In last month's whitepaper examining how time spent in the market means more to

stock-market investors than market timing ("Time, Not Timing, Is What Matters"),

we concluded by saying we would examine investor returns vs. investment returns

in this month's white paper. So here we are.

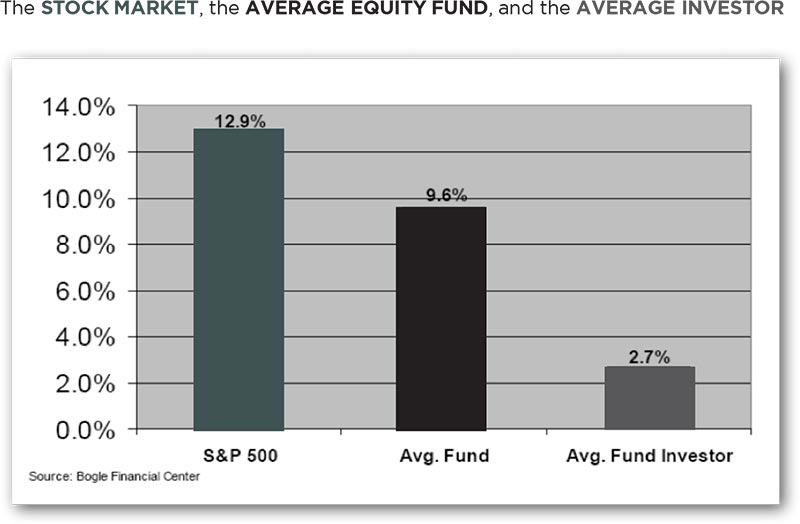

Think about this: How can a mutual fund have, say, a 9% return over a 10-year period, even though the average

investment in it realized less than 3% return? Unfortunately, it's because investors acting on their own have an

uncanny ability to buy high and sell low on a consistent basis.

Picture yourself in outer space, gazing down on Planet Earth: You see a perfectly round, smooth orb, truly a

thing of magical beauty. Closer up, you notice mountains rising high and valleys digging deep. Looking at a

map and navigating the actual terrain it depicts are very different experiences indeed.

