Interest Rates

Since March 2022, the Federal Reserve's (Fed's) aggressive interest rate policy has been all about reigning in red-hot inflation numbers. As a result of the global pandemic the Fed Funds Rate (FFR) had been moved to near-zero. These low interest rates, combined with direct checks to consumers and loans to businesses for pandemic relief, enhanced unemployment benefits, and Washington DC-directed stimulus ignited an inflation fire that caught many Americans by surprise.

In its on-going battle against inflation, the Fed raised rates again last week, for the tenth consecutive meeting, bringing the FFR from a target range of 0.00%-0.25% to 5.00%-5.25%, the most dramatic move by Fed Policy makers since the early 1980's. As of the time of this writing, Fed Fund Futures are betting against an 11th rate hike at the June meeting, with over 90% believing the Fed is done raising rates. Only 8.5% predict another hike of 25 bps and no one is predicting a rate cut.

(1)

The FFR matters because it has an impact on every aspect of consumers' financial lives, from how much they're charged to borrow to how much they earn in interest on their savings. The magnitude and abruptness of rate hikes in the current cycle have sparked leaps in mortgage rates, auto loans, credit cards and home equity lines of credit. Yields on bonds, certificates of deposit (CDs) and savings accounts are also on the rise.

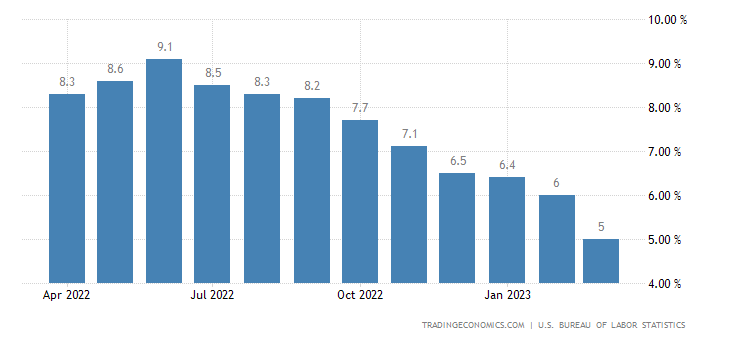

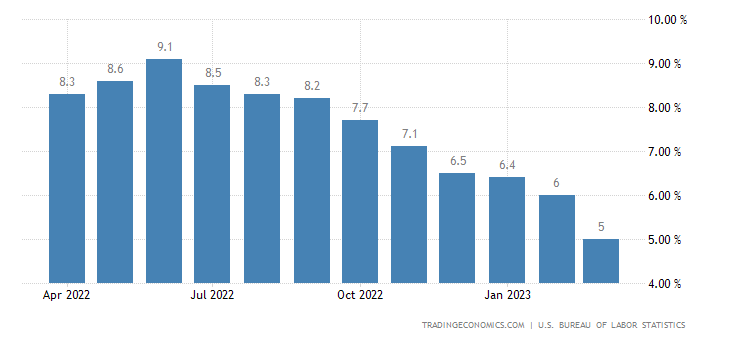

Consumer Price Index

We are finally seeing indications that the efforts of the Fed are beginning to take hold. The Consumer Price Index (CPI), a measure of prices paid by urban consumers for a market basket of consumer goods, rose 0.1% in March against a Dow Jones estimate for 0.2%, and 5% from a year ago versus the estimate of 5.1%. This was the lowest level since May of 2021. While inflation is still well above where the Fed feels comfortable, it is at least showing continuing signs of decelerating. Federal Reserve Policymakers target inflation around 2% as a healthy and sustainable level of growth.

Table 1: U.S. Annual CPI

https://tradingeconomics.com/united-states/inflation-cpi

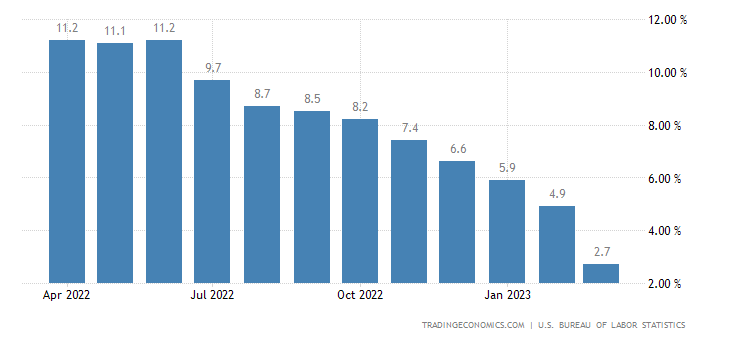

Producer Price Index

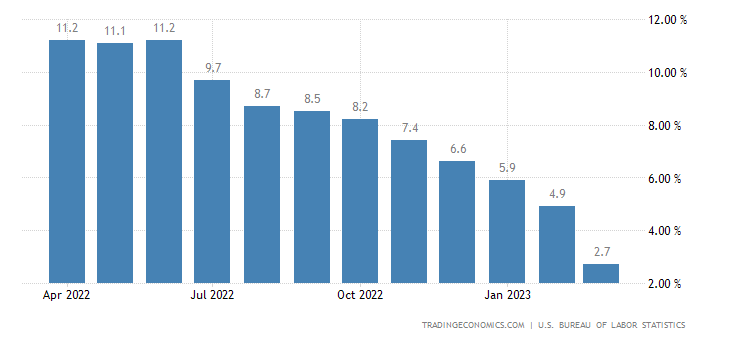

Encouragingly, the Producer Price Index (PPI), a wholesale/producer-centric index, also continued its downward slide in March with annualized price increases sinking to 2.7%, below expectations of 3.0%, and substantially down from 4.9% in February 2023. It is the lowest annual increase for the key inflation gauge since January 2021.

