The 4

th of July was always a special Holiday for me growing up in Boston, MA - the birthplace of the revolutionary war. As a kid I walked the freedom trail, climbed to the top of the Old North Church, threw a crate of tea off an "English" shipping vessel, climbed below deck on the USS Constitution and attended many Boston Pops concerts on the Charles River Esplanade. The WT Wealth Management family hopes you too enjoyed a 4th of July holiday with your friends and family, especially now that we are enjoying a little more "freedom" this year than last.

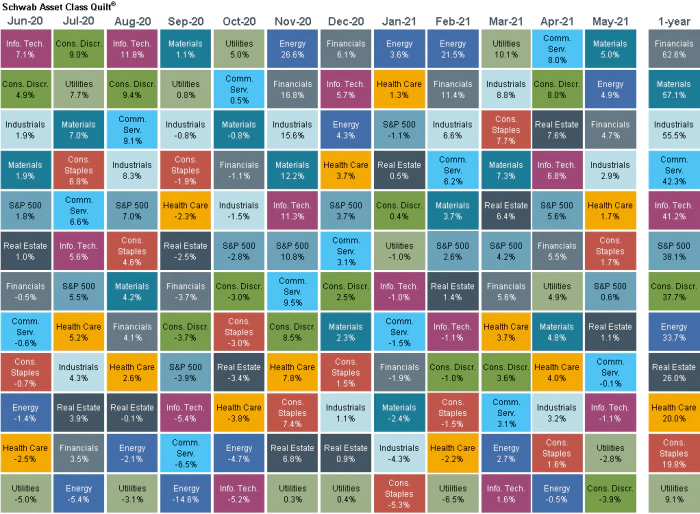

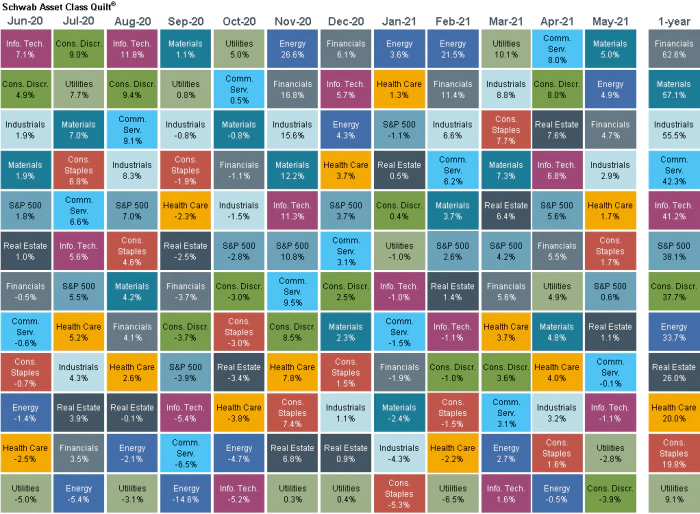

It has long been said that sector leadership rotation is the best indication of a sustainable bull-market.

From the March 2020 market low, the leadership bias was the "big 5" S&P 500 tech giants: Apple, Google, Amazon, Facebook and Microsoft, along with the easy to identify "stay at home plays". Starting this past November, as a re-opening became imaginable as a result of the vaccines, market leadership expanded and shifted toward cyclicals, defined as companies/sectors that rotate in and out of favor based on economic expansion and contraction like energy, materials and financials.

The table below shows S&P 500 sector rotations over the past year on a month-to-month basis. Clear direction has generally been unpredictable. Sectors like energy have spent as many months at the top of the leaderboard as they have at the bottom. Utilities were last in February and first in March. So no single sector or industry has had to do all the heavy lifting alone. This is considered to be very healthy as we move higher.

(1)

Just as a 20-horse carriage will travel farther and faster than one pulled by only 2-horses, stock markets have the potential to rise longer and higher when driven by multiple sectors rather than just a few. Market technicians refer to the level of sector participation as "breadth." Broad breadth advances are more encouraging than narrow ones.

