This is the time when everyone rolls out their forecasts (aka “guesses”) for the year

ahead. In fact, we did our own 2016 Market Outlook last month and prognosticated about the U.S. markets.

Looking around the globe there are some experts that believe global GDP growth is going to go into reverse

next year. One notable economist was quoted as saying “the world at the end of 2016 will be 3, 4 or even 5%

poorer than it was at the beginning of the year”. This is, of course, possible. We don’t believe it to be the case

but believe GDP is going to be hard to come by and best described as SLOW. In fact, just today (January

6, 2015), the World Bank reduced its global GDP outlook from 3.2% to 2.9% mostly on Emerging Market

weakness.

For first time in recent memory economists have worried about the influence of China on global GDP. For

much of the past decade, China has been the gas in the engine with unprecedented demand of natural

resources and a major GDP contributor as the leading manufacturing in the world. Many observers believe

there could be a GDP measurement problem in China. Can we really believe their GDP numbers? I’m not sure

anyone has the answer to that.

CHINA

China’s recent economic rise has been facilitated by a massive stimulus campaign. No emerging nation has ever

tacked on debt at such a furious pace as China has done since 2008. History has shown that a rapid increase

in debt is the single most reliable predictor of future economic slowdowns and financial crises. Policymakers

in Beijing have been trying to sustain an unrealistic and randomly selected growth target of 7 percent by

steering cheap loans into one bubble after another-first housing, and most recently the stock market -only to

see each bubble collapse. While China reported that its GDP grew exactly in line with its growth target of 7

percent in the first three quarters of 2015, all other independently-collated data -from electricity production

to auto sales -indicate that economy activity is increasing at a pace closer to 5 percent.

What happens to the Chinese economy is indeed going to be a major determinant of how global GDP goes.

Simply stated, the stunning growth in China over the past few decades has made it a significant part of the

world economy again, recently ranking #2 behind the U.S., according to The World Bank.

The US looks unlikely to grow at a rate that would counteract a Chinese slowdown and the Eurozone is

hampered with the idiocy of the euro and certainly doesn’t have the horsepower to make up the difference,

in our opinion.

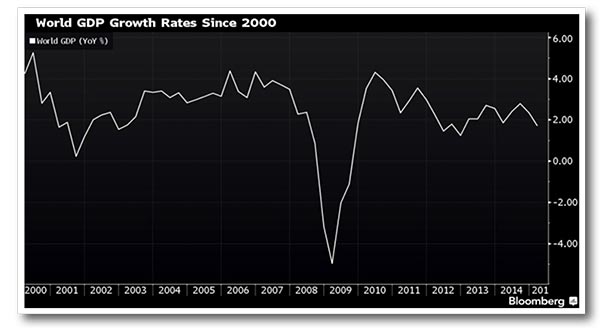

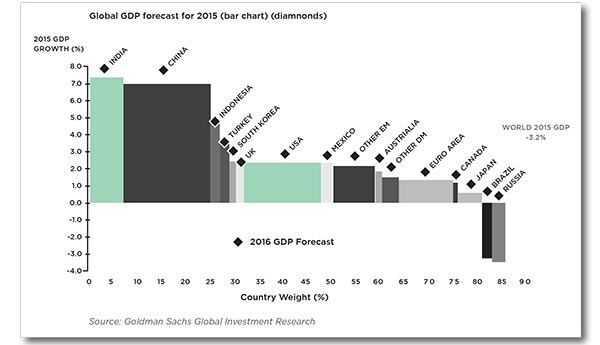

World GDP over the past several years is reflected in the below chart. It’s been a series of non-starts as

attempts to spark global growth has been hampered by a myriad of hurdles.

Adding to global GDP struggles, any potential China slowdown will affect many of the Emerging Market

countries around the world. A great deal of the Emerging Markets growth has been from feeding the raw

materials into China’s booming -or what some would called a propped up- economy. Never-the-less, the China

draw on raw material consumption has been powerful.

