Conventional wisdom says that many New Year's resolutions don't make it past the end

of January. But that never means it's too late to aim higher anyway. Midway through

February, we still have the opportunity to shed old practices, improve our diet, and resolve to build good

financial habits. These exercises will contribute to your long-term well-being, regardless of whether they

began on New Year's Day or later.

In the November 2018 White Paper, I laid out a sobering picture of Americans' savings behaviors. Simply

stated, we aren't prepared for short-term financial setbacks, and we're saving too little to ensure comfortable

retirements.

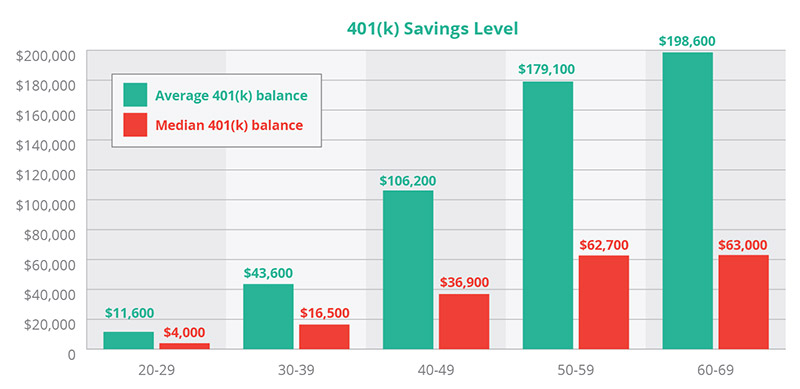

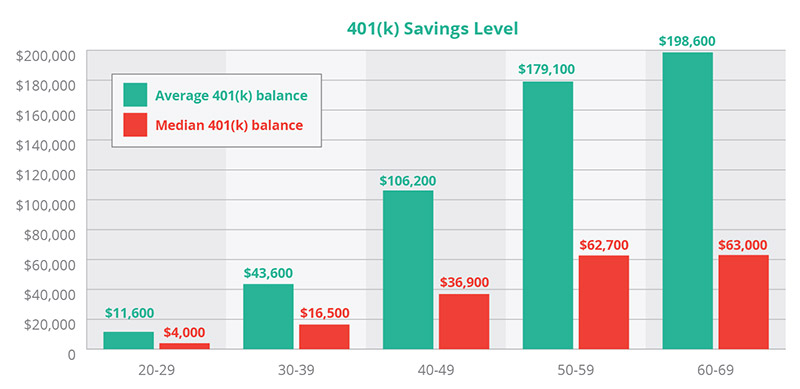

To further illustrate how little we are saving, the February 4-8, 2019 issue of Investment News contained

a column insert entitled, "How Much Is Enough to Have Saved at Each Age", which revealed, for accounts

administered by Fidelity, the 401(k) savings levels of six different age groups (see chart below).

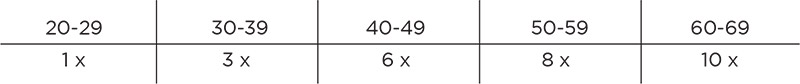

For reference, the retirement savings levels recommended by Fidelity (measured in multiples of annual salary)

for each age range were:

While pensions, including defined benefit and defined contribution plans, were once a reliable source of

retirement income, the burden of funding retirement has shifted to the individual. However you choose to

fund your retirement, you need to take a more active role.

In hopes of helping you build good financial habits that become permanent, I will share sound savings

strategies, explore the concept of how much savings is "enough," and look deeper into how much you'll need

for retirement.

SAVINGS STRATEGIES

Saving styles come in many forms. At one extreme, there is a recent savings strategy movement focused

on aggressive saving and retiring early – Financial Independence Retire Early (FIRE). The basic idea is that

financial independence is attainable once you've saved 25 times your annual expenses. At that point, you can

live off a 4% withdrawal rate. For example:

$60,000 of annual expenses x 25 = $1,500,000 at 4% = $60,000.

Furthermore, to accumulate these savings, you're expected to save anywhere from 40 to 60 percent of annual

after-tax income.

Your first impression is probably, "that's way too much to save annually", especially if you are still young,

paying down student loans, starting a family, investing in a home, and living your life. Your next thought might

logically be that's an impossible amount to save over time, and out of most people's reach. In both cases,

you're probably right.

Instead of such an extreme approach, I recommend this simple three-step plan.

Step 1: Spend less than you earn. To do that successfully, you'll need to create a personal budget and track

your income and expenses. Seeing on paper where your money is going can be enlightening (free, online

expense tracking websites include

Mint.com and

EveryDollar.com). Simple habits become grossly expensive

when annualized; the cost of buying versus bagging your own lunch, daily gourmet coffee shop stops, or quick

runs into the "C" store while your car is gassing up. Frightening.

