What topic should we address with our clients today?

The WT Wealth Management Investment Committee frequently asks that question as we continually monitor the domestic and international markets in equities, bonds, commodities, real assets, alternatives and other asset classes that make up your investment portfolio.

- Special Market Updates, which we deliver at the beginning of each month, provide insights into market fundamentals, economic statistics and metrics, government reports, and other topics that drive the markets.

- White Papers, which we deliver mid-month, are more research driven and seek to provide a layman’s explanation of current news events within the markets or the economy.

So what will it be today?... Earnings Season

Earnings Season - Definition

The reports delivered by companies during earnings season (generally the first 45-60 days following the end of each quarter) provide two things:

- A report card of last quarter results focusing on top-line revenue (ring the register sales) and bottom-line earnings per share (EPS), and

- A look into companies’ expectations for their financial future through “guidance”.

Wall Street analysts also make projections on both top-line revenue and EPS for each publicly traded company, what are commonly referred to as “street estimates”. The markets closely watch how a company performs against these street estimates and then rewards or punishes the company’s stock accordingly.

We pay close attention to these reports as the information is a key input in company valuations for our individual equity strategies. Also, taken as a whole, earnings season provides an indication of general economic strength, weakness or overall market direction.

As earnings season concludes each quarter we always like to take a step back and evaluate. How do results stack up against street estimates? Against last year’s numbers? Any significant revisions to forward guidance? Reviews are useful in terms of setting an overall strategy for stock allocations and provide a base case for trading in our strategies.

Earnings Season Q1 2021

In 2021, the usefulness of that exercise is questionable. At this time in 2020 most of the economy was in full shut down mode, so comparing data from this year to last year and drawing any meaningful conclusion is fraught with challenges. Also after March 2020, once the pandemic was in full swing, most analysts and companies stopped providing forward-looking guidance about sales and earnings because they simply had no idea what the future held. While most companies today, post-pandemic, are back to providing regular guidance, a few companies (e.g., Carnival Cruise lines) are still in the “we have no idea” stage of their recovery.

According to FactSet, with nearly 90% of S&P 500 companies having reported for Q1 2020, 86% have beaten EPS expectations, while 76% have beaten on revenue. The percentage of companies that beat street estimates for EPS is the highest since 2008. And the year-over-year EPS growth rate, at 49.4%, is the highest since Q1 of 2010. Interestingly, back then we were also comparing to an extreme downward quarter from the prior year (2009).

(1)

This Crisis Versus Last Crisis

It is tempting to look at Q1 2021’s similarity with Q1 2010 and conclude that our future will be what their future was. . . one of the longest bull markets in history (a roughly 300% increase in the S&P 500 over the next decade). That’s a risky assumption with a high likelihood that we are overestimating the similarities.

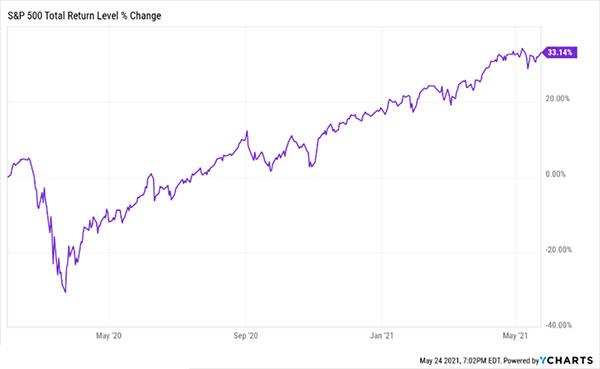

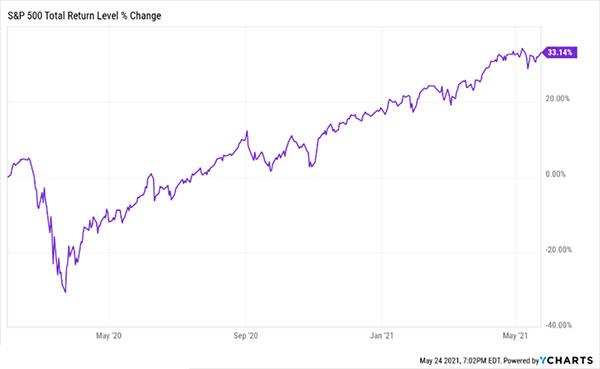

For example, by Q1 2010 the S&P 500 had recovered less than half of its losses from the low point of the recession in Q1 2009. In our case today, the S&P 500 is trading approximately 25% above where it was before the March 23 bottom in 2020. Said another way, following the events of 2009 it took four years for stocks to get back to their pre-financial crisis levels. This time around, we did it in five months!

The recovery charts below compare the two time periods.

January 2020 thru May 2021

January 2008 thru January 2012

The circumstances around these two crises are quite different. It would be unrealistic to assume or even hint that we will have a long-term post-pandemic bull market like the decade that followed the 2008-2009 financial crisis. In fact, we believe there could be some hangover effects in 2022 and 2023 as the Federal Reserve normalizes interest rates and Covid-19-focused fiscal stimulus is removed from the US economy.

Improvise, Adapt and Overcome

But that was the plan all along. The United States has the most complex, elaborate and financially sound Central Bank in the world. They, and the Federal Government, saw the pandemic unfold and reacted swiftly and with unprecedented monetary and fiscal stimulus. That response appears to have served its purpose of bridging the economy until the vaccine could be administered.

Over the last 15 months both everyday America and corporate America have shown us that the US Marine Corps’ unofficial slogan – “Improvise, Adapt, and Overcome” – has never been truer. The United States is one of the best run federal government systems and has some of the very best run companies and households in the world.

We are quite optimistic about the US economy and the financial markets for the remainder of the year.

Sources

1.Earnings Insight - FactSet.com