Predicting the course of the US economy is notoriously difficult, and last year proved to be no exception. Many prominent economists forecasted the US would fall into a recession in 2023 based on what appeared to be solid historical evidence, which turned out to be simply wrong. Neither a hard nor soft landing recession occurred.

At the time, we understood the perspective of those calling for recession. In fact, we were in that camp and positioned clients' accounts accordingly. In hindsight (which is always 20/20), we wish we had found a way to be more bullish, but discretion is the better part of valor with client assets.

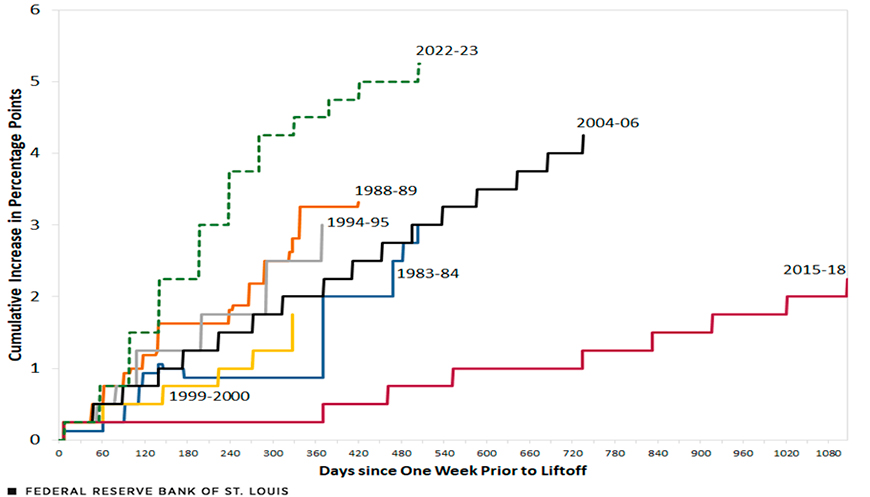

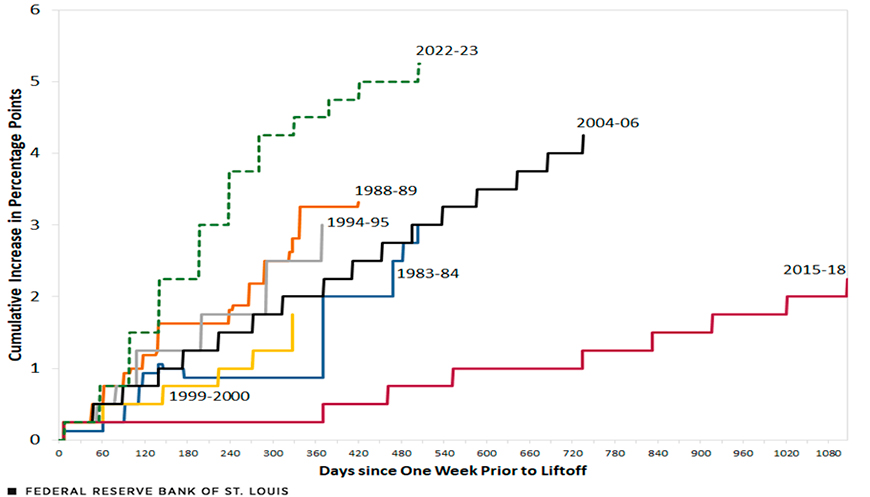

Never has the American economy seen rates go up so quickly and not fall into a recession. The monetary policy employed by the Fed in 2022-23 was the fastest and steepest rate hiking cycle since the 1980s. As such, we expected more disruption in the economy, housing and labor markets, which hardly budged, and, some may argue, even strengthened. The Investment Committee at WT Wealth Management closely monitored unemployment and GDP releases looking for a measurable increase in the jobless rate or fall in economic activity, neither of which materialized.

Figure 1: History of Federal Reserve Rate Hike Cycles (1983-Present)

Current economic data suggests a "little to no" recession landing for the economy — a situation in which inflation cools without causing a recession or spike in unemployment. Side-stepping a recession, if achieved, is a favorable outcome for financial markets. In 2022, stock prices suffered, in part from recession fears. Now, signs of a well-balanced economy are emerging:

- Disinflation - slowing rate of increase in Consumer Price Index (CPI), Producer Price Index (PPI) and Personal Consumer Expenditures (PCE);

- Solid labor market - 3.9% unemployment is well below the average since 1990;

- Strong Gross Domestic Product (GDP) - +4.9% in Q3 2023 and Q4 2023 estimate of +2.3%; (1)

- Housing has slowed but prices have been resilient – Existing home sales are down ~35% from last year while the median home price is up +4%; (2) and

- Consumer spending (up +2.2% year-over-year (3)) has remained largely intact.

