Even now, with 16 months before Americans march to the polls on November 3rd, 2020, investors are beginning

to ask about the impact of the 2020 Presidential Election on financial markets.

Presidential Election Cycle theory was first developed by stock market historian, Yale Hirsch (creator of the

"Stock Trader's Almanac") in 1968. This theory attempts to predict how the stock market might perform in

each year of a Presidential term and is considered "conventional wisdom" by many stock investors interested

in market timing. So how does this theory predict how the stock market might perform?

The fundamental assumptions of Presidential Election Cycle theory are as follows

1:

- In years one and two of a presidential term, the President exits campaign mode and works hard to

fulfill campaign promises before the next election begins. Markets may experience uncertainty as to the

financial or economic impact of campaign promises. For these reasons, the first year is typically the weakest

of the presidential term and the second year is not much stronger than the first.

- This trend of relative weakness is because campaign promises in the first half of the presidency are not

typically aimed at strengthening the economy; they are aimed at political interests, such as tax law changes

and social welfare issues.

- In years three and four of the Presidential term, the President re-enters campaign mode and works hard to

impact voter sentiment, while hopefully strengthening the economy and creating employment opportunities.

Financial or economic impacts of Presidential policies have typically become clearer by this point. For these

reasons, the third year is typically the strongest of the four and the fourth year is the second-strongest of

the four.

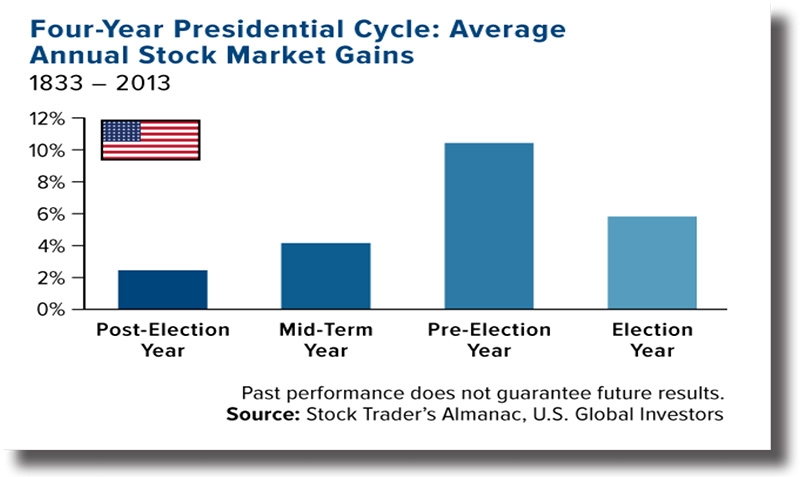

Long-term historical averages show there is some reliability to this stock market indicator. However, more

recent results have been less in line with the fundamental assumptions. While this theory, and others like

it, might provide framework and guidance to investment decisions, investors should always be cautious in

changing their investment strategies on the possible outcome of a presidential election.

