Coronavirus

As I often say when people ask me about the future in equity markets, "it's never the bear you can see that will get you, it's the bear you never saw coming".

News of the coronavirus was clearly just that. As little as two weeks ago not a single person had even heard of it. But once investors began to understand how severe the potential economic impact could be across all of Southeast Asia, global equity markets sold off on January 24th and 27th as investors flocked to safe-haven assets like US treasuries, gold and the US dollar.

In fact, some economists appearing on CNBC over the past several days, estimate that the outbreak could lower China's GDP growth by 1%. However, the impact on the US economy of a China-contained outbreak would likely be minimal as US growth is more dependent on domestic consumption and the ever resilient US consumer. Clearly, international and emerging market economies may have more downside risk as their economies are more closely linked to China. Also, industries related to travel or tourism, such as airlines and hospitality, clearly will be hurt the most.

However, all of this could change and US market sentiment may be negatively impacted if the virus continues its spread across the Pacific to US shores, especially when the US markets and valuations are at their current lofty levels.

As we have repeated over the years, medium and long-term market performance is nearly always driven by fundamentals like corporate earnings, interest rates and the state of the economy. On the other hand, short-term market performance can be influenced by a myriad of news-driven events and should generally be overlooked. At best, short-term swings might best be viewed as opportunities to buy something that has moved too far too fast.

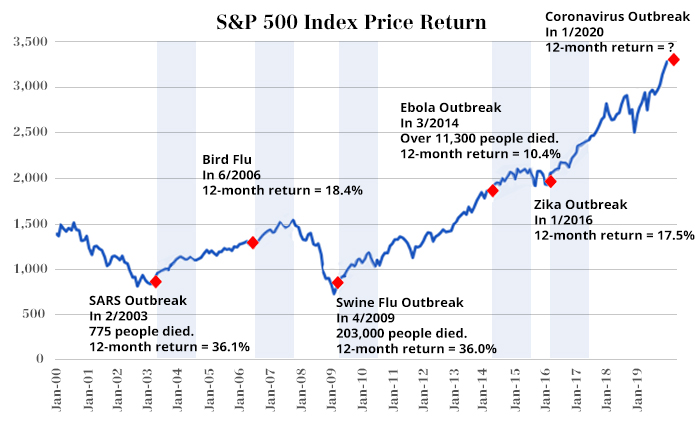

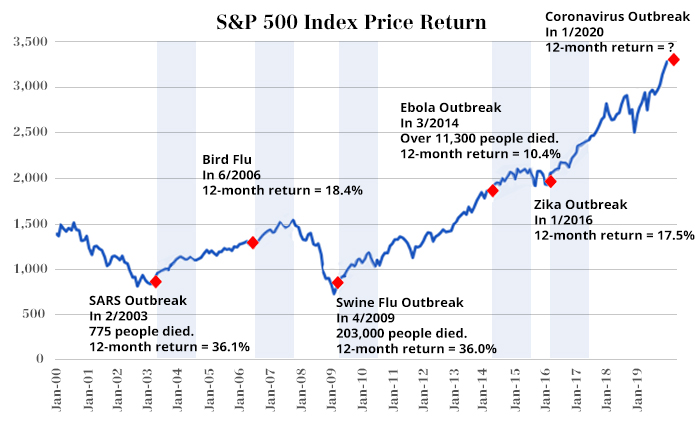

Historically, past epidemics like SARS, Swine Flu, Bird Flu or Zika virus did not have much impact on the underlying economic fundamentals of the global economy, but all resulted in short-term sell-offs and heightened market volatility as investors grappled with the unknown impact of their emergence.

The below chart, courtesy of Factset, highlights how the news of health epidemics tend to be rather short-lived as the equity markets usually react, evaluate and then revert back to current fundamentals – a sort of "fire, ready, aim" approach to things.

Is there any silver lining in the coronavirus? With the assured loss of human life, of course not. But one resounding sentiment I have heard this month, from colleagues and clients alike, is that many feel the markets are moving higher too fast. For example, over the first 15 trading days in January we experienced 10 up days and 5 down days and had climbed higher by 3% on the S&P 500 and nearly 5% on the NASDAQ. This, by itself, wouldn't have bothered investors so much. But since it piggybacked on 2019's spectacular returns, it intensified the feeling of being near the top. Oftentimes, when markets are in this situation, investors begin looking for any uncertainty or news event that could justify taking some gains off the table.

The last substantial pullback was May of 2019 when the S&P 500 declined over 6.5%. So it wouldn't be unreasonable to expect we are due for another 5-7% retraction sometime soon. Will the coronavirus be the news catalysts for this? It really depends on the evolution of affairs over the next several weeks: whether the virus becomes a pandemic or can be contained or falls somewhere in between.

The next drawdown is never that far away. That's the expected risk that comes with the compelling returns we witnessed in 2017 and 2019. Double digit returns are not generated without fluctuations and volatility. With any uncertain news event – like the coronavirus – it's an excellent time to make sure that your tolerance for volatility is in-line with your goals and the plan you have with your financial advisor.

We encourage you to call if you feel the need.