The Volatility Question

Over the last several weeks of turmoil in the markets many clients have asked "was I taking too much risk in my portfolio"?

As investment managers we are very careful to insure that our client's tolerance for volatility (account value fluctuation) is appropriate based on our asking questions and listening to you during our personal interactions. We also take into account your investment experience, your goals and objectives and finally your attitude toward risk (actual loss).

The dilemma investors are facing today surrounds the unprecedented level of volatility that has emerged because of the uncertain economic impact of the Coronavirus. The daily whipsawing we are seeing within the financial markets is some of the most extreme in the past 25 years.

In 11 of the last 15 trading session we have seen +/- 3% moves in the S&P 500. This current sell-off already owns the record for the fastest 10% and 20% declines in history.

Faced with current events, many investor's initial reaction might be to get to the sidelines and wait things out. However, over the years we have observed and learned that the equity markets almost-always overdo things on the upside and downside. We feel if there was ever a time for patience and emotions to not be part of the decision making process it is now.

As Warren Buffet has said many times "the stock market is the perfect mechanism for transferring wealth from the impatient to the patient."

Some Things to Consider

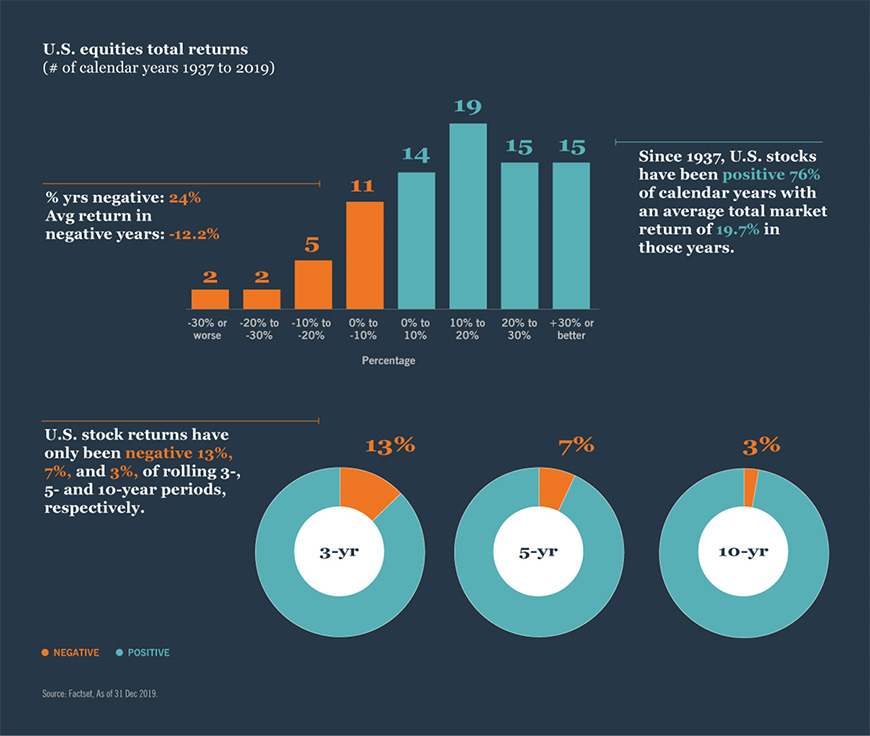

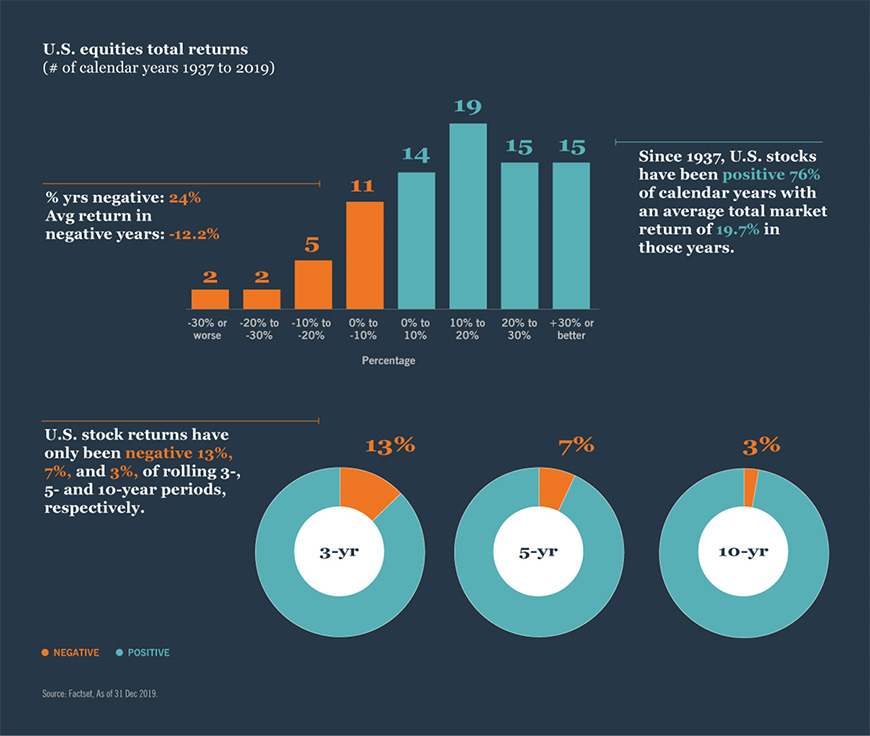

In the chart below you can see that in any 3 year rolling period a negative return occurs about 13% of the time. That drops to 3% of the time when reviewing 10 year rolling periods.

Sadly, volatility leads investors to make poor decisions out of fear of permanent loss. Permanent loss only occurs when something is sold and the loss in realized. Statement losses, no matter how discouraging, can be recovered because they are not yet realized.

Aiding what many believe would be a quick recovery after a short 1st quarter stumble for GDP is the unprecedented low interest rate environment along with a strong housing market and generationally low unemployment. Additionally, tailwinds from the newly signed China/US trade deal and the associated reduction in tariffs can only help.

The recovery will not be without hurdles. Global leisure and business travel has been disrupted to post 9/11 levels and major sporting and other social events are now not being held at all. This will have an emotional impact on Americans as much as an economic impact.

