Click here to download the PDF

The steep decline in the number of U.S. publicly traded companies has resulted in

fewer quality opportunities, particularly for small-cap investors.

Key Points:

- Small-cap stock indexes have experienced a structural deterioration in quality. This is reflected in the

number of companies with negative earnings and lower returns on equity and invested capital.

- The sluggish pace of initial public offerings (IPOs) in recent years has not offset the loss of attractive

smaller companies in the public market.

- The combination of relatively high valuations and reduction in quality and liquidity in small-cap indexes

poses significant risks for passive investors.

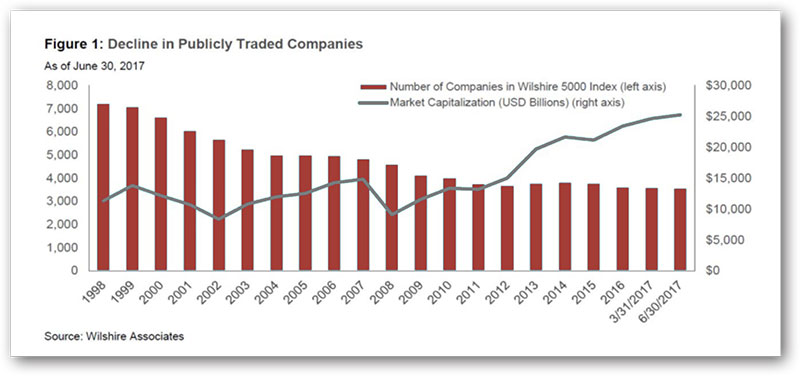

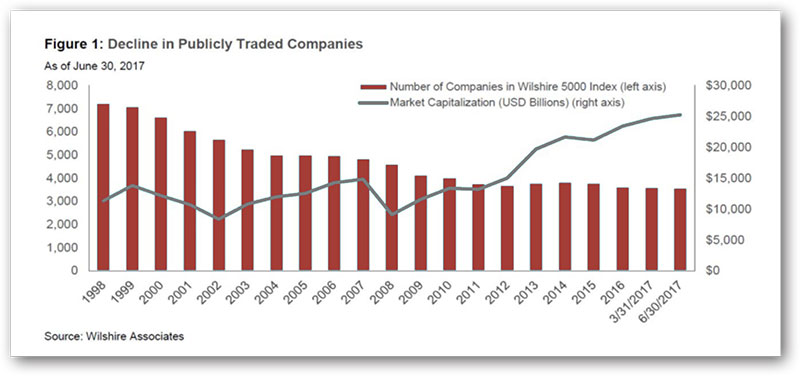

The stock market's impressive gains in recent years have masked a less encouraging trend: the number of

public companies has been cut by more than half over the past two decades. This incredibly shrinking stock

market poses challenges for investors, particularly those investing in small-cap stocks.

The number of public companies in the Wilshire 5000 Total Market Index-widely regarded as the best single

measure of the U.S. equity market has fallen from a peak of 7,562 in July 1998 to just 3,465 as of June 2017.

The Wilshire 5000 has not included 5,000 stocks since the end of 2005.

Not only are fewer public companies issuing shares, but the total number of shares traded on the market has

also declined. Record-low interest rates and slow economic growth encourage companies to buy back their

own shares, further reducing the availability of equity shares that remain public.

The shrinking opportunity set can also be traced to several other trends:

- increased merger and acquisition (M&A) activity and private-equity deals;

- increased regulation;

- the rise of shareholder activism;

- a significant decline in recent years in the number of companies going public; and

- a number of corporate failures.

Larger companies have been buying out smaller ones at hefty premiums in an effort to meet growth targets,

aided by low interest rates. Strategic buyers are not the only buyers: private-equity funds have ample capital

to deploy as well.

Motivation also exists on the sellers' side. Increased regulatory burdens and compliance costs stemming from

the Sarbanes-Oxley Act of 2002 have dampened desires to go-or remain-public. The ongoing cost of being

a publicly held company-including legal, compliance and technology expenses-can approach $10 million.

The rise of activism by hedge funds and other investors pressuring management to achieve better results is

encouraging some public companies to sell out to private investors, while also discouraging private companies

from going public. Corporate leaders don't want to subject themselves to such scrutiny, especially when they

can often obtain money to expand elsewhere.

