There’s something about the word ‘preferred’ that puts a smile on your face. It conjures

up images of better treatment, faster service, and lower rates. It’s the antithesis of the

ordinary, everyday, common experience.

But is that the case if you’re an investor? Should preferred stock get an allocation in your equity portfolio?

In some ways, preferred stock resembles common stock. For example, both types give you an ownership stake

in the issuing corporation and the right to share in its profits. And you can sell both preferred and common

stock in the secondary market whenever you please.

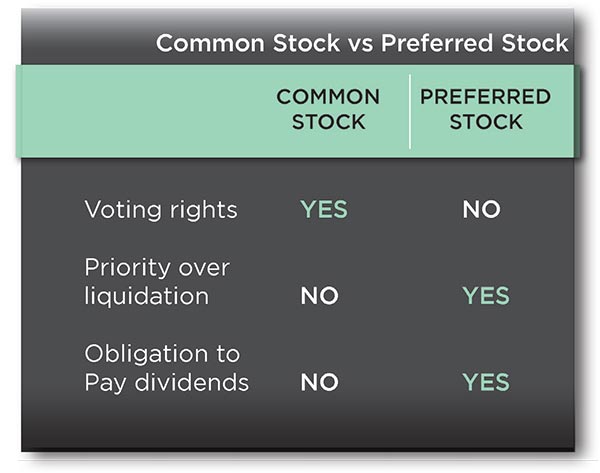

But the differences between the two vehicles are more striking than their similarities. Preferred stocks were

not on the radar of most investors until just a few years ago. When bond yields began to fall, investors started

to hunt for yields in other places, thus discovered preferred stocks.

But what exactly are preferred stocks? What advantages do they offer investors? And why do they belong in

your portfolio?

The big attraction of preferred stocks is their dividend yield. Most pay above 5% annually, and can pay 8% or

more. As a result, some trade above the par value at which they were originally issued, because investors are

willing to pay a bit more than par to obtain the higher yield.

Most preferred stock provides regular income in the form of a dividend, which must be paid before any

dividends are disbursed on the corporation’s common stock. The dividend is not linked to the company’s

profitability the way common stock dividends are, so the amount is usually fixed at issue, hence does not

increase or decrease later.

In some cases, the corporation may issue participating preferred shares. In this case, preferred shareholders

receive an additional payment if the dividend on its common shares is more than the preferred dividend.

Equally important, if the corporation cannot pay preferred dividends on schedule, they usually accrue until

the company is once again able to pay them. Not

so with common stock dividends, which may be

cut or eliminated if the issuing company is having

financial problems or decides to use its profits in

other ways.

When it comes to tax treatment, however, common

stock has the advantage, because its dividends

are usually taxed at your long-term capital gains

rate: 15% maximum. By contrast, most preferred

stock dividends are taxed at your regular ordinary

income rate.

Unlike investors who own common stock, holders

of preferred stock usually do not have voting rights.

In fact, one reason why privately held corporations

sometimes choose to raise capital with preferred

rather than common stock is to avoid giving

shareholders any say on matters of corporate

governance

IS NOW THE TIME FOR PREFERRED STOCKS?

Lately, I’ve been often asked whether preferred stocks will remain an attractive asset class in a rising-rate

environment. While preferred stocks may, indeed, see price declines as traditional long-term bonds would,

the losses may be more than offset by the potential yield. Additionally, because we expect the rate rises to be

gradual, we wouldn’t expect to see big downward spikes in preferred prices.

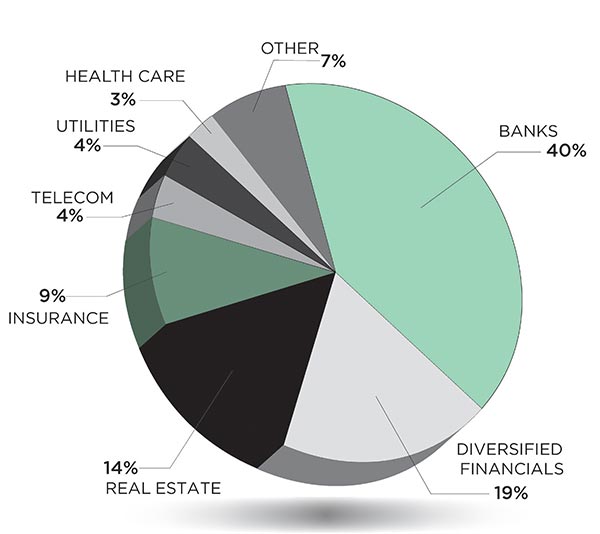

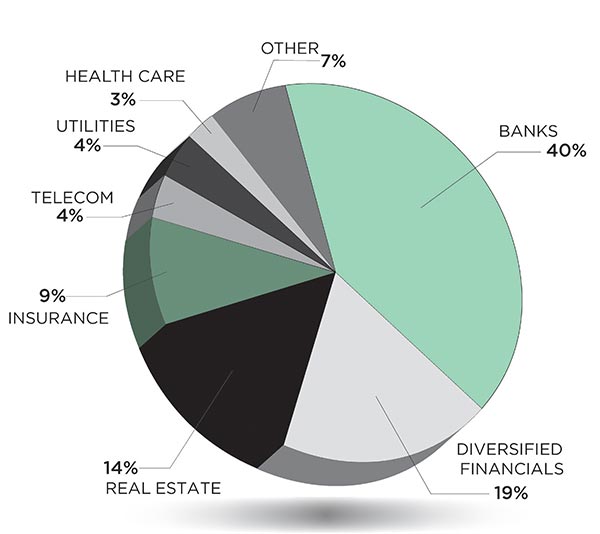

Preferred stocks may also be attractive because they are issued mainly by financial companies, like banks.

