We are now one third of the way through 2021. The equity market environment has at times been "easy", at times been "challenging", but overall, it may be best categorized as "transitional" as the markets seek clear direction.

Over the last half-decade, it has been a simple market; with growth stocks widely outperforming value stocks and large cap stocks trouncing mid and small cap stocks. But we have recently seen a tenacious battle for market leadership between growth versus value and large cap versus small cap. On the surface, we appear to be on the verge of a natural, long-overdue, rotational change in market leadership. Then again, the current trends could simply be another example of brief value outperformance.

97 million Americans, or 29% of the population, has been fully vaccinated

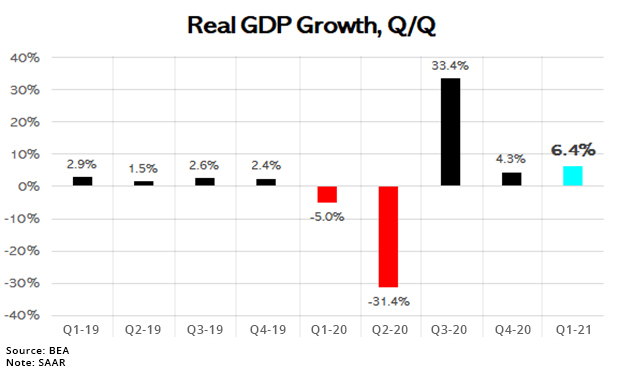

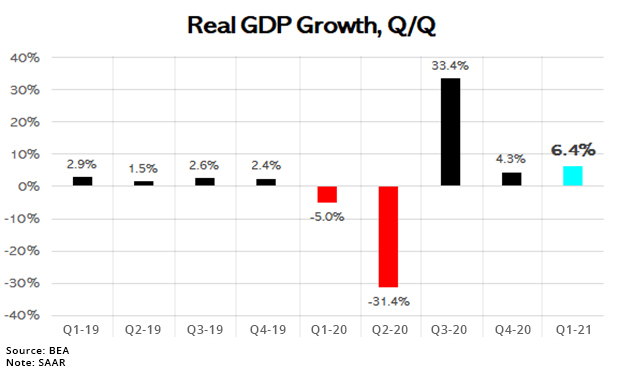

(1) fueling the story of strong spending from "pent up demand" that could result in extremely strong GDP numbers in the 2nd, 3rd and 4th quarters of 2021. In fact, on April 29th, Q1 GDP was reported at a robust 6.4%, on the heels of a 4.3% GDP gain in the final quarter of 2020.

Growth in the current Q2-2021 period is expected to be faster still, potentially reaching a 10% annual pace or more, led by an increase in people willing and able to travel, shop, dine out and otherwise resume their spending habits. For 2021, economists expect the US economy to expand close to 7%, which would mark the fastest calendar-year growth since 1984.

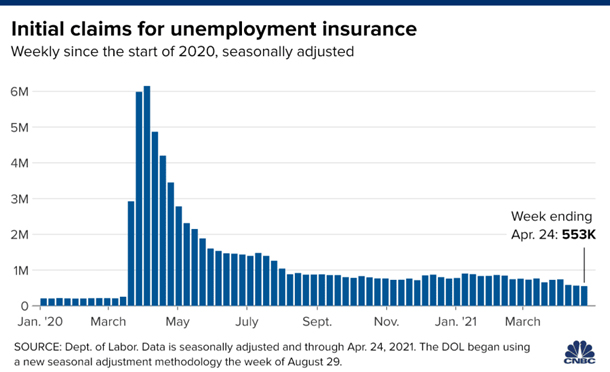

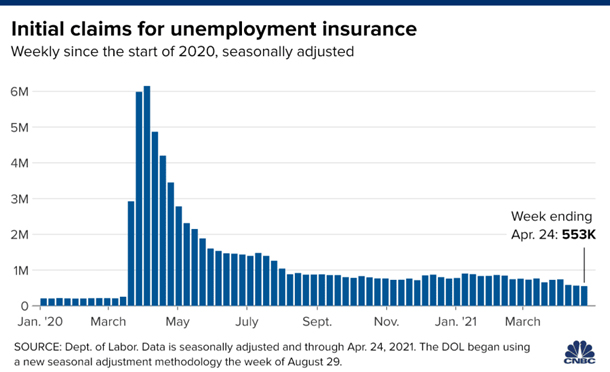

The Department of Labor also released its weekly report on April 28th. New weekly jobless claims fell below 600,000 to its lowest level since the beginning of the pandemic. During the comparable week last year, new weekly jobless claims totaled nearly 3.5 million.

(2) The unemployment rate has tumbled from its high of 14.7% down to 6.0% (still well above the 3.5% rate in February 2020 pre-pandemic).

There is something clearly distinct about the nature of this most recent economic shock. We see Covid as more akin to a natural disaster, followed by a rapid "restart" of the economy, rather than a traditional business cycle recession followed by a "slow recovery." This is precisely why a year ago we warned against extrapolating too much from the steep decline in GDP related activity.

