Markets Look to the Pause

With just two weeks until the next Federal Reserve meeting on June 14th, it remains unclear if the Fed will need to raise interest rates further to combat inflation.

The 25 bps rate increase approved in May 2023 was the tenth in a row since March of 2022, and raised the benchmark policy rate to the 5.00%-5.25% range – the highest level since the summer of 2006 and the level most policymakers had projected as the likely stopping point for rate hikes.

Since the last Federal Reserve meeting on May 3rd, fresh data on inflation, jobs, and the banking industry have done little to clarify the situation. Nothing is changing very fast. Job growth seems to be cooling but remains strong. Inflation appears to be falling but remains too high. Overall demand, bank credit and the economy look to be slowing, but also are holding up better than anticipated.

As of today, U.S. policymakers remain divided about their upcoming policy decision as they continue to balance uncertainty about recent credit tightening from regional banks and the fact that inflation is proving to be stubborn to defeat against the lagging impact of past rate hikes.

Academic consensus about the lagged effects of rate tightening consistently falls in the 9–12-month range. So, we are just entering the 4-month period where we will most likely feel the full impact of last year's four consecutive 75 bps increases.

| OMC Meeting Date |

Change (bps) |

Federal Funds Rate |

| 3-May-23 |

25 |

5.00% to 5.25% |

| 2-May-23 |

25 |

4.75% to 5.00% |

| 1-Feb-23 |

25 |

4.50% to 4.75% |

| 14-Dec-22 |

50 |

4.25% to 4.50% |

| 2-Nov-22 |

75 |

3.75% to 4.00% |

| 21-Sep-22 |

75 |

3.00% to 3.25% |

| 27-Jul-22 |

75 |

2.25% to 2.50% |

| 16-Jun-22 |

75 |

1.50% to 1.75% |

| 5-May-22 |

50 |

1.50% to 1.75% |

| 17-May-22 |

25 |

0.25% to 0.50% |

Federal Reserve policy makers have recently said they would make decisions "meeting by meeting," but clearly noted that after a year of aggressive rate increases, they can be more deliberate while reviewing data and make more careful assessments. Fortunately, Federal Reserve officials will receive important jobs and inflation data ahead of the June 14th rate decision.

| Date |

Time |

Release |

| Thursday, June 1, 2023 |

8:30AM |

Productivity and Costs for First Quarter 2023 |

| Friday, June 2, 2023 |

8:30AM |

Employment Si tuation for May 2023 |

| Tuesday, June 13, 2023 |

8:30AM |

Consumer Price Index for May 2023 |

| Tuesday, June 13, 2023 |

8:30AM |

Real Earnings for May 2023 |

| Wednesday, June 14, 2023 |

8:30AM |

Producer Price Index for May 2023 |

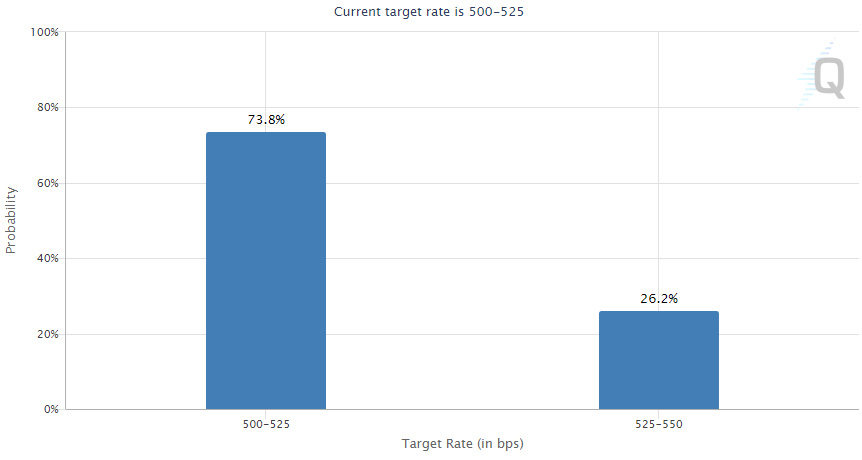

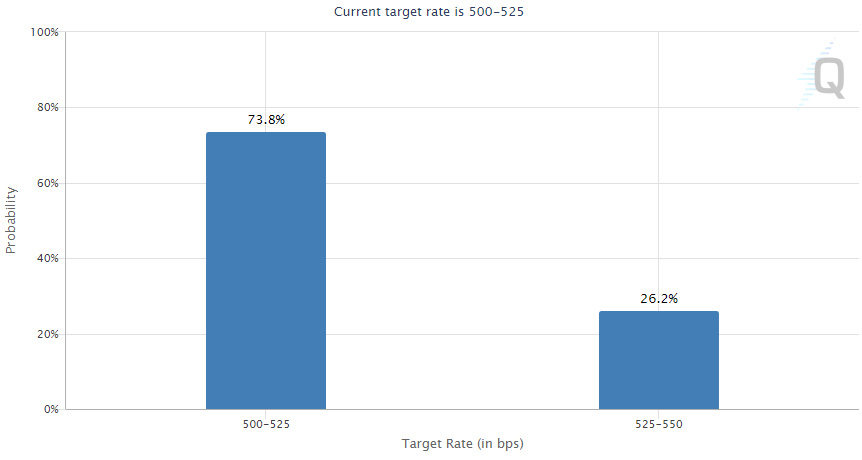

Currently, Fed Fund futures are showing a higher probability of a pause than another 25-bps increase at the June meeting