JAPAN

Simply put, their current economy is full of uncertainty. Japan’s GDP, a comprehensive measure of economic

activity, for the second quarter (April–June) of this year was down 0.5 percentage points in real terms

(annualized) from the preceding quarter, which was followed by an increase of a 1.0 percentage point in the

following quarter (July–September) on the same basis. Thus far, the economy has been hanging in the balance

in fiscal 2015, and will most likely end up with annual growth of less than 1% for 2015. In view of the fact that the Japanese government expected growth of 1.5%, it is obvious

that the economy this year underperformed expectations.

Just look at how the Japanese government views the current economic situation in Japan. Its views clearly

reflect the uncertainty and somewhat concerned mood. According to the Assessment of the Current State

of the Japanese Economy in the Monthly Economic Report for November 2015 released by the Cabinet Office,

they stated:

This assessment seems to suggest that the government still maintains its view that the “economy is still recovering.”

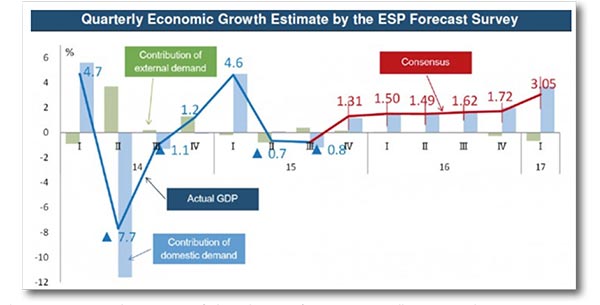

How the economy will develop after the current period of standstill is the important part. Financial

markets look ahead, not backwards. The view that “moderate recovery will continue” seems to represent

a consensus of opinion among the market experts most follow. Most economists (see chart below) expect

that Japan’s GDP will start growing again after the third quarter (October–December) of fiscal 2015 and will

maintain growth at around 1.5% growth over the course of the next fiscal year.

The primary reason why economists believe that a moderate recovery will continue is that corporate earnings,

as well as the labor situation, remain on an uptrend in Japan. According to the Financial Statement Statistics of

Corporations by Industry, which are published quarterly by the Ministry of Finance Japan, corporate earnings

in terms of recurring profit continued to show high growth, recording a 9% increase in the second quarter

(July–September) of fiscal 2015 on a year-on-year basis.

Another piece of good news is that crude oil prices have continued to fall in recent months. Many believe

that the central bank will extend its drastic monetary easing program for some time and the government will

remain reluctant to implement fiscal policies that would have a negative impact on the economy. In other

words, the trend seen during 2015 will most likely stay unchanged with no particular negative repercussions

expected on the economy leading to a setback.

Having said that, the current situation raises some concerns. One of those concerns is that domestic demand

has remained sluggish despite record corporate profit. According to the basic economic principles of business

cycles, higher corporate earnings will boost capital expenditure, leading to wage increases. This sequential

flow beginning with higher corporate earnings is usually expected to lead to higher household income.

Unfortunately, this correlation does not seem to be very strong as of right now.

EUROZONE

The Eurozone economy has benefited from strength in consumer spending, with more countries contributing

to GDP growth than in the past. Growth is still modest, however, and not strong enough to stem deflation or

significantly contribute to global GDP expansion. This has compelled the European Central Bank to extend

monetary stimulus into 2016. Hope is that will support an acceleration of economic growth in 2016.

Expectations for additional stimulus were high prior to the ECB’s December meeting, but we still believe the

outlook for European stocks in 2016 is favorable, as economic growth may accelerate as a result of ECB’s

continued monetary stimulus campaign.

Europe weathered multiple crises in 2015, including a flare-up in the Greek debt crisis, the migrant crisis and

terrorism. Despite these challenges, economic growth has been fairly steady, led by consumer spending.

Consumer spending has been leading the Eurozone recovery, accounting for almost three-quarters of growth

in the six quarters through September 2015. When 4th-quarter gross domestic product numbers are released,

they are likely to show that consumer spending has remained strong, continuing an 18-month trend.

