Hey, we get it... The last few months have been overwhelming in terms of news flow, volatility and price-gyrations within the equity markets. During times like these the professionals at WT Wealth Management really earn our stripes.

In this age of rapid technological progress, we have near instantaneous access to a multitude of news sources on our phones, computers and TV sets. No matter your preferred news outlet, inflation has been a dominant headline for several months. Now Ukraine is the new focus.

First, on inflation, the Federal Reserve is going to address this issue after months of hanging their hat on the hopes that inflation was "transitory". I think we all recognize now that it is not. The Fed will systematically tighten the money supply which will make it more expensive to borrow money thus, hopefully, curtailing demand and slowing price increases without backing the economy into a recession.

History has shown that recessions are generally accompanied by a dramatic increase in unemployment. So far we are not experiencing rising unemployment, in fact many companies are struggling to find enough workers. So that should also help the Fed get interest rates back to the pre-pandemic levels without derailing the economy.

Second, we are not overly concerned about the impact of Russian aggression in Ukraine, as geo-political selloffs within the equity markets tend to be rather short-lived. We think a large part of the decline, as it relates to Ukraine, has already been realized. Ultimately, what happens between Russia and Ukraine is a bad optic -- but has very little to do with earnings of the companies we own or the health of the US economy. Remember, Russia's GDP is small, only about the size of the state of Texas. So the geo-political impact of this situation is far more significant than the direct economic implications.

Experience has shown, the best way to get through volatile times is simple. Ignore the volatility. Years ago, I visited another very successful money manager and commented that they did not have one single TV set in their office playing the requisite financial news channel like every other money manager I had ever visited. Their managing director looked me square in the eyes and said, "that's just noise. We hate noise. Noise makes you make bad decisions."

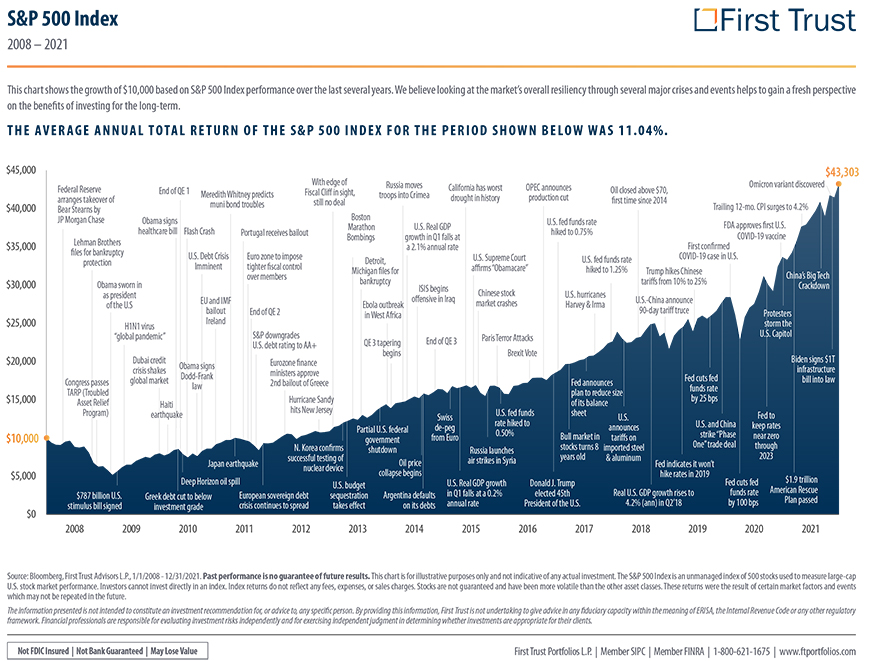

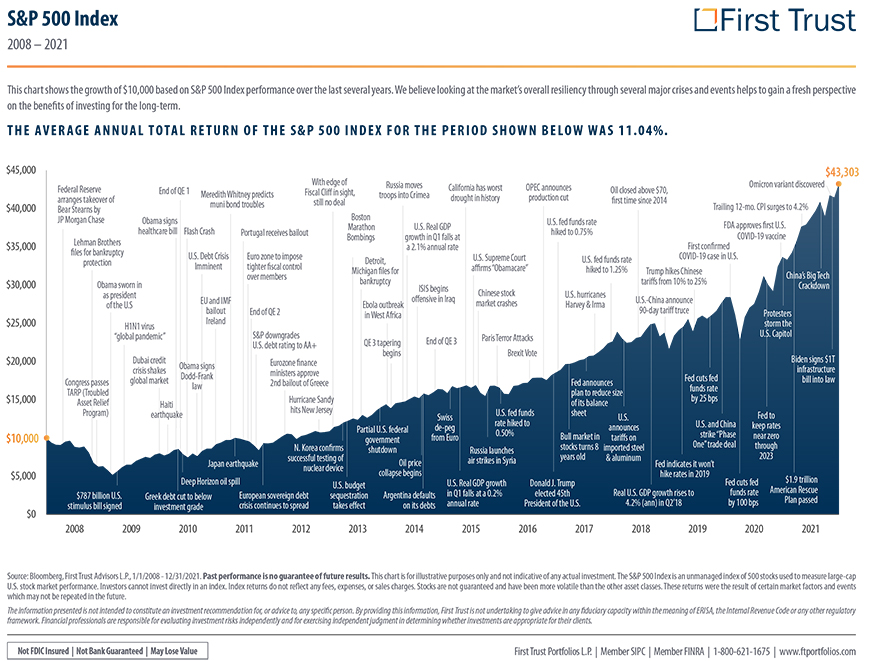

That lesson always stuck with me and is one of the reasons I love this chart, maintained by First Trust. As they highlight, the market's resiliency through crises and change events, no matter how "end-of-the-world-as-we-know-it" they may appear at the time, provides perspective on the benefits of staying invested over the long-term.

The Investment Committee at WT Wealth Management has long felt that most of the gains within the 2022 markets would occur in the second half of the year. Covid-19 concerns seem to be fading as mask mandates are lifted across the country. The conflict between Russia and Ukraine should settle down as the world unites to slow Russian aggression. The full impact of the Fed's monetary tightening will take time to reach full effect. If corporate America can fill in the supply chain issues, this could also provide measurable inflation abatement by the second half of this year. The equity markets would view all of this with great enthusiasm.

At the end of the day, if you stay the course, what happens today, tomorrow, next week or next month will not have an impact on your financial future. If life is a long game, investing should be the second longest game. With pensions a thing of the past and social security not nearly enough for most households to live comfortably, individuals will need to invest with more determination and commitment than ever before. Sometimes that just means working harder to ignore the noise.

As always, the professionals at WT Wealth Management are here to help you make sense of the financial world around you and to help you recognize what to pay attention to and what to ignore. Please reach out.