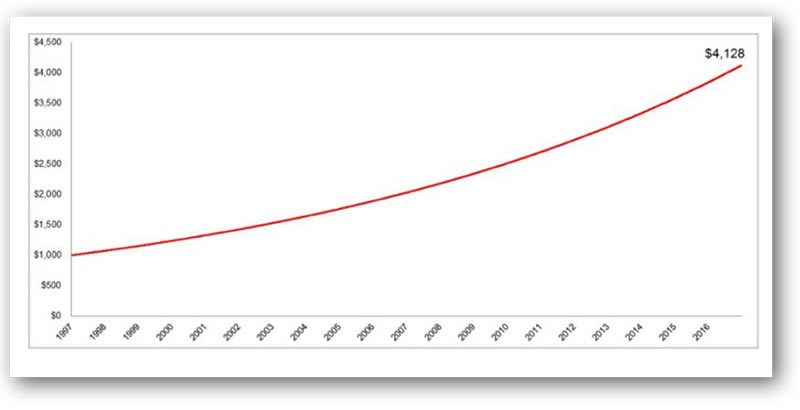

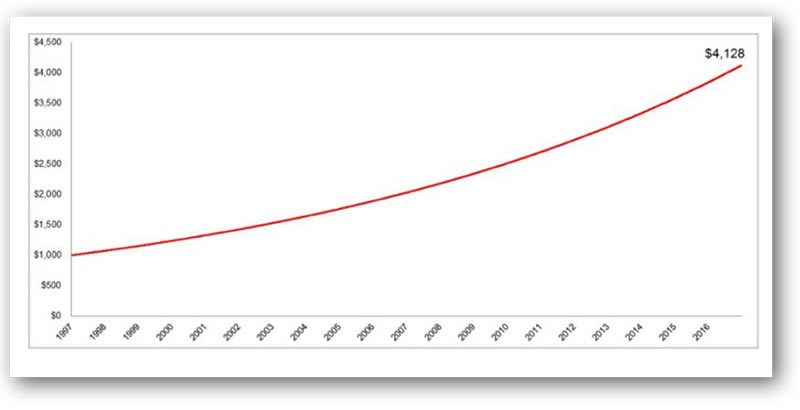

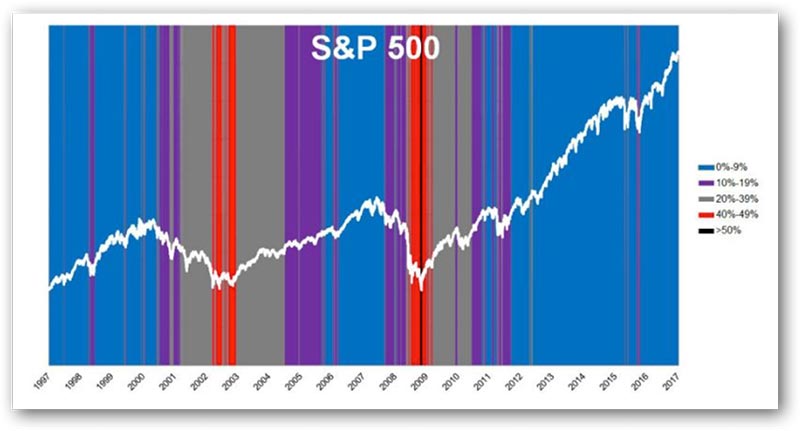

Similarly, scanning a long-term

investment's development and

looking at where it's going

doesn't tell us much about

the process of achieving its

end, for "statistics provided

rather bloodless answers,"

in Adam Smith's words. For

instance, the following chart

depicts the 7.3% compounded

annual growth rate of S&P 500

companies from 1997 to 2016.

Easy ride, no?

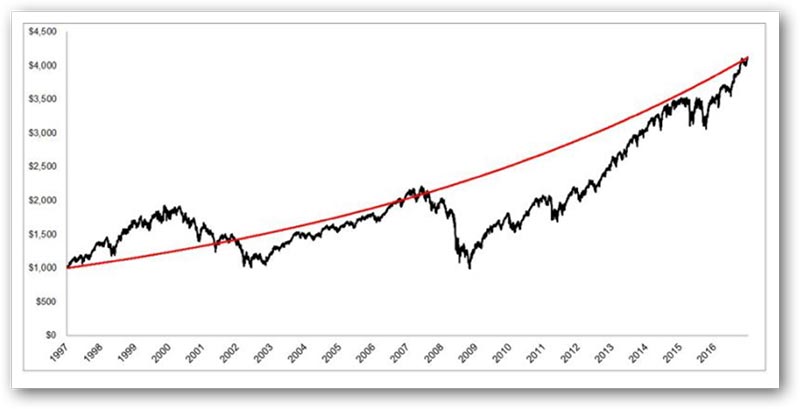

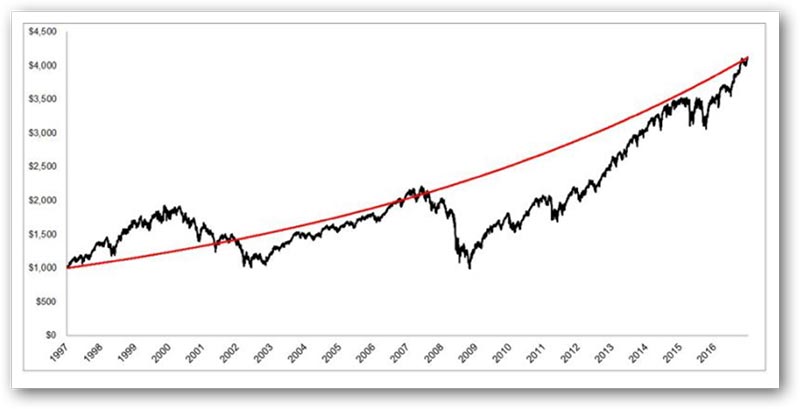

Think again. Transforming $1,000 in 1997 into a 313% return of $4,128 by year-end 2016 was nothing short of a

tough haul. The next chart clearly differentiates the flat map from the rugged terrain, and the white space inbetween

the fluid red curve and the scraggly black line signifies the occurrence of unforced investment errors,

especially where investors acting on their own threw in the towel at lows.