Step 2: Build up an emergency fund. Here, there is no "right" dollar figure to shoot for. I suggest you save 3 to

6 months or more of living expenses. Now that Step 1 has provided a personal budget to guide you, that's an

easier figure to calculate than it was before.

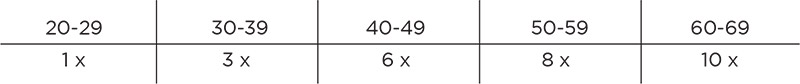

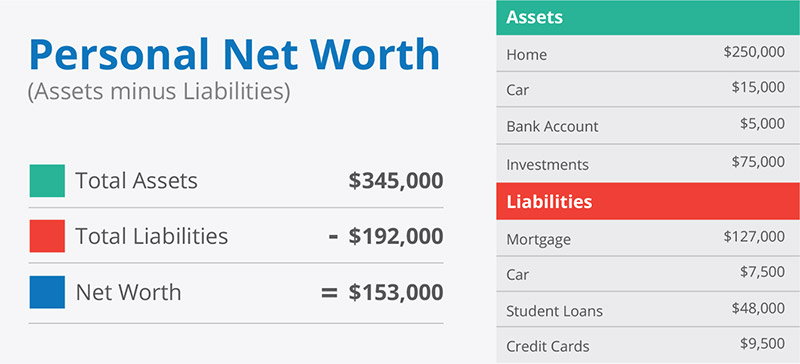

Step 3: Pay down debt. When you do, your net worth (Assets – Liabilities) goes up. Liabilities are just another

word for debt after all. Also be cautious about taking on new debt.

After achieving this financial foundation, it's time to save for retirement.

HOW MUCH SAVINGS IS "ENOUGH"?

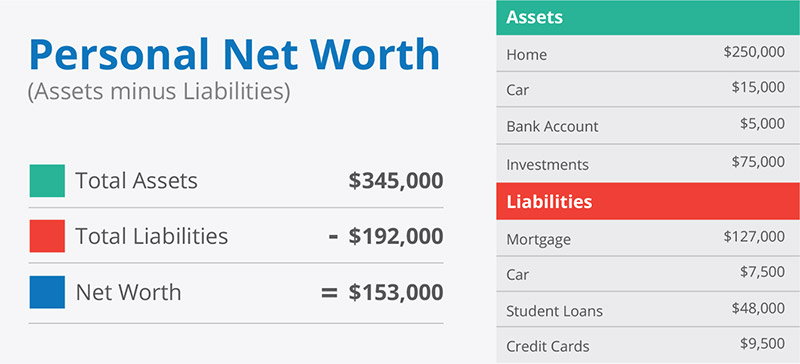

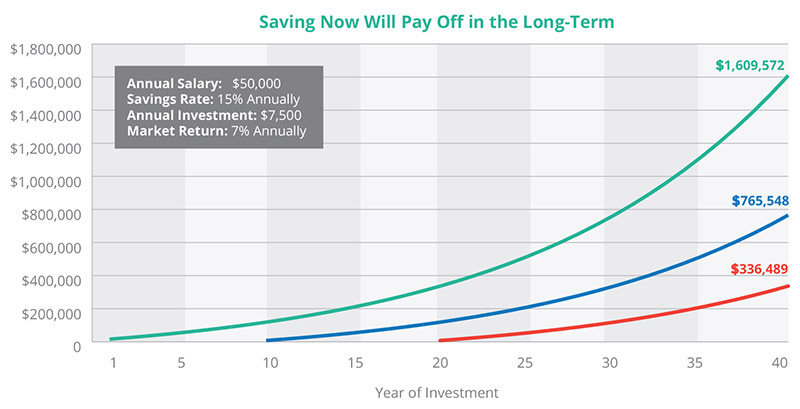

While there's still some debate over the "right" savings rate to target, most experts, including Dave Ramsey

(How to Save 15% for Retirement Without Cramping Your Style), believe it's 15% of your income, and that

sounds right to me. That's not the 40 to 60 percent the FIRE movement shoots for, but it is still a challenge if

you've never even saved 1% of your income before! To make this manageable, I recommend you start saving as

little as 1%, but commit to building toward that 15% figure over time. The earlier you start, the more powerfully

time works in your favor.

Keep it simple. For example, get in the habit of taking your annual raise and applying it toward that 15% goal;

maybe 1% at a time. Also, be sure to max out any employer contributions you are entitled to. That's free money,

and it will count towards your 15%.

HOW MUCH SAVINGS WILL YOU "NEED"?

