Let's not sugarcoat things. It's been a terrible year for investors in both stocks and bonds. Stocks are in the midst of their worst run since the 2008 financial crisis, while bonds are experiencing their worst year ever. The S&P 500 is down about 15% from its highs, and retail investors are faring far worse. Recent data from JP Morgan's personal portfolios shows that retail investors, doing things on their own, are down 44% this year.

(1)

But there is reason to believe that 2023 could be a better year. Specifically, two reasons seem to indicate that we may already have seen the worst.

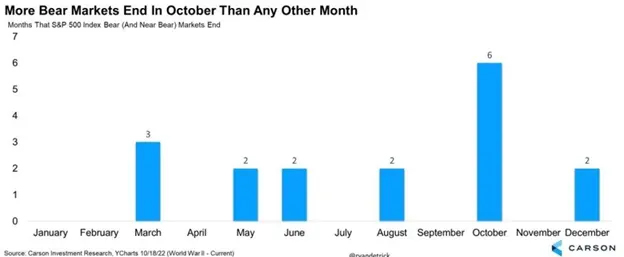

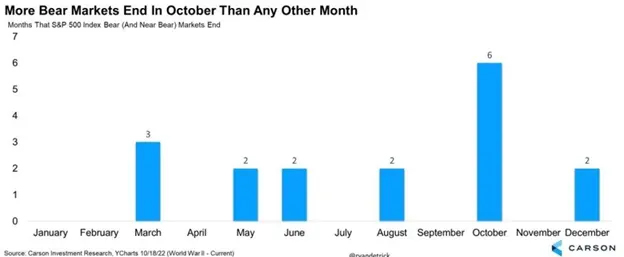

October Has Been the Witching Month for Bear Markets

First, if history does repeat itself, stocks may have already bottomed, and they could rally about 20% over the next six months. Why is that? October, best known for changing leaves and the celebration of all things spooky, is also the month in which bear markets tend to die. Since 1950, Wall Street has experienced 17 bear markets. Six of them – about 35% – ended in October.

https://www.yahoo.com/now/history-bear-markets-stocks-soar-172817719.html

March, May, June, August, and December all have experienced the end of a bear market, while January, February, April, July, September and November never have. In other words, bear markets find a bottom in October more frequently than in any other month of the year.

What's so significant about October?... Mid-term elections... And this is the second reason for hope.

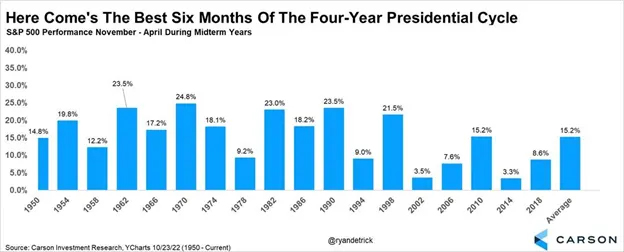

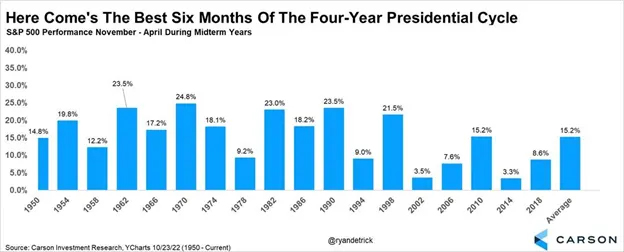

Market Response to Mid-Term Elections

History has shown that stocks tend to soar after mid-term elections. Since 1950, on average, the six months following the mid-terms have proven to be the best six months of the four-year presidential cycle. Perhaps more importantly, stocks have never dropped over these six months. We've had 18 mid-term elections since 1950. All 18 saw stocks rally over the next six months. Even in 1990, amid a recession, stocks powered 24% higher during this six-month stretch.

https://www.yahoo.com/now/history-bear-markets-stocks-soar-172817719.html

As always, records are made to be broken, so this is no guarantee. History has no memory. But these results are not random. Elections create political uncertainty and markets despise uncertainty. However, once an election is over, uncertainty becomes certainty and stocks have always rallied on the "unknown" becoming the "known." We're in a bear market... and 2022 was a mid-term election year... so there's hope for an early Christmas present.

Conclusion

Just because we have found reasons for optimism, does that mean there is clear sailing in the months ahead? While we feel like the worst is "mostly" over we remain moderately cautious in the current market (compared to early fall when we were extremely cautious).

As a result, we are steadily increasing our exposure to equities in CSE and TRM portfolios, while closely following two big questions that remain: 1) does a hard or soft landing recession lie ahead? and 2) how far will the Fed need to go to beat inflation?

At WT Wealth Management, we always root for soft landing recessions. It just may happen in the current case. The consumer has been stubbornly engaged in spending – seemingly in spite of inflation, supply chain challenges and a nearly $9 trillion loss in the equity markets over the past year. How is that possible? Jobs have remained plentiful and high-paying, so short-term disposable income, and the consumer sentiment that accompanies it, has remained strong. If the Fed's rate increases can slow consumer spending, especially on high-ticket items sensitive to interest rate changes (e.g., homes, vehicles, consumer debt, etc.), then maybe, just maybe, the Fed can thread the needle and deliver a reduction in inflation without catastrophic job losses and dramatic economic slowdown.

The market has shown some recent enthusiasm over early indications that inflation pressures may be easing. But the Federal Reserve has clearly stated they will "keep at it until the job is done" and that rates may end up higher than originally thought and then stay there for an extended period of time. There is still a long way to go before the current 7.7% level of inflation is brought down to the targeted 2% inflation level.

(2) If inflation remains stubbornly high the Fed will have to continue raising rates, as they have clearly stated, until something breaks. That "something" to break will be employment and the economy, which will lead to a deeper recession and surely re-set the economy in order to finally kill inflation. As we have said many times, inflation is the worst tax and affects everyone. So we encourage the Fed to remain undeterred in its mission.

Your WT Wealth Management team is hopeful that the bear market is near the bottom, which should provide us a clearer path forward. We will continue to take the necessary precautions and actions as economic conditions develop. As always, please reach out to your advisor if you would like to discuss more. We are always here for you.

Sources

- Retail investor portfolios down 44% year to date

Financial Times

- Consumer prices rose 0.4% in October, less than expected, as inflation eases

CNBC