Click here to download the PDF

You wouldn't be human if you didn't fear loss. Obviously, when markets are going well, we hardly hear from

our clients. But bring on a few rough months and our clients begin to ask questions about how their account

is positioned, what we foresee, and whether they should be concerned.

Nobel Prize-winning psychologist Daniel Kahneman demonstrated this with his loss aversion theory. It states

that people feel the pain of losing money more than they enjoy gains. Thus, investors' natural instinct is to flee

the market when it starts to drop, just as greed prompts people to jump back in when stocks are skyrocketing.

Both have negative impacts. Buying high and selling low is never the formula for success.

With our 100+ years of combined experience at WT Wealth Management, we have learned that Mr. Kahneman

was correct: clients are much more concerned about losses than getting every bit of upside out of their

investments. And so, most clients should have two basic investing objectives:

OUTPERFORM ON THE DOWNSIDE

PARTICIPATE ON THE UPSIDE

Smart investing can overcome the power of emotion by focusing on relevant research, solid data and proven

strategies. At least once a year we enjoy sharing some basic keys to being a successful investor, and, being at

the halfway mark in 2019, this seemed like an appropriate time to revisit some of our favorite fundamentals.

So here are seven principles that the professionals at WT Wealth Management believe in and rely on when the

markets are just not that fun to watch.

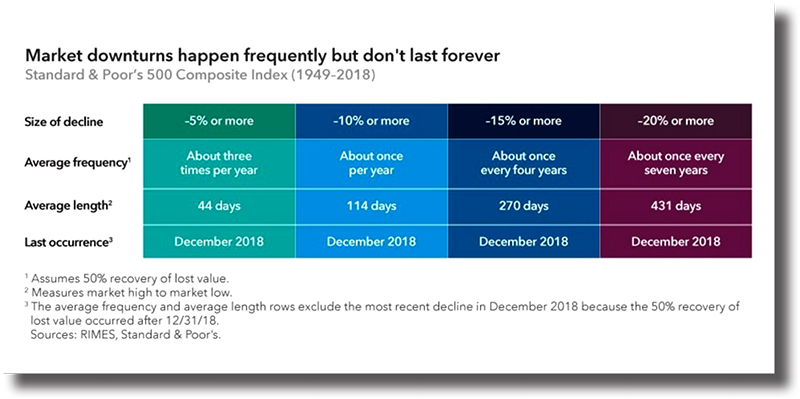

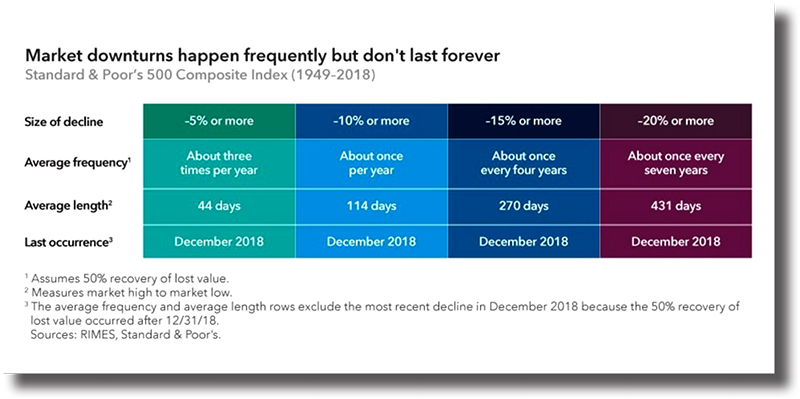

1. Understanding that market declines are part of investing.

Stocks have risen steadily for a decade, but history tells us that stock market declines are an inevitable part

of investing. The good news is that corrections (defined as a 10% or more decline), bear markets (an extended

20% or more decline) and other challenging patches haven't lasted forever.

The Standard & Poor's 500 Composite Index has dipped at least 10% once a year on average, and 20% or

more once every seven years on average, according to data from 1949 to 2018. While past results are not

predictive of future results, each downturn has been followed by a recovery and a new market high.