The amount of money you need in retirement is based on what you think your annual expenses will be when

you retire, and how long a retirement you will enjoy. In other words, you are projecting how much money you

will need in the future, to live the lifestyle you'll desire. But actually, it's really hard to predict how much you'll

be spending in retirement. There are so many unknowns when calculating "how much you need." Let's start

with the most obvious: how long you and your spouse will live? Impossible to know. Then there is the challenge

of accurately accounting for inflation (that we discussed in our Dec 2018 White Paper), and its effect on your

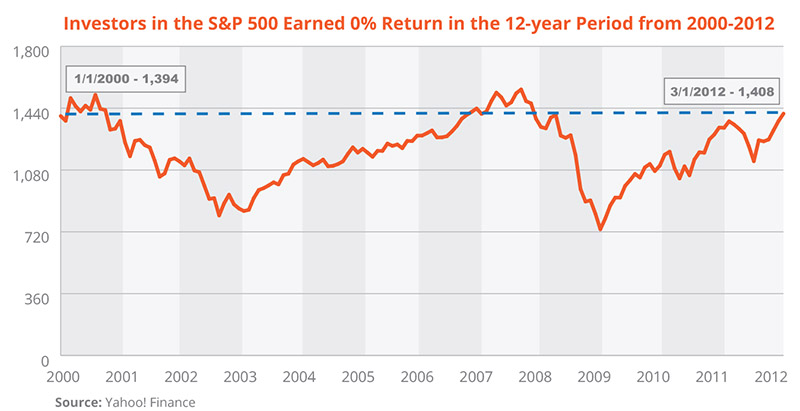

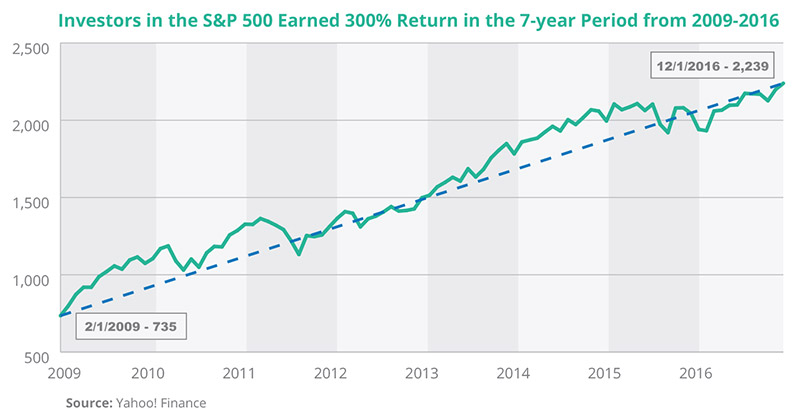

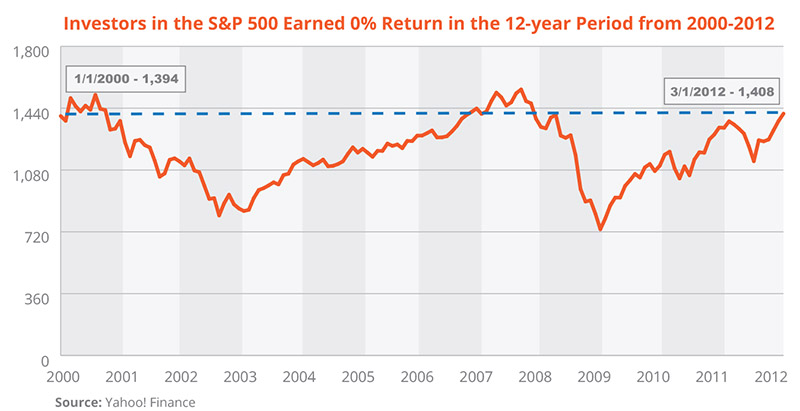

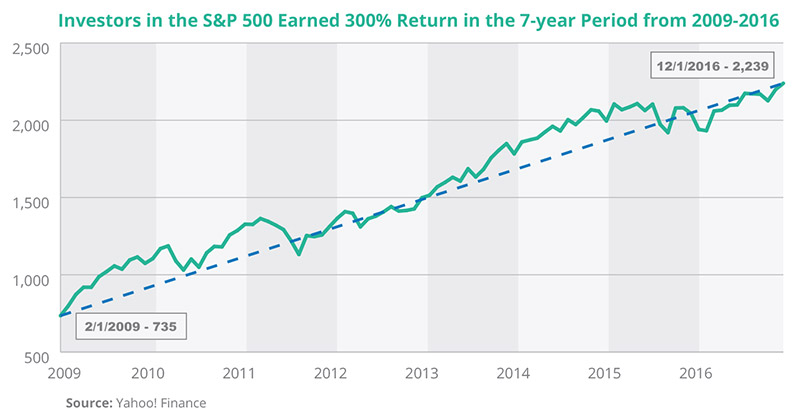

expense calculations. Also, consider that equity market conditions when you retire really matter. A retiree in

2000, with the Standard & Poor's index around 1400, received no return on their stock investments for close

to 13 years, but a retiree in 2009 almost tripled their money in just over half that time.

