On September 20th the Federal Reserve ("Fed") held interest rates steady while also indicating it expects one more hike before the end of the year along with fewer cuts next year than previously indicated. Currently, the Fed Funds Rate ("FFR") is in a targeted range between 5.25% and 5.50%, the highest in 22 years.

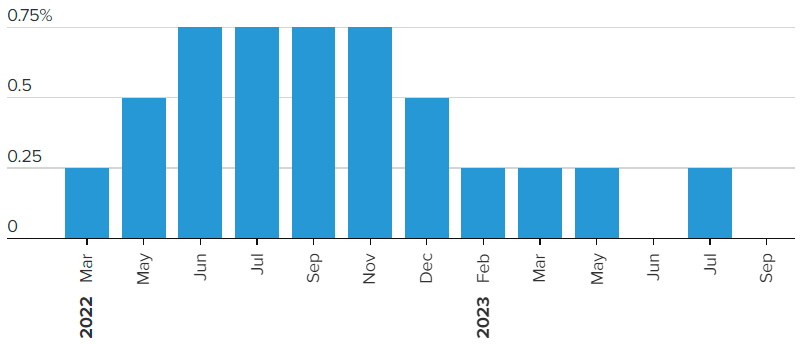

If the Fed goes ahead with another rate increase this year, that would make a full dozen hikes between 0.25% and 0.75% since policy tightening began in March 2022 (see Chart 1 below).

Chart 1: History of Fed Rate Changes

https://www.cnbc.com/2023/09/20/fed-rate-decision-september-2023-.html

While Fed Chair Jerome Powell stopped short of telegraphing an end to the current tightening cycle, he did state: "We're in a position to proceed carefully in determining the extent of additional policy firming," adding that the Fed would like to see more progress in its fight against inflation.

Most economists felt the "net-net" of the message leaned hawkish with a "higher-for-longer" undertone as unemployment remains historically low and a sustained imbalance in the labor market is more likely to keep inflation above the Fed's 2% target.

Falling into the counterintuition that "good news is bad and bad news is good", the Federal Open Market Committee ("FOMC") members revised their economic growth expectations sharply higher for this year. Gross Domestic Product ("GDP") is expected to increase 2.1% in 2023. The current estimate is more than double the June estimate and indicative that FOMC members do not anticipate a recession any time soon. The committee characterized economic activity as "expanding at a solid pace," compared with "a moderate pace" in previous statements.

(1)

Powell warned in the Summer of 2022, that to combat high single-digit inflation levels, "pain" would have to come to the labor markets, housing markets and overall economy.

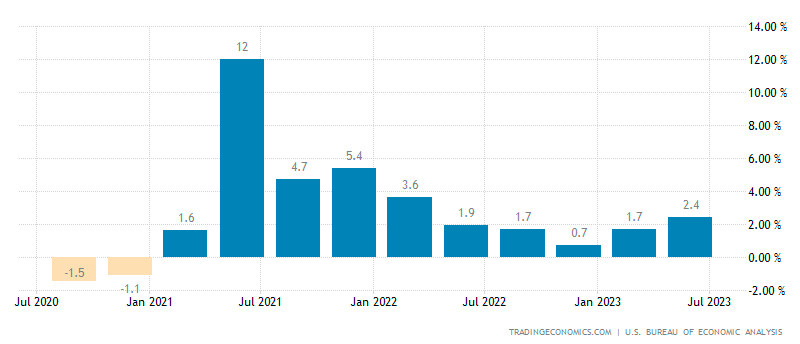

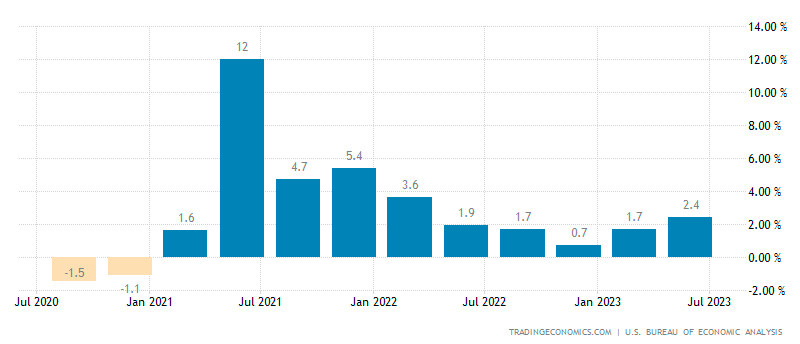

(2) We were repeatedly warned that while restored supply chains post-pandemic would provide some price relief, the ultimate reduction in inflation would come from higher unemployment and a sluggish economy. To this point, after 11 rate hikes and 5% being added to the FFR, neither a sharp rise in unemployment nor a decline in GDP has materialized (see Chart 2 below).