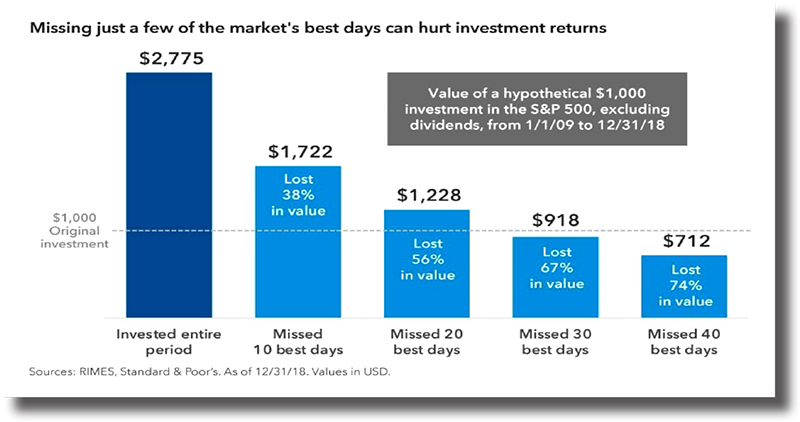

2. Time in the market matters, not market timing.

No one can accurately predict short-term market moves, and investors who sit on the sidelines risk losing out

on periods of meaningful price appreciation that follow downturns.

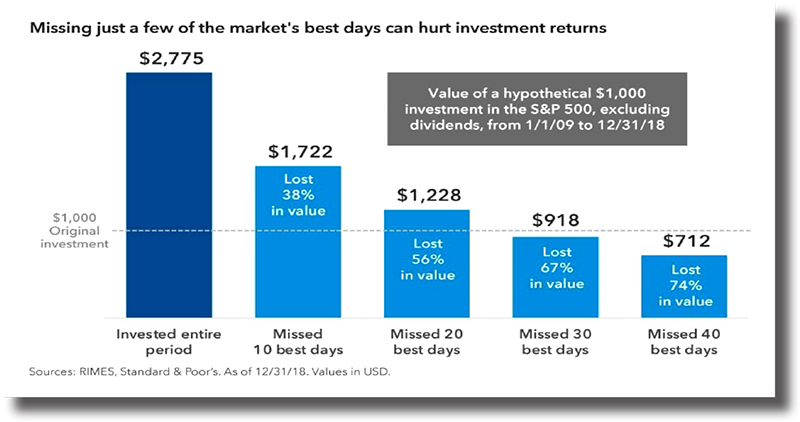

Even missing out on just a few trading days can take a toll. A hypothetical investment of $1,000 in the S&P 500

made in 2009 would have grown to more than $2,700 by the end of 2018. But if an investor missed just the 10

best trading days during that period, he or she would have ended up with 38% less.

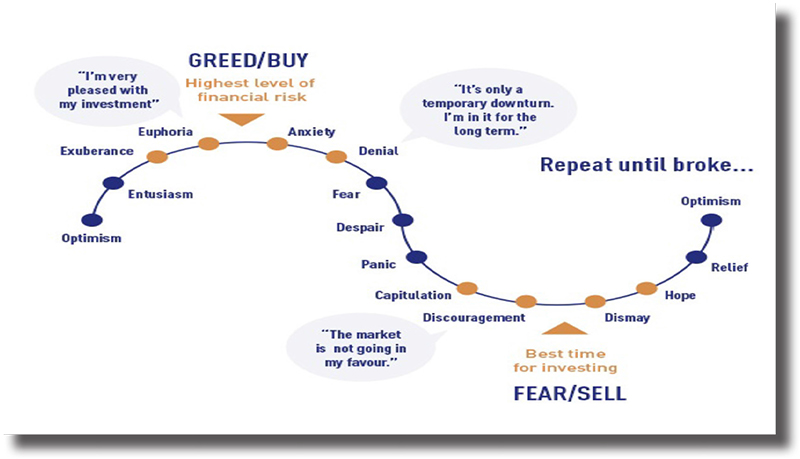

3. Emotional investing can be hazardous.

Kahneman won his Nobel Prize in 2002 for his work in behavioral economics, a field that investigates how

individuals make financial decisions. A key finding of behavioral economists is that people often act irrationally

when making such choices.

