Key Points

- One of the most commonly watched recession indicators - the interest rate yield curve - inverted briefly

in the second half of March 2019.

- A yield curve inversion exists when short-term interest rates are higher than long-term interest rates. For

this article, we will use the yield on the 10-year US Treasury Note for the long-term interest rate and the yield

on the 3-month US Treasury Bill for the short-term interest rate. We will also use the terms "yield" and "interest rate" interchangeable as synonyms.

- While all recessions since the mid-1960 have been preceded by a yield curve inversion, not all yield curve

inversions during that time period have led to a recession.

- Bull and bear markets, recessions and expansions, are natural occurrences in the economic cycle. They are

as inevitable as death or taxes. But good times have historically far outweighed the bad. Investing for the

long-term remains the right play.

Why do yield curve inversions happen?

We'll begin with the premise that yield curve inversion is an unnatural and unsustainable state for the economy.

The interest rate on the 10-year Treasury Note is set by the invisible hand of the market. Supply and demand. Based

on studies of investor behavior, when investors are nervous about market decline or fear a recession may be

coming, they run to the safety of the 10-year Treasury Note. This causes pricing on outstanding Notes to rise

and the yields on new offerings to fall. Supply and demand.

The Fed Funds rate, which is closely associated with the interest rate on the 3-month Treasury Bill, is set by officials at the Federal Reserve. When the Fed is nervous about market expansion

and fears an overheated economy, it raises short-term rates to cool down the economy and prevent runaway

inflation.

While many nuanced factors contribute to the phenomenon of yield curve inversion, a common interpretation

of yield curve inversion is that the yield curve measures investors' expectations of economic growth in the

current period compared with economic growth in the future. According to this interpretation, a yield curve

inversion implies that investors expect current economic growth to exceed future economic growth. That's

another way to say that investors believe a recession is likely.

When falling long-term interest rates, due to investor concerns about future market decline, coincide with

rising short-term interest rates, due to Fed concerns about current market expansion, a yield curve inversion

can occur. These two opposing directional forces cannot coexist for an extended period of time. So yield

curve inversions are typically short-lived.

The current yield curve inversion

On March 22nd, for the first time since mid-2007, the yield on the 3-month Treasury Bill exceeded the yield on

the 10-year Treasury Note signifying a yield curve inversion (10y-3m). Investors took notice and unleashed a

near-2% decline in the S&P 500 on heightened fears of recession.

Every recession since the mid-1960s has been preceded by an inverted yield curve, so it's little wonder recession

fears have elevated. However, not every yield curve inversion during that time period produced a recession. In more colloquial

terms: all poodles are dogs, but not all dogs are poodles.

First, let's dissect the lead-in to the March 22nd inversion. From the short-term perspective: The Fed has

made 9 rate increases since December 2015, four of which came in 2018, to arrive at 2.25-2.50 percent range

on the Fed Funds Rate. The Fed's hawkish stance during that period indicated concern about an overheating

economy and a consistent effort to reign it in. Wednesday, March 20th, brought the Federal Open Market

Committee (FOMC) decision to keep rate hikes on hold; reinforcing the more recent dovish 180 degree turn

the Fed has taken since it last raised rates in December 2018. But the impact on the short-term side of the

yield curve was already in effect.

From the long-term perspective: After last year's second quarter real gross domestic product (GDP) growth

rate of more than 4%, we are now looking at a fairly modest growth rate expectation of 1.2% for Q1 2019.

Additionally, global growth has clearly weakened; with the negative interest rate policies of the European

Central Bank (ECB), Germany and Bank of Japan (BoJ) also contributing to the inversion of the U.S. yield

curve. This is because low (and/or negative) yields outside the United States make U.S. Treasury bonds more

attractive. The combination of these buying pressures cause Treasury prices to rise and yields to fall.