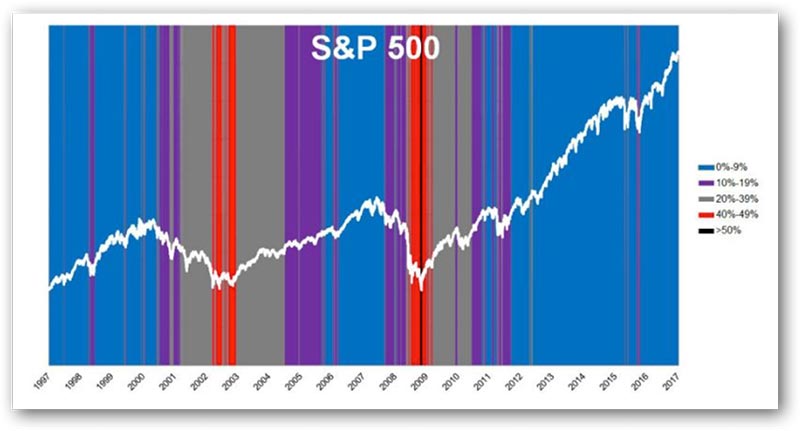

The chart below graphs S&P 500 performance against the distance it dropped from its highs over its course,

thus indicating the investment terrain's true up-and-down ruggedness.

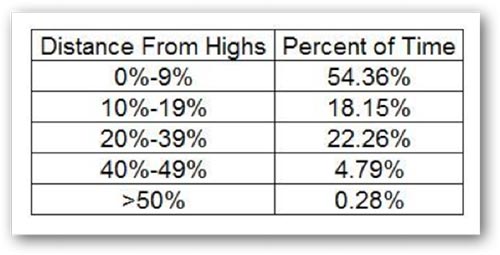

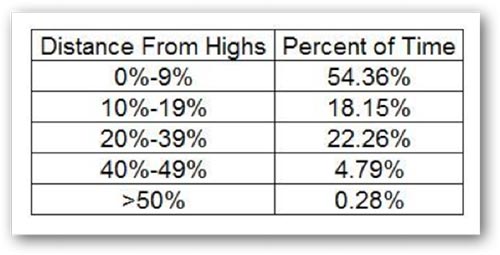

The following table itemizes the percentages of time S&P 500 companies were in diverse drawdown periods.

While catastrophic drawdowns are rare, they do happen. This is the time to add additional capital to the

markets, not bail out. (But that's another story for another day.)

The chart below shows us that, while the deepest valleys

have the shortest duration, that's more likely when most

investors acting on their quit the game, and that an investor

could be below the most recently set high over 50% of the time.

We at WT Wealth Management particularly notice the following:

- The index was 20% or more distant from its highs 27% of the time.

- Staying committed to your plan sounds easy, but the drawdowns make commitment extremely

difficult without a long-term investment plan, since many investors believe that zero is always in play.

- The ‘catastrophe scenario' investors often dwell on took place only 5% of the time, if you look at 40%

and higher downward moves, and 27% of the time if you look at any downward move of 20% or more.

Don't get us wrong—a 20% decline is no sunny day in paradise. Yet even disciplined, long-term

investors will see several such declines in the lifetimes of their investments.

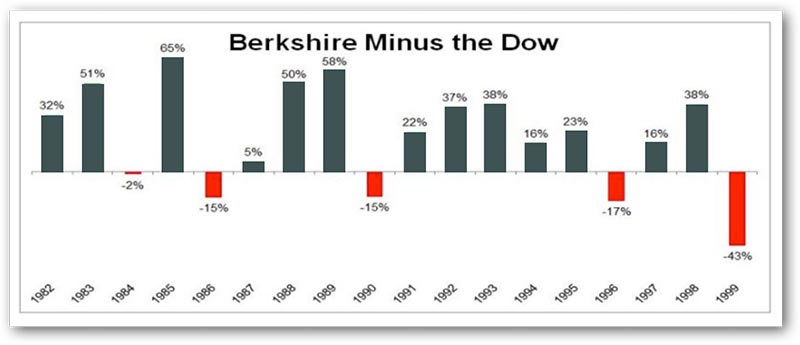

Earning market returns takes considerable self-management, including developed investment skill and a thick

skin in the face of selloffs and global uncertainty. Berkshire Hathaway has many such investors. In his 1997

