It is an economic condition in which the yields, or returns, on shorter-duration bonds surpass the yields on longer-duration bonds.

Over the last few weeks some analysts have become concerned that an overly aggressive Federal Reserve could invert the yield curve, which would be one of the very few market indicators that can predict recessions without sending out false positives.

What makes inverted yield curves so rare?

A normal yield curve denotes a lower yield on short-term bills than on long-term bonds, which means investors anticipate a lower return on money invested in bonds for a shorter length of time. Conversely, a higher yield allows lenders greater returns on long-term bond investments.

What does an inverted yield curve signify?

It is a sign of low investor confidence in the present economy. Investors prefer to put their money into a 10- year U.S. Treasury note, even though it may yield lower returns for them. Known as the "no free lunch on Wall Street" doctrine, this is illogical, given the higher returns investors expect on longer-term investments. For investment in a short-term Treasury bill would force investors to reinvest the money tied up in it into another bill, because they anticipate that a short-term bill's value would drop within the coming year if they think a recession is on the horizon, given the Fed's tendency to push down Fed Funds rates in an economic slowdown to motivate more money-lending, hence some fiscal recovery.

An inverted yield curve has accurately foretold the last seven recessions since the late 1960s. The yield curve last inverted in 2000 and 2006 prior to each of the recessions that followed those years.

What causes the yield curve to invert?

The more U.S. Treasury bonds investors put their money in, the lower the yield on each bond: the more in demand they are, the lower the yield they need to lure investment. This lowers the demand for short-term Treasury bills, which means they must yield higher returns to be investment-attractive. Therefore, in time short-term bill returns surpasses long-term bond ones, thus inverting the yield curve.

In periods of normal economic growth, a 30-year bond's return averages three points above that of a threemonth bill. Nevertheless, investors who sense economic slowdown over the following two years followed by a rebound in a 10-to-20-year span would rather put their money into bonds and keep it there until the recovery, as a sounder fiscal option to immediate reinvestment at far lower rates.

In what years did the inverted yield curve predict recession?

In recent memory, the U.S. Treasury yield curve inverted before the recessions of 2000, 1991, and 1981. The yield curve also predicted the 2008 financial crisis two years earlier.

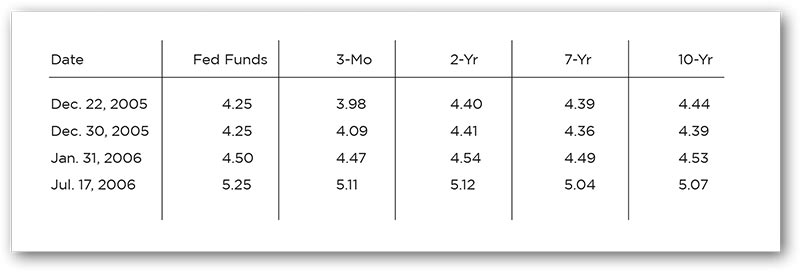

The initial inversion took place on December 22, 2005, partially because the Fed had been increasing Fed Funds rates since June 2004—to 4.25% by December—out of fear of an asset bubble burst in the housing market. That action increased the two-year Treasury bill's yield to 4.40%, but the seven-year Treasury note's yield rose to a mere 4.39%. This signified investors' willingness to receive a lower return on a seven-year investment than on a two-year one, which was that initial inversion.

By December 30, the discrepancy was worse. Although the two-year Treasury bill yielded 4.41%, the sevenyear note's yield had declined to 4.36%, and the 10-year Treasury note yield had gone down to 4.39%, under the two-year bill's yield.

