"Diversification", "compound returns", and "bond yields"... are a few phrases you may have heard from the world of finance. These fundamental concepts are critical to successful investing. Yet, they are simply the application of basic math principles. This "Simple Math for Successful Investing" series aims to demystify the complex world of investing by using simple math concepts anyone can understand.

Our second installment will review the concept of "diversification" and the math behind not "putting all your eggs in one basket".

Diversification

During my two-year work abroad experience in Australia, I did what most land-locked ex-patriots do when they suddenly have direct access to world-class beaches and warm water currents - I attempted surfing. While nothing from my previous 15+ years of snowboarding experience seemed to give me any edge on riding a wave, I slowly trained my eye to decipher the subtle patterns of the waves. As a novice, I would spot what appeared to be a promising wave approaching, but as I paddled my heart out to catch it, the wave would either suddenly grow and become too steep (knocking me off my board) or fizzle out (passing harmlessly beneath me). What I soon realized was that the combination of an incalculable number of factors - the angle of the wave's approach, the wind, the tide, the undertow - was causing each wave to form differently than expected, sometimes creating un-ridable waves, but sometimes creating the perfect wave for me. Investors are likewise subject to innumerable unforeseen and uncontrollable market forces affecting their investments.

What is the goal of surfing? You might say it is riding the perfect wave. But what constitutes a perfect wave is different for every surfer. Some surfers seek the massive winter swells on Hawaii's North Shore, while others are content with long-boarding small rollers at their local beach. In this way, investors are like surfers. There are investors with high risk tolerances and low risk tolerances, and everywhere in between.

You might say the "perfect wave" of investing is to maximize your return at your personal risk tolerance level. (You can find out your risk tolerance by taking our simple

Risk Test!) But how can diversification help you achieve this? Let's start by reviewing a few simple, but fundamental, concepts in investing:

- Expected Return: As the name implies, this is the return you might expect on your investment. It is often estimated using the average of historical returns. It is the thrill you get from riding your wave.

- Risk: Risk is the future uncertainty of your investment value. Financial professionals calculate risk as the degree of variation of expected returns for an investment. Higher risk investments will have larger potential variations, while lower risk investments will have smaller potential variations. It is the hazards you may encounter while riding your wave.

- Correlation: Finally, and MOST IMPORTANTLY for our understanding of diversification, correlation is the degree different investments move in relation to each other. It is the complex interactions of all the forces that go in to forming your wave. There is positive correlation, negative correlation and zero correlation. Positive correlation means that if one investment increases the other is likely to increase. Negative correlation means that if one investment increases the other is likely to decrease. Zero correlation means that if one investment increases the other is just as likely to increase as it is to decrease.

Now here's the key concept - If investments are positively correlated, they will move up and down together, hence not providing "diversification". If investments are negatively correlated, they will move in opposite directions and gains in one investment could be erased by losses in the other, taking you back to where you started. It is investments that are neither positively nor negatively correlated (ideally near zero correlation) that provide the best diversification.

Now that we understand expected return, risk, and correlation, let's see how these three ingredients create the "free lunch" of diversified investing.

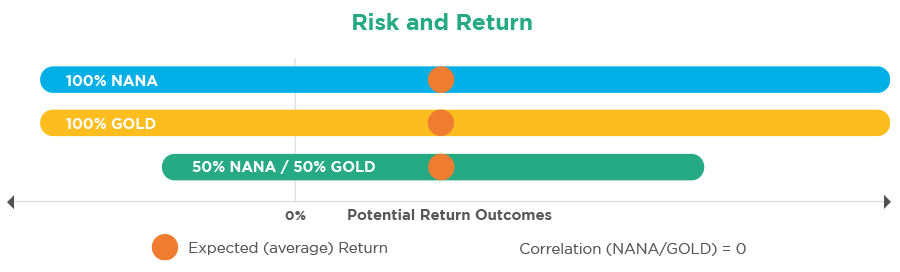

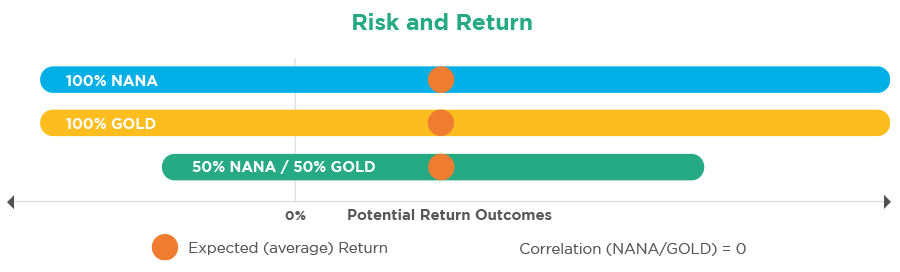

Say you are considering two investments, Banana Inc (NANA) stock and Gold. The chart below depicts the risk and return characteristics of the two investments.

In this example, NANA and Gold have the same expected return and risk (as measured by the range of potential return outcomes). If your only option is to choose either 100% NANA or 100% Gold, you might be indifferent between the two investments considering only their risk/return attributes. Then why might you consider creating a portfolio out of the two if they are the "same"? Correlation! Note the correlation between NANA and Gold is 0.

(1) As illustrated by the shorter green bar, investing 50% in NANA and 50% in Gold gives you the same expected return, with less risk! In fact, if you do the math

(2), a 50/50 portfolio would reduce risk by one-third simply by combining the investments!

Don't worry, there won't be a pop-quiz. What is important to understand is that when the two investments are combined, risk is decreased without sacrificing expected return. This fact allows savvy investors to create diversified portfolios that maximize return at their personal risk tolerance using investments that may be unsuitable by themselves. The above example includes only two investments but, of course, this concept can apply to the combination of any number of non-correlated investments (e.g. bonds, foreign stocks, mortgages, etc.). But keep in mind, simply adding investments does not necessarily improve your portfolio diversification. Analysis of expected return, risk, and correlation is critical. That's why we do the math!

Diversification is key to the investment philosophy for our professionals here at WT Wealth Management because we know that it is a tried and true method to increase the likelihood that our Clients will catch their perfect wave.

To learn more about diversification and other key investment philosophies we employ to help you achieve your financial goals, please visit

our website or reach out to your financial advisor.

Stay tuned for the next installment, which will use simple math to explain "bond yields" - what they are, what they mean, and why they're important!

REFERNECES:

(1) According to research conducted by State Street Global Advisors, "Gold has demonstrated a 0.00 and 0.07 monthly correlation to the S&P 500 Index and Bloomberg Barclays US Aggregated Bond Index, respectively, since the 1970s."

(2) https://www.riskprep.com/all-tutorials/36-exam-22/58-modeling-portfolio-variance