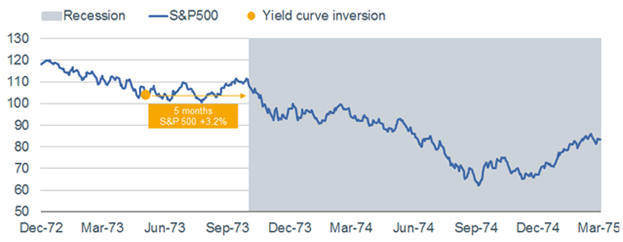

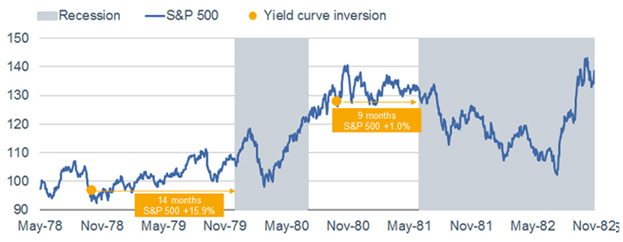

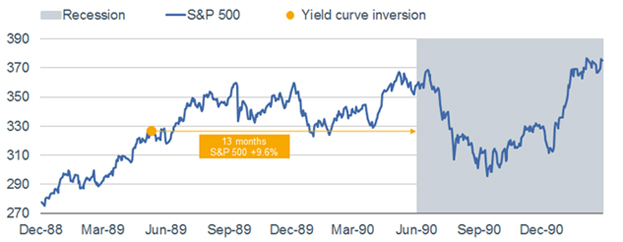

Yield Curve Inversions Since 1968

When shorter-term rates are below longer-term rates (a normal curve), banks can lend profitably as they earn

the spread by borrowing at the short end and lending at the long end. But once the curve inverts, the absence

of profitability leads to compressed lending; with the resultant tightening in credit conditions contributing to

a recession.

In the last few months I doubt anything in the finance industry has been more researched, or more Googled,

than the history of yield curve inversions. Because of the wide dispersion in past experiences - both in

duration-to-recession and stock market performance terms - I want to share details around each of the past seven

inversions that led to recession. In our analysis, we considered the "double-dip" recessions of the early-1980s

to be a single instance; although each of the two back-to-back recessions had a yield curve inversion preceding

it. Our data sets span the six months prior to each inversion through the entire subsequent recession.

The average span between yield curve inversions and subsequent recessions has been 11 months, with a range

from five months (1973) to 16 months (2006-2007).

The average return for the S&P 500 during the spans from inversion to recession has actually been positive

at +2.8%, with a range of -14.6% (2000-2001) to +16.5% (2006-2007) and 4 out of the 6 instances producing

a positive return.

The S&P 500 experienced a negative return during each of the recessions (as one would expect), but recovered

those losses either toward the end of the recession period or shortly thereafter as the next economic cycle

began.

To note, mid-2007 through March 2019 is the longest stretch of time since the mid-1960s without an inversion.

Is this inversion a poodle or a dog?

As stated previously, every recession since the mid-1960s has been preceded by an inverted yield curve. But

keep in mind one of the earliest lessons in logic: while all poodles are dogs, not all dogs are poodles. In other

words, while all recessions since the mid-1960s have been preceded by a yield curve inversion, not all yield

curve inversions during that time period have led to a recession.

What we don't know yet is whether last month's inversion was a one-off situation when the yield curve briefly

inverts before steepening again and the recession doesn't follow (a poodle); or the beginning of a more

protracted inversion leading to recession (a dog). The only certainty on that question comes with hindsight.

But certain aspects of this inversion indicate to us that it might be a poodle. First, this inversion only lasted

about 6 days. Historically, the longer the inversion lasts, the more likely there will be a subsequent recession.

Second, the rates on the 2-year / 10-year Treasury Notes have not yet inverted, and many consider that to be

the more reliable predictor of recession. Third, while only a few experts believe it will happen, the Fed could

still steepen the curve by cutting rates later this year. Others have commented as well on the possibility that

this inversion might be a poodle, leading to a soft landing rather than a recession.

In CFRA's April 1, 2019 US Equity Research Sector Watch report, Chief Investment Strategist, Sam Stovall, stated

that, "Looking at monthly data since 1980, there have been seven times that the [yield] curve was essentially

flat to inverted (narrower than 30 basis points). In all seven instances, the Federal Reserve responded by

initiating a new rate-easing cycle. Yet in only four occurrences was this flat-to-inverted environment followed

by a recession. Indeed, 1984, 1995 and 1998 were periods marked by economic weakness, also known as soft

landings, but not recession."

Bespoke Investment Group tackled this same question with its new report on yield curve inversion. "When

investors hear yield curve inversion, they automatically think 'recession,'" Bespoke wrote. "But not every

inversion has been followed by a recession." Bespoke outlined the performance of the S&P 500 following the

first day of an inverted yield curve. One month after the first day of an inversion, the S&P 500 averaged a gain

of 1.74%. Five out of six times, there were positive returns. Over the next six months, the index has gained 6.75%

on average, though positive returns only occurred half the time, Bespoke noted. And from 1978 onward, the

S&P 500 was positive one year after an inversion, with minimum gains of 9%.

