Personal Consumption Expenditures (PCE), the Bureau of Economic Analysis inflation index most closely watched by the Federal Reserve (even more so than CPI), slowed in November

(1): another sign that the long-lasting surge in consumer prices seems to be easing.

The December 24th PCE report showed that prices rose 5.5% in November from a year earlier, down from a revised 6.1% increase in October and the smallest gain since October 2021. Excluding volatile food and energy prices, so-called core inflation was up 4.7% over the previous year. That was also the smallest increase since October 2021.

(2)

Despite this encouraging downward trend, inflation, which began to rise a year and a half ago as the economy bounced back from 2020's coronavirus recession, still remains well above the 2% level targeted by the Fed.

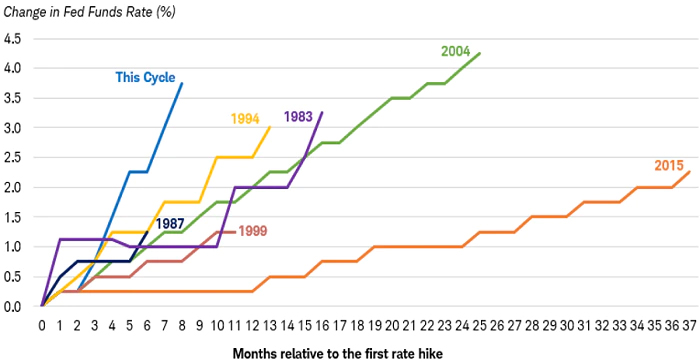

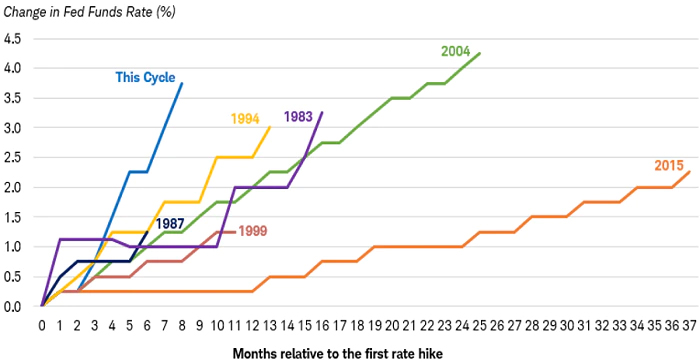

To combat inflation the Fed has raised its benchmark interest rate seven times since March in an attempt to bring consumer prices under control. The latest tightening cycle has been the most aggressive in US history.

https://www.schwab.com/learn/story/fixed-income-outlook

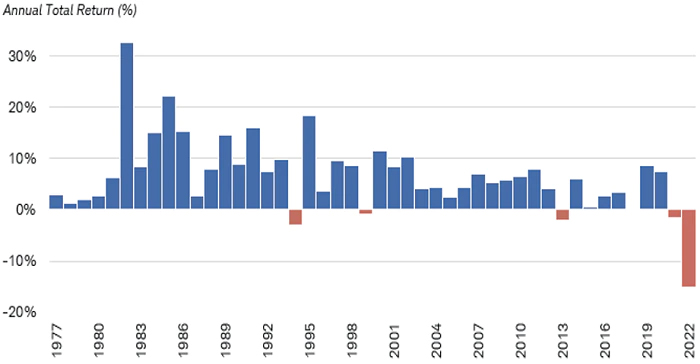

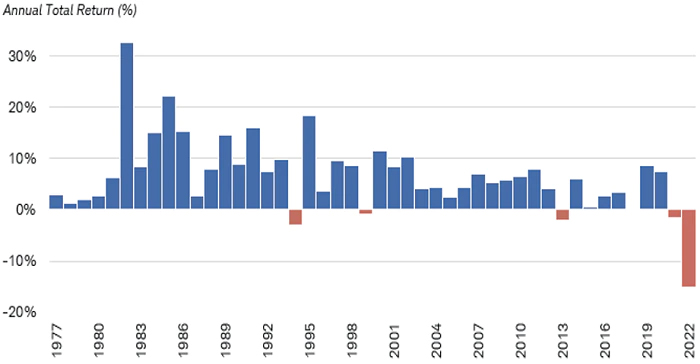

With interest rates (yields) starting so low and the increases coming so fast, nearly every segment of the fixed income market experienced declines, especially bonds with longer maturities. In fact, this asset class's performance during 2022 has been an anomaly. Even in past periods of sharply rising interest rates, bonds have generally delivered positive returns since the income yield from a bond's coupon typically offsets price declines. However, during 2022, without the cushion of higher yields to begin with, coupon and price returns were historically weak.

