What to consider when implementing gold in a portfolio

Gold demand jumped 21% in the 1st quarter of 2016 - its strongest first-quarter on record, according to the

World Gold Council. This is not totally unexpected, as negative interest rates, worries over slowing growth in

China, and uncertainty around global monetary policy fueled investor need for risk mitigation. Global equity

markets began 2016 firmly in a downward trend; some regions, including Japan and Europe, entered into a

bear market. The S&P 500® posted its worst January performance since 2009. Gold, however, registered a

positive 4% return as volatility dragged most assets lower.

Turbulent and choppy markets, like those we saw through mid-February, enable investors to reexamine the

strategic role gold may play in a portfolio. While it may be used tactically during periods of elevated inflation

or persistent dollar weakness - as we saw after the Federal Reserve's first quantitative easing program - gold's

most paramount role is a strategic diversifier within portfolios.

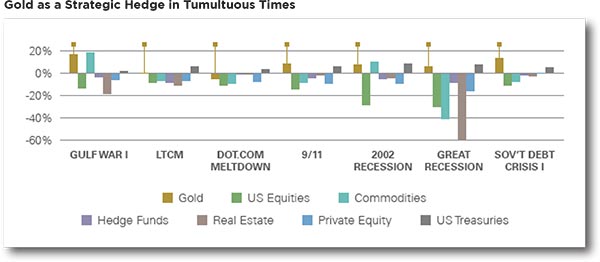

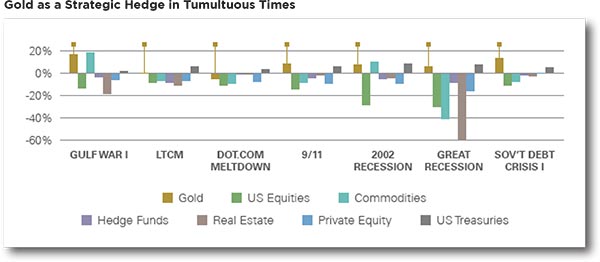

The chart below demonstrates gold's performance during similarly recent tumultuous times, including the Gulf

War, the Great Recession, and the demise of the bond-trading hedge fund, Long Term Capital Management

(LTCM).

Two strategic reasons to hold gold

While gold can play a few roles in a portfolio, two should be emphasized regarding gold implementation:

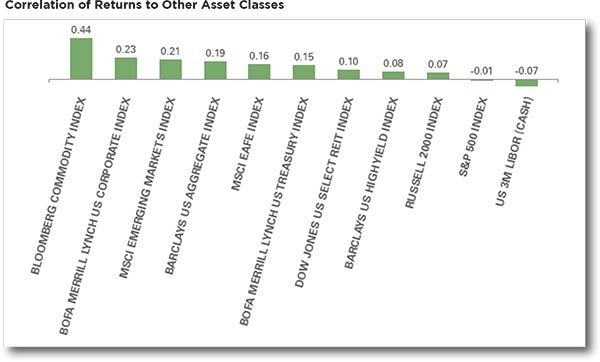

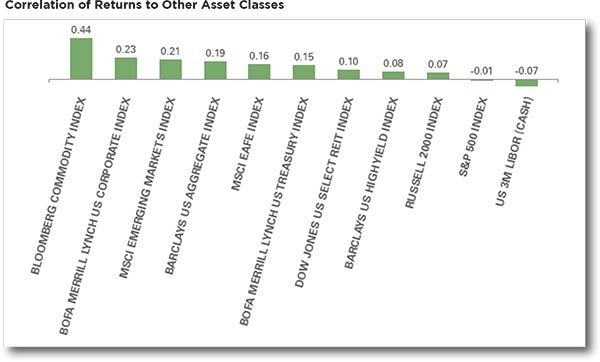

1. Gold can potentially improve diversification, given its historically low correlation with traditional asset

classes, as the chart below shows.