History and Accuracy

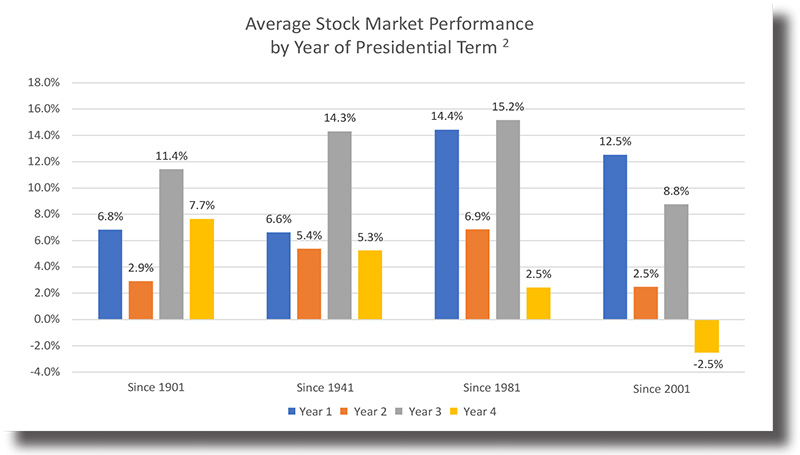

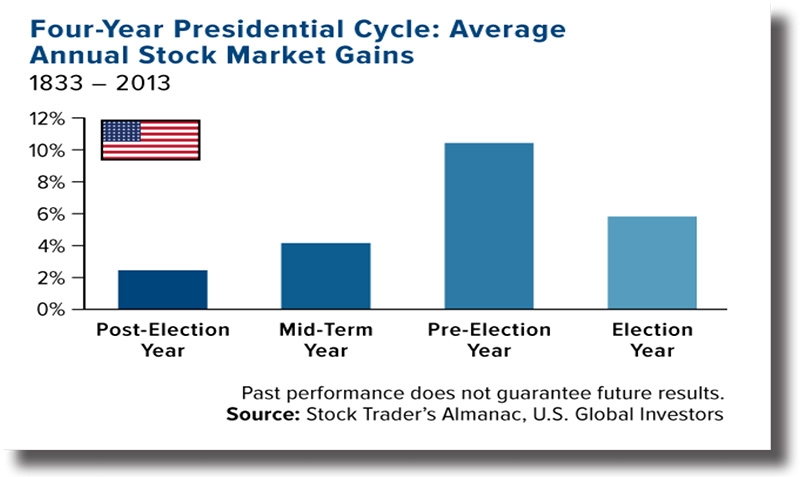

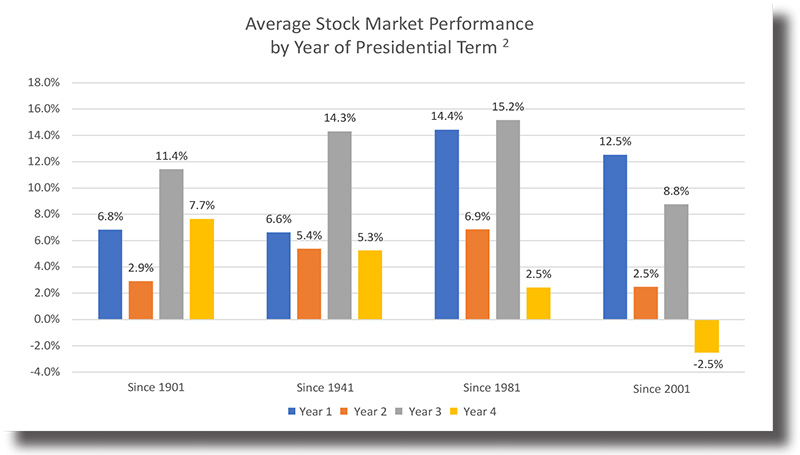

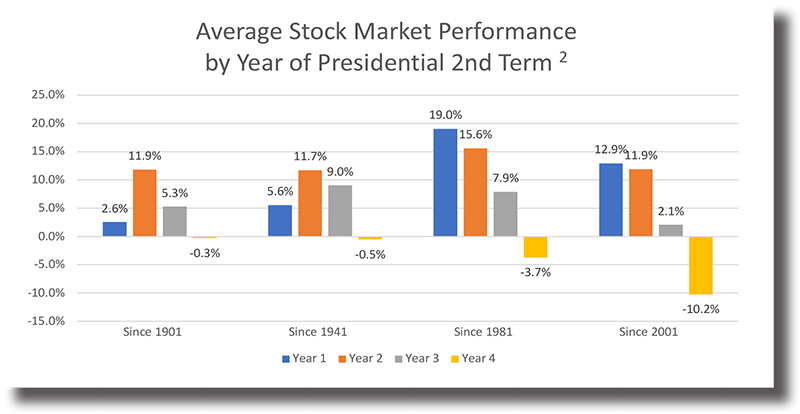

The table below summarizes historical stock market performance in each year of a Presidential Term over

the past 180 years. It is clear that the latter half of a Presidential term has averaged better performance

historically then the first half.

Analyzing the data across more recent periods indicates similar patterns, but with a modern shift where years

one and three are strongest and years two and four are weakest (with year four being the weakest of all).

As with any data tabulation based on averages, the overall pattern of investment performance related to the

Presidential Election Cycle may be convincing, but the pattern does not guarantee consistent results in a

specific cycle!

For instance, stock market performance in the first two years for each of Barack Obama's presidential terms was much stronger than either of his third years. During Bill Clinton's presidency the fourth year of his first term produced better performance (26.0% on the Dow) than in any other year of his presidency (including

the 2nd term) except the third year of his first term (33.5% on the Dow). One final example, stock market

performance during the Reagan administration was strong during the second year of both terms (19.6% and

22.6% respectively on the Dow).

