Click here to download the PDF

YOU CAN'T AFFORD TO IGNORE INFLATION!

Many investors and advisors today have become complacent about inflation's impact

on retirees, because inflation has been at historically low levels in recent years. This is in sharp contrast to the

elevated inflation rates we saw during the late 1970s. While "Comfortably Numb" is a great representative of

1970s classic rock, it is not a great approach to planning for the effects of inflation today.

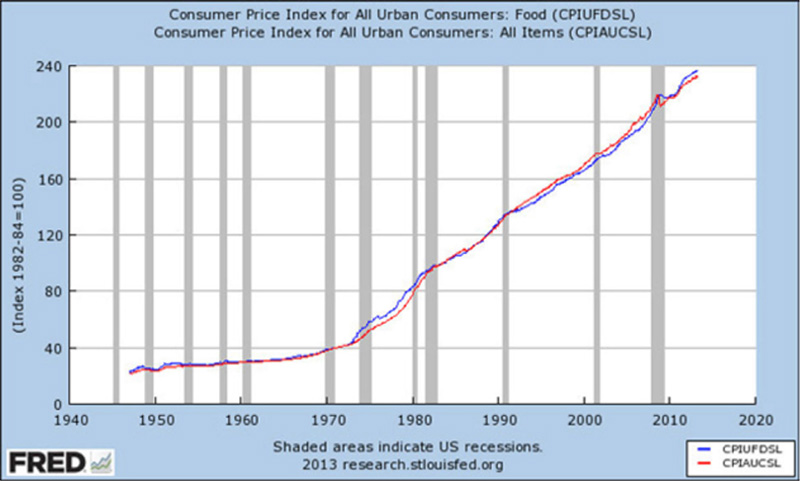

Let's take a step back to lay some more groundwork. Inflation refers to the rate at which the prices of goods

and services rise. Different goods and services experience rising costs at different rates, so we typically hear

about the average inflation rate. The consumer price index (CPI), which shows below the steadily rising prices

since the 1970s, may be the most common general measure of average inflation.

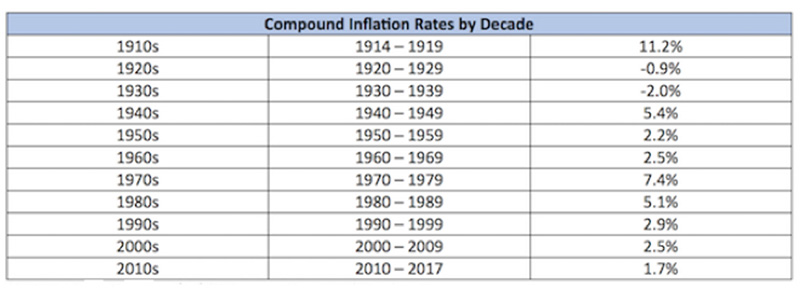

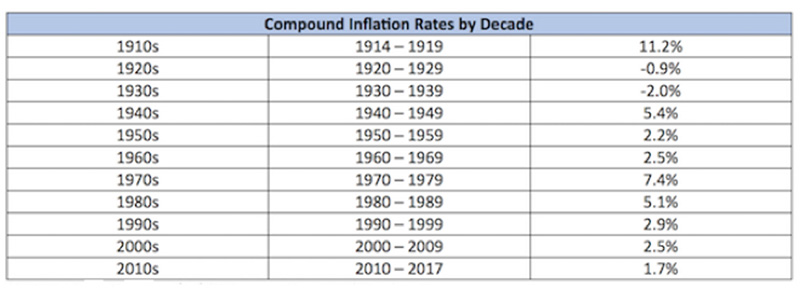

Since the end of World War II, the annual rate of inflation has averaged 3.8%.

It has been as high as 7.4% during the 1970s, but well below 2% in recent years.

WHY DOES INFLATION MATTER?

The reason all this matters to you and your retirement savings is that inflation can eat away at your money

from three directions:

1. Inflation depletes purchasing power. The rule of 72 is a well-known and simple method of calculating 1)

how long it takes an investment to double at a given rate of return, or 2) how long it takes an investment to

lose half its purchasing power at a given inflation rate. For example, if we use the 3.8% average inflation rate

since World War II, a portfolio's value today would be cut in half in about 19 years (72/3.8 = 18.95). At the

1.7% inflation rate of the most recent decade it would take more than 42 years (72/1.7 = 42.35). But at the

7.4% inflation rate of the 1970s, it would take less than 10 years (72/7.4 = 9.73). For someone aged 65, average

inflation would cause their spending power to drop by 50% around age 84, not unrealistic by life expectancy

standards enjoyed today.

2. Inflation erodes savings. Inflation doesn't literally reduce the number of dollars you have saved, but it does reduce the value of those dollars. The interest rate your bank savings account is paying is almost certainly well below the rate of inflation, which means that the cost of goods and services is climbing much faster than the value of each dollar in that savings account.