(2)

Table 2: U.S. Annual PPI

https://tradingeconomics.com/united-states/producer-prices-change

PPI, along with CPI, is one of the most closely watched inflation gauges. Because PPI captures price shifts upstream of the consumer, it is looked to as a potential leading indicator of how prices may eventually change at the retail level. Since notching a 11.2% gain in June 2022, the PPI has seen a dramatic cooldown in recent months. Supply chains appear to be back in sync since being disrupted by the pandemic.

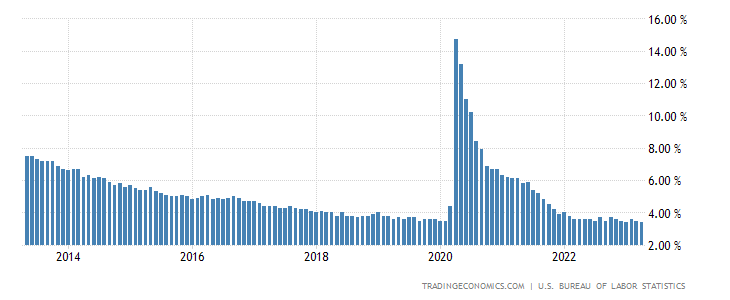

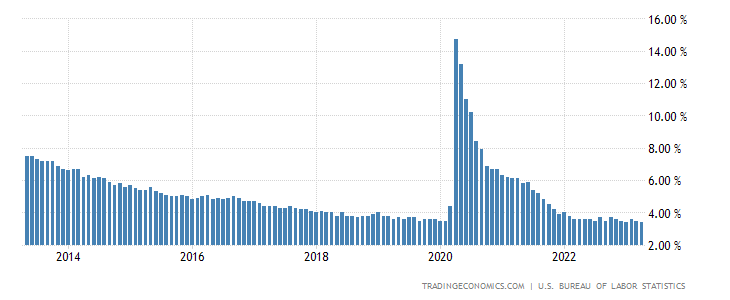

Unemployment

The most recent unemployment report shows modest slowdowns in hiring and wage growth and no measurable increase in the unemployment rate, which remains sub-4% and near historical lows, indicating a healthy labor market.

(3)

Table 3: U.S. Unemployment Rate

https://tradingeconomics.com/united-states/unemployment-rate

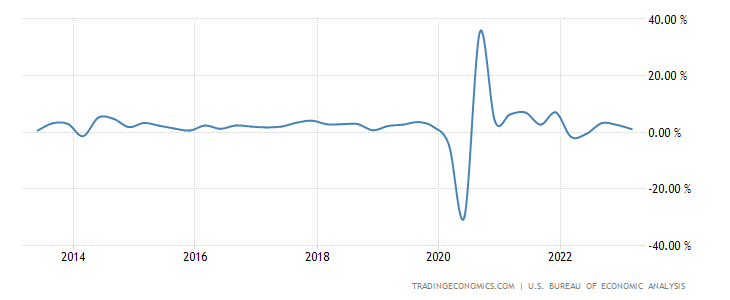

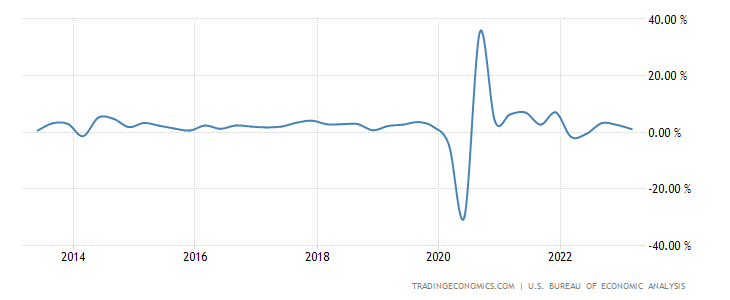

Gross Domestic Product

On April 27th, U.S. Q1 Gross Domestic Product (GDP) was released indicating the U.S. economic activity grew at a slower pace (1.1%) than expected (1.9%), a warning that the economy is slowing. Q1 GDP was significantly cooler than the previous two quarters, which saw annualized growth of 2.9% and 3.2%, respectively.

(4)

Table 4: U.S. GDP Growth (Annualized)

https://tradingeconomics.com/united-states/gdp-growth

Conclusion

Ultimately, the end of this rate tightening period, slowing inflation, steady employment and moderating GDP are all good news for Americans. Studies have shown that it can take 9-12 months for the effect of a rate increase to be seen in the overall economy so the impact of the four successive 0.75% rate hikes that occurred between June and November of 2022 may still lie ahead. So the Fed may not only halt future rate increases, but may even start to think about rate cuts, which we believe would be enthusiastically received by the equity markets.

At WT Wealth Management we believe the economy will continue to cool into a mild recession come summer and fall of 2023 followed by rate cuts in the early part of 2024. The so-called "soft landing" the Fed has targeted is a real possibility, but many stars need to align perfectly. The labor market must weaken, but remain healthy. Consumer spending must slow, but not collapse. GDP could decline from current levels, but not by much. And finally, the Fed needs to pivot from tightening to easing at just the right moment. There's an old saying the Fed always shows up late to the party and overstays its welcome. Hopefully, they'll pick up on the social cues better this time.

One of our oft-repeated mantras is that investors who stick to their plan will ultimately reap the benefits of their tenacity and faith in the plan. Please reach out to your advisor if you feel you need an encouraging word.

Sources

- CME FedWatch Tool

CMEGroup.com

- US wholesale inflation saw dramatic cooldown in March

CNN.com

- Historical US Unemployment Rate by Year

TheBalanceMoney.com

- GDP: US economy grows 1.1% in Q1, slower than expected

Yahoo! Finance