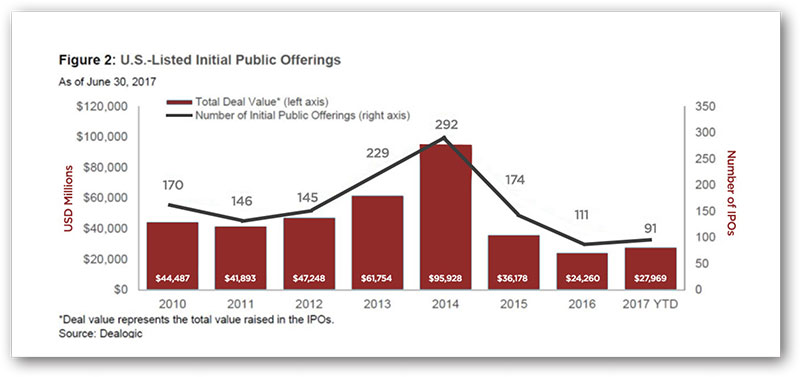

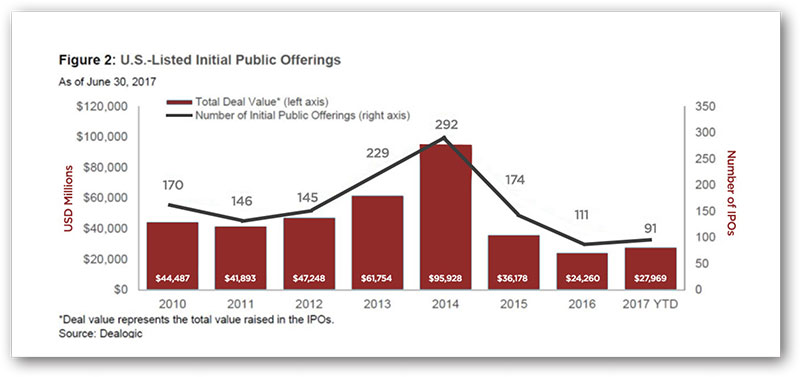

As more public companies are acquired or sell out to private investors, we have seen a dearth of new IPOs to

replace them. IPO activity has fallen by more than half since peaking in the late 1990s and has steady declined

in recent years; the pace of this downturn has accelerated this year.

This IPO activity reduction has been partially caused by a surge in venture capital investment, which has

enabled startups to expand and access capital while avoiding the public market's scrutiny and transparency.

By the time some firms go public, they have grown beyond small-cap managers' reach.

The median age of companies executing an IPO has increased from 7.8 years during the 1976-1996 period to

10.7 years in the 1997-2016 period-a 37% increase, according to Credit Suisse.

A Shrinking Pool for Small-Cap Investors

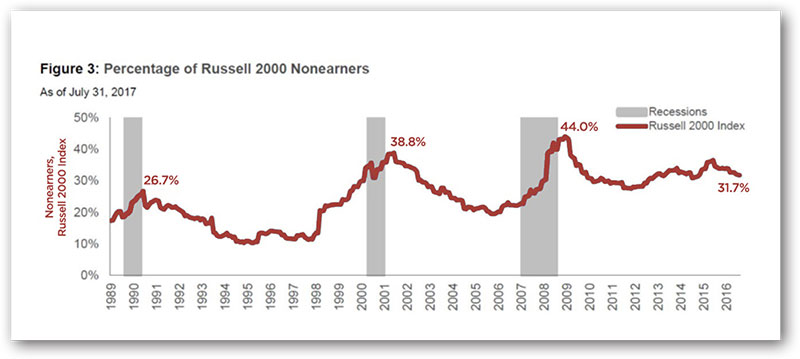

The shrinking equity market has had a disproportionate impact on the small-cap Russell 2000 Index. While the

index is rebalanced annually in June to include 2,000 names, the companies recently added to the index have

tended to be smaller, more illiquid, and of lower quality than those they replaced.

The index includes older names that have been there for years, as well as those that have fallen out of the midand

large-cap universes. This has masked a steady increase in lower-quality firms populating the bottom tier

of the Russell 2000 companies.

