Looking Ahead to the Q2 Earnings Season

Let's talk about earnings:

Earnings are the "mother's milk" of the equity markets.

Fundamentally, stocks rise if a company's earnings grow or their multiple (price/earnings ratios) expands. Multiples are the premium that someone is willing to pay for a dollar of company earnings. Factors impacting multiples include future company or industry growth, economic stimulus and interest rates.

For example, if a company earns $2 a share and the multiple for that company or industry is 15x that stock would roughly trade around $30 ($2x15x = $30). If multiples were to expand to 18x, that same stock should be trading in the $36 range ($2x18x = $36) on that same $2 in earnings. A best case scenario for accelerating stock price gains would be that company earnings grow (e.g., from $2 to $2.25 per share) and the multiple expands (e.g., 15x to 18x).

What we expect from the Q2 earnings season:

The Q2 earnings season will (unofficially) get underway when the big banks report results in mid-July.

The growth picture is not expected to improve during the Q2 earnings season (covering April - June).

The chart below of quarterly year-over-year earnings and revenue growth for the S&P 500 index shows actual results for the preceding 4 quarters and estimates for the current and following 3 quarters. Revenue growth figures (i.e., top line sales numbers) are in orange and earnings (i.e., bottom line net profits) are in green.

As you can see from the above chart, earnings growth was essentially flat in the first quarter of 2019. For the second quarter, the expectation is for -3.1% year-over-year decline in earnings for the S&P 500 index on +4.3% higher revenues.

Why the slow down?:

Driving the current growth challenge is a combination of tough year-over-year comparisons and slowing economic growth.

Investors face tough comparisons to last year when company profitability and growth was significantly boosted by the tax cut legislation. Moderate U.S. economic growth and notable slowdowns in other major global economic regions are having a further negative impact on earnings. And finally, uncertainty about the global trade and the actual impact of continued tariffs are not helping business sentiment.

As a result, 2019 earnings were essentially flat in Q1 and no significant improvement is expected in Q2. In fact, the trend of flat to negative growth is expected to continue through Q3, after which current consensus estimates look for positive growth resuming in Q4 of 2019.

What might be in store for the rest of this year and beyond?:

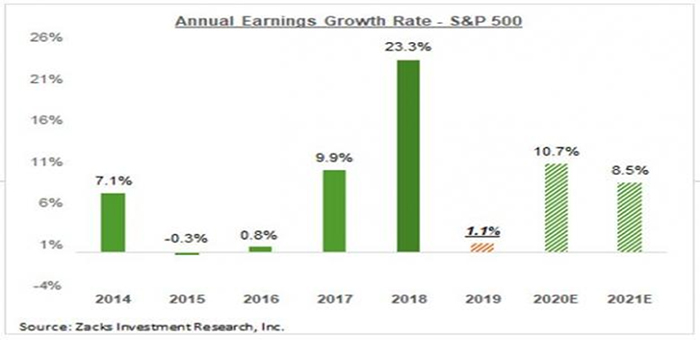

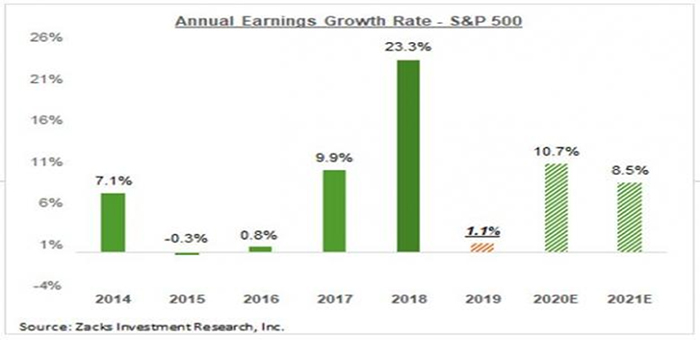

The chart below puts earnings growth expectations for full-year 2019 in the context of where growth has been in recent years and what is expected in the next two years.

For full-year 2019, total earnings for the S&P 500 index are expected to be up +1.1% on +2.5% higher revenues, which would follow +23.3% earnings growth on +9.2% higher revenues in 2018. Double-digit growth is expected to resume in 2020, with earnings expected to be up +10.7% that year.

Conclusion:

The equity markets look ahead, not behind. As companies report over the next 6 weeks, comments about the future will affect the markets more than results of what has already happened. The market appears to have accepted the deceleration in growth this year in the hope that growth resumes from next year onwards.

The key thing to watch during the Q2 earnings season will be whether guidance for the second half of 2019 and beyond remains steady or even declines. Analysts have not made any significant downward adjustments to their estimates in response to the ongoing trade dispute, likely in the hope that the issue will eventually get resolved. Clearly a resolution to the trade war will have explosive effects on business sentiment.

Perhaps the largest lift markets could see will come from our old friend, The Federal Reserve. Last week dovish and reassuring comments from Fed Chair Jerome Powell suggested the Federal Reserve is ready and posed to consider rate cuts. And as we have discussed in the past, equity markets do not like anything more than low interest rates.