Chart 2: U.S. Annual GDP Growth

https://tradingeconomics.com/united-states/gdp-growth-annual

Unemployment continues to hover around record lows (3.8% last reported)

(3), and the U.S. economy has proved to be incredibly resilient. Both factors have allowed the economy to stave off the most anticipated recession in decades while providing support to stubbornly sticky inflation numbers.

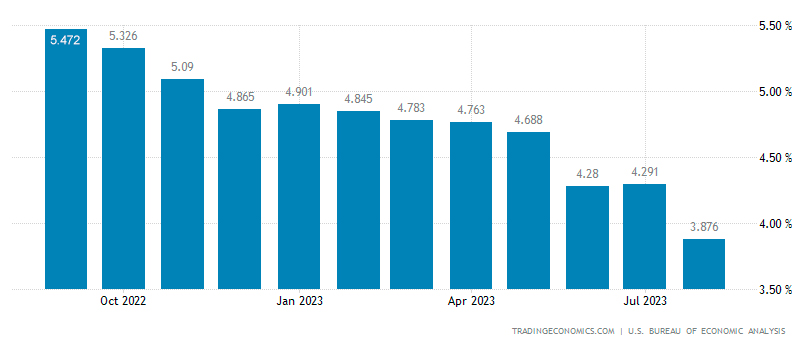

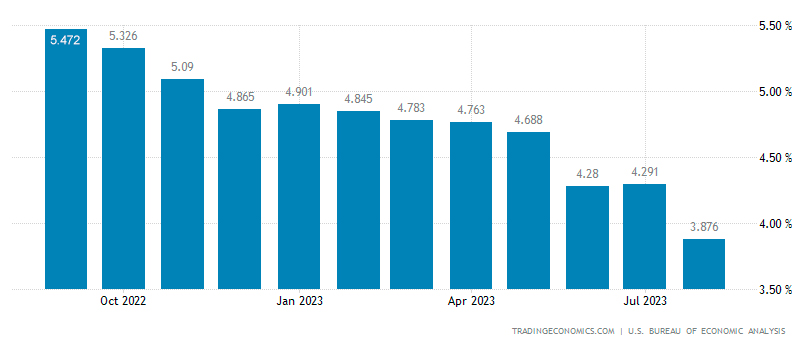

Undoubtedly, the inflationary situation has improved, though the annual rate remains well above the Fed's 2% target. In August, the Fed's favored inflation gauge, Core Personal Consumption Expenditures ("PCE"), showed core inflation, which excludes volatile food and energy prices, running at a 3.9% annualized rate (see Chart 3 below).

Chart 3: U.S. Annualized Core PCE

https://tradingeconomics.com/united-states/core-pce-price-index-annual-change

Consumers, who make up about two-thirds of all economic activity, have been incredibly resilient, spending even as post-pandemic savings have diminished. While this is a case for optimism, I have a friend that always asks me "what keeps me up at night?" and indeed there are some potentially concerning headwinds on the consumer.

Recently, credit card debt passed the $1 trillion mark for the first time and the resumption of student loan payments, high rents, high housing prices and high interest rates will ultimately slow the consumer and the American economy.

The astute reader may be wondering why the swift rate increases since the beginning of last year haven't had a larger effect on the economy? Sustained higher rates is like running in deep sand. The first 20 yards may not slow you down. The next 20 yards you start to feel it. Finally, in the last 20 yards you nearly fall flat. The longer rates remain high, the greater chance the economy hits a wall and falls flat on its face. We think the Fed is aware of this and is now at the stage of proceeding slowly and cautiously. Whether they can hit the brakes in time to avoid a recession is yet to be seen.

A wise man once told me "The Fed has a good track record of showing up late to the party and then overstaying their welcome." Let's hope this time it's different.

Sources

- Fed declines to hike, but points to rates staying higher for longer

CNBC.com

- Powell warns of 'some pain' ahead as the Fed fights to bring down inflation

CNBC.com

- United States Unemployment Rate

TradingEconomics.com