In 1952, Harry Markowitz, a Nobel Prize winner and one of the founders of modern portfolio theory, said, "Diversification is the only free lunch in investing." Indeed, diversification has been a consistent theme that we have preached to you, our clients, throughout the years. In many ways, diversification is the foundation of our investment approach. We have many real estate professionals as clients, and we feel: "Diversify, diversify, diversify" is just as important as the real estate mantra: "Location, location, location." And yet, what happens when diversification doesn't work? What happens and how should investors react when the golden rule of investing proves false? Welcome to 2018 - the year we all had to pay for our lunch.

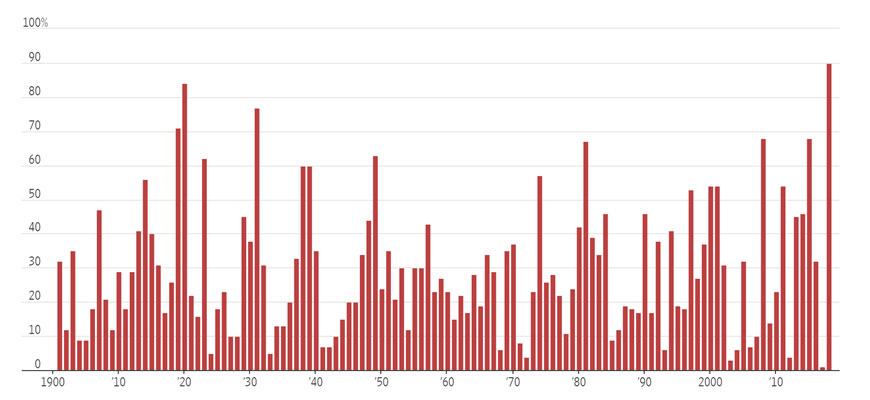

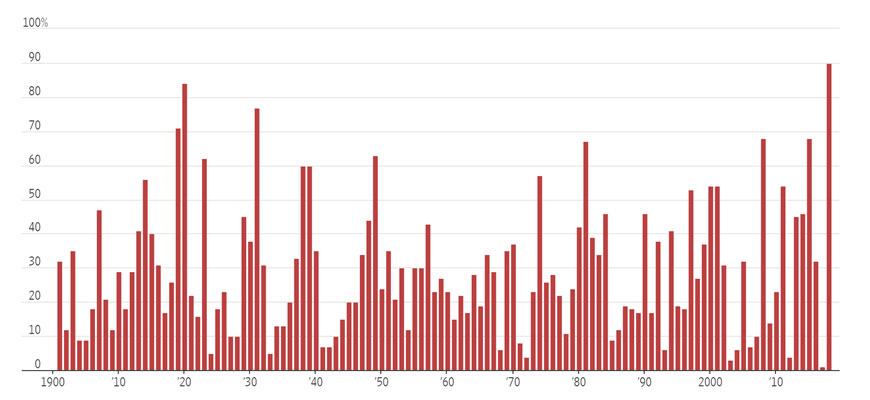

And, the lunch was rather expensive. In fact, a study by Deutsche Bank tracking 70 different asset classes shows that 90% of them "are posting negative total returns in dollar terms for the year through mid-November." As you can see from the chart below, that is a record since Deutsche Bank started tracking in 1901. It may feel even worse, particularly after the year we had in 2017. As you can also see, 2017 was a record-low year for negative returns among asset classes. Definitely a tale of two years in the market.

Under Pressure

A Record share of asset classes have posted negative total returns this year,

according to Deutsche Bank data going back to 1901.

Note: Returns are in U.S. dollars. Data for 2018 are as of mid-November.

Note: Returns are in U.S. dollars. Data for 2018 are as of mid-November.