However, compared to past generations, we are in a much better environment to deal with these challenges. Americans are more comfortable working from home and can be just as productive. Lastly, all reports of the banking system show that banks are dramatically better capitalized than back in 2008.

What Now?

We are actively talking with clients and recommending no fundamental changes to portfolio structures. In good conscience we can't recommend all out selling and realizing losses that are to this point just statement losses. We feel a bounce back could happen as additional fiscal and monetary stimulus enters the economy along with a better understanding of the true health and economic impact of COVID-19.

The equity markets are still one of the very best places to build wealth during your accumulation years and derive income during your retirement years. In fact, earlier this week we took the preemptive step of eliminating our European equity exposure along with domestic small cap stocks. We are also conducting research this weekend and performing trades to tighten up your accounts by eliminating some of the more speculative, less-capitalized company stocks and replacing them with equities that are better positioned to recover quickly.

The markets are not without ups and downs and periods when volatility can make you feel just a bit queasy. However, the longer you are committed to the plan of being an investor, the more muted volatility becomes and the less likely the chances to realize losses. Even a 70 year old retiree today needs to plan on being an investor for the remainder of their lives. With interest rates near zero and most Americans under-capitalized for retirement, the equity markets are a logical landing place for most pre- and post-retirement investors.

The sure way to beat volatility is to ignore it. Don't allow the noise from a given day, week or month to deter you from the results of the past 50 years in the equity markets. The above graph also highlights that 76% of the time the markets are positive, with an average return of 19.7% in those years. That's a solid reminder of the reason investors invest.

Working closely with a financial professional is the very best way to determine what amount of volatility is prudent and acceptable for you and will keep you committed to your long-term plan. As you feel the need, we would suggest that you sit down with your advisor and review your accounts and their associated volatility levels to insure they meet the level of risk that will allow you to sleep at night while still being committed to the long-term plan.