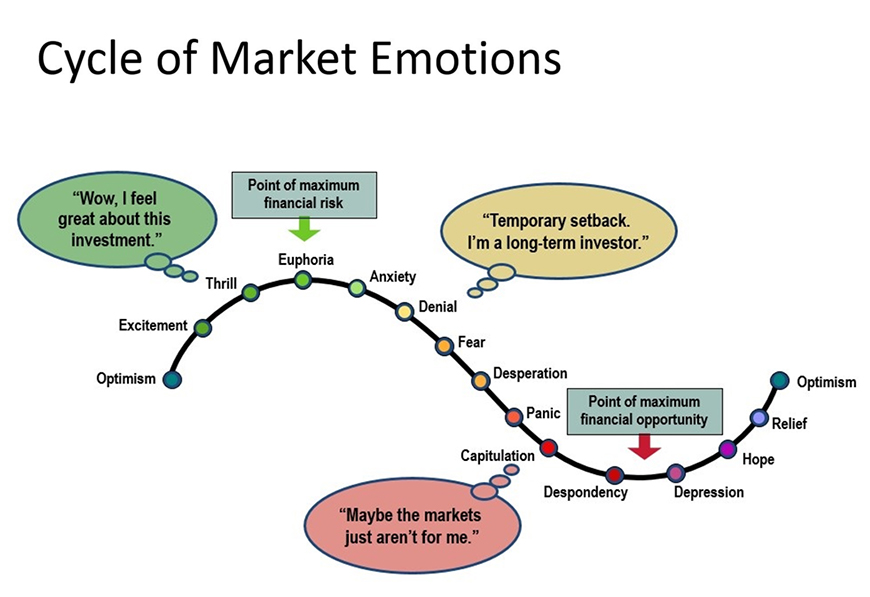

As market indexes sit at all-time highs it reminds me of the chart I use as a screen saver at the office. I have included it below.

Have we reached Euphoria? I'm not sure, but it seems as if we are at least at the "thrill" level. Many newer investors that have entered the financial markets since the March lows have yet to see a difficult trading stretch. In fact, since March 23rd, the NASDAQ and S&P 500 have only had a three-day losing streak one time each. Some uncomfortable volatility could lead many investors to seek refuge, pushing prices lower.

Investing is never easy. When investors are fearless, it's time to be careful.

If you would like to speak with me directly about your account and your personal situation, please call me at

480.589.7522.

Sincerely,

John Heilner

References

1 Yardeni Research