Sources: Deutsche Bane; Bloomberg Finance LP, GFD

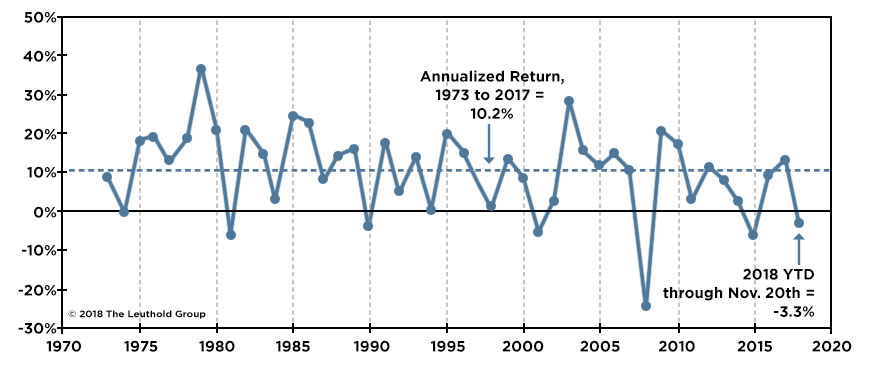

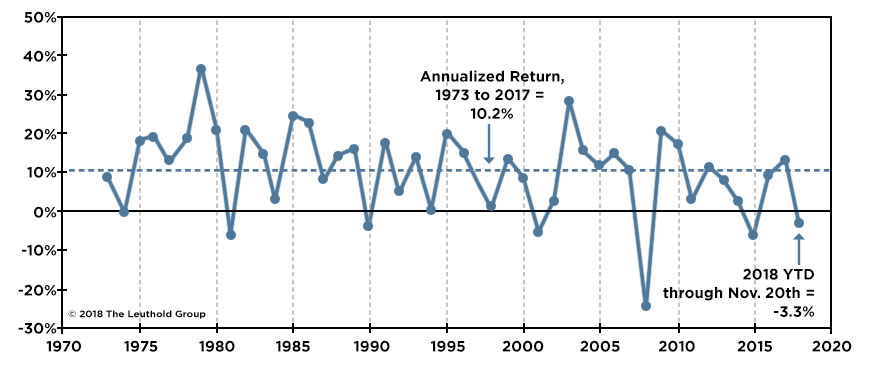

Historically, portfolios that diversify their assets among the seven major asset classes (commodities, large U.S. stocks, small U.S. stocks, foreign developed-market stocks, real-estate investment trusts, 10-year U.S. Treasury Bonds, and gold) have done extremely well. According to a study by the Leuthold Group, from 1972 to 2017, if assets were equally allocated into each asset class and rebalanced annually, the annualized return would have been 10.2% as you can see in the next chart. That nearly matches the S&P 500's return of 10.4% with significantly less volatility.

Annual Returns for the All Asset No Authority (AANA) Portfolio

(Equal Weightings Across Seven Assets)

However, in 2018, this same strategy has not worked for many reasons. Stocks, in general, have struggled in the latter half of the year from worries of trade wars, higher interest rates, and concerns about a slowdown in economic growth. Rising interest rates have impacted bonds. Gold, the investor's safe-haven in times of uncertainty, is also down this year. Gold typically moves opposite the value of the dollar which has climbed with the rising U.S. interest rates. This perfect storm has coincided to negatively impact our investment portfolios, despite our efforts to carefully place our clients' eggs in different baskets.

The good news? If the trend holds for this year, it will be just the seventh time in 46 years that diversification did not work. That's just 15% of the time. The other "good" news is that some investors look at 2018 as the market reacting to 2017 in a "healthy, albeit painful readjustment of expectations" (The Wall Street Journal). While we would all like to have the 2017 markets every year, we know the reality is that moderate, steady growth resulting from a combination of both bull and bear markets is more sustainable.

They say misery loves company. As you know, at WT Wealth Management we invest our own money right alongside that of our clients, and our personal portfolios have struggled this year just as yours have. Despite what has been a challenging year, we believe such years are infrequent enough that diversification will remain the "free lunch" of investing.

With the recent market downturn, Barron's highlighted that the S&P 500 now "trades at its lowest valuation since the market drop in early 2016." In addition, there seems to be a growing belief by investors that the Fed will not need to raise rates as many times in 2019 as was previously forecast with inflation staying in check (particularly with oil prices falling), the recent stock market downturn, and Fed Chairman Powell's recent comments that interest rates are just below the range of estimates for neutral. The above, in combination with low inflation and continued solid economic growth, has us cautiously optimistic about the market outlook for 2019.

Let's then go back to the question we asked at the beginning: "How should investors react when the golden rule of investing proves false?" First and foremost, remember this was a one-time, short-term phenomenon. We continue to be firm believers in "Diversify, diversify, diversify" as the appropriate long-term investment strategy and will hold the course as we move forward into 2019. Over the long-term, we feel quite confident this strategy will provide attractive risk-adjusted returns even if 2018 was not the year any of us had hoped for.

References:

Bary, Andrew.

"Dow Stocks Drop 4.4% in a Turkey of a Week."

Barrons.

November 23, 2018.

"No Refuge for Investors as 2018 Rout Sends Stocks, Bonds, Oil Lower."

The Wall Street Journal.

November 25, 2018.

Ramsey, Doug.

"For Asset Allocators, As Bad As It Gets!"

The Leuthold Group.

November 7, 2018.

"Stocks Have Struggled in 2018. Bonds Too. Oh, and Gold."

The Associated Press.

November 15, 2018.