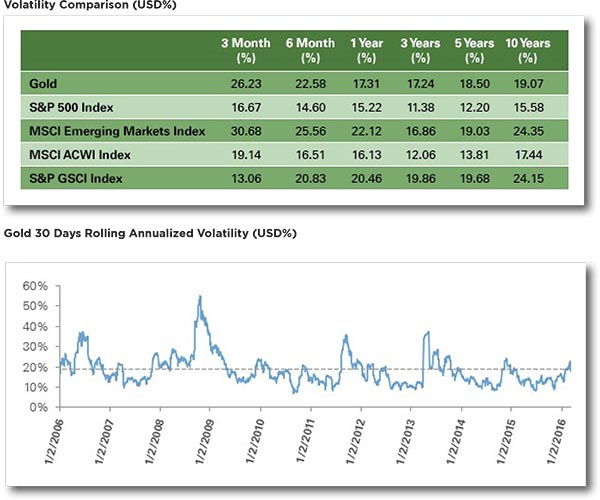

2. The precious metal can also be a hedge against stock market volatility. Despite gold's historically low

correlation with traditional assets, at times it can move in tandem with them. Rising correlation can occur

when the market is facing liquidity constraints, from which investors liquidate gold to shore up assets in other

areas of the portfolio. This may mitigate some of gold's allure as a portfolio diversifier. Nevertheless, a strategic

allocation to gold may provide diversification for a portfolio in the long run.

Nobel Prize-winning economist Harry Markowitz famously called diversification "the only free lunch." And

gold is one asset with a unique, largely uncorrelated return pattern when measured relative to other traditional

asset classes.

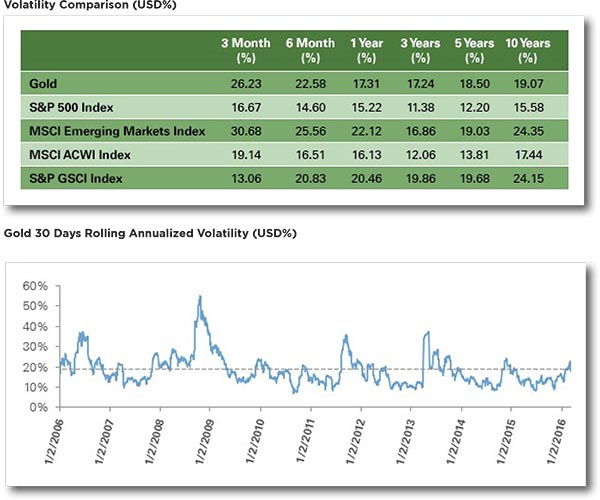

As the chart above shows, gold typically sits somewhere below the middle of the volatility spectrum, compared

to equities and bonds. This helps gold to act as a hedge against equities, thus reduce overall risk in a portfolio.

Implementing gold in a portfolio

The mistake many investors make in gold investments is to use them in an attempt to time the market.

Investors tend to flee gold when the stock market is rallying but turn to the precious metal when times get

tough. However, by the time investors react, chances are the value of their portfolio has dropped, while the

price of gold has risen, thereby eliminating some of the benefits of a gold exposure.

Investors can hold gold in a portfolio to potentially guard against risks from unforeseen events. Gold can be

viewed in isolation and kept in a bank vault, or as a strategic component within a portfolio.

Over the long run, many experts believe that holding 2%-10% of a portfolio in gold can "potentially" improve

performance. Assessing expectations for market volatility, along with your personal risk tolerance, can be a

useful guide for determining an allocation to gold. Every investor is unique and special, we realize that.

How much of a portfolio should an individual investor allocate to gold? This can be determined by considering

personal expectations for return and volatility. History has shown that gold can potentially provide ballast in

portfolios, having historically exhibited a low correlation to traditional asset classes.

Yet gold is only one way to accomplish this task, and WT Wealth Management employees many risk mitigation

techniques daily.

Using ETFs to invest in gold

Gold ETFs, such as SPDR® Gold Shares [GLD®], provide investors an efficient way to gain access to the gold

market without having to pay the transportation, storage and insurance costs of holding physical gold. Holding

gold ETFs allows investors to view their gold allocation holistically across their entire portfolio, and these gold

funds provide liquidity, flexibility and accessibility.

For instance, more than $1 billion worth of GLD shares trade each day, putting GLD in the top 99th percentile

of all stocks and ETFs traded on NYSE Arca. In addition, GLD investors can buy as few or as many shares as

they wish, giving them ownership to fractional ounces of gold. GLD also trades the way ordinary stocks do,

allowing investors to buy, sell and hold this ETF through standard investment accounts. In many cases with

GLD, investors can readily integrate and measure gold as a strategic presence in a portfolio that diversifies risk

and can be incorporated into a broad asset-allocation framework of investing.