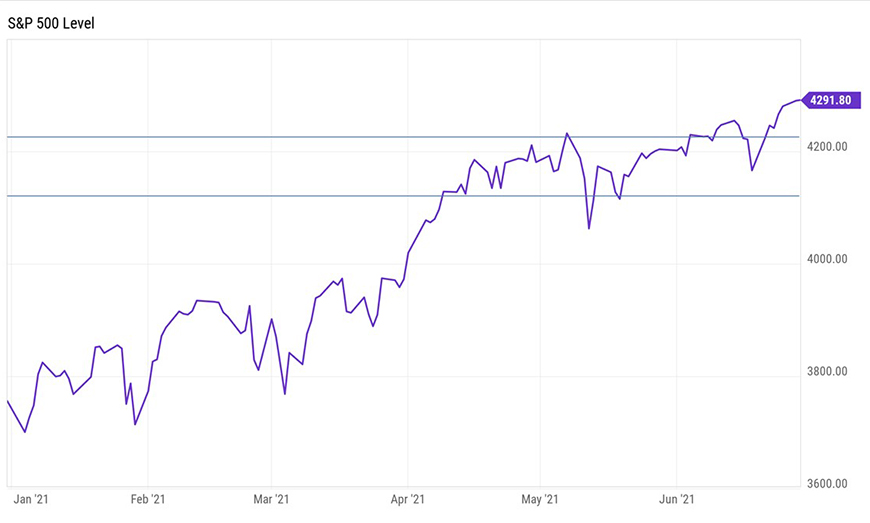

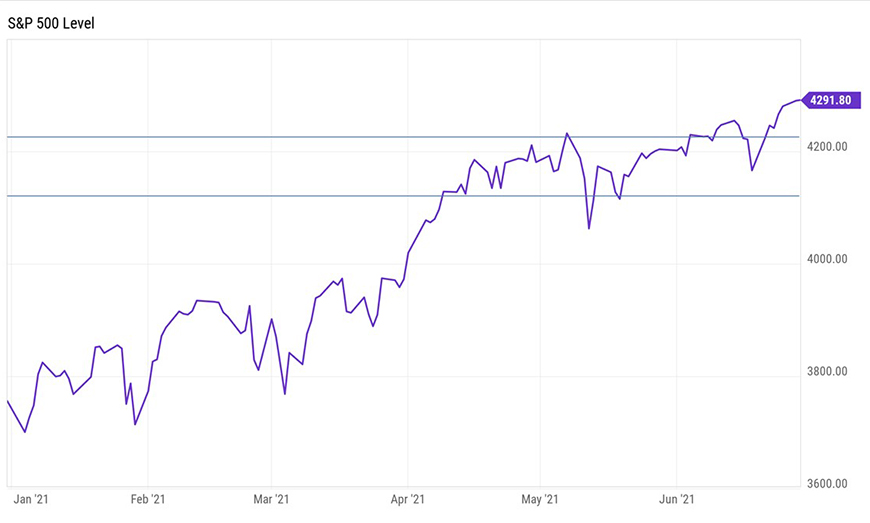

Indeed, we have seen several subtle, positive developments in recent weeks that reflect strengthening market conditions and a broader advance. Improvements in market breadth imply a potential upside breakout from the sideways pattern that the S&P 500 has been exhibiting since mid-April. In fact, the S&P 500 hit an all-time high on June 29th.

Last week, a client asked me whether there was one indicator I watch most closely. With little hesitation I said there are actually three: employment, inflation and interest rates.

The fuel of any sustainable expansion is getting Americans back to work. The US unemployment situation has greatly improved, but there are still far more people out of work than pre-pandemic. The good news, at least for workers, is that wages appear measurably higher than pre-pandemic levels. Since we know Americans like to spend what they make, this should help sustain economic expansion.

The longer inflation can be tolerated, mitigated and justified as transitory (temporary), the greater will be the Federal Reserve's ability to continue the current easy monetary policy that has supported the economy and the equity markets.

Low rates are one of the hardest "habits" to break – the equity markets just love them. In the coming months, as we expect the Fed to announce "normalization of interest rates", we also expect to experience noticeable volatility in the financial markets. This is a natural result of an improving, healthier economy. We simply need to maintain focus that, long-term, a healthier economy is good news for Americans and great news for the financial markets.

Sources

1.

Turn Turn Turn: Rotations Persist - Schwab.com