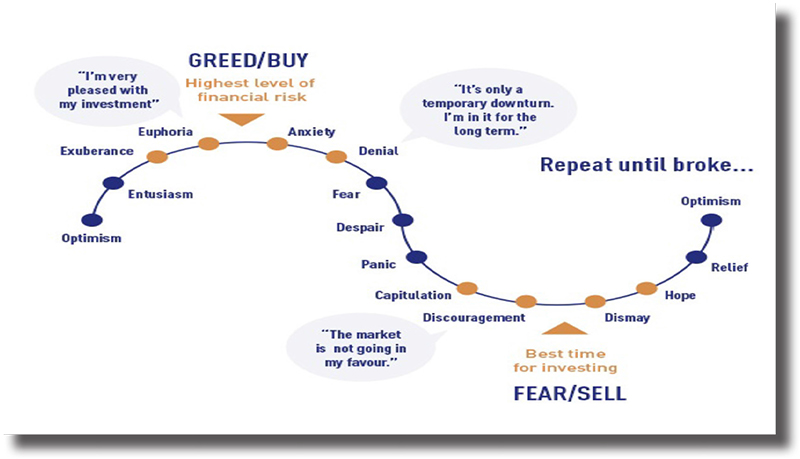

Emotional reactions to market events are perfectly normal. Investors should expect to feel nervous when

markets decline. But it's the actions taken during such periods that can mean the difference between

investment success and shortfall.

The above graph demonstrates that investors managing their own money experience powerful temptations to

do the wrong thing at the wrong time. Studies have shown that investors often chase returns late at the top

and sell too soon at the bottom . . . diminishing performance or even ensuring losses.

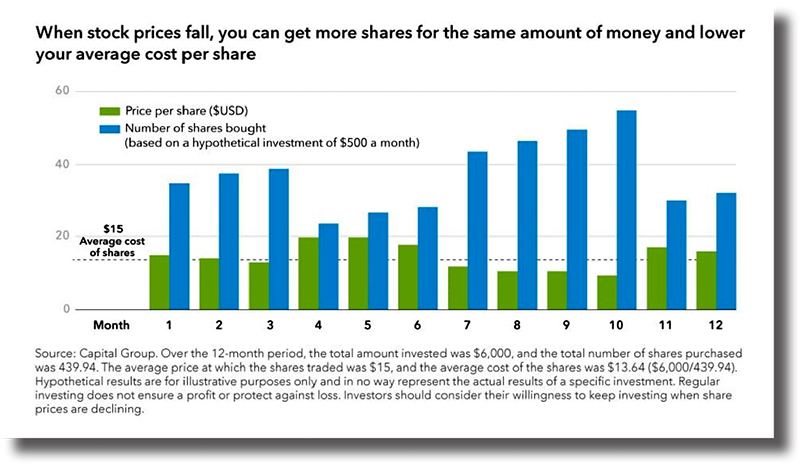

4. Make a plan and stick to it.

Creating and adhering to a thoughtfully constructed investment plan is another way to avoid making shortsighted

investment decisions — particularly when markets move lower. The plan should take into account a

number of factors, including risk tolerance and short- and long-term goals.

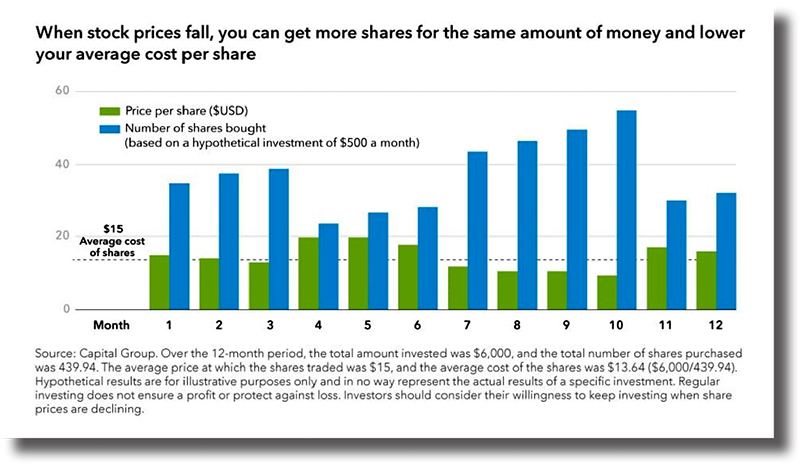

One way to avoid futile attempts to time the market is with dollar cost averaging, where a fixed amount

of money is invested at regular intervals, regardless of market ups and downs. This approach utilizes a

fundamental concept in investing - diversification. But, rather than diversifying across different investments,

dollar cost averaging seeks to diversify your investment across time periods. The outcome of this strategy is

less risk that you invest all of your money at a market high.

Regular investing does not ensure a profit or protect against loss. Investors should consider their willingness

to keep investing when share prices are declining.

Retirement plans, to which investors make automatic contributions with every paycheck, are a prime example

of dollar cost averaging.