Consumer spending has benefited from strength in consumer sentiment, which reached a 14-year high over

the summer in Germany. Consumers have positive outlooks on their incomes and are benefiting from low

borrowing rates. Those factors have helped boost retail sales for the first 10 months of 2015 to their fastest

pace of growth since 1994. It’s very American, live life and borrow.

Although the early phase of the Eurozone’s economic recovery was driven by strength in Germany, the recovery

is now becoming more broad-based. Recently, the Italian and French economies have shown measured

improvement. Italy’s 2015 economic growth is expected show the fastest pace since 2010. The Organization for

Economic Cooperation and Development’s leading indicators for the Eurozone economy suggest the region

will continue to grow modestly in coming months, accelerating in France and Italy while remaining stable in

Germany.

At its December meeting, the ECB lowered its inflation forecast and predicted inflation would not reach its

2% target until after 2017. Since the ECB has one mandate—price stability—it made several decisions aimed

at keeping deflation at bay. It said it would continue its asset purchasing program for six months beyond its

originally scheduled expiration date, until March 2017. It also pushed the deposit rate further into negative

territory to increase the universe of assets eligible for purchase.

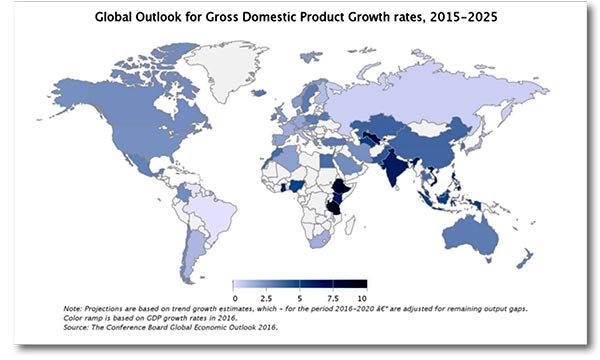

Unfortunately, when looking at the entire world, the world’s economy is growing at a slower pace than the

International Monetary Fund and other large forecasters are predicting in our opinion.

Reports show, the world economy is currently growing at its weakest pace since it began recovering in 2009,

with global GDP growth for 2015 estimated to end the year at 2.5 percent in real terms. But measured in

nominal dollar terms, global GDP will likely contract by about 5 percent in 2015. This would be just the third

time that the global economy has shrunk in nominal GDP terms since 1980.

Most economists expect the dollar to rise against other currencies into the near future, as the Federal Reserve

continues to raise interest rates. This means that economic activity conducted in other currencies, when

measured in dollars at those market rates, is worth less. We’re not in fact saying that growth is going to fall

when measured in renminbi, euros, yen or pounds. Rather, that it will fall, and look weak when we measure it in

dollars. We still think that the global economy at the end of 2016 will be producing more goods and services

than it did at the beginning: it’s just that the value of our measuring stick, the US dollar, has changed as it

becomes stronger.

The IMF on Oct. 6 lowered its 2015 global gross domestic product forecast to 3.1 percent from 3.3 percent

previously, citing a slowdown in emerging markets driven by weak commodity prices. The IMF also cut its 2016

forecast to 3.6 percent from 3.8 percent. But even the revised forecasts may be too optimistic, according to

many global economists, including ourselves.

The Organization for Economic Cooperation and Development in December lowered its forecasts for the

global economy for a second time in three months. In their opinion, GDP will grow 2.9 percent in 2015 and

3.3 percent in 2016, down from the 3 percent and 3.6 percent the group predicted as recently as September.

Maersk’s container line in November reported a 61 percent slump in third-quarter profit as demand for ships

to transport goods across the world hardly grew year over year. The low growth rates are proving particularly

painful for an industry that’s already struggling with excess capacity. Ships not moving, or moving half

full do not make money.