The inevitable end of an economic cycle

Recently, we've been inundated with questions about yield curve inversions; and whether they are a predictor

for the next recession and/or the likely path for the stock market. The honest answer is: We wish it were as

easy as "oh, here's the inversion, a recession will automatically follow in X days... go to cash now".

With much hyperbole being thrown around these days, it may not actually be headline-worthy to suggest

a recession is coming. Recession is the inevitable end to an economic cycle. The current expansion will be

10 years old later this year. We can count on a recession in the coming years. It's as inevitable as death and

taxes. With the yield curve inverted, it shouldn't be unexpected that the countdown clock to the end of this

economic cycle has "officially" begun: be it 3 months, 13 months, or 23 months.

What's always difficult to gauge in advance is the length of runway between the present day and the next

recession. That knowledge only becomes certain with hindsight. WTWM is not blindly bullish, but we have

been in the camp that believes it is more likely to be longer than shorter. Remember, the official definition of

a recession is two successive quarterly declines in GDP. With unemployment at generational lows and GDP

comprised of over 70% of consumer spending, unless people stop spending it will be hard to reach negative

GDP in the immediate future. Just since the beginning of 2018, this economy has survived a bitter trade war

with China, unprecedented geo-political turmoil, 4 rate increases and the longest government shutdown in

history.

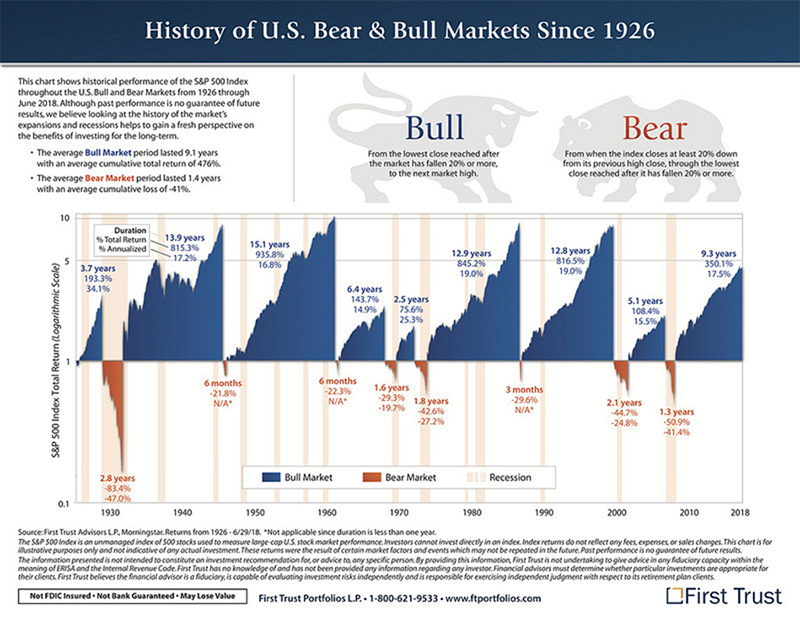

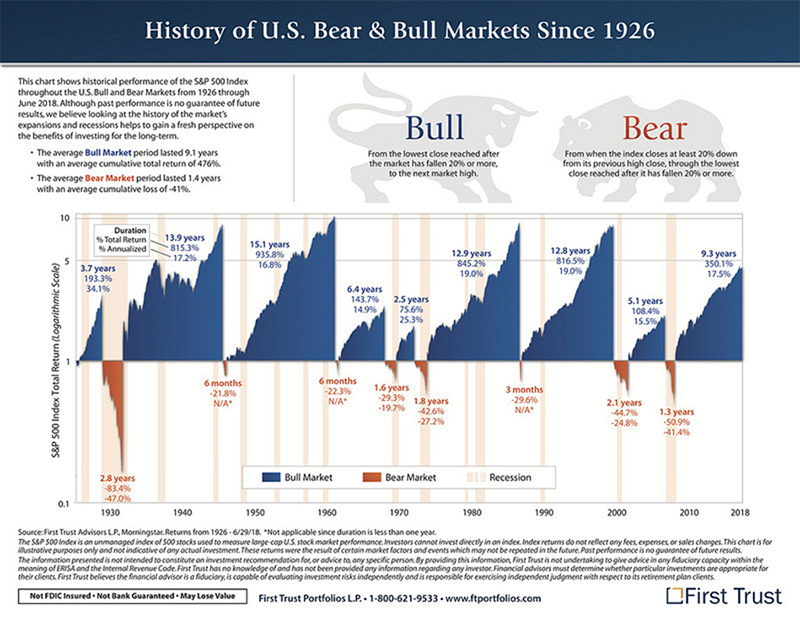

We'll close with one last chart.