Chairman's Letter to the Shareholders of Berkshire Hathaway Inc., Chairman of the Board Warren Buffett

wrote:

Gyrations in Berkshire's earnings don't bother us in the least: Charlie (Munger) and I would much rather

earn a lumpy 15% over time than a smooth 12%. (After all, our earnings swing wildly on a daily and weekly

basis – why should we demand that smoothness accompany each orbit that the earth makes of the sun?)

We are most comfortable with that thinking, however, when we have shareholder/partners who can also

accept volatility, and that's why we regularly repeat our cautions.

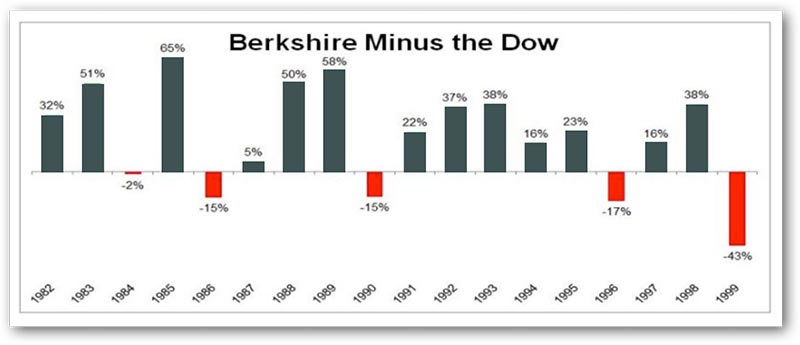

Berkshire Hathaway earned 9,918% (29% per year) from 1982 to 2000, over a very rough terrain, yielding a

standard return deviation of 11.5% for the Dow and 33.6% for Berkshire over those 18 years.

Most investors do not earn returns of that magnitude because they are overconfident in the beginning and

narrowly focused on the final outcome, hence caught off-guard when the terrain becomes rockier.

Buffett once said, "I never attempt to make money on the stock market. I buy on the assumption that they

could close the market the next day and not reopen it for five years," which is unusual for one of the 20th

century's greatest investors to say. Yet it tells us plenty about what has made him so great: his habit of

investing for the long term and not worrying about the short-term value of his investments. That is, sound

investor behavior is the main prerequisite for investment success.

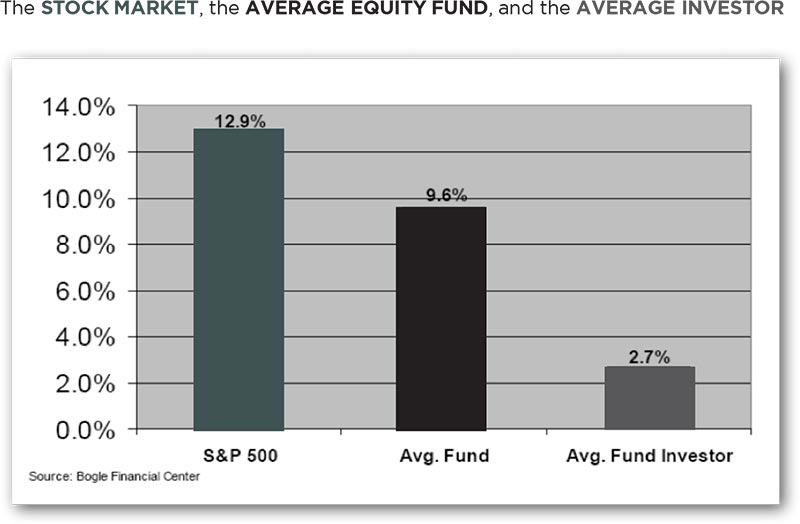

A recent study by the Bogle Investment Center at Vanguard Investments found that the average equity mutual

fund in the U.S. produced an average annual return, with dividends reinvested, of 9.6% from 2004 to 2014.