https://www.schwab.com/learn/story/fixed-income-outlook

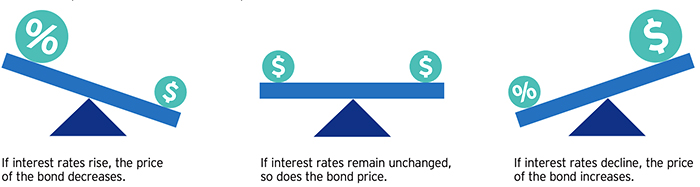

The abysmal performance of bonds in 2022 is because bond prices and interest rates hold a direct inverse relationship. When rates increase, bond prices typically decrease. When rates decrease, bond prices typically increase. The more aggressively yields increase/decrease, the more aggressively bond prices fall/rise. In other words, it was more the speed of the rate increase, rather than the rate increase itself, that generated the steep price declines in 2022. It's like a see-saw, as illustrated below.

https://lcvadvisors.com/blog/interest-rate-risk-what-does-it-mean-for-your-bond-investments

Now with U.S. inflation showing early signs of slowing and a peak Fed Funds Rate in sight, many bond analysts expect 2023 to be a year of recovery for fixed-income. This is the silver lining from the past 12 months for many retirees and investors whose risk profile falls into more conservative and moderate ranges.

At WT Wealth Management we feel US treasuries & investment grade corporate bonds offer an excellent risk/return trade off. Our optimism about bond returns for 2023 is based on three factors: yields are the highest in more than 15 years, the bulk of the Fed tightening cycle appears to be over, and inflation is showing signs of decline.

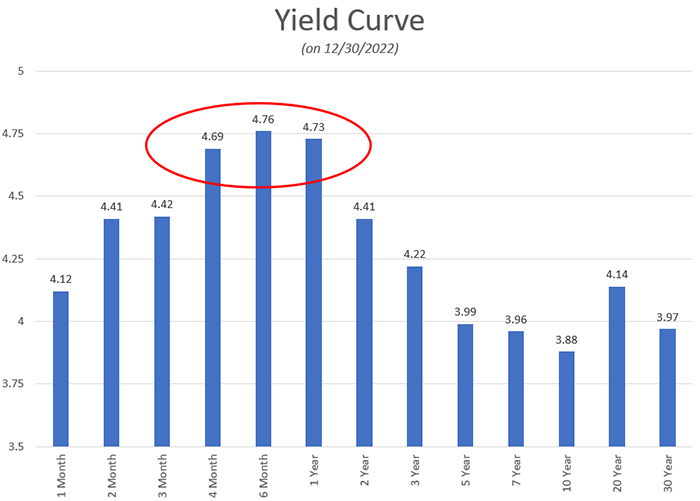

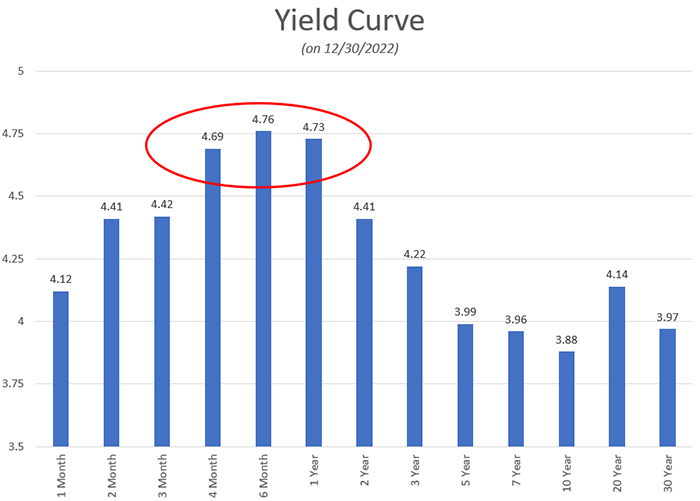

More importantly, to achieve the best yields we currently have the option to invest on the short side of the yield curve (i.e., shorter duration), which also offers the best insurance from additional price declines if the Fed continues to tighten.

Let's face it, many investors and financial advisors have taken on more equity risk over the last decade in the face of what has essentially been 0% interest in the bond markets for far too long. "There was no alternative." It was hard to be an advocate of treasuries or corporate bonds when their yields were less than 2%.

After a long drought, "there is [once again] an alternative" as the bond market is awash in yields that are finally attractive. Now that we have seen a yield "re-set" it's time to build a new game plan based on the new playing field. A portfolio of high-quality bonds—such as US treasuries and other government-backed bonds, along with investment-grade corporate bonds—can yield in the vicinity of 4.0% to 5.5% without excessively high duration or credit risk. We like these yield numbers over equities in the short-to-medium term, at least until inflation returns to the Fed target of 2% and the US economy has averted, or passed through, a measurable recession.

As we flip the calendar, we find ourselves squarely in an environment of lower equity returns contrasted by higher bond yields. Now is the time to meet with your financial advisor and revisit your asset allocation mix. We look forward to meeting with you in the New Year.

Sources

- Personal Consumption Expenditures Price Index

bea.gov

- Fed's preferred inflation measure shows price pressures eased in July

CNBC