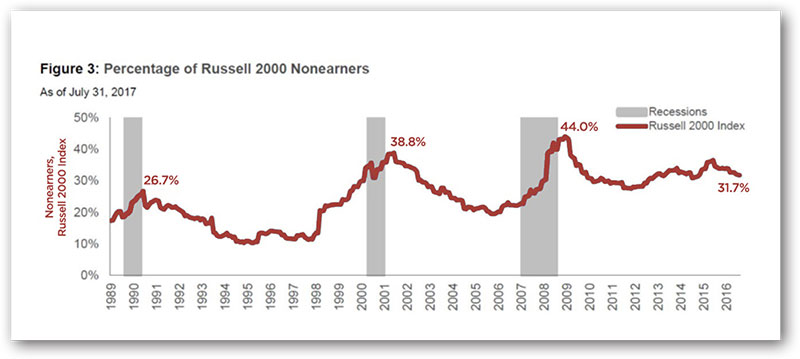

The erosion in the index's quality is reflected in Figure 3, which shows that about one-third of the companies in

the index have not earned money in the past 12 months, a level normally seen only in recessions. Companies with

negative earnings are more likely to struggle to generate the cash necessary to maintain solvency internally,

so they may need to raise capital by increasing leverage or issuing additional stock to fund their operations.

Also, debt levels, as measured by debt-to-equity ratios, have risen over the past decade. Returns on equity

and invested capital of the Russell 2000 companies are dramatically lower than they were 20 years ago. While

active portfolio managers may look more skeptically at the index's lower-quality members, passive products

such as exchange-traded funds and index funds have been the natural buyer of their shares, aided by the flood

of money into passive products. This has helped drive up the shares of mediocre companies as much as, and

sometimes even more than, those of their stronger competitors, posing significant risk for passive investors.

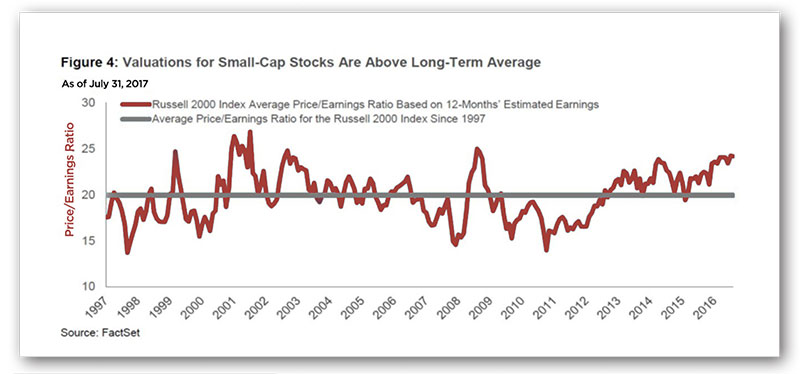

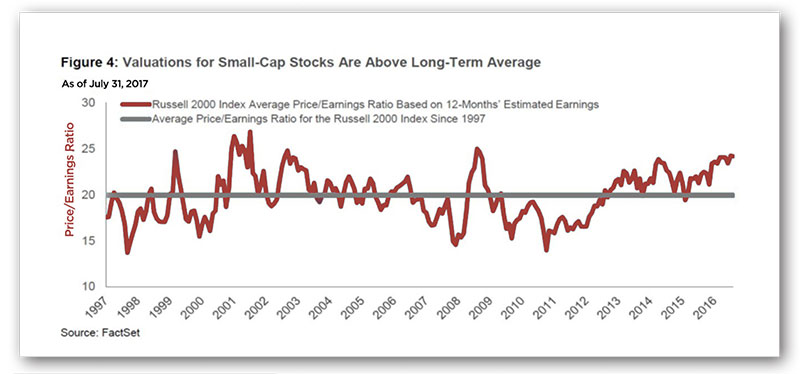

That risk is magnified by relatively high valuations for small-cap stocks. At the end of July 2017, the forward

price/earnings ratio on the Russell 2000 Index stood at 24x, well above the historical average. In the next

sustained market downturn, passive products seeking to sell to fund outflows may have trouble finding buyers

for the lower-quality, less liquid stocks in the rush to the exits.