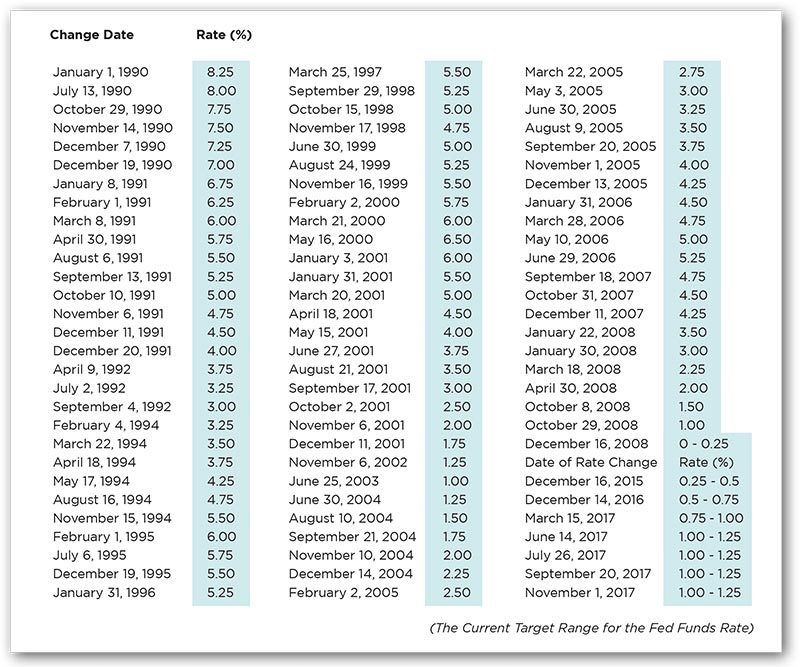

The following January 31, Fed Fed Funds rates had gone up again, prompting the two-year bill yield to increase to 4.54%, above the seven-year yield of 4.49%. However, the Fed continued to increase rates, which reached 5.25% that June. (For details, see Fed Funds Rate History in Appendix #1.)

On July 17, 2006, the inversion grew more intense when the 10-year note yielded 5.07%, below the threemonth bill's 5.11%—a sign that investors believed the Fed was on the wrong path.

Unfortunately, the Fed ignored the warning, believing that low long-term yields would provide enough liquidity in the economy to prevent a recession. They were wrong. Yet I wouldn't blame them—it was a perfect 100-year storm.

The yield curve stayed inverted until June 2007, then continually rose and fell between an inverted yield curve and a flat one over the following summer. By September 2007, the Fed woke up to reality and lowered the Fed Funds rate to 4.75%—a significant drop, at half a point—to send an aggressive signal to the markets. The Fed then reduced the rate ten times until it was near 0% by the close of 2008. This ended the inverted yield curve, but too late for it to make a difference, for it was on the cusp of the worst recession since the Great Depression. In the end, the rate decreased nine more times, ending at .25% and remaining that way for seven years, until December 2015, when the Fed raised rates 25 bps (.25%). Since then we have had three more .25% rate increases—December 2016, March 2017 and June 2017—a long and difficult road to recovery.

Conclusion

The Fed has tightened monetary policy since lessening its $80-billion-per-month quantitative easing (QE) program beginning in December 2013. It has subsequently raised rates four times and is now most likely ready for a fifth rate hike in December of 2017.

But, as always, if the Fed fails to read the correct economic indicators and moves too fast, this could have serious consequences for investors. The Fed maintains it is "data driven" and is now fixated on the low unemployment rate and its hopeful effect on inflation. While gross domestic product (GDP) has seen some improvement since the Trump presidency began the "cross the T's, dot the I's" part of the recovery, this is normalized inflation, which signals increased demand. We've yet to see that.

Some argue that the yield curve won't invert if economic growth stalls, because the Fed will then truncate its rate-hike path, resulting in an inverted yield curve. We agree.

This is but one of the many fundamental, empirical data points we monitor at WT Wealth Management. Economic data points are the foundation of the US economy, therefore a report card on America's fiscal health. Some data points look forward, others rearward—one of hundreds of reasons to work with a seasoned investment team that can read, analyze and interpret these data points to your benefit.

Appendix #1

Federal Funds Target Rate History --- From 1990 to the Present

Most economists expect a increase of the Fed Fund Rate to 1.25%– 1.5%. The next FOMC meeting and decision on short-term Fed Funds rates will be December 13, 2017.

Sources

Amadeo, Kimberly. "US Economy: How an Inverted Yield Curve Predicts a Recession."