During that period the average equity investor earned 2.7% in equity mutual funds. Clearly the performance of

specific mutual funds cannot account for the difference. Investor behavior (moving and switching) is the only

logical explanation for the average investor's lower return.

The point is: Behavior, which is driven by one's beliefs or perspective, is the primary driver of investor

performance, good or bad. As Buffett said, "Success in investing doesn't correlate with IQ once you're above

the level of 25. Once you have ordinary intelligence, what you need is the temperament to control the urges

that get other people into trouble [quitting, or selling, at the lows] in investing."

As your advisor, we at WT Wealth Management provide the efficient, cost-effective after-tax results needed

to help your investment performance meet the expectations of your financial plan. We not only manage

your investment's design and structure; we also have the necessary discipline to increase your probability of

success.

At WT Wealth Management, in our combined 100 years of experience working with all types of clients, we

have noticed a number of mistakes in thinking that wreak havoc on an investment strategy. Here are four

major ones we help our clients avoid:

- Mistake #1: People too often use their recent investment experiences to predict what will happen

to their investments in the future. This is often called the "this time is different" syndrome, and the

'90s investment bubble exemplified this.

- Mistake #2: People who frequently measure their investments shift them often, which greatly

undercuts their investment performances. Given the inevitable unevenness of market returns over

time, proper measuring methods are needed for long-term investment success. Solution: Look at your

investment results quarterly, not weekly or monthly.

- Mistake #3: People don't give the markets a fair chance to yield them the benefits those markets

could hold for them in the long term. Solution: Time in the market, not timing the market, is key to

successful investing, as we explored in last month's whitepaper.

- Mistake #4: People shun actions that affirm their errors, even if those are the wisest actions, and cling

to those errors too long in order to shirk proper acknowledgment of them. Solution: Sell losers quickly

and move on.

Are we always right? Heck, no. Do we make money for our clients over a full market cycle? Heck, yes. How do

we achieve these results? Just go back and read our past two months' white papers. As a firm, WT Wealth

Management has rigid beliefs in our approach to investing and a flexible style in order to find value and

momentum in virtually any market. We take the time to educate our clients so they understand that they are

in it for the long haul. We let them know the terrain will be bumpy, but we urge them to keep their eyes on

the horizon.

In up markets like those we have experienced since Election Day 2016, it's easy for investors to become

overconfident and think they are smarter than the markets, or even their financial advisors. I hear stories every

day about someone who bought shares in Amazon at $300, and now they are worth $1,000. My grandfather

used to tell me something about a blind squirrel. (But that's probably a story for another day.)

The combined hours our WT Wealth Management team spend on market research each week greatly surpasses

100. We are no different than any other professionals, be they dentists, doctors, lawyers or engineers. This

is our life, we live and breathe it, we eat it sleep it, and most importantly, we have our money in our own

strategies. We eat our own cooking, and we think that's incredibly important.

The greatest compliment you can give us is to refer us to a friend, family member or acquaintance who is

struggling to find a good way through the difficult investment terrain. I referred to this last month. I have

met people that have been out of the market since 2009 simply because of fear, and then, after the markets

recovered, they felt as if they had missed the move. Heck, people felt that way a year ago, and we have had

one of the great runs in the history of investing over the past six months. Will it continue? I doubt it. But the

next great selloff is the next great opportunity to be part of something great.

Every day is a great day to invest, in our opinion. However, you need a plan, a strategy, and commitment to the

process to fully realize the potential of the equity markets.

Batnick, M. (2017, May 11). The map versus the terrain. The Irrelevant Investor.

Retrieved from

http://theirrelevantinvestor.com/2017/05/11/the-map-versus-the-terrain/

Buffett, W. (1997, February 28). "Berkshire Hathaway Inc.: Chairman's letter." Berkshirehathaway.com.