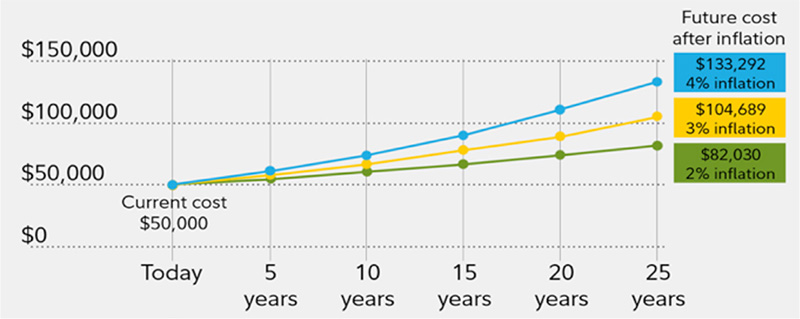

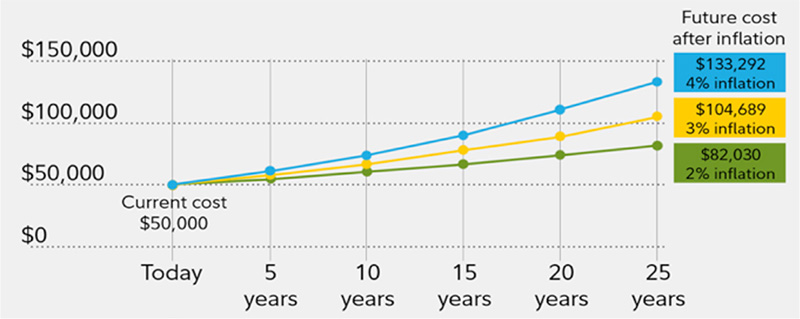

For example, assume your annual budget for 2018 requires a net total income of $50,000. You can expect that purchasing exactly the same goods and services 5 years down the road, in 2023, will cost more with inflation. That's why many employers, and even social security, periodically offer cost-of-living increases to help you keep pace. Unfortunately, your savings account doesn't get a comparable raise. On average, each dollar you own loses value every year because of inflation.

3. Inflation undermines budgets. During retirement, when you're no longer a full-time wage earner, budgeting

becomes especially important. To help increase the likelihood that your savings will last through retirement,

you'll have to establish a budget.

The problem is that - as stated above - $50,000 per year in 2023 is expected to buy fewer goods and services

than it did in 2018. And in 2028, $50,000 will buy even fewer goods and services than it did in 2023. You get

the picture. So as a retiree, you'll need to give your budget a cost-of-living adjustment every couple of years

in order to continue buying the same goods and services.

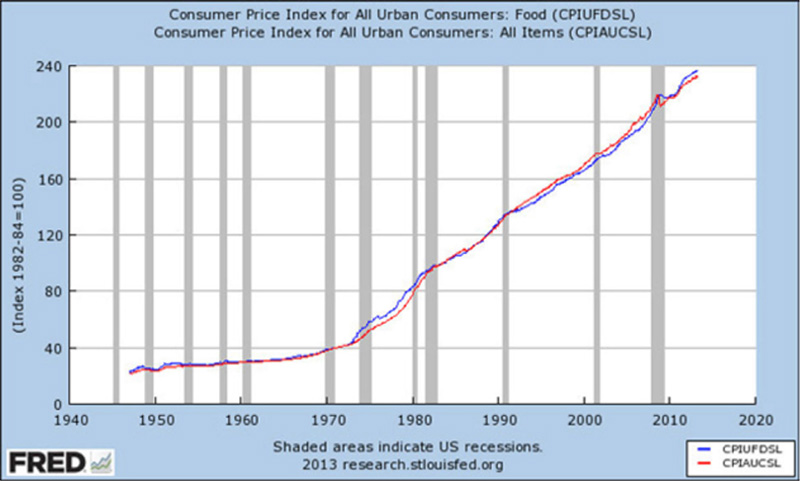

If you remember earlier in this white paper, we referred to average inflation as measured by the CPI.

Unfortunately, not everyone lives an "average" life and retirees may be more exposed to certain types of

expenses than the general population. For example, medical costs are on the rise, and they're significantly

outpacing CPI inflation averages. In retirement, you're likely to need more medical care than you do at a

younger age, so carefully consider medical inflation as you plan for retirement.

Food costs can be volatile. For example, dairy, beef and grains have seen pricing spikes in recent years due to

factors such as drought, livestock illnesses and changing farming practices. Expect more of the same in the

future.

WHAT CAN YOU DO TO FIGHT INFLATION DURING RETIREMENT?

First, as you calculate your retirement needs, you must incorporate inflation into your plan. Proper planning

isn't just about identifying what you need to live your same lifestyle over the next few years, but also decades

from now. WT Wealth Management has clients in their late 70s, 80s and even a few lucky souls in their 90s.

