Successful investing starts with having the self-awareness

to realize you can't abandon your plan based on fear.

Fear is the enemy when making decisions during any market downturn. Fear is normal, and understandable, when faced with measurable losses in your retirement accounts that could subsequently affect your life savings. However, fear could result in making a regrettable decision about your investments. Too often, rational decisions don't carry the day in the heat of sell-off. The understandable reaction is to simply say, "I want out."

Having experienced dozens of corrections over the course of our careers, the experts at WT Wealth Management have always counseled investors to make as few decisions as possible until the fear and panic have subsided.

Berkshire Hathaway Inc. vice-chairman, Charlie Munger, has said "Always remember, human nature is the great enemy at market lows. At your absolute climax of fear, you must do the exact opposite of what you want to do.

The Sell-Off, The Bounce-Back, The Consolidation and The Breakout

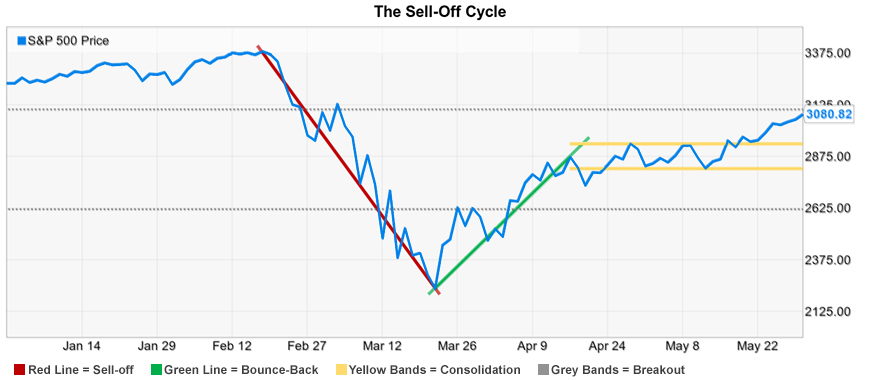

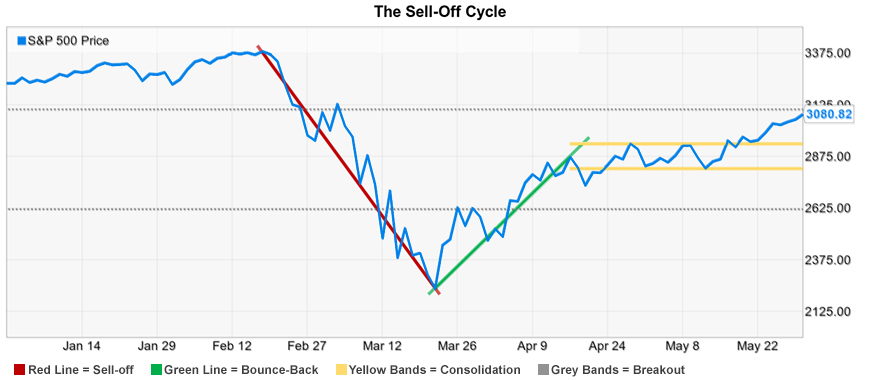

There are four classic technical events in every dramatic market sell-off. These events are classified as the sell-off, the bounce-back, the consolidation and the breakout. Our most recent experience, from mid-February through the end of May, clearly illustrates these patterns.

During the most recent sell-off event (the red line in the chart below), the market quickly realized that a global pandemic was an authentic reason for aggressive selling. The decline started on Feb. 20th and culminated on March 23rd. When the S&P 500 finished its free-fall, it had dropped 1,149 points (to 2,237 from 3,386), a 34% decline.

The second event is the bounce-back (the green line in the chart below), which is usually a 50% recovery from the peak decline. In this most recent case, that would mean a rise in the S&P 500 index of 575 points (1,149/2) to the 2,790 range. Sure enough, the index hit 2,789 on April 9, just 17 days after the trough.

The third event is the consolidation (the yellow band lines in the chart below), where the market trades sideways, awaiting additional information or news events to determine its next move. From April 17th through May 15th the S&P 500 has lost just 9 points while trading from a high of 2,939 to a low of 2,736, a classic consolidation event.

The final event is a breakout from the consolidation pattern (governed by the dotted grey lines) -- either to the downside or upside. This is the least definitive phase as the breakout is more commonly influenced by news and noise, and far less frequently by measurable facts. Bad news can result in a breakout to the downside, perhaps retesting a prior market low, while good news can result in a breakout to the upside, perhaps retesting a prior market high. While this breakout event has not yet produced a clear result, it does appear to be trending towards the upside

What's next?

Clearly, news will dictate the next move in the market. There are dozens of unanswered questions. When will the country re-open and to what degree? How many people displaced from their jobs can return to work? Will industries like airline, hotel, restaurant, cruise and travel recover? Will there be a second wave of the Covid-19 virus? Will we have a vaccine, or cure, and when?

If only to add more uncertainly to an already uncertain picture; we have a Presidential election in November along with 50% of the house members up for re-election and 1/3rd of the Senate.

Markets generally despise the "unanswered questions" that create uncertainty. But we do see some rays of hope. Georgia, one of the early states to emerge from restrictions, hasn't seen a spike in Covid-19 cases like many health experts predicted.

Aiding the recovery, the Federal Reserve has delivered the most monetary policy stimulus in its history. There's a long and documented history of monetary policy stimulus working to revive a stumbling economy. The record level of fiscal stimulus passed and funded from Capitol Hill simply adds to the impact of the Fed's actions.

Wrapping Things Up

COVID-19 will be with humanity for the foreseeable future. We will learn how to co-exist with it. However, while the world pursues more testing (both for the virus and for antibodies), improves how we monitor outbreaks, ensures a sufficient supply of equipment, and develops more proven treatments, including a widely available vaccine, the masses will vacillate between fear and euphoria. As we learned in the four phases above, not reacting to the panic and fear (or to the euphoria either, for that matter) and staying the course will remain the best solution for long-term investors.

Like death and taxes, there are two economic certainties from Covid-19. First, a recession, defined by two consecutive quarters where GDP declines, will occur. Secondly, the downturn will end and the economy will normalize, as it always does. Americans are tough, resilient, optimistic, and creative, with a natural inclination to spend.

Fear is greatest when uncertainty reigns, when we are unprepared or when we have no clear plan. In all likelihood, your pre-existing plan is still valid. The biggest mistake is to ignore your plan at the exact moment that you so badly need it and instead make a decision based on fear.

There is no better time to review your personal financial plan with your advisor and verify it incorporates your time horizon, income needs and other assets along with your personal, emotional risk tolerance. Your plan should include an understanding that markets are volatile and clearly identify how to withstand that volatility. Please reach out for help.

"If you fail to plan, you are planning to fail!" Benjamin Franklin