2019 Recap

2019 was the year that just kept on giving. Despite continued trade tensions with China, a corporate earnings slowdown following the historic 2018 tax cuts, recession warnings as a result of an inverted yield curve, a slowing Gross Domestic Product (GDP) from Q1 to Q2 to Q3, and a partisan impeachment vote in the House of Representatives nothing seemed able to derail the market from its determination to move higher.

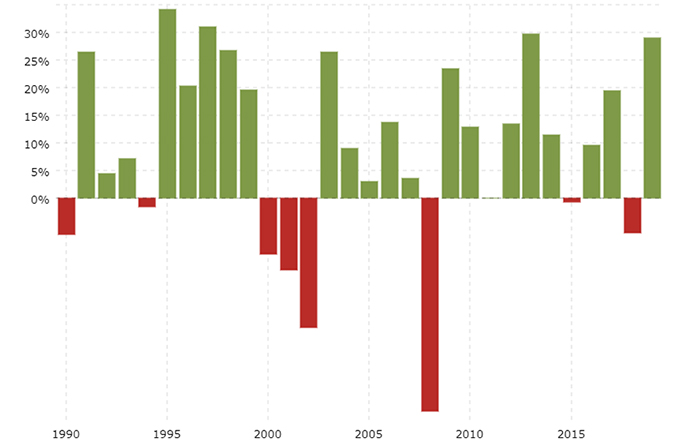

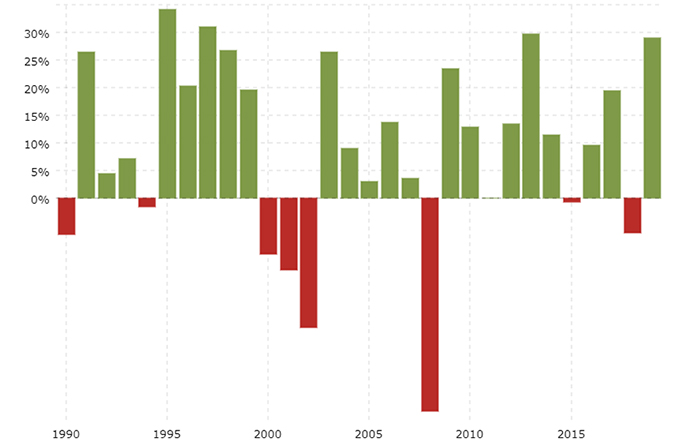

By year's end, markets were sharply higher as the Dow Jones Industrial Average rose 22.3%, the S&P 500 Index increased 28.9%, and the Nasdaq Composite jumped 35.2%.

(1)

To put last year's performance in historical perspective, 2019 was the 4th best year on the S&P 500 since 1990 - a span of 30 years (34.11% in 1995 / 31.01% in 1997 / 29.60% in 2015).

(2)

Understanding the market's determined upward charge has been difficult for everyone, but most Wall Street analysts attribute it to hope: hope that a trade deal with China would come to fruition, hope that the Federal Reserve would reverse course from 2018 and take a dovish stance* on interest rates, hope that corporate earnings would be better in 2020 than 2019, and hope that a record low unemployment number would keep the consumer engaged, active and spending money. GDP is 72% attributable to consumer spending. With a 3.5% unemployment rate and 3.0% wage growth in 2019,

(3) American's have remained strong spenders and borrowers when they are employed.

*The Federal Reserve is often described as "dovish" or "hawkish", the former referring a tendency toward reducing rates and the latter referring to a tendency toward raising rates.

