From the start, July was clearly going to be about two things from an investment perspective: the US economy and the Federal Reserve meeting, with both news events falling within 5 days of month end. In the end, neither disappointed as the GDP surprised modestly to the upside and the Fed delivered a 0.25% rate cut.

2nd Quarter Gross Domestic Product (GDP)

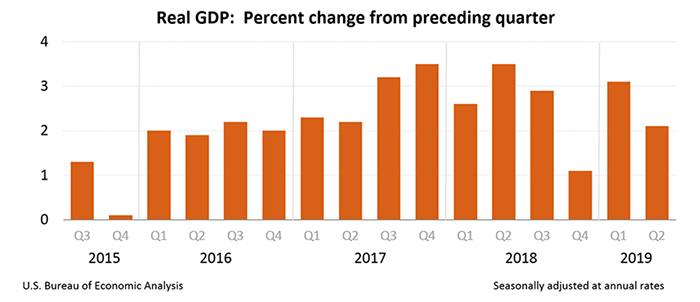

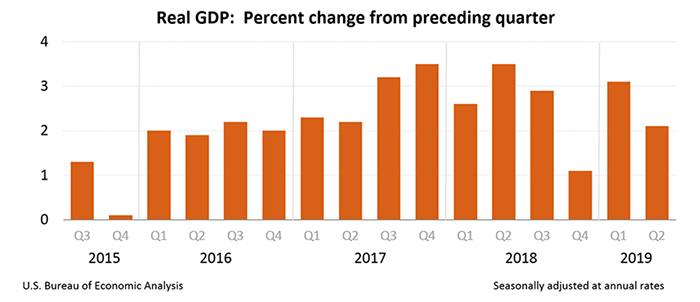

For weeks, anticipation was building over 2nd quarter GDP. Gross domestic product, the official report card on the economy, grew at a 2.1% annual pace from the start of April to the end of June. GDP slowed from a 3.1% gain in the first three months of the year but surprised many Wall Street analysts who had predicted that GDP would come in below 2%.

The details of the GDP report show that the economy was stronger in the second quarter than it was at the start of the year, especially on Main Street where the biggest increase in household spending in a year and a half provided a jolt of adrenaline. But lackluster business investment, especially among exporters and manufacturers, suggests the economy could expand more slowly in the second half of the year.

The Consumer: Americans spent considerably more in the spring (4.3% for Q2) compared to the start of the year (a sluggish 1.1% for Q1), as they were recovering from the holiday shopping season, coping with a government shutdown and bearing the brunt of winter weather. Households spent more on new cars and trucks, food and drinks and clothing. Consumers account for almost 70% of all spending in the economy. Buoyed by steadily rising incomes, more job security and the lowest unemployment rate in almost 50 years, we are spending more than enough to keep the U.S. growing around 2% a year.

The Business Environment: The situation was reversed for business. Fixed investment fell 0.8% to mark the biggest drop in three and a half years. Inflation rose at a mild 1.4% clip year over year. Businesses will eventually cut jobs or reduce worker hours if growth doesn't pick up — a potential threat to the golden goose known as the American consumer.

The Federal Open Market Committee (FOMC)

In its policy-setting meeting on July 31, the Federal Reserve cut interest rates by 0.25% to 2.00-2.25%. This marked the first time the central bank has reduced the benchmark interest rate since the financial crisis in 2008. The Fed also decided to pre-emptively end its process of shrinking its balance sheet, a process known as quantitative tightening, two months ahead of schedule.

The interest rate cut comes as the Fed continues to worry about a possible slowdown in the U.S. economy. The FOMC statement, released Wednesday, recycled language from its June meeting, describing business fixed investment as "soft" and stating that inflationary pressures "remain low."

On the labor market, the Fed said job gains are still "solid." The June jobs report, received since the last Fed meeting, showed an estimate-beating 224,000 new jobs with unemployment moving up only slightly to 3.7%. The Fed also said the consumer remains a bright spot, with household spending still growing relative to earlier this year.

The Fed reiterated that it will "act as appropriate to sustain the expansion," adding new language in saying that this priority will be in focus as "the committee contemplates the future path of the target range for the federal funds rate."

The Fed's actions last Wednesday followed through on market expectations for a 25 basis point cut. Heading into the meeting, federal funds futures markets were pricing in a 79.1% chance of a 25 basis point move, with a 20.1% chance that the Fed would cut by 50 basis points.

Conclusion:

There's an old adage to "not fight the Fed." Equities like low interest rates, low inflation and modest growth. Couple those characteristics with generationally low unemployment and comparisons to a "goldilocks economy" will naturally follow. While this market is not devoid of risks, we feel it's a good environment in which to be an investor.

P.S.

You may have noticed that we did not touch on recent developments in the US-China trade war in today’s Special Market Update. We are carefully watching and monitoring events. In the past few weeks, we understood that President Trump could assign additional tariffs on imports and that China could choose to weaken their currency or impose counter-restrictions that could affect the state of negotiations and unsettle the global markets. The recent developments have not taken us by surprise and we will communicate more fully once we see how things develop over the next few days and weeks. As we have said many times in the past; markets tend to overdo things both on the upside and downside and then review the facts later. We feel this is no exception. Until we see evidence of a fundamental change in the US economy we recommend staying with your individual, long-term investment plans.

Sources:

MarketWatch.com

The economy slows to 2.1% growth in the spring as businesses retrench, GDP shows

Federal Reserve

July 31, 2019 Press Release