October was one of the busiest news months of the year. Despite moderately slowing GDP, mixed corporate earnings results, Brexit drama, US/China trade war developments and impeachment noise the equity markets marched higher after some early month weakness and surprised even the most ardent bulls with a 2.17% return on the S&P 500. Adding potential fuel to the "bulls' case" was the October 30th Federal Reserve interest rate cut of 0.25% — the third such cut in 2019.

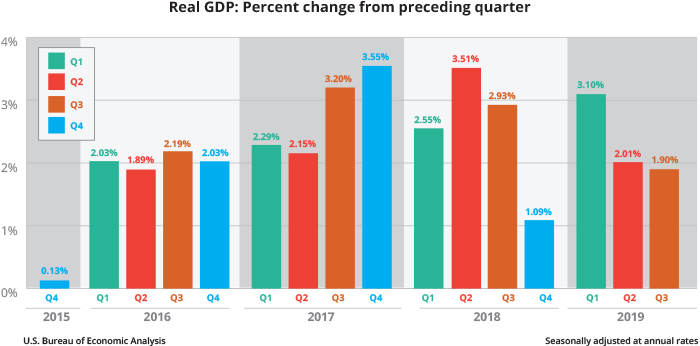

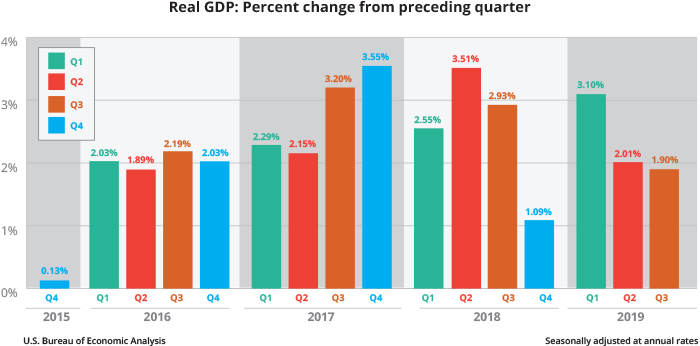

US GDP Was Better Than Expected

U.S. gross domestic product (GDP) — the broadest measure of the health of the U.S. economy — grew faster than expected in the third quarter (Q3), but slowed slightly from the second quarter (Q2) as business investment continued to decline.

The Commerce Department announced on October 30th that economic activity grew at an annualized rate of 1.9% in the third quarter, down slightly from the 2.0% pace in the second quarter. Economists polled by CNBC had expected the third-quarter economic growth to come in at 1.6%.

(1)

The better-than-expected data was the result of continued consumer spending as well as government expenditures. Personal consumption expenditures, a gauge of spending by American households, rose at a 2.9% annualized rate while government spending grew at a 2.0% rate.

Spotlight on Earnings

With 40% of the companies in the S&P 500 already reporting Q3 2019 results, 80% have reported earnings per share results above analyst expectations and 64% have reported a positive revenue surprise (compared to expectations). To date, the market is rewarding positive earnings surprises more than average and punishing negative earnings surprises more than average.

The blended Q3 2019 earnings decline for the S&P 500 is -3.7%. If -3.7% is finalized as the actual decline for the quarter, it will mark the first time the index has reported three straight quarters of year-over-year earnings declines since the period Q4 2015 through Q2 2016.

(2)

Brexit Extension

The European Union (EU) granted the British government's request to delay Brexit for three more months beyond its scheduled October 31st deadline. British citizens will go back to the polls on December 12th to elect a new Parliament that may, or may not, be able to settle on a Brexit plan.

(3)

It is not at all clear that the December election will settle the Brexit question. Prime Minister Boris Johnson and the Conservatives would need to win a majority in Parliament to implement a Brexit plan by the EU's deadline of Jan. 31, 2020. British voters could also deliver a Parliament that is still gridlocked on the issue. Either way, the outlook for European markets is likely to remain uncertain.

US/China Trade War Developments

On October 11th, President Trump announced that the United States had reached a Phase 1 trade deal with China that would forestall a tariff increase slated for November, providing a temporary de-escalation to the trade war.

This represents a reversal from both countries' previous positions that a "complete" deal would be the only one worth exploring. But the economic pain appears to have softened both sides' appetite for a continued fight, who have now agreed to work on the deal in phases.

The latest news on the impeachment inquiry

A bitterly divided House of Representatives voted Thursday, October 31st to approve the resolution that lays out the rules for the "public facing phase" of the impeachment process. The tally foreshadowed the battle to come as Democrats take their case against the president fully into public view, sending both parties into uncharted territory and reshaping the nation's political landscape.

(4)

Meanwhile Republicans have been highly critical of the process. The White House said the resolution "confirms" the inquiry "has been an illegitimate sham from the start." President Trump is urging his allies to defend him on the substance of the allegations against him, arguing he did nothing wrong during the July call in which he pressed the Ukrainian President to investigate former vice president Joe Biden and his son Hunter Biden.

Federal Reserve Eases Again

The Federal Reserve, as expected, cut rates by a quarter-point (0.25%) to a range of 1.50% to 1.75% on Wednesday, October 30th. This was the third cut this year as part of what Fed Chairman Jerome Powell characterized as a "mid-cycle adjustment" in a maturing economic expansion.

Along with the decrease came language pointing to a higher bar for future easing — in other words, we may be nearing a pause in further rate cuts. The FOMC statement read, "The Committee will continue to monitor the implications of incoming information for the economic outlook as it assesses the appropriate path of the target range for the federal funds rate"

(5), removing a key clause that had appeared in post-meeting statements since June saying that it was committed to "act as appropriate to sustain the expansion."

Conclusion:

There's an old adage in investing that says "don't fight the Fed". An easing, dovish, Fed is a nice tailwind for owners of most financial instruments, from stocks to bonds to REITs. If Phase 1 of the China/US trade resolution comes to fruition and the current impeachment inquiry goes nowhere, most impediments to moving higher would be cleared and the markets could expand into early 2020 until we all turn our attention to the 2020 Presidential Election.

Sources

(1) https://www.cnbc.com/2019/10/30/us-gdp-q3-2019-first-reading.html

(2) https://www.zacks.com/earnings

(3) https://www.bbc.com/news/uk-politics-46393399

(4) https://www.nytimes.com/2019/10/31/us/politics/house-impeachment-vote.html

(5) https://www.cnbc.com/2019/10/30/fed-decision-interest-rates-cut.html