That is because banks have historically tended to do well in rising-rate environments, as they can benefit from

making loans at higher interest rates.

When we search for yield, preferred securities end up in nearly every WT Wealth Management portfolios, we

add preferred stocks in a variety of formats: exchange-traded funds (ETFs), mutual funds, closed-end funds,

and even individual issues.

As you can see, from the pie chart

to the right, banks and financials

make up a big chunk of the iShares

US Preferred Stock ETF (symbol:

PFF). One of our favorites, this

ETF had a 5.79% yield as of May

2, 2016.

As we mentioned earlier, rising

interest rates may not affect

preferred shares as much as one

might think. The attached graph

shows the sector weights for the

iShares US Preferred Stock ETF

(PFF). Banks make up as much as

40.4% of the ETF. Financials as a

whole make up ~68% of the fund.

Now, financials tend to do well

when interest rates rise, and rates

usually rise when the economy

improves. Given the cyclical nature

of financials, rising interest rates

would actually benefit them —

especially banks, as explained

previously.

Banks’ profitability has been hurt since the Great Recession of 2007-09, as interest rates remained at record

lows throughout that time and low rates even persist today. However, as the Federal Reserve gets ready to

raise rates for the first time in ten years, banks may see increased profitability, which would positively affect

preferred stocks in our opinion.

As with any investment decision we make, the bottom line is whether the potential return on a specific security

justifies the risks we take in owning it. With preferred stocks, we like the risk/return profile. And, with a 5.79%

yield more than three times the current yield of the 10-year treasury, we believe that nearly all investors should

have an allocation to this misunderstood asset class.

WT Wealth Management is a manager of Separately Managed Accounts (SMA). Past performance is no

indication of future performance. With SMA’s, performance can vary widely from investor to investor as each

portfolio is individually constructed and allocation weightings are determined based on economic and market

conditions the day the funds are invested. In a SMA you own individual ETFs and as managers we have the

freedom and flexibility to tailor the portfolio to address your personal risk tolerance and investment objectives

– thus making your account “separate” and distinct from all others we potentially managed.

An investment in the strategy is not insured or guaranteed by the Federal Deposit Insurance Corporation or

any other government agency.

Any opinions expressed are the opinions of WT Wealth Management and its associates only. Information is

neither an offer to buy or sell securities nor should it be interpreted as personal financial advice. You should

always seek out the advice of a qualified investment professional before deciding to invest. Investing in stocks,

bonds, mutual funds and ETFs carry certain specific risks and part or all of your account value can be lost.

In addition to the normal risks associated with investing, narrowly focused investments, investments in smaller

companies, sector ETF’s and investments in single countries typically exhibit higher volatility. International,

Emerging Market and Frontier Market ETFs investments may involve risk of capital loss from unfavorable

fluctuations in currency values, from differences in generally accepted accounting principles or from economic

or political instability that other nation’s experience. Emerging markets involve heightened risks related to the

same factors as well as increased volatility and lower trading volume. Bonds, bond funds and bond ETFs will

decrease in value as interest rates rise. A portion of a municipal bond fund’s income may be subject to federal

or state income taxes or the alternative minimum tax. Capital gains (short and long-term), if any, are subject

to capital gains tax.

Diversification and asset allocation may not protect against market risk or a loss in your investment.

At WT Wealth Management we strongly suggest having a personal financial plan in place before making

any investment decisions including understanding your personal risk tolerance and having clearly outlined

investment objectives.

WT Wealth Management is a registered investment adviser located in Scottsdale, AZ. WT Wealth Management

may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion

from registration requirements. Any subsequent, direct communication by WT Wealth Management with a

prospective client shall be conducted by a representative that is either registered or qualifies for an exemption

or exclusion from registration in the state where the prospective client resides. For information pertaining to

the registration status of WT Wealth Management, please contact the state securities regulators for those

states in which WT Wealth Management maintains a registration filing.

A copy of WT Wealth Management’s current written disclosure statement discussing WT Wealth Management’s

business operations, services, and fees is available at the SEC’s investment adviser public information website

– www.adviserinfo.sec.gov or from WT Wealth Management upon written request. WT Wealth Management

does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness,

or relevance of any information prepared by any unaffiliated third party, whether linked to WT Wealth

Management’s web site or incorporated herein, and takes no responsibility therefor. All such information is

provided solely for convenience purposes only and all users thereof should be guided accordingly