On Wednesday, March 20

th, the Federal Reserve ("the Fed") held interest rates steady maintaining a Fed Funds Rate ("FFR") range between 5.25% and 5.50%, the highest in more than 23 years, where it has held since July 2023.

(1) The FFR is what banks charge each other for overnight lending and it forms the base rate for many kinds of consumer debt including credit cards, car loans, student loans and home mortgages.

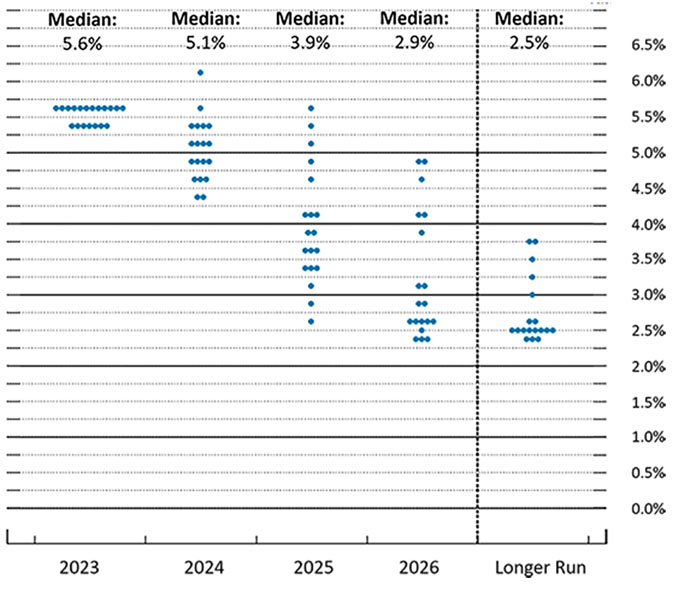

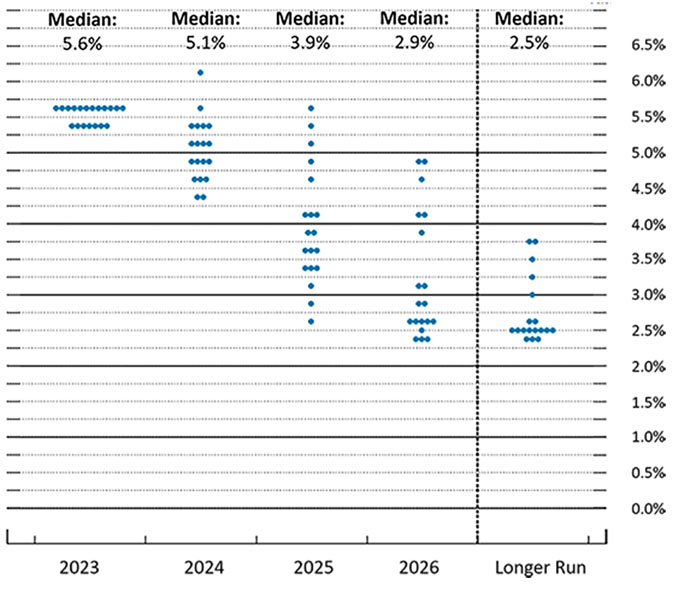

According to the Fed’s "Dot Plot," a closely watched matrix of anonymous projections from the 19 officials who comprise the Federal Open Market Committee ("FOMC"), three 25bps (0.25%) rate cuts could be expected as long as the economy evolves as anticipated; however, it provides no indication for the timing of the moves.

Fed Dot Plot (3/20/24)

The Fed Dot Plot indicated three cuts in 2024 and potentially three more in 2025 – one fewer in 2025 than the last time the grid was updated in December 2023. The FOMC forecasts three more reductions in 2026 and then two more in the future until the FFR settles at 2.50%-2.75%, near what policymakers estimate to be the "neutral rate" that is neither accommodative nor restrictive.

Fed Chair Jerome Powell did not elaborate on timing but said he still expects the cuts to come, as long as inflation data like the Consumer Price Index, Producer Price Index and Personal Consumption Expenditures ("PCE") continue to move toward target and stabilize. However, Powell reiterated that the Fed are prepared to maintain rates at their current level for longer if appropriate.

"We believe that our policy rate is likely at its peak for this type of cycle, and that if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year," Powell said at his post-meeting news conference.

Jerome Powell

The Dot Plot grid is part of the Fed’s Summary of Economic Projections**, which also provides estimates for gross domestic product ("GDP"), inflation (as measured by PCE) and unemployment. Fed officials accelerated their projections for GDP growth this year to an annualized rate of 2.1%, up from the 1.4% estimate from December 2023. The unemployment rate forecast moved slightly lower from the previous estimate to 4.0%, from 4.2%. Lastly, the projection for core inflation as measured by PCE rose to 2.6%, up 0.2% from December 2023 but slightly below the most recent level of 2.8%.

(2)

Since the second half of 2023 there has been a considerable divergence between the projections of Wall Street economists and "Fed Speak". In late 2023 many Wall Street economists were forecasting 4-6 rate cuts in 2024 and a considerable amount of the 2023-year-end rally in stocks were a result of investors attempting to get ahead of the anticipated lower rate news despite the Fed providing no clear indication rate cuts lay ahead as late as November 2023.

(3)

Market participants had been watching closely for clues about where the Fed would go with monetary policy from the current 5.25-5.50% range. Anticipation for rate cuts has moderated over the last several months.

There’s an old Wall Street adage to "buy the rumor and sell the news" as investors would rather be early than late to the game. However, when rumor buying is in play, the actual news can cause selloffs. We continue to maintain a 5-10% pullback is real possibility the longer rate cuts are kicked down the road by the Fed.

Jerome Powell

The Investment Committee at WT Wealth Management feels the current consensus of three cuts could be optimistic if inflation is sticky, GDP remains strong, and/or rising unemployment turns out to be a non-factor. Strong economic results allow the Fed to maintain the higher for longer stance to ensure inflation stabilizes within their target range.

If we had to take the over/under on three cuts for 2024, we would take the under because we believe there is a better chance of one or two rate cuts based on the economic data available today than three or four.

Sources

- Fed holds rates steady and maintains three cuts coming sometime this year

cnbc.com

- The Federal Reserve’s latest dot plot, explained – and what it says about interest rates

bankrate.com

- Fed gave no indication of possible rate cuts at last meeting, minutes show

cnbc.com

**Economic projections are collected from each member of the Board of Governors and each Federal Reserve Bank president four times a year, in connection with the Federal Open Market Committee's (FOMC's) meetings in March, June, September, and December.