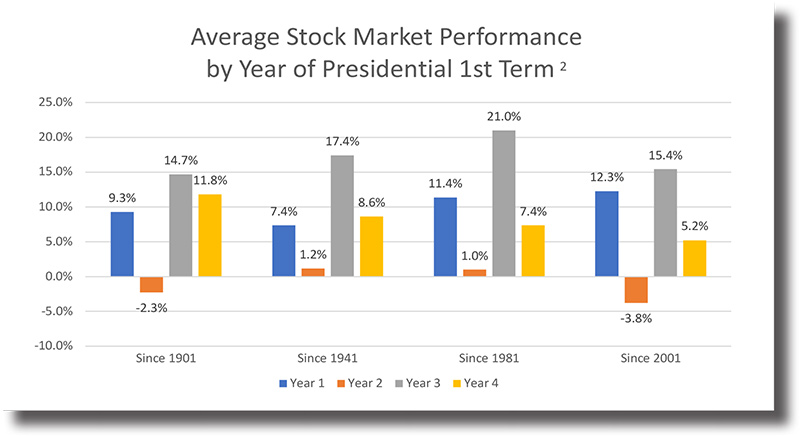

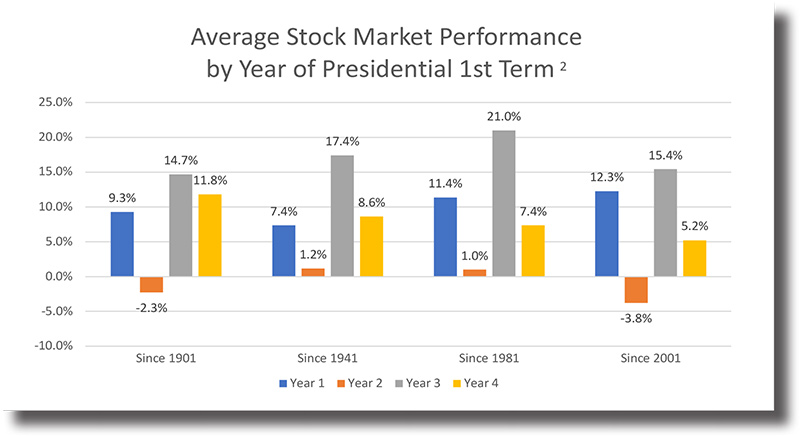

A deeper analysis comparing first term versus second term results sheds some interesting light on the matter.

First terms tend to look very much like the original theory predicted, with year three being the strongest

economic performance year.

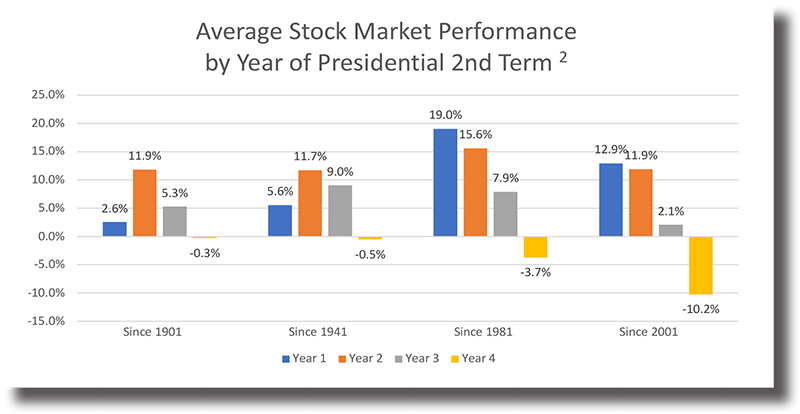

However, when a President is elected to a second term, the potential for political change is dramatically

reduced and the equity markets like the "certainty" of knowing future policy. The data table below shows that

the first half of a President's second term is usually quite bullish. Years three and four reveal a considerable

drop off in market performance as the reality of a change in the nation's highest elected official is guaranteed.

This trend is especially pronounced since 1981 – a period where we have seen only one single term president

(George HW Bush).

Do Presidential Politics Cause or Simply Correlate with Movement in the Stock Market?

The overriding caution with any market timing strategy is that the strategy is never reliable enough to remove

market risk, which exists primarily due to the random and unforeseeable nature of economic and market

conditions. It's a classic example of confusing causation with correlation. When considering Presidential

Election Cycle theory, it's likely more accurate to say that the relationship between the President's actions (or

inaction) is coincidental when it comes to financial markets.

So is 2019's reasonably strong performance to date the result of it also being the third year of a Presidential

Term? Or are other factors in play? We believe that 2019's performance is most directly attributable to a

recovery from the overdone selloff in Q4 2018 and the clear and consistent signal by the Federal Reserve that

they are on the sidelines for now and will procced with extreme caution in the future. But it's interesting to

wonder if Presidential politics still might be behind it all.