If Americans today are going to live for 15, 20 or even 25 years in retirement, then inflation risk needs to be

considered.

Second, retirees need to remain properly invested for their time horizon - and that usually means remaining

invested in a diversified portfolio that includes a significant allocation to equities. While retirees should

gradually move to a more conservative portfolio as they approach and enter retirement, it's critical to select

a mix of investments likely to at least keep pace with inflation. Bonds, money market funds, and bank savings

accounts, which are generally considered relatively safe places to put your money, may not provide enough

growth to outpace inflation. We feel most retirees still require a diversified portfolio that includes allocations

to stocks, and other investment classes that will add a prudent level of growth potential to your portfolio.

Because many of our clients will easily live 20 or 25 years post retirement, let's look at the impact one more

time.

WT Wealth Management is uniquely positioned to assist retirees in their pursuit of the retirement dream. As a

firm, we concentrate on participation in rising markets, out performance in declining markets and preservation

of capital.

We understand that having 30, 40 or even 50% of your retirement assets exposed to the equities markets

while in retirement may feel too aggressive. But with increasing life expectancies and the need to plan for

decades (and not just years) in retirement, it has become the new "norm".

Please contact your advisor to further discuss the impact of inflation on your retirement plans and start the

formal discussion about the steps to insure inflation doesn't erode your quality of life post-retirement.

WT Wealth Management is an SEC registered investment adviser, with in excess of $100 million in assets under management

(AUM) with offices in Flagstaff, Scottsdale, Sedona and Tucson, AZ along with Jackson Hole, WY and Las Vegas, NV.

WT Wealth Management is a manager of Separately Managed Accounts (SMAs). With SMAs, performance can vary widely

from investor to investor as each portfolio is individually constructed and managed. Asset allocation weightings are

determined based on a wide array of economic and market conditions the day the funds are invested. In an SMA, each

investor may own individual Exchange Traded Funds (ETFs), individual equities or mutual funds. As the manager we have

the freedom and flexibility to tailor the portfolio to address an individual investor's personal risk tolerance and investment

objectives - thus making the account "separate" and distinct from all others we manage.

An investment with WT Wealth Management is not insured or guaranteed by the Federal Deposit Insurance Corporation

(FDIC) or any other government agency.

Any opinions expressed are the opinions of WT Wealth Management and its associates only. Information offered is neither

an offer to buy or sell securities nor should it be interpreted as personal financial advice. Always seek out the advice of

a qualified investment professional before deciding to invest. Investing in stocks, bonds, mutual funds and ETFs carries

certain specific risks and part or all of an account's value can be lost.

In addition to the normal risks associated with investing, narrowly focused investments, investments in smaller companies,

sector and/or thematic ETFs and investments in single countries typically exhibit higher volatility. International, Emerging

Market and Frontier Market ETFs, mutual funds and individual securities may involve risk of capital loss from unfavorable

fluctuations in currency values, from differences in generally accepted accounting principles or from economic or political

instability that other nations experience. Individual bonds, bond mutual funds and bond ETFs will typically decrease in

value as interest rates rise. A portion of a municipal bond fund's income may be subject to federal or state income taxes or

the alternative minimum tax. Capital gains (short and long-term), if any, are subject to capital gains tax.

Diversification and asset allocation may not protect against market risk or investment losses. At WT Wealth Management, we

strongly suggest having a personal financial plan in place before making any investment decisions including understanding

personal risk tolerance, having clearly outlined investment objectives and a clearly defined investment time horizon.

WT Wealth Management may only transact business in those states in which it is registered, or qualifies for an exemption

or exclusion from registration requirements. Individualized responses to persons that involve either the effecting of

transactions in securities, or the rendering of personalized investment advice for compensation, will not be made without

registration or exemption. WT Wealth Management's website is limited to the dissemination of general information

pertaining to its advisory services, together with access to additional investment-related information, publications, and

links.

Accordingly, the publication of WT Wealth Management's website should not be construed by any consumer and/or

prospective client as WT Wealth Management's solicitation to effect, or attempt to effect transactions in securities, or the

rendering of personalized investment advice for compensation, over the internet. Any subsequent, direct communication

by WT Wealth Management with a prospective client shall be conducted by a representative that is either registered or

qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

A copy of WT Wealth Management's current written disclosure statement discussing WT Wealth Management's registrations,

business operations, services, and fees is available at the SEC's investment adviser public information website (www.

adviserinfo.sec.gov) or from WT Wealth Management directly.

WT Wealth Management does not make any representations or warranties as to the accuracy, timeliness, suitability,

completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to WT Wealth

Management's web site or incorporated therein, and takes no responsibility therefor. All such information is provided solely

for convenience purposes and all users thereof should be guided accordingly.