Trade from Asia to Europe has so far suffered most as a weaker euro makes it tougher for exporters like

China to stay competitive. Still, there are no signs yet that the global economy is heading for a slump similar

to one that followed the financial crisis of 2008, in most experts’ opinion.

Economic forecasting is a tough game, especially in far flung regions around the globe. One thing that has

been learned from the financial crisis and Great Recession is that even those equipped with the most sophisticated

models get it wrong, sometimes spectacularly wrong.

So it is with both humility and trepidation that we will try to make predictions for what is going to happen in

2016 with world GDP. In all honesty, the future is murky and anybody who says otherwise is being less than

honest. We are talking about economies from the far corners of the globe. We have political risk, currency

risk, terrorism risk and probably a million risks we are overlooking.

So, with that caveat, here’s what we think might happen. At some point, a recovery built on booming asset

prices, weak growth in earnings and rising personal debt is going to lead to another financial crisis - but not

in the next 12 months. Cheap money is a bad drug. Always has been, always will. But the immediate “high”

feels great and shouldn’t be overlooked. Cheap oil and commodity prices only fuels the good times more.

There will always be a bit of a delay between oil prices falling and spending going up, in part because people

want to be sure that the lower costs are going to stick around. It is, however, now 16 months since crude began

its decline from its August 2014 peak of $115 a barrel, and there is a good chance it will fall a bit further

from its current level in the mid-$30 a barrel range. Additionally, with no sign that the oil cartel, OPEC, has

the political will to agree production curbs, it’s quite possible that prices could fall below $30 a barrel in the

early months of 2016. Iran coming on on-line is only going to add glut, to an already highly inventoried asset,

oil. As of today, January 12, oil is getting close to $30 a barrell.

In our opinion, cheap oil will keep inflation lower than any of the world’s major central banks are anticipating

or wanting. Policymakers at the US Federal Reserve, the Bank of England and the European Central Bank

(ECB) insist they “look through” rises and falls in oil and other commodity prices and make their interest rate

judgments on the basis of what is happening to core inflation, which excludes energy and food costs.

Central banks are looking for signs of wage inflation picking up as a result of years of steady growth and falling

unemployment. If wage inflation does not go up, there is less of a reason to raise the cost of borrowing.

The theme of 2016 will be China, where the question is not whether the pace of growth will slacken, but by

how much. Expert opinion differs about the state of the world’s second biggest economy. Some analysts say

Beijing has everything under control, others that the country is already having a hard landing from years of

overinvestment in unproductive manufacturing plant and speculative real estate. In all reality, who knows?

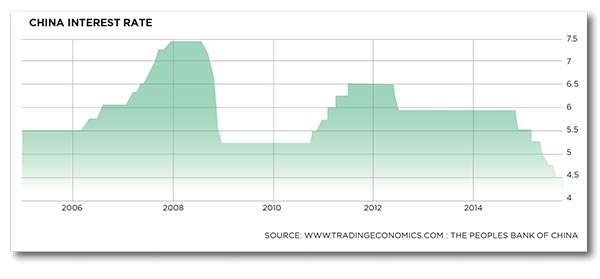

The official interest rates are zero in the major developed countries of the west, in China they are still above

4%. This gives the People’s Bank of China room to cut the cost of borrowing if it wants to stimulate growth,

a tool it will almost certainly use if the government thinks the economy is slowing too rapidly. The exchange

rate can also be cut to make Chinese exports cheaper, and the country also has the option of raising public

spending. In our opinion, China will slow in 2016 but policy easing will prevent a collapse. There’s too much

to lose if they don’t.

There are a couple of reasons why the Eurozone might stumble through to 2017 before there is fresh trouble.

The first is that it will benefit from the delay in tightening policy in the US and the UK, and from pro-growth

measures in China. The second is that the ECB will keep using quantitative easing (QE) in the hope that an

increase in the supply of money will get the bank’s lending. The ECB is also keen to drive down the value of

the euro to boost exports, although this may prove more difficult if the Fed raises interest rates more slowly

than the markets currently expect. There is a good chance the dollar will fall rather than rise against the euro.