The biggest risk to economic stability is the threat of a softening job market. Any significant deterioration in the labor market would be a signal that the Fed overtightened and may need to adjust course. Fed Chair Jerome Powell recently said that policy is "in restrictive territory" and noted that the risk of doing too much or too little on inflation is close to balanced now. At WT Wealth Management, if we see unemployment drifting higher and GDP slacking, we would anticipate rate cuts. If we are right, and the Fed is cutting rates as the economy continues to grow at a modest pace, it will be a nirvana-like situation for equities.

In an environment with a moderating labor market and easing inflation, the Fed has a reasonable case to make tactical interest-rate cuts — call it a recalibration of policy to keep the outlook steady. The momentum under the economy may limit the magnitude of rate cuts, because too much policy accommodation could rekindle inflationary pressure, but the Fed could have reason to justify a modest change in its policy stance, especially in an election year.

Are we completely out of the recession woods? No. Upcoming economic data releases require close examination. Historically, recessions have emerged after the Fed has stopped raising rates, not while raising rates. In fact, past recessions have occurred 10-17 months after the last rate hike which is now five months in the rear-view mirror.

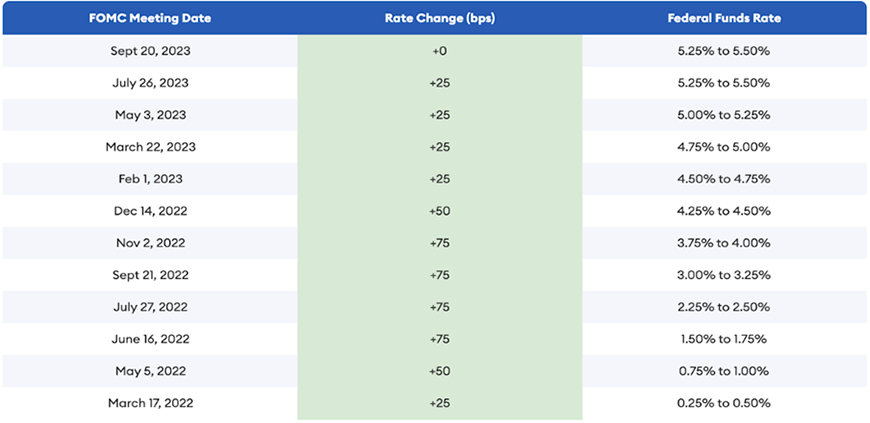

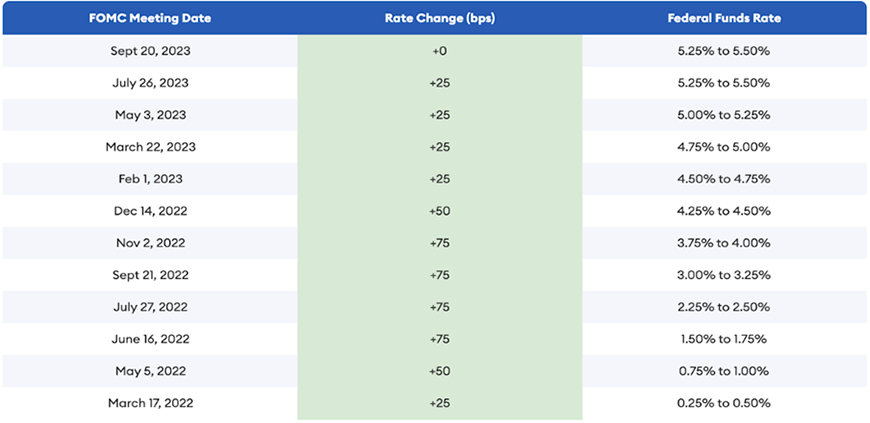

Figure 2 – Fed Rate Hikes 2022-2023: Taming Inflation (4)

Despite the historical evidence that indicates we are still within the normal timeframe between the end of a rate tightening cycle and a recession, the US economy has shrugged off an astonishing 5% Fed Funds Rate increase over 18 months with relative ease on the back of a strong and resilient consumer and a robust job market. We always say that as long as Americans are employed and generating income, they will find a way to spend money. With consumer spending making up nearly 70% of US expenditures, that bodes well for the 2024 outlook.

Based on current economic data, the odds of continued economic growth alongside slowing inflation are improving and that is good news for stocks and great news for investors.

Sources

- GDPNow - Federal Reserve Bank of Atlanta

AtlantaFed.org

- United States Existing Home Sales

TradingEconomics.com

- United States Consumer Spending

TradingEconomics.com

- Gauging the Fed's Current Tightening Actions: A Historical Perspective

StLouisFed.org