In a short period of time economists have drastically changed their outlook on interest rates for 2024 from a 2023 year-end consensus that the Fed would cut rates 4-6 times to potentially no cuts at all. However, according to rhetoric from Governors at the Federal Reserve, it is a matter of when, not if.

In their most recent public statements, the Fed has indicated that rate cuts are unlikely until at least the spring but have reiterated they "stand at the ready" if the economy needs a jolt. Inflation pressures have continued to subside, but universally Fed Governors have signaled their decisions will be data-driven with the Federal Open Market Committee ("FOMC") closely watching for evidence of further reductions in inflation and price stability before cutting rates.

In their January 2024 meeting, the FOMC held interest rates steady at a target range of 5.25% to 5.50%, the highest it has been in more than 20 years. The FOMC will have seven more opportunities to cut interest rates this year, starting with its next meeting March 19-20. According to Fed Funds Futures provided by the CME Group, it is close to unanimous that rates will be held steady at the March meeting. Moreover, fewer economists are now predicting that the Fed will cut rates at its May 1 meeting. Currently, only 22% are still penciling in a May rate reduction, down from 90% earlier this year.

(1) In our opinion, you will most likely need to wait until the Fed's June 12 meeting, or beyond, to see the first rate cut.

WT Wealth Management’s Investment Committee systematically monitors thirty economic data releases on a monthly basis and uses the information to formulate our own independent indication of the strength of the economy and its overall effect on the market. Based on our conclusions from our most recent analysis, the economy appears strong, corporate profits are intact, the consumer is engaged, unemployment has remained low, but inflation has remained sticky and wage growth is still higher than we believe the Fed would prefer.

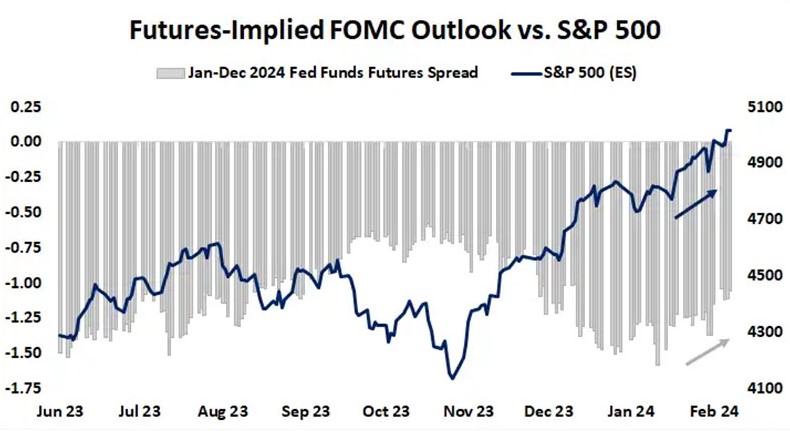

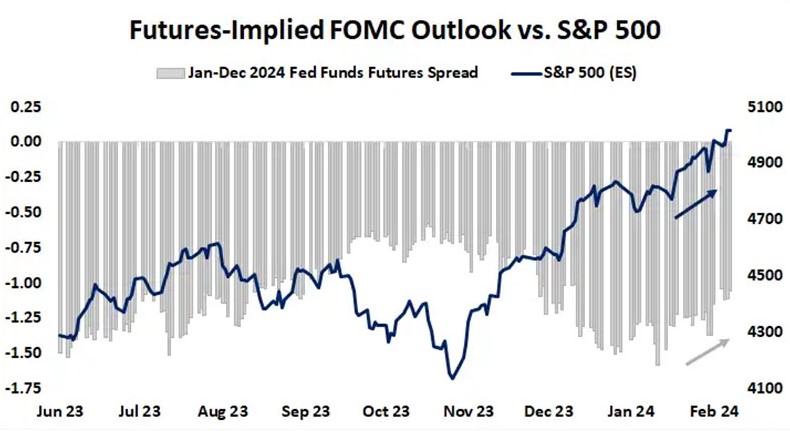

Investors have been pushing stocks higher on expectations that the Fed will soon cut rates, which could lower costs for businesses and spur consumers to spend more — potentially juicing corporate profits. As can be seen in the graph below, the expectation of more rate cuts (as represented by the longer gray bars) has provided a tailwind to the stock market, and less rate cuts (shorter gray bars) have resulted in short-lived pullbacks. The most recent change in expectations to fewer rate cuts this year (as shown by the gray arrow) has not yet appeared to have the same negative effect on the stock market.

https://www.tastylive.com/news-insights/fed-will-cut-rates-2024-later-not-by-much

The question now becomes, can the equity markets maintain their gains since the fourth quarter of 2023

(2) if investors believe rates will not be cut as much as previously anticipated? While rate cut expectations have undoubtedly played a part in the recent stock market winning streak, solid fundamentals exist beneath the footing of this market rally that have us convinced the most recent market gains are sustainable.

It is important to note, the above statement does not mean we will not see average volatility in 2024. Keep in mind, nearly every year since 1980, the market has experienced a pullback of 5% or more. On average, a 5% decline in stock market prices has occurred 4.5 times a year since 1980 and a correction of 10% or more happens about once per year.

(3)

In conclusion, while the recent gains are fantastic, and we believe the fundamentals of the greater market are solid even if rate cuts are postponed to later in 2024, there will still be ups and downs over shorter periods of time in the equity markets and that’s a good thing. As a wise man once told me - every market needs a nap, a good meal and a break before the next move can be made higher.

Sources

- Stay up-to-date with the latest probabilities of FOMC rate moves.

cmegroup.com

- S&P 500 has gained ~19% since 9/30/2023.

- Understanding Stock Market Corrections and Crashes (2023)

covenantwealthadvisors.com