But the Japanese “fixes” are merely temporary solutions to encourage growth in the economy. It is not

possible for the government to keep sending out a message with a powerful announcement effect and the

effects of the weaker yen, higher stock prices and increased public investment will not last long, being seen

only during the period in which they occur. It appears Japan is on somewhat of a roll so I would consider the

momentum to continue.

So, here is my final prediction: there will be no explosion in 2016, but a fuse will be lit and we should all be

careful .This is a case of history threatening to repeat itself, because the buildup to the 2008 crisis began on

the periphery of the global economy. 2016 Should be interesting on many fronts and it’s easy to say it will

be like 2015. We believe 2016 will be slightly better than 2015 as inflation pressures around the globe remain

quiet, interest rates stay under presure, full employment continues and oil stays historically low. In additions,

while governments around the world look calm cool and collected, we believe that beneath the surface they

are like the proverbial duck and are paddling furiously to aid their sluggish economies. I’m more worried

about 2017 and the ensuing hangover from everything in the previous sentence.

WT Wealth Management is a manager of Separately Managed Accounts (SMA). Past performance is no

indication of future performance. With SMA’s, performance can vary widely from investor to investor as each

portfolio is individually constructed and allocation weightings are determined based on economic and market

conditions the day the funds are invested. In a SMA you own individual ETFs and as managers we have the

freedom and flexibility to tailor the portfolio to address your personal risk tolerance and investment objectives

– thus making your account “separate” and distinct from all others we potentially managed.

An investment in the strategy is not insured or guaranteed by the Federal Deposit Insurance Corporation or

any other government agency.

Any opinions expressed are the opinions of WT Wealth Management and its associates only. Information is

neither an offer to buy or sell securities nor should it be interpreted as personal financial advice. You should

always seek out the advice of a qualified investment professional before deciding to invest. Investing in stocks,

bonds, mutual funds and ETFs carry certain specific risks and part or all of your account value can be lost.

In addition to the normal risks associated with investing, narrowly focused investments, investments in smaller

companies, sector ETF’s and investments in single countries typically exhibit higher volatility. International,

Emerging Market and Frontier Market ETFs investments may involve risk of capital loss from unfavorable

fluctuations in currency values, from differences in generally accepted accounting principles or from economic

or political instability that other nation’s experience. Emerging markets involve heightened risks related to the

same factors as well as increased volatility and lower trading volume. Bonds, bond funds and bond ETFs will

decrease in value as interest rates rise. A portion of a municipal bond fund’s income may be subject to federal

or state income taxes or the alternative minimum tax. Capital gains (short and long-term), if any, are subject

to capital gains tax.

Diversification and asset allocation may not protect against market risk or a loss in your investment.

At WT Wealth Management we strongly suggest having a personal financial plan in place before making

any investment decisions including understanding your personal risk tolerance and having clearly outlined

investment objectives.

WT Wealth Management is a registered investment adviser located in Jackson, WY. WT Wealth Management

may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion

from registration requirements. Any subsequent, direct communication by WT Wealth Management with a

prospective client shall be conducted by a representative that is either registered or qualifies for an exemption

or exclusion from registration in the state where the prospective client resides. For information pertaining to

the registration status of WT Wealth Management, please contact the state securities regulators for those

states in which WT Wealth Management maintains a registration filing.

A copy of WT Wealth Management’s current written disclosure statement discussing WT Wealth Management’s

business operations, services, and fees is available at the SEC’s investment adviser public information website

– www.adviserinfo.sec.gov or from WT Wealth Management upon written request. WT Wealth Management

does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness,

or relevance of any information prepared by any unaffiliated third party, whether linked to WT Wealth

Management’s web site or incorporated herein, and takes no responsibility therefor. All such information is

provided solely for convenience purposes only and all users thereof should be guided accordingly.

Reach us directly at 800-825-0616

or by using the contact form below.