Clearly, the recovery has been remarkable in nearly every respect since the March 23, 2020 lows. For only the fourth time since 1929, the S&P 500 index has gained over 70% in a 12-month period. The other three occurrences came post the Great Depression (1933, 1934 and 1936).

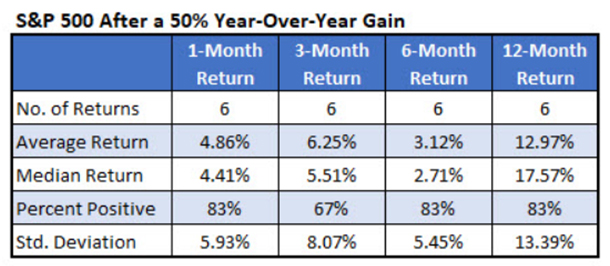

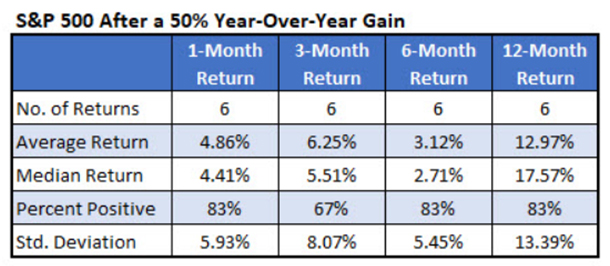

Additionally, there have been six times that the S&P 500 Index gained 50% or more on a year-over-year basis. The table below summarizes the generally favorable returns that followed these dramatic gains.

Schaeffer's Investment Research, "A Look at SPX Performance 1 Year After the COVID-19 Bottom," March 24, 2021 (Rocky White)

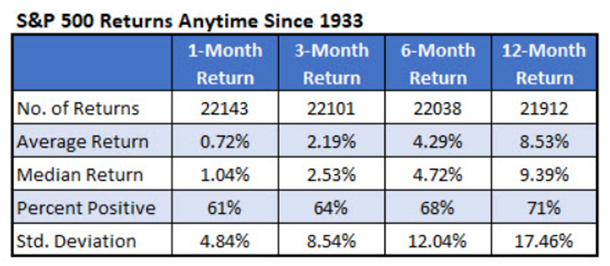

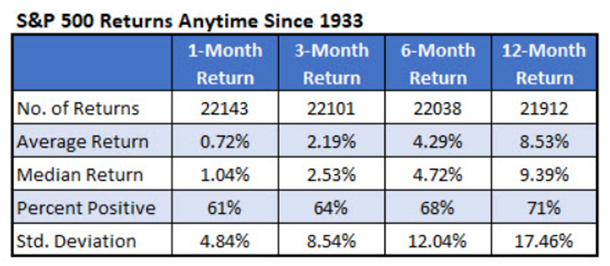

For comparison, the second table shows typical index returns since 1933 (i.e., the year of the first 70%+ run up). While it is only six data points, the average returns after big one-year gains appear to be better than typical returns. These results could be sparked from natural market momentum, from the influence of fiscal stimulus, or from any number of other factors.

(3)

Schaeffer's Investment Research, "A Look at SPX Performance 1 Year After the COVID-19 Bottom," March 24, 2021 (Rocky White)

Based on simple historical observation, we feel the current market rally could be sustained long-term. With the S&P 500 higher by 11.84% and the NASDAQ higher by 8.34% YTD on April 30th, we are off to a good start toward matching the historical trends highlighted above.

However, risks remain. One is a market overreaction to exceptional growth data in the months ahead. We may see bouts of volatility as markets test the Federal Reserve's resolve to stay "behind the curve" on inflation. U.S. growth will also likely peak over the summer: the more activity is restarted now, the less there will be to restart later.

Catalysts that could sustain a rally include a widespread vaccination program, a friendly Fed continuing its low interest rate policy

(4), and the unprecedented amount of fiscal stimulus from the Federal government. Interestingly, the more than $5 trillion injected into the economy during 2020 and 2021 YTD represents 27% of the United States 2020 GDP total.

(5) Economic stimulus to this degree has not been seen since WWII.

The Investment Committee at WT Wealth Management feels all the ingredients are in place for an above average year of returns in 2021 compared to the long-term, historical, average annual return of 10.9%.

(6)

Sources

1.https://www.beckershospitalreview.com/public-health/states-ranked-by-percentage-of-population-vaccinated-march-15.html

2.https://finance.yahoo.com/news/weekly-jobless-claims-week-ended-april-24-2021-pandemic-185007904.html

3.https://www.schaeffersresearch.com/content/analysis/2021/03/24/a-look-at-spx-performance-1-year-after-the-covid-19-bottom

4.https://www.cnbc.com/2021/04/28/fed-holds-interest-rates-near-zero-sees-faster-growth-and-higher-inflation.html

5.https://www.washingtonpost.com/world/2021/03/10/coronavirus-stimulus-international-comparison/

6.https://www.fool.com/investing/how-to-invest/stocks/average-stock-market-return/