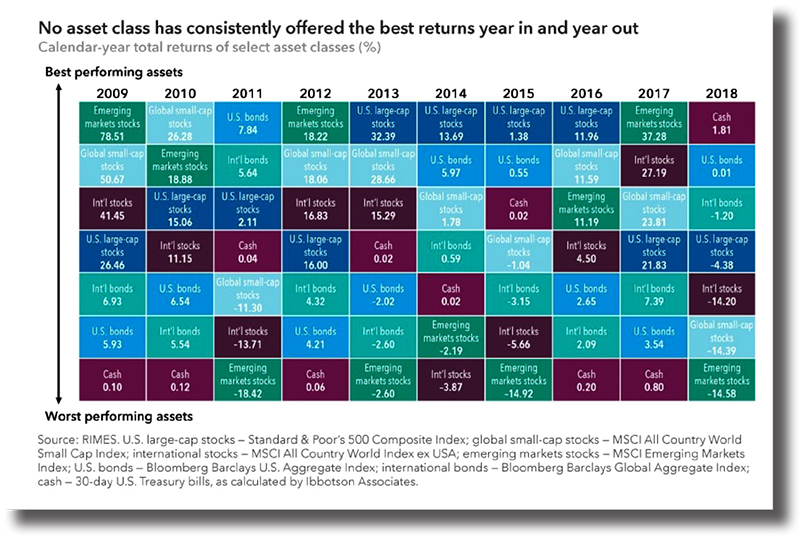

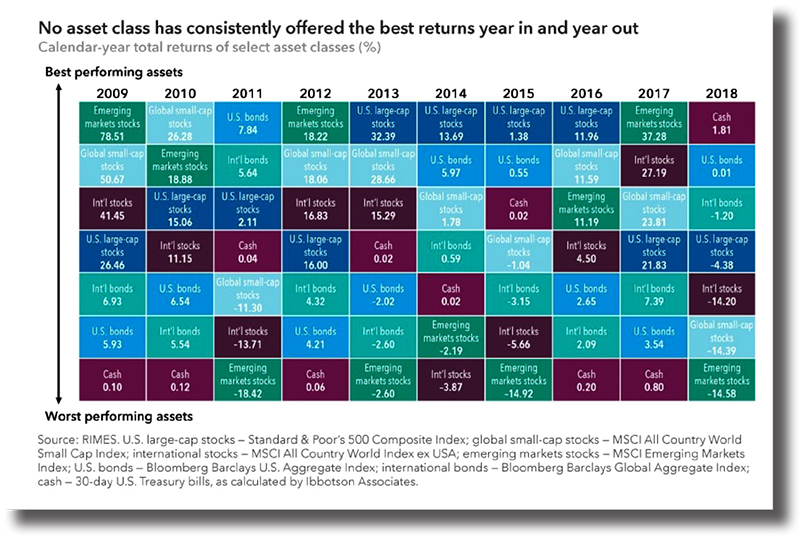

5. Diversification matters.

A diversified portfolio doesn't guarantee profits or provide assurances that investments won't decrease in

value, but it does lower risk. By spreading investments across a variety of asset classes, investors can buffer the

effects of volatility on their portfolios. Overall returns won't reach the highest highs of any single investment

— but they won't hit the lowest lows either.

For investors who want to avoid some of the stress of downturns, diversification can help lower volatility.

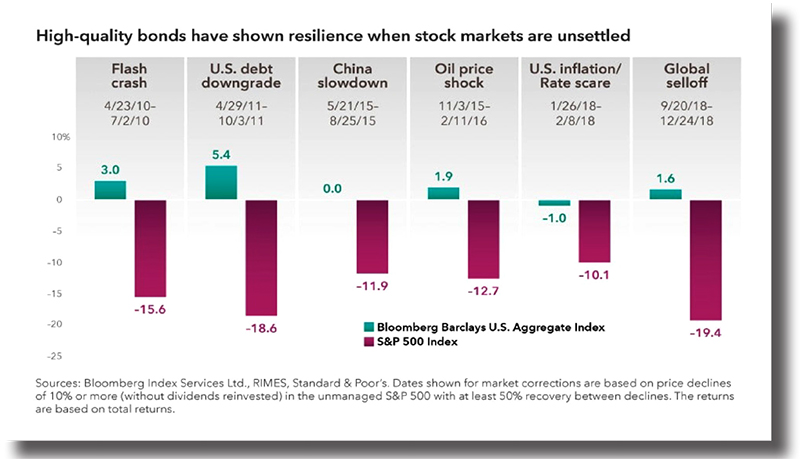

6. Fixed income can help bring balance.

