The Stock Market Is Not the Economy

There's an old investment adage that has been around for decades, "the stock market is not the economy and the economy is not the stock market." While the relationship between the two can be closely associated, one is rearward-looking and the other forward.

The economy is commonly described as the wealth and resources of a country or region, especially in terms of the production and consumption of goods and services. Economists measure the health of the economy using various statistical reports like gross domestic product (GDP), unemployment, wage growth, manufacturing output, consumer spending, housing, borrowing, trade, debt and deficits. Economic statistics are generally reported in arears and, as such, are trailing indicators - a rearward look at actual results. As an example, when GDP is reported at the end of each quarter it's typically reported between 25 & 30 days after the end of each quarter. It's a recap of the past, not a current update.

The equity market is a forward-looking indicator, with investors discounting today's equity prices based on educated guesswork about future earnings, stock price multiples, news, and sentiment as market participants try to anticipate the direction and strength of the economy.

The early-August inversion of the 2-year/10-year US Treasury yield curve caused a strong market reaction to this economic indicator. The inversion, coupled with daily rhetoric on the US-China trade war, increased volatility to uncomfortable levels for many investors during the month of August.

Obviously, August's back and forth trade war rhetoric between China and President Trump has confused and confounded both the forward and rearward indicators. We are in uncharted territory in regards to the impact of tariffs on business spending, consumer sentiment and ultimately GDP. In response, the markets seem to be reacting to the latest sound bite to determine their short-term direction.

We have commented on the trade war on numerous occasions but our approach to this "unfinished event" has been to show patience until a clear direction emerges. Otherwise we are simply guessing as to the end results.

Short-term market corrections can unsettle the most experienced investor, but they are normal and actually become the fuel for the next move higher. It's ironic, but still amazing, that many investors would rather jump in after a 20% increase in stock prices (joining the crowd) than a 20% decline (in the words of Warren Buffet, "buying at the sale rack first").

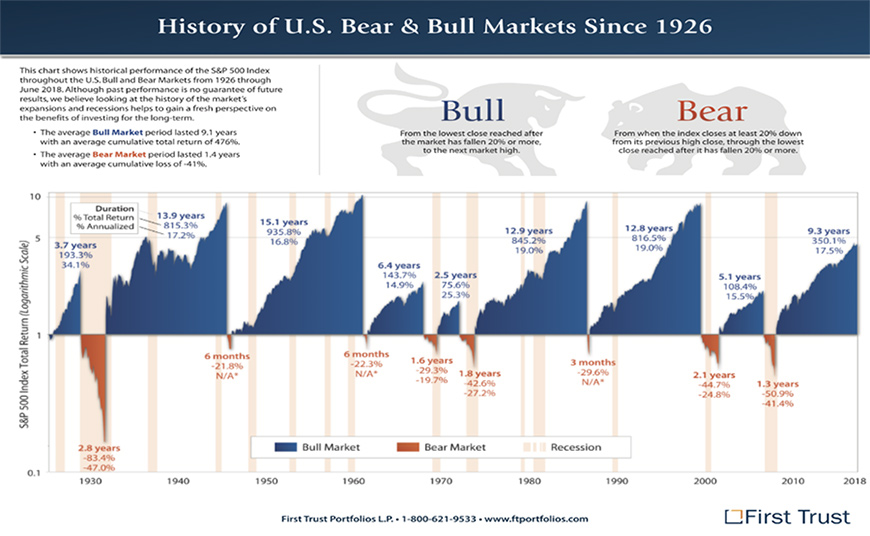

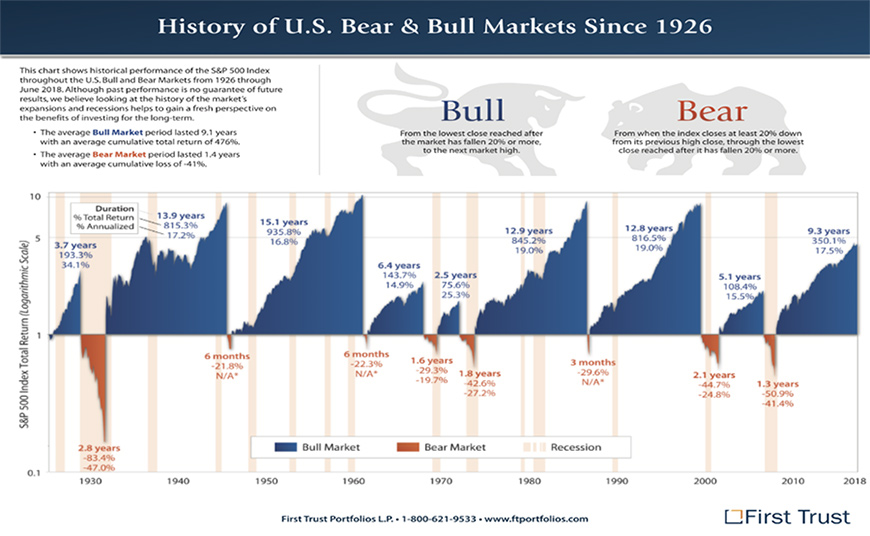

There are always expansion (bull) and contraction (bear) cycles in the market. Some correspond with growth or recession in the economy and others do not. Reviewing historical data (see chart below), we see that bear market contractions, which are short but noticeable, can often be painful and are usually overly anticipated. Bull market expansions tend to last longer, but are often less perceptible; they are late to be accepted with reports of their death often premature.

The next economic contraction is inevitable. After all, the current expansion is in its 10th year. Despite best efforts from the Federal Reserve, the President or Congress we will have another recession. Economic cycles should never deter you from being a long-term investor.

At WT Wealth Management, we use news-driven-events as opportunities to reach out to clients and provide education, perspective and assurance. Today's "touch" is designed to reinforce the message that the ups and down of the equity markets are subject to a variety of "pushes and pulls" and may very well have nothing to do with the overall health of the economy. We feel the economy is in good shape as long as the consumer stays engaged (they are 72% of GDP after all). As recently as August 27th Consumer Confidence was reported at 135.1 - a healthy result over the 129 expected (both of which are very strong, given that the benchmark of 100 represents a theoretical mid-point in the economic cycle). We feel the first warning sign would be any uptick in unemployment, as that news could trigger a consumer spending slowdown.

If you ever feel uncomfortable, contact your financial advisor to review your risk tolerance and long-term objectives. Our goal is to ensure we are constructing a portfolio with the risk targets that allow you to sleep easy at night, while still meeting your overall investment objectives. We have many tools to help us through this process, please allow us to put them to use on your behalf.

Remember, the stock market is not the economy and the economy is not the stock market.

Other Resources

RealMoney

The Stock Market Is Not The Economy.

Yahoo Finance

The Stock Market Is Not The Economy. The Labor Market Is.