Of course, this shrinkage in number and overall quality of the small-cap market amid higher valuations also

poses challenges for active managers and investors who are trying to separate the wheat from the chaff and

not overpay for it.

In this environment, WT Wealth Management has decided that our clients should have minimal exposure to

small-cap stock investing, which usually amounts to less than 6-7% of the total portfolio value. We remain

confident that our focus on factor-driven ETFs, including those that specialize in small-cap and mid-cap stock

investment, should provide some downside protection in a potential downturn, and that our fundamental and

patient approach should prove rewarding for our clients over time.

While investing in small-cap stocks has become more challenging, we are fortunate to benefit from ETF

companies that are spending their time and money on back-testing and exploring new and exciting factorbased

ETF strategies, from dividend growers to dividend achievers to low-volatility strategies. We will always

continue to ferret out the most attractive opportunities for our clients in an otherwise shrinking market of

small-cap stocks.

WTWealth Management is a manager of Separately Managed Accounts (SMA). Past performance is no indication

of future performance. With SMA's, performance can vary widely from investor to investor as each portfolio is

individually constructed and allocation weightings are determined based on economic and market conditions

the day the funds are invested. In a SMA you own individual ETFs and as managers we have the freedom and

flexibility to tailor the portfolio to address your personal risk tolerance and investment objectives - thus making

your account "separate" and distinct from all others we potentially managed.

An investment in the strategy is not insured or guaranteed by the Federal Deposit Insurance Corporation or any

other government agency.

Any opinions expressed are the opinions of WT Wealth Management and its associates only. Information is neither

an offer to buy or sell securities nor should it be interpreted as personal financial advice. You should always seek

out the advice of a qualified investment professional before deciding to invest. Investing in stocks, bonds, mutual

funds and ETFs carry certain specific risks and part or all of your account value can be lost.

In addition to the normal risks associated with investing, narrowly focused investments, investments in smaller

companies, sector ETF's and investments in single countries typically exhibit higher volatility. International,

Emerging Market and Frontier Market ETFs investments may involve risk of capital loss from unfavorable

fluctuations in currency values, from differences in generally accepted accounting principles or from economic or

political instability that other nation's experience. Emerging markets involve heightened risks related to the same

factors as well as increased volatility and lower trading volume. Bonds, bond funds and bond ETFs will decrease

in value as interest rates rise. A portion of a municipal bond fund's income may be subject to federal or state

income taxes or the alternative minimum tax. Capital gains (short and long-term), if any, are subject to capital

gains tax.

Diversification and asset allocation may not protect against market risk or a loss in your investment.

At WT Wealth Management we strongly suggest having a personal financial plan in place before making any

investment decisions including understanding your personal risk tolerance and having clearly outlined investment

objectives.

WT Wealth Management is a registered investment adviser in Arizona, California, Nevada, New York and

Washington with offices in Scottsdale, AZ Jackson, WY and Las Vegas, NV. WT Wealth Management may only

transact business in those states in which it is registered,orqualifies for an exemptionor exclusion from registration

requirements. Individualized responses to persons that involve either the effecting of transaction in securities,

or the rendering of personalized investment advice for compensation, will not be made without registration or

exemption. WT Wealth Managements web site is limited to the dissemination of general information pertaining

to its advisory services, together with access to additional investment-related information, publications, and links.

Accordingly, the publication of WT Wealth Management web site on the Internet should not be construed by

any consumer and/or prospective client as WT Wealth Management solicitation to effect, or attempt to effect

transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet.

Any subsequent, direct communication by WT Wealth Management with a prospective client shall be conducted

by a representative that is either registered or qualifies for an exemption or exclusion from registration in the

state where the prospective client resides. For information pertaining to the registration status of WT Wealth

Management, please contact the state securities regulators for those states in which WT Wealth Management

maintains a registration filing.A copy ofWTWealth Management's current written disclosure statement discussing

WT Wealth Management's business operations, services, and fees is available at the SEC's investment adviser

public information website - www.adviserinfo.sec.gov or from WT Wealth Management upon written request. WT

Wealth Management does not make any representations or warranties as to the accuracy, timeliness, suitability,

completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to WT

Wealth Management's web site or incorporated herein, and takes no responsibility therefor. All such information

is provided solely for convenience purposes only and all users thereof should be guided accordingly