|

Market Correction Update

At WT Wealth Management, we believe that investment management must always be transparent to the client. We know it is important to remain in constant contact with our clients during periods of market turmoil and uneasiness. The sound of silence can be deafening and brings uneasiness to even the savviest investor. So let's talk.

The recent increase in volatility and market sell-off that we have seen across the broad markets - specifically within technology and industrials - over the last 2 weeks has been sparked by the rise in interest rates as the 10-year treasury rate moved from 2.85% to 3.25%.

A stock market reaction to rising interest rates is not unexpected. Knowing this day would come, we have talked and written for well over 2 years now about being late-phase in the current economic cycle and anticipating its characteristic tightening. Any rise in interest rates puts the equity markets through a rebalancing process as investors evaluate the decelerating repercussions of higher rates on borrowers and overall economic growth.

At WT Wealth Management, we live our clients' investing experience by design, as our own money is invested in the same strategies as our clients. We have seen our account values dip over the last several weeks as well.

But rest assured, there are reasons to remain optimistic for the time being. The US economy is in exceptional shape with unemployment at a 49-year low, a second quarter GDP number of 4.2%, and an anticipated third quarter GDP in the mid 3% range. By definition, a recession cannot happen when the economy is expanding at the current rate.

Earnings season begins on Friday with many of the big banks reporting. Then it's on to technology, healthcare and industrials in the following days. Most experts estimate earning growth in the 7-8% range year over year. Companies today appear to be in a strong position to deliver results to their shareholders. The smartest minds we follow see this earnings growth momentum continuing into mid-2019.

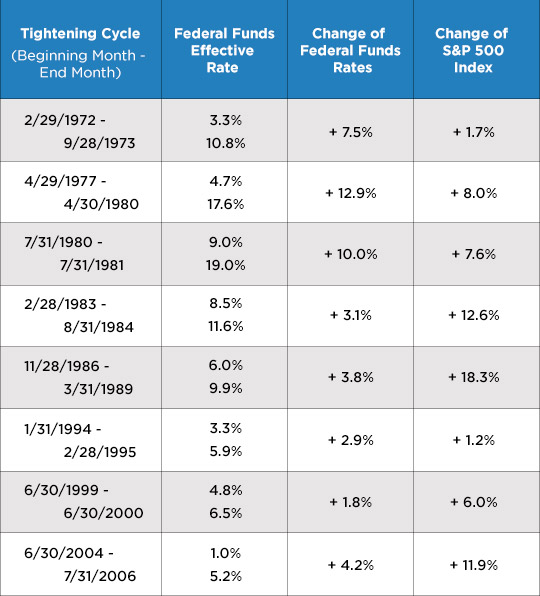

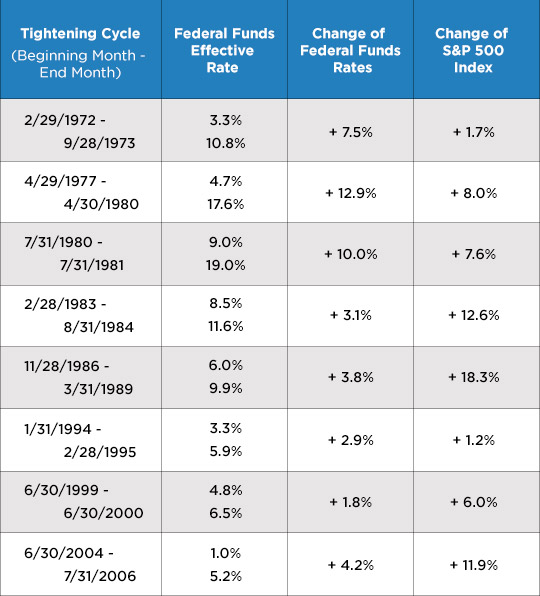

However, there is no doubt that higher interest rates can act as a brake on future economic expansion. That's the current concern of the US financial markets. Will the Federal Reserve move too far and too fast, tipping the economy into recession? We think not. After 7 years (Dec 2008 to Dec 2015) without any interest rate increases from the Federal Reserve, this is a new environment for many investors. Looking back, we had our first rate hike in December of 2015. This was followed with an additional move higher one year later in December 2016 before 3 moves higher in 2017 and 3 subsequent hikes YTD in 2018. History has shown that equities perform well during rate tightening cycles after the initial shock has worn off. A tightening cycle generally signals a growing and improving economy.

Sources: Bloomberg, FactSet, Fed Reserve St. Louis Sources: Bloomberg, FactSet, Fed Reserve St. Louis

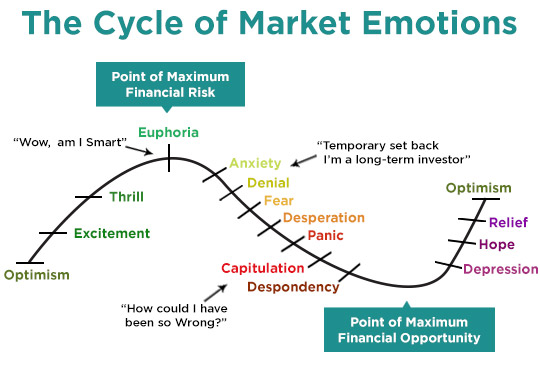

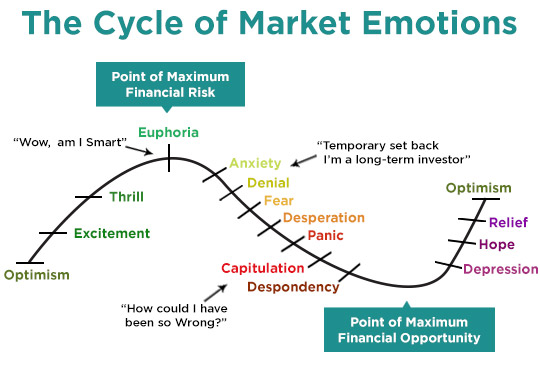

After doing this for 29 years there are two things I have learned. First, the market always over does things both in good times and bad. We feel this is the case over the last several days. Secondly, the average investor has an impeccable track record of doing the wrong thing at the wrong time when basing their investment decisions on market emotions. We believe that understanding human emotions makes us better advisors.

We believe in a long-term investing approach where clients are properly invested through full market cycles. Accordingly, we believe this recent weakness will pass and the markets will recover like they have always done. The current economic backdrop and earnings growth momentum all but assures this. Nevertheless, we remain diligent, observant and ready to adapt if the situation requires it.

In the meantime, please do not hesitate to contact your advisor to have further discussion on your personal situation if you feel it's warranted.

Click here to view our Disclosure |

Sources: Bloomberg, FactSet, Fed Reserve St. Louis

Sources: Bloomberg, FactSet, Fed Reserve St. Louis