Hopefully, you get the idea: Don't bet the farm on any single pattern or study. At the same time, a prudent

investor wouldn't bet against repeatable patterns either and should consider the Presidential Election Cycle

as only one of many factors influencing economic and market conditions. Certainly, politics do play a role in

financial markets and the legislation passed in Congress (often originating from a sitting President's agenda)

does have a significant impact on corporate earnings.

Sometime later this Fall, we plan to revisit Presidential politics in a piece analyzing which combination –

Republicans or Democrats in Congress and the White House – has historically proven itself most favorable to

financial markets.

References:

1 Presidential Election Cycle Theory is described in The Stock Trader's Almanac 2019. Language used here

can be found on

Investopedia.com

2 DJIA data taken from:

https://www.forecast-chart.com/historical-dow-industrial.html

US Presidents data taken from:

https://www.presidentsusa.net/presvplist.html

Chart analysis was internally prepared

WT Wealth Management is an SEC registered investment adviser, with in excess of $100 million in assets under management

(AUM) with offices in Flagstaff, Scottsdale, Sedona and Tucson, AZ along with Jackson Hole, WY and Las Vegas, NV.

WT Wealth Management is a manager of Separately Managed Accounts (SMAs). With SMAs, performance can vary widely

from investor to investor as each portfolio is individually constructed and managed. Asset allocation weightings are

determined based on a wide array of economic and market conditions the day the funds are invested. In an SMA, each

investor may own individual Exchange Traded Funds (ETFs), individual equities or mutual funds. As the manager we have

the freedom and flexibility to tailor the portfolio to address an individual investor's personal risk tolerance and investment

objectives - thus making the account "separate" and distinct from all others we manage.

An investment with WT Wealth Management is not insured or guaranteed by the Federal Deposit Insurance Corporation

(FDIC) or any other government agency.

Any opinions expressed are the opinions of WT Wealth Management and its associates only. Information offered is neither

an offer to buy or sell securities nor should it be interpreted as personal financial advice. Always seek out the advice of

a qualified investment professional before deciding to invest. Investing in stocks, bonds, mutual funds and ETFs carries

certain specific risks and part or all of an account's value can be lost.

In addition to the normal risks associated with investing, narrowly focused investments, investments in smaller companies,

sector and/or thematic ETFs and investments in single countries typically exhibit higher volatility. International, Emerging

Market and Frontier Market ETFs, mutual funds and individual securities may involve risk of capital loss from unfavorable

fluctuations in currency values, from differences in generally accepted accounting principles or from economic or political

instability that other nations experience. Individual bonds, bond mutual funds and bond ETFs will typically decrease in

value as interest rates rise. A portion of a municipal bond fund's income may be subject to federal or state income taxes or

the alternative minimum tax. Capital gains (short and long-term), if any, are subject to capital gains tax.

Diversification and asset allocation may not protect against market risk or investment losses. At WT Wealth Management, we

strongly suggest having a personal financial plan in place before making any investment decisions including understanding

personal risk tolerance, having clearly outlined investment objectives and a clearly defined investment time horizon.

WT Wealth Management may only transact business in those states in which it is registered, or qualifies for an exemption

or exclusion from registration requirements. Individualized responses to persons that involve either the effecting of

transactions in securities, or the rendering of personalized investment advice for compensation, will not be made without

registration or exemption. WT Wealth Management's website is limited to the dissemination of general information

pertaining to its advisory services, together with access to additional investment-related information, publications, and

links.

Accordingly, the publication of WT Wealth Management's website should not be construed by any consumer and/or

prospective client as WT Wealth Management's solicitation to effect, or attempt to effect transactions in securities, or the

rendering of personalized investment advice for compensation, over the internet. Any subsequent, direct communication

by WT Wealth Management with a prospective client shall be conducted by a representative that is either registered or

qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

A copy of WT Wealth Management's current written disclosure statement discussing WT Wealth Management's registrations,

business operations, services, and fees is available at the SEC's investment adviser public information website (www.

adviserinfo.sec.gov) or from WT Wealth Management directly.

WT Wealth Management does not make any representations or warranties as to the accuracy, timeliness, suitability,

completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to WT Wealth

Management's web site or incorporated therein, and takes no responsibility therefor. All such information is provided solely

for convenience purposes and all users thereof should be guided accordingly.