Stimulus, the Fed and the Eventual Recovery

Over the last several weeks the American people have had their lives uprooted as terms like "social distancing," "self-quarantine," "shelter in place" and "COVID-19" entered our collective vocabulary.

If making frequent trips to the grocery store while hording toilet paper, canned foods and hand sanitizer wasn't stressful enough, Americans also had to contend with the fastest 10% and 20% declines in the S&P 500 on record along with the corresponding declines in their investment accounts.

Fear and uncertainty surrounding the virus has led to the most unprecedented shutdown/work-from-home movement in U.S. history resulting in steep declines across major equity indexes from the all-time highs set in February.

In the most recent unemployment report from March 26th, new claims soared to over 3 million as Americans awaited government assistance on a variety of fronts from school and home loan forgiveness to increased unemployment benefits for those affected.

Fiscal Stimulus

The US Government recently passed the largest fiscal stimulus package in U.S. history

(1), which will deliver a massive infusion of financial aid into a struggling economy, hard-hit by job loss. Key elements of the proposal are $250 billion set aside for direct payments to individuals and families, $350 billion in federally guaranteed small business loans, $250 billion in unemployment insurance benefits and $500 billion in loans for distressed companies, including airlines.

Under the plan, individuals who earn $75,000 in adjusted gross income or less would get direct payments of $1,200 each, with married couples earning up to $150,000 receiving $2,400 -- and an additional $500 per each child. The payment would scale down by income, phasing out entirely at $99,000 for singles and $198,000 for couples without children.

In addition, the bill would provide $130 billion for hospitals as well as $150 billion for state and local governments that are cash-strapped due to their response to COVID-19.

(2)

Monetary Policy Stimulus

On Monday, March 23rd, The Federal Reserve ("Fed") pledged to buy bonds in an unlimited quantity while allocating at least $300 billion to new emergency-lending programs. These monetary policy measures

(3) are being taken as Wall Street reels from fresh predictions of a steep drop-off in economic output due to coronavirus-related lockdowns, business disruptions and job losses.

These injections signaled the Fed's willingness to go beyond even the already dramatic steps taken in recent weeks to keep traditional Wall Street stock and bond markets from stopping dead in their tracks.

On Sunday, March 15th policymakers, led by Chair Jerome Powell, slashed short-term interest rates virtually to zero, just days after pledging to inject $1.5 trillion into the financial system via short-term loans to Wall Street dealers.

The Fed also said it would start buying bonds backed by commercial mortgages as part of a previously announced pledge to purchase Treasury bonds and residential mortgage-backed securities. In keeping with Powell's recent pledge to use emergency programs hatched during the 2008 financial crisis, the Fed rolled out a series of lending initiatives to support bonds backed by student loans, auto loans, credit card loans, small business loans and "certain other assets."

(4)

Don't Fight the Fed

The Fed's monetary policy stimulus moves highlight the old adage, "don't fight the Fed". This investing mantra stands the test of time for a reason.