As we outlined in this white paper, bull and bear markets, recessions and expansions, are natural occurrences in

the economy. Over the past century we have seen far more good times than bad times in the equity markets,

we simply remember the bad times much more clearly. The chart should help reiterate that bull markets are a

far more common and long lasting event than the occasional bear. Our objective is to remind you that good

times outweigh the bad and that investing for the long-term remains the right play.

This is an excellent time to visit with your financial advisor to ensure you risk profile is in line with your

investment objectives. WTWM has tools like Riskalyze to help us put a number to your tolerance for risk, but

there is no better way than sitting and talking with your financial professional.

WT Wealth Management is an SEC registered investment adviser, with in excess of $100 million in assets under management

(AUM) with offices in Flagstaff, Scottsdale, Sedona and Tucson, AZ along with Jackson Hole, WY and Las Vegas, NV.

WT Wealth Management is a manager of Separately Managed Accounts (SMAs). With SMAs, performance can vary widely

from investor to investor as each portfolio is individually constructed and managed. Asset allocation weightings are

determined based on a wide array of economic and market conditions the day the funds are invested. In an SMA, each

investor may own individual Exchange Traded Funds (ETFs), individual equities or mutual funds. As the manager we have

the freedom and flexibility to tailor the portfolio to address an individual investor's personal risk tolerance and investment

objectives - thus making the account "separate" and distinct from all others we manage.

An investment with WT Wealth Management is not insured or guaranteed by the Federal Deposit Insurance Corporation

(FDIC) or any other government agency.

Any opinions expressed are the opinions of WT Wealth Management and its associates only. Information offered is neither

an offer to buy or sell securities nor should it be interpreted as personal financial advice. Always seek out the advice of

a qualified investment professional before deciding to invest. Investing in stocks, bonds, mutual funds and ETFs carries

certain specific risks and part or all of an account's value can be lost.

In addition to the normal risks associated with investing, narrowly focused investments, investments in smaller companies,

sector and/or thematic ETFs and investments in single countries typically exhibit higher volatility. International, Emerging

Market and Frontier Market ETFs, mutual funds and individual securities may involve risk of capital loss from unfavorable

fluctuations in currency values, from differences in generally accepted accounting principles or from economic or political

instability that other nations experience. Individual bonds, bond mutual funds and bond ETFs will typically decrease in

value as interest rates rise. A portion of a municipal bond fund's income may be subject to federal or state income taxes or

the alternative minimum tax. Capital gains (short and long-term), if any, are subject to capital gains tax.

Diversification and asset allocation may not protect against market risk or investment losses. At WT Wealth Management, we

strongly suggest having a personal financial plan in place before making any investment decisions including understanding

personal risk tolerance, having clearly outlined investment objectives and a clearly defined investment time horizon.

WT Wealth Management may only transact business in those states in which it is registered, or qualifies for an exemption

or exclusion from registration requirements. Individualized responses to persons that involve either the effecting of

transactions in securities, or the rendering of personalized investment advice for compensation, will not be made without

registration or exemption. WT Wealth Management's website is limited to the dissemination of general information

pertaining to its advisory services, together with access to additional investment-related information, publications, and

links.

Accordingly, the publication of WT Wealth Management's website should not be construed by any consumer and/or

prospective client as WT Wealth Management's solicitation to effect, or attempt to effect transactions in securities, or the

rendering of personalized investment advice for compensation, over the internet. Any subsequent, direct communication

by WT Wealth Management with a prospective client shall be conducted by a representative that is either registered or

qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

A copy of WT Wealth Management's current written disclosure statement discussing WT Wealth Management's registrations,

business operations, services, and fees is available at the SEC's investment adviser public information website (www.

adviserinfo.sec.gov) or from WT Wealth Management directly.

WT Wealth Management does not make any representations or warranties as to the accuracy, timeliness, suitability,

completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to WT Wealth

Management's web site or incorporated therein, and takes no responsibility therefor. All such information is provided solely

for convenience purposes and all users thereof should be guided accordingly.