Retrieved from

http://www.berkshirehathaway.com/letters/1996.html

Padrón, R. V. (2005, February 27). Investor returns vs. investment returns. Brightworth.

Retrieved from

http://www.brightworth.com/insights-news/investor-returns-vs-investment-returns

Quinn, M. (2015, March 8). Warren Buffett's most misunderstood investment advice. GO Banking Rates.

Retrieved from

https://www.gobankingrates.com/personal-finance/warren-buffetts-misunderstood-advice/

Smith, A. (2006). Supermoney. Malden, MA: John Wiley & Sons Inc.

Sure Dividend. (n.d.). "107 profound Warren Buffett quotes: Learn to build wealth. Sure Dividend: High Quality

Dividend Stocks, Long Term Plan. Retrieved from

http://www.suredividend.com/warren-buffett-quotes/

WT Wealth Management is a manager of Separately Managed Accounts (SMA). Past performance is no indication

of future performance. With SMA's, performance can vary widely from investor to investor as each portfolio is

individually constructed and allocation weightings are determined based on economic and market conditions

the day the funds are invested. In a SMA you own individual ETFs and as managers we have the freedom and

flexibility to tailor the portfolio to address your personal risk tolerance and investment objectives - thus making

your account "separate" and distinct from all others we potentially managed.

An investment in the strategy is not insured or guaranteed by the Federal Deposit Insurance Corporation or any

other government agency.

Any opinions expressed are the opinions of WT Wealth Management and its associates only. Information is neither

an offer to buy or sell securities nor should it be interpreted as personal financial advice. You should always seek

out the advice of a qualified investment professional before deciding to invest. Investing in stocks, bonds, mutual

funds and ETFs carry certain specific risks and part or all of your account value can be lost.

In addition to the normal risks associated with investing, narrowly focused investments, investments in smaller

companies, sector ETF's and investments in single countries typically exhibit higher volatility. International,

Emerging Market and Frontier Market ETFs investments may involve risk of capital loss from unfavorable

fluctuations in currency values, from differences in generally accepted accounting principles or from economic or

political instability that other nation's experience. Emerging markets involve heightened risks related to the same

factors as well as increased volatility and lower trading volume. Bonds, bond funds and bond ETFs will decrease in

value as interest rates rise. A portion of a municipal bond fund's income may be subject to federal or state income

taxes or the alternative minimum tax. Capital gains (short and long-term), if any, are subject to capital gains tax.

Diversification and asset allocation may not protect against market risk or a loss in your investment.

At WT Wealth Management we strongly suggest having a personal financial plan in place before making any

investment decisions including understanding your personal risk tolerance and having clearly outlined investment

objectives.

WT Wealth Management is a registered investment adviser in Arizona, California, Nevada, New York and

Washington with offices in Scottsdale, AZ Jackson, WY and Las Vegas, NV. WT Wealth Management may only

transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration

requirements. Individualized responses to persons that involve either the effecting of transaction in securities, or

the rendering of personalized investment advice for compensation, will not be made without registration or

exemption. WT Wealth Managements website is limited to the dissemination of general information pertaining

to its advisory services, together with access to additional investment-related information, publications, and links.

Accordingly, the publication of WT Wealth Management web site on the Internet should not be construed by

any consumer and/or prospective client as WT Wealth Management solicitation to effect, or attempt to effect

transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet.

Any subsequent, direct communication by WT Wealth Management with a prospective client shall be conducted

by a representative that is either registered or qualifies for an exemption or exclusion from registration in the

state where the prospective client resides. For information pertaining to the registration status of WT Wealth

Management, please contact the state securities regulators for those states in which WT Wealth Management

maintains a registration filing. A copy of WT Wealth Management's current written disclosure statement discussing

WT Wealth Management's business operations, services, and fees is available at the SEC's investment adviser

public information website – www.adviserinfo.sec.gov or from WT Wealth Management upon written request. WT

Wealth Management does not make any representations or warranties as to the accuracy, timeliness, suitability,

completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to WT

Wealth Management's web site or incorporated herein, and takes no responsibility therefor. All such information

is provided solely for convenience purposes only and all users thereof should be guided accordingly.