The Decade Closes

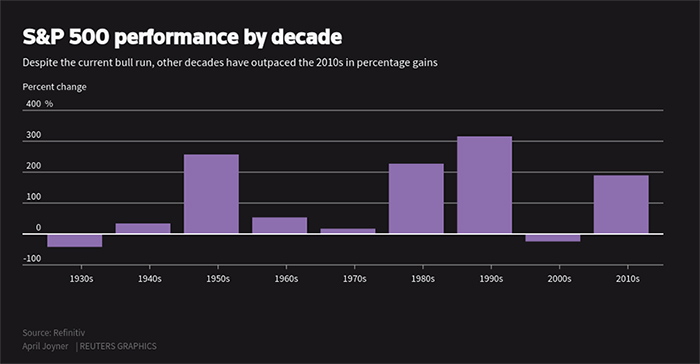

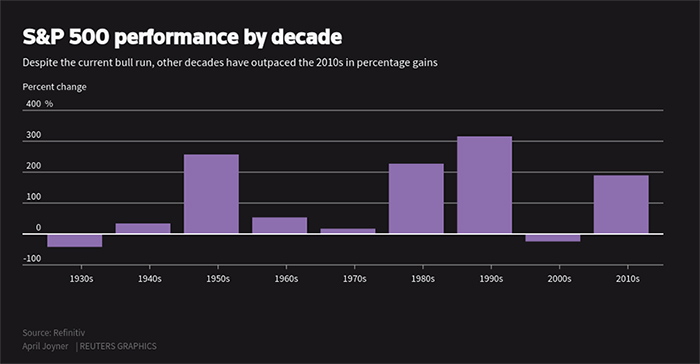

The end of 2019 also marked the end of a decade. From a decade-by-decade perspective the period 2010-2019 was more in line with what we have seen in our recent lifetimes than an outlier. For the decade, the Dow advanced 173.67%, the S&P 500 189.72% and the Nasdaq 295.42%.

(4)

As stunning as a 190% increase on the S&P 500 over the last 10 years is, it is perhaps more surprising to realize that it trails performance in the 1980's (over 200%) and 1990's (over 300%). The true outlier decade is the 2000's (negative 0.9%), which many refer to as the lost decade due to recessions in 2001 and 2008.

(5)

Your next question is probably, "what's in store for 2020?"

In our opinion, 2020 could be a year of four distinct quarters. We feel continued momentum from 2019 will persist in Q1, especially after President Trump announced that the Phase 1 USA-China trade deal will be signed on Jan. 15 at the White House. Thereafter, things will turn political. Q2 will be about the democratic primaries, the eventual emergence of a front-runner and formation of a Democratic ticket. Q3 will feature the mid-summer Republican and Democratic Conventions. And finally, Q4 will focus on preparation for and reaction to the Presidential Election in November.

While election-year politics will carry the day, we expect to see the following important economic developments: continued dovishness from the Federal Reserve ahead of the November US Elections, sustained full employment, and improving GDP as a result of the trade deal and the easing of tariffs. Barring any major surprises as companies report Q4 2019 / holiday shopping results and provide forward guidance for 2020, we can't see a lot of hurdles to navigate in the early part of the year.

The impeachment trial in the Senate already appears to be a forgone conclusion, so we do not feel there will be any downward market pressure from those proceedings. As well, recession talk has almost completely subsided with the 2-year to 10-year yield curve returning to its normal, upward-sloping state after last summer's brief flirtation with inversion.

By choice, we try to not make predictions on upcoming market results or make big swings on ultimate returns. Instead, we focus our attention on managing risk for our clients based on individual return requirements, risk profile questionnaires, and our many personalized engagements.

Without knowing who the President will be at year's end, it is nearly impossible to predict market returns for 2020. The largest remaining unknown affecting the financial markets and the American economy is – "Who will be the next President?". There is nothing the financial markets hate more than the unknown.

That being said, if President Trump is re-elected (markets have historically "liked" the re-election of incumbent presidents) it would be a very bullish signal for equities. His unconventional style, while unacceptable to many, did put the required pressure on the Federal Reserve to get three rate cuts in 2019, a likely Phase 1 trade deal with China and a recently signed revamped-USMCA agreement with Canada and Mexico. A Trump re-election victory could bring Democrats in the House and Senate to the table on infrastructure, healthcare and maybe even addressing immigration and the "dreamers". The best thing for the American people is to have both parties engaged with each other.

On the other hand, a change in the presidency could have a significant, short-term, downward impact – depending on the political agenda of the eventual winner. A mitigating (or exacerbating) factor would be how the House and Senate races conclude. A division in power would "somewhat-mute" what a new president could accomplish. Markets have historically responded well to that. A democratic president with democratic control of the House and Senate could be very unsettling for the financial markets.

Remember This

I'll conclude with this: for every bull there is a bear, for every naysayer a believer. Each market transaction has a buyer and seller who are both happy with the transaction price. This is the beauty of the financial markets.

Every economic data point or political event builds on each other throughout the year. This produces the tug-of-war, the back and forth, the up and down of the financial markets. Opinions make markets. As a wise old man once told me "it's good to have two steps forward and one step back, it helps sustain the march higher".

Sources

(1)https://us.spindices.com/

(2)https://www.macrotrends.net/2526/sp-500-historical-annual-returns

(3)https://www.usatoday.com/story/money/2019/11/14/wage-growth-why-isnt-pay-climbing-faster/2580205001/

(4)https://www.reuters.com/article/us-usa-stocks/wall-street-edges-higher-sp-closes-decade-with-nearly-190-gain-idUSKBN1YZ0US

(5)https://seekingalpha.com/article/4314289-returns-decade