|

Special Market Update - September

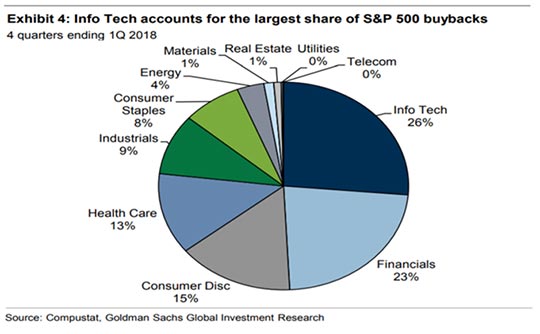

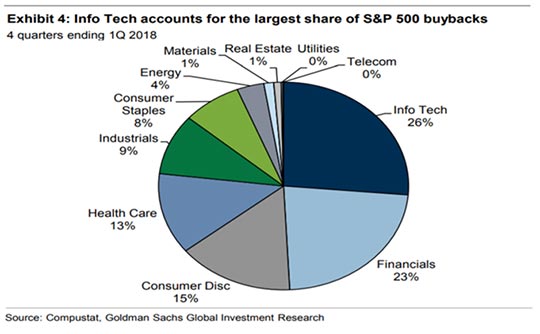

The domestic equity markets are on track to benefit from nearly $1 trillion worth of scheduled stock buy backs. In our opinion, Technology and internet-related stocks are likely to be the biggest beneficiaries of generous buyback programs.

A stock buyback, also known as a "share repurchase", is when a company buys back its shares from the marketplace. You can think of a buyback as a company investing in itself, or using its cash to buy its own shares. The idea is simple: because a company can't act as its own shareholder, repurchased shares are absorbed by the company, and the number of outstanding shares on the market is reduced. When this happens, the relative ownership stake of each investor increases because there are fewer shares, or claims, on the earnings of the company.

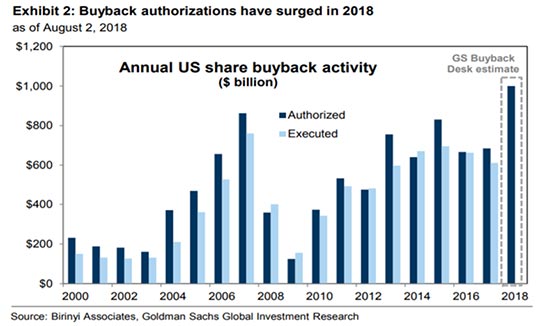

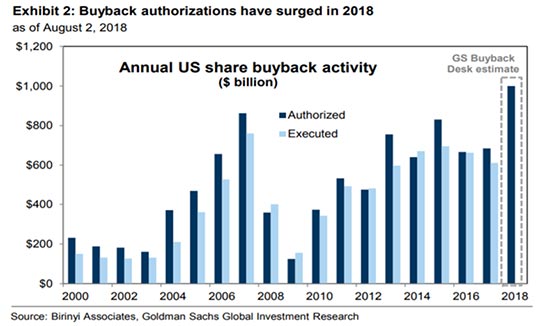

The stock market's new buzz number is $1 trillion. On August 2nd, tech giant Apple hit that market-cap-value milestone. The 13-digit figure may hold a different level of importance and relevance for the broader market in terms of share buybacks.

A variety of Wall Street giants have projected that stock repurchases will reach $1 trillion this year on the back of tax reform and strong corporate cash flows, up 46% from 2017. Investors are likely to see the immediate impact of those repurchases as August and September tend to be the most popular months for buybacks. These months together usually accounts for 13% of such deals for the year.

More than 80% of firms in the S&P 500 have now reported earnings results for the April-June quarter (Q2). Many may now resume repurchasing stock (as buybacks are prohibited during earnings announcement season).

Q2 2018 repurchases are up 57% from the same period in 2017, with notable activity in the tech sector where buybacks surged 130% year-over-year.

Many experts feel, going forward, that buybacks are expected to play a critical role in supporting equity prices.

Buybacks aside, in our opinion, the overall market sentiment is positive. We see economic activity remaining healthy with consumer confidence strong. Remember, 70% of GDP is consumer spending.

We have seen robust corporate earnings results with a large number of companies turning in better-than-expected earnings. With 80% of S&P 500 firms reporting, second-quarter revenue rose by 12% and earnings per share increased by 24% vs. last year.

AT WT Wealth Management we have repeatedly calmed concerns that stocks are headed for a bear market or the economy is headed toward recession. We also disagree with the growing belief that the technology and internet-related sectors valuations will be the broader market's undoing. Recessions rarely come after GDP reports above 2% and with last quarter's 4.1% result, we remain confident the economy is healthy and expanding.

The bears on the street argue that the "trade" in the technology-internet sector is 'crowded,' the sector appears overvalued, growth has peaked, and the benefits of the tax cuts have passed. Some even view Facebook as the "canary in the coal mine". We couldn't disagree more. Technology is the future and the future is technology and while many tech companies are priced to near perfection in the short-term we feel they are undervalued in the long-term.

As an example of "near perfection pricing" within the technology sector: Facebook, Twitter and Intel each had earning misses when they reported revenue and earnings for Q2. As a result their stocks prices subsequently declined. However, Apple, Google and Amazon each reported record earnings for Q2 and investors were rewarded with strong rallies in these stock prices.

However, as shown above, tech stocks are expected to be among the biggest beneficiaries of the $1 trillion-buyback bonanza, given many tech companies still have yet to complete their existing repurchase programs. For its part, Apple just approved a new $100 billion repurchase program in May 2018.

While we should never expect stock buyback programs to stop stocks from correcting (as they do historically by 5% about 3x’s per year, by 10% usually once per year and by 15% once every three years), having a consistent buyer in the market place is certainly healthier than having a consistent seller.

Click here to view our Disclosure |