Today's market conditions could prove challenging for near-term retirees, with stock valuations at all-time

highs and interest rates still relatively low.

Most financial experts suggest you plan to retire on 70% of your current income. I disagree. 70% is an absolute

minimum; the true figure will approach 100%. Sure, by retirement your kids are gone, and ideally the house

is paid off. But what about those fabulous plans you have such as traveling, new hobbies, and indulging your

grandkids? And the biggest expense you have to plan for? Healthcare, which is increasing well beyond the

general rate of inflation. The Motley Fool (December 18, 2017) writes that the average healthy 65-year-old

couple will need at least $400,000 for medical costs in retirement PLUS even more savings for long-term care!

If your plan is to "figure it out as you get there", then you are most likely to fail. At the very least, start following

the three-step savings approach above. Even better, please contact your financial advisor to review how

you are doing on retirement preparations. They can help you imagine your future. Whatever you do, start

practicing good savings habits today before it's too late. If not, those mistakes become permanent and your

retirement will be less than fulfilling.

WT Wealth Management is an SEC registered investment adviser, with in excess of $100 million in assets under management

(AUM) with offices in Flagstaff, Scottsdale, Sedona and Tucson, AZ along with Jackson Hole, WY and Las Vegas, NV.

WT Wealth Management is a manager of Separately Managed Accounts (SMAs). With SMAs, performance can vary widely

from investor to investor as each portfolio is individually constructed and managed. Asset allocation weightings are

determined based on a wide array of economic and market conditions the day the funds are invested. In an SMA, each

investor may own individual Exchange Traded Funds (ETFs), individual equities or mutual funds. As the manager we have

the freedom and flexibility to tailor the portfolio to address an individual investor's personal risk tolerance and investment

objectives – thus making the account "separate" and distinct from all others we manage.

An investment with WT Wealth Management is not insured or guaranteed by the Federal Deposit Insurance Corporation

(FDIC) or any other government agency.

Any opinions expressed are the opinions of WT Wealth Management and its associates only. Information offered is neither

an offer to buy or sell securities nor should it be interpreted as personal financial advice. Always seek out the advice of

a qualified investment professional before deciding to invest. Investing in stocks, bonds, mutual funds and ETFs carries

certain specific risks and part or all of an account's value can be lost.

In addition to the normal risks associated with investing, narrowly focused investments, investments in smaller companies,

sector and/or thematic ETFs and investments in single countries typically exhibit higher volatility. International, Emerging

Market and Frontier Market ETFs, mutual funds and individual securities may involve risk of capital loss from unfavorable

fluctuations in currency values, from differences in generally accepted accounting principles or from economic or political

instability that other nations experience. Individual bonds, bond mutual funds and bond ETFs will typically decrease in

value as interest rates rise. A portion of a municipal bond fund's income may be subject to federal or state income taxes or

the alternative minimum tax. Capital gains (short and long-term), if any, are subject to capital gains tax.

Diversification and asset allocation may not protect against market risk or investment losses. At WT Wealth Management, we

strongly suggest having a personal financial plan in place before making any investment decisions including understanding

personal risk tolerance, having clearly outlined investment objectives and a clearly defined investment time horizon.

WT Wealth Management may only transact business in those states in which it is registered, or qualifies for an exemption

or exclusion from registration requirements. Individualized responses to persons that involve either the effecting of

transactions in securities, or the rendering of personalized investment advice for compensation, will not be made without

registration or exemption. WT Wealth Management's website is limited to the dissemination of general information

pertaining to its advisory services, together with access to additional investment-related information, publications, and

links.

Accordingly, the publication of WT Wealth Management's website should not be construed by any consumer and/or

prospective client as WT Wealth Management's solicitation to effect, or attempt to effect transactions in securities, or the

rendering of personalized investment advice for compensation, over the internet. Any subsequent, direct communication

by WT Wealth Management with a prospective client shall be conducted by a representative that is either registered or

qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

A copy of WT Wealth Management's current written disclosure statement discussing WT Wealth Management's registrations,

business operations, services, and fees is available at the SEC's investment adviser public information website (www.

adviserinfo.sec.gov) or from WT Wealth Management directly.

WT Wealth Management does not make any representations or warranties as to the accuracy, timeliness, suitability,

completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to WT Wealth

Management's web site or incorporated therein, and takes no responsibility therefor. All such information is provided solely

for convenience purposes and all users thereof should be guided accordingly.