Target Rate Probabilities for 14 Jun 2023 Fed Meeting

CME FedWatch Tool on 6/1/2023

Ultimately, the Fed will have to make a tough decision and either agree the economy needs time to fully adjust to last year's aggressive rate hikes - a core argument for pausing - or maintain a hawkish position and continue raising rates until there are clear signs inflation is dead.

The Fed constantly faces the risk of doing too much or too little. Too much could result in a much-feared deep recession. Too little could result in persistent inflation. As a mentor once said to me "the Fed has a habit of showing up late to the party and then overstaying their welcome."

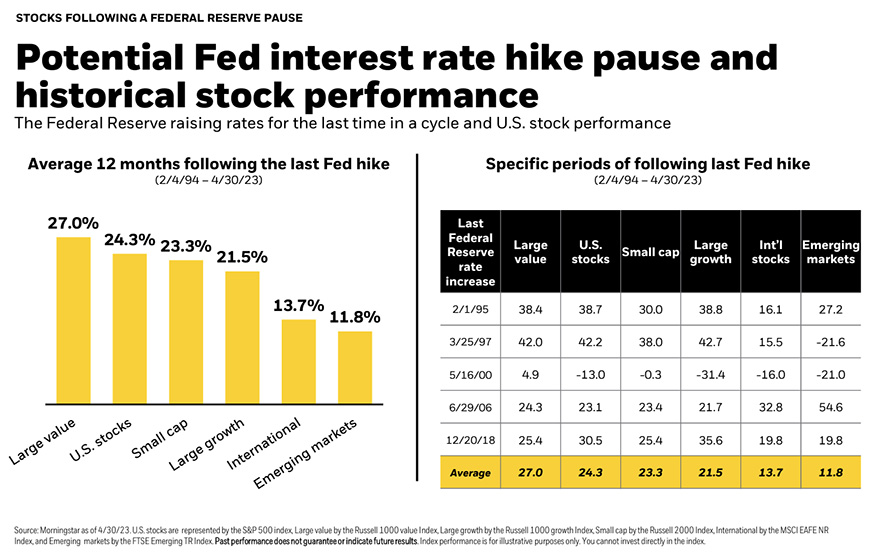

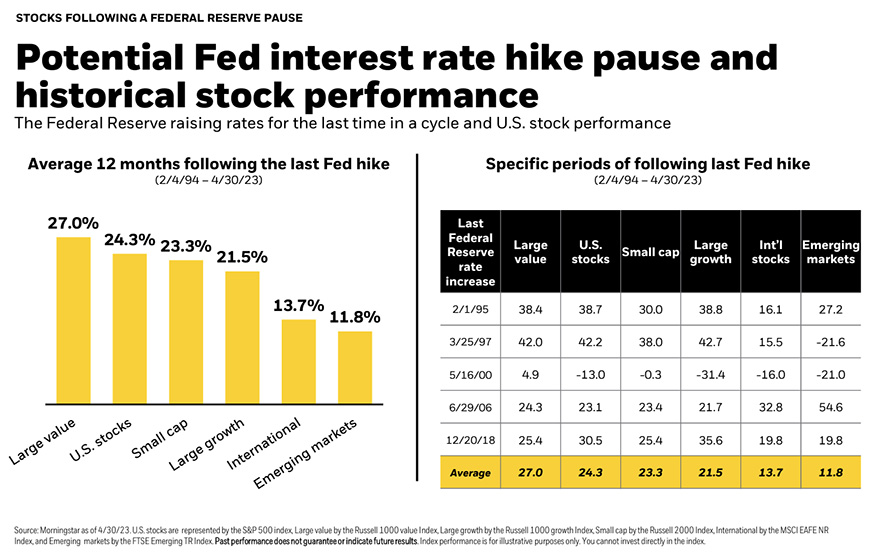

Why would the markets be so excited for a rate-hike pause? Over the past 30 years, a rate-hike pause has generally, with one exception, led to strong rallies in both the bond and stock markets. Everyone could use a little of that right now.

https://www.blackrock.com/us/individual/literature/investor-education/student-of-the-market.pdf

At WT Wealth Management, our initial takeaway from the May post-meeting press conference (which emphasized that Fed officials were not sure further tightening would be necessary, but were also not afraid to continue tightening if the data warranted it) was that a June pause was likely. After some back and forth in the context of the Debt Ceiling debate, market watchers now seem to be in agreement. We're close... oh, so close!

As always, your advisor stands ready to hear your concerns and answer your questions. Please reach out.