Our Position

In general, WT Wealth Management does not allocate to gold or any of the precious metals. If investment prospects have become so risky, and uncertain, that gold becomes a good choice, we would rather have exposure to US treasuries and cash.

Our feelings with the precious metals is that they tend to trade on fear, economic turmoil and global uncertainty. Gold can be just as volatile as any other asset class as news sways investors' fears.

Gold is an asset class with no yield, no dividend, no earnings or PE (price to earnings) to evaluate. At WT Wealth Management we have strong feelings that we will not invest in any investment vehicle if we are unable determine whether it's priced expensively, inexpensively or if we can't determine if it's currently undervalued or overvalued.

We feel in our role as a fiduciary, it would be nearly impossible to justify exposure to gold simply because we are "scared." However, we do understand gold's attraction to many investors. We understand that you are unique and have certain feelings about your account. We respect that and always say every account is like DNA and should reflect who you are and what you believe in. So, the team at WT Wealth Management would be happy to discuss an allocation to Gold in your portfolio at any time.

WT Wealth Management is a manager of Separately Managed Accounts (SMA). Past performance is no indication

of future performance. With SMA's, performance can vary widely from investor to investor as each portfolio is

individually constructed and allocation weightings are determined based on economic and market conditions

the day the funds are invested. In a SMA you own individual ETFs and as managers we have the freedom and

flexibility to tailor the portfolio to address your personal risk tolerance and investment objectives – thus making

your account "separate" and distinct from all others we potentially managed.

An investment in the strategy is not insured or guaranteed by the Federal Deposit Insurance Corporation or any

other government agency.

Any opinions expressed are the opinions of WT Wealth Management and its associates only. Information is neither

an offer to buy or sell securities nor should it be interpreted as personal financial advice. You should always seek

out the advice of a qualified investment professional before deciding to invest. Investing in stocks, bonds, mutual

funds and ETFs carry certain specific risks and part or all of your account value can be lost.

In addition to the normal risks associated with investing, narrowly focused investments, investments in smaller

companies, sector ETF's and investments in single countries typically exhibit higher volatility. International,

Emerging Market and Frontier Market ETFs investments may involve risk of capital loss from unfavorable

fluctuations in currency values, from differences in generally accepted accounting principles or from economic or

political instability that other nation's experience. Emerging markets involve heightened risks related to the same

factors as well as increased volatility and lower trading volume. Bonds, bond funds and bond ETFs will decrease in

value as interest rates rise. A portion of a municipal bond fund's income may be subject to federal or state income

taxes or the alternative minimum tax. Capital gains (short and long-term), if any, are subject to capital gains tax.

Diversification and asset allocation may not protect against market risk or a loss in your investment.

At WT Wealth Management we strongly suggest having a personal financial plan in place before making any

investment decisions including understanding your personal risk tolerance and having clearly outlined investment

objectives.

WT Wealth Management is a registered investment adviser in Arizona, California, Nevada, New York and

Washington with offices in Scottsdale, AZ Jackson, WY and Napa Valley, CA. WT Wealth Management may only

transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration

requirements. Individualized responses to persons that involve either the effecting of transaction in securities, or

the rendering of personalized investment advice for compensation, will not be made without registration or

exemption. WT Wealth Managements web site is limited to the dissemination of general information pertaining

to its advisory services, together with access to additional investment-related information, publications, and links.

Accordingly, the publication of WT Wealth Management web site on the Internet should not be construed by

any consumer and/or prospective client as WT Wealth Management solicitation to effect, or attempt to effect

transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet.

Any subsequent, direct communication by WT Wealth Management with a prospective client shall be conducted

by a representative that is either registered or qualifies for an exemption or exclusion from registration in the

state where the prospective client resides. For information pertaining to the registration status of WT Wealth

Management, please contact the state securities regulators for those states in which WT Wealth Management

maintains a registration filing. A copy of WT Wealth Management's current written disclosure statement discussing

WT Wealth Management's business operations, services, and fees is available at the SEC's investment adviser

public information website – www.adviserinfo.sec.gov or from WT Wealth Management upon written request. WT

Wealth Management does not make any representations or warranties as to the accuracy, timeliness, suitability,

completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to WT

Wealth Management's web site or incorporated herein, and takes no responsibility therefor. All such information

is provided solely for convenience purposes only and all users thereof should be guided accordingly.