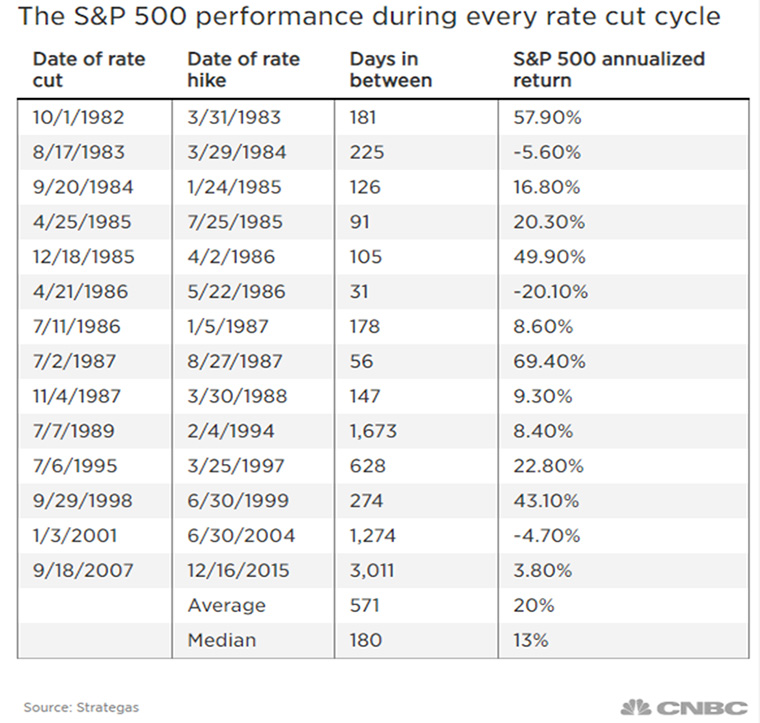

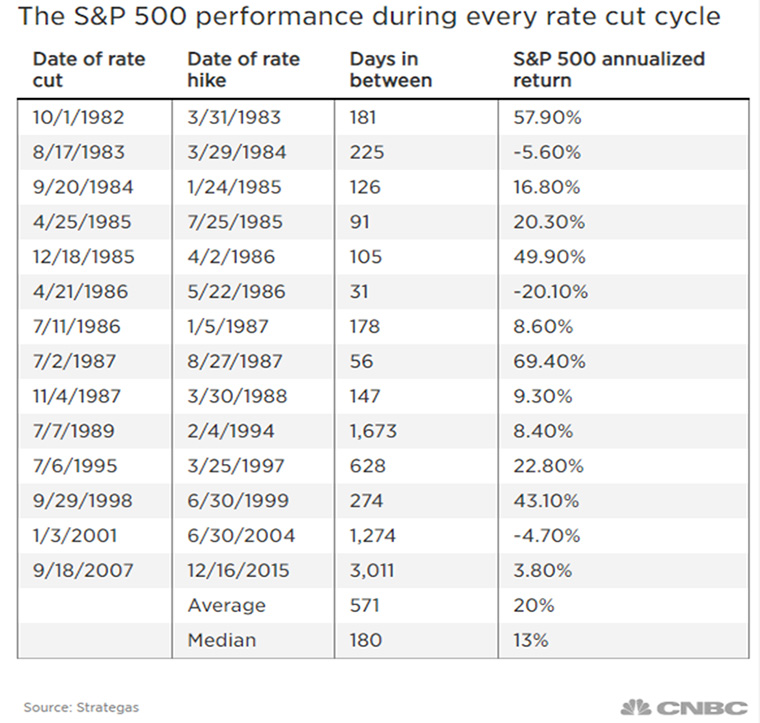

Over the past 14 interest rate "easing" cycles, which lasted 571 days on average, data from Strategas show that the S&P 500 only fell three times during those periods.

(5)

Going back to 1982, the average annualized return for the S&P 500 between the first rate cut and the next rate hike has been 20% (a median increase of 13%) according to Strategas.

Not included in the above chart are the results from 2019 and the 30% return of the S&P 500 aided by the three rate cuts the Fed induced into the system to aid the US economy through the US/China trade war.

Fed liquidity and stimulus programs have a long history of boosting economic growth, including the equity markets. Clearly in the COVID-19 case, people need to resume their daily lives in order for the economic stimulus policies to have any real effect. Economic expansion with high unemployment is nearly impossible. However, once the pressure is released and people venture out again, many experts are talking about a "V shape" recovery and a record rebound of economic activity from late summer through year-end. Markets tend to look forward, and with the first signs of normalcy, we should expect equity markets to return to fundamentals. Measurable drivers of business value such as earnings, PE's and growth rates will begin to have meaning again.

This outlook is one of the many reasons we have encouraged investors to not sell at these depressed levels. The markets have become extremely discounted and we feel market participants have priced in every worst-case scenario and unknown in this sell-off. As these pressures release and the "unknowns become knowns" we would anticipate equity prices to move higher, the volatility to reduce and the equity markets to return to a more normal state. Remember, the biggest market gains commonly follow the biggest market losses.

Is this Crisis Different?

Of course, this crisis is vastly different. Economic production in the U.S. and globally has virtually been halted outside of essential services like grocery and utilities. This doesn't come without repercussions. Main Street America businesses have been incredibly hurt - small restaurants, bars, gyms, retail, beauty, nails, hair, car dealerships, dentists, chiropractors, regional/strip malls, hotels and lodging, etc. Weddings and proms have been cancelled and high school and college graduations postponed as Americans shelter in place.

The long-term impact on many industries including air travel, hospitality, cruises and even movie theaters still remains to be fully determined. Will Americans be less inclined to travel, attend sporting events, visit Disney parks and sit next to each other in movie theaters at festivals and concerts? Only time will tell.

The light at the end of the tunnel is provided by the amount of unprecedented fiscal and monetary policy stimulus that has and will be added to the system, coupled with the incredible resiliency of the American people and the entire human race. Unlike previous recessions, and specifically the 2008 financial crisis where the underlying economy was quite weak, the pre-COVID-19 economy in the U.S. was healthy with low interest rates, low inflation and record employment levels. Many of the Wall Street economists we follow believe we can return to a healthy-normalized economy rather quickly once the pandemic subsides.

People will be tired of sitting at home. They will quickly be back at the gym, back at the mall, back at work and back to contributing to a consumer-led economy that accounts for more than 70% of GDP.

History has proven that fortune favors the bold. The proven facts remain that selling at the bottom doesn't result in long-term growth of capital. Investors with knowledge, a steady hand and a long-term view will generally outperform others, because they are optimistic about the future, even during difficult times, yet show moderation when markets reach all-time highs, even as sideline investors jump all-aboard.

(6)

Footnotes

(1)Fiscal stimulus refers to increasing government aid, consumption or transfers or lowering taxes. Effectively this means increasing the rate of growth of public debt and often assumes that the stimulus will cause sufficient economic growth to fill that gap partially or completely.

(2)https://www.cnn.com/2020/03/25/politics/stimulus-senate-action-coronavirus/index.html

(3)Monetary stimulus refers to lowering interest rates, quantitative easing, or other ways of increasing the amount of money or credit.

(4)https://www.upi.com/Top_News/US/2020/03/23/Fed-opens-unlimited-quantitative-easing-to-stabilize-US-economy/9871584966352/

(5)https://www.cnbc.com/2019/07/30/this-chart-shows-why-stock-investors-say-dont-fight-the-fed.html

(6)https://en.wikipedia.org/wiki/Fortune_favours_the_bold