The Balance, September 15, 2017. https://www.thebalance.com/inverted-yield-curve-3305856

Bogle, John. "Yield Curve and the Next Stock Market Correction."

Bogleheads.org, May 21, 2017. https://www.bogleheads.org/forum/viewtopic.php?t=219396

McWhinney, James E. "The Impact of an Inverted Yield Curve."

Investopedia, March 24, 2017. http://www.investopedia.com/articles/basics/06/invertedyieldcurve.asp

Pento, Michael. "Investing: This market indicator has predicted the past 7 recessions. Here's where it may be headed next." CNBC, June 5, 2017. https://www.cnbc.com/2017/06/05/inverted-yield-curve-predictingcoming-recession-commentary.html

Disclosure

WT Wealth Management is a manager of Separately Managed Accounts (SMA). Past performance is no indication

of future performance. With SMA's, performance can vary widely from investor to investor as each portfolio is

individually constructed and allocation weightings are determined based on economic and market conditions

the day the funds are invested. In a SMA you own individual ETFs and as managers we have the freedom and

flexibility to tailor the portfolio to address your personal risk tolerance and investment objectives – thus making

your account "separate" and distinct from all others we potentially managed.

An investment in the strategy is not insured or guaranteed by the Federal Deposit Insurance Corporation or any

other government agency.

Any opinions expressed are the opinions of WT Wealth Management and its associates only. Information is neither

an offer to buy or sell securities nor should it be interpreted as personal financial advice. You should always seek

out the advice of a qualified investment professional before deciding to invest. Investing in stocks, bonds, mutual

funds and ETFs carry certain specific risks and part or all of your account value can be lost.

In addition to the normal risks associated with investing, narrowly focused investments, investments in smaller

companies, sector ETF's and investments in single countries typically exhibit higher volatility. International,

Emerging Market and Frontier Market ETFs investments may involve risk of capital loss from unfavorable

fluctuations in currency values, from differences in generally accepted accounting principles or from economic

or political instability that other nation's experience. Emerging markets involve heightened risks related to the

same factors as well as increased volatility and lower trading volume. Bonds, bond funds and bond ETFs will

decrease in value as interest rates rise. A portion of a municipal bond fund's income may be subject to federal

or state income taxes or the alternative minimum tax. Capital gains (short and long-term), if any, are subject to

capital gains tax.

Diversification and asset allocation may not protect against market risk or a loss in your investment.

At WT Wealth Management we strongly suggest having a personal financial plan in place before making any

investment decisions including understanding your personal risk tolerance and having clearly outlined investment

objectives.

WT Wealth Management is a registered investment adviser in Arizona, California, Nevada, New York and

Washington with offices in Scottsdale, AZ Jackson, WY and Las Vegas, NV. WT Wealth Management may only

transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration

requirements. Individualized responses to persons that involve either the effecting of transaction in securities,

or the rendering of personalized investment advice for compensation, will not be made without registration or

exemption. WT Wealth Managements web site is limited to the dissemination of general information pertaining

to its advisory services, together with access to additional investment-related information, publications, and links.

Accordingly, the publication of WT Wealth Management web site on the Internet should not be construed by

any consumer and/or prospective client as WT Wealth Management solicitation to effect, or attempt to effect

transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet.

Any subsequent, direct communication by WT Wealth Management with a prospective client shall be conducted

by a representative that is either registered or qualifies for an exemption or exclusion from registration in the

state where the prospective client resides. For information pertaining to the registration status of WT Wealth

Management, please contact the state securities regulators for those states in which WT Wealth Management

maintains a registration filing. A copy of WT Wealth Management's current written disclosure statement discussing

WT Wealth Management's business operations, services, and fees is available at the SEC's investment adviser

public information website – www.adviserinfo.sec.gov or from WT Wealth Management upon written request. WT

Wealth Management does not make any representations or warranties as to the accuracy, timeliness, suitability,

completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to WT

Wealth Management's web site or incorporated herein, and takes no responsibility therefor. All such information

is provided solely for convenience purposes only and all users thereof should be guided accordingly.