|

Special Market Update - August

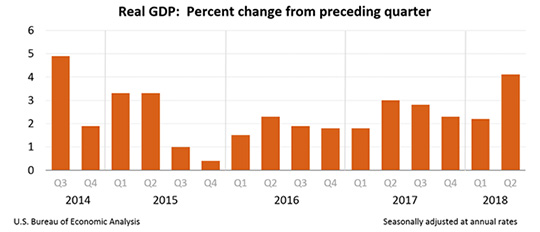

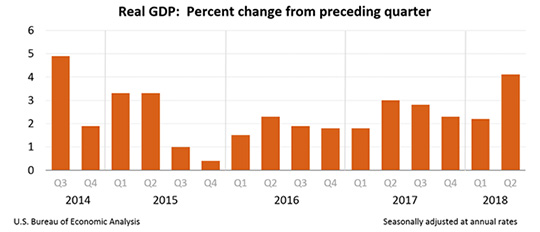

In what was one of the most anticipated pieces of quarterly economic data to be released in years, second quarter (Q2) Gross Domestic Product (GDP) jumped to 4.1%. This represents the third-best growth rate since the 2008-2009 Great Recession. The last time the economy grew this quickly was in the third quarter of 2014. GDP growth drivers included strong consumer and business spending as well as a surge in exports ahead of retaliatory tariffs from China aided economic growth.

GDP is a monetary measure of the market value of all the god and services produced in a period and typically reported each quarter.

For Q2 2018, in addition to the rise in consumer and business spending, increases in exports and government spending also helped. Personal consumption expenditures rose 4% while business investment grew 7.3% and federal government outlays increased by 3.5%.

Exports rose in part as US farmers rushed to get soybeans to China ahead of expected retaliatory tariffs to take effect in the coming days. Declines in private inventory investment and residential fixed investment were the main drags, according to government economists.

In recent days, White House officials had indicated the reading would be strong. The administration has used a mix of tax cuts, deregulation and spending increases to goose growth. The White House has clearly communicated, from day #1, that it believes deregulation has had the most impact, as companies feel more comfortable about committing capital.

The next question for investors will be whether the growth spurt is sustainable. Many signs indicate no. Federal Reserve officials forecast GDP to rise 2.8% for all of 2018 but then to tail off to 2.4% in 2019 and 2 percent in 2020. Some economists worried that the jump in consumer spending for Q2 2018 may not be sustainable, adding to skepticism that GDP can remain this strong.

Economists generally expect the trade war between the U.S. and China to temper further GDP growth. Over the last 30 days the Trump administration has slapped 25 percent duties on $34 billion worth of Chinese imports and has threatened $200 billion more. The administration also has put tariffs on steel and aluminum. More recently, markets were bolstered after positive comments by European Commission president Jean-Claude Juncker in response to progress on trade agreements last week. The Bureau of Economic Analysis stated that the effects from trade disputes are "typically modest," shaving only about 0.2 percent from GDP output.

So, what does this all mean? Clearly strong economic growth is good for America and for equities.

Typically, the markets interpret good news, like a spike in GDP, negatively because they assume the Federal Reserve will need to tighten interest rates faster and sooner than anticipated. This domino effect can lead to equity sell-offs, as higher interest rates offer reluctant equity investors' alternatives to stocks.

However, most economists feel this GDP report will not be received this way and instead will put investors' minds at ease that the two additional Fed rate hikes anticipated for the latter half of 2018 are appropriate and warranted. There is also some skepticism if this quarter was merely a "perfect storm" and GDP will be more in-line next quarter.

The potential upside is that we could be entering a late stage "goldilocks" period where interest rates, economic growth, inflation and unemployment all remain in balance, allowing the equity markets to continue their march higher for the remainder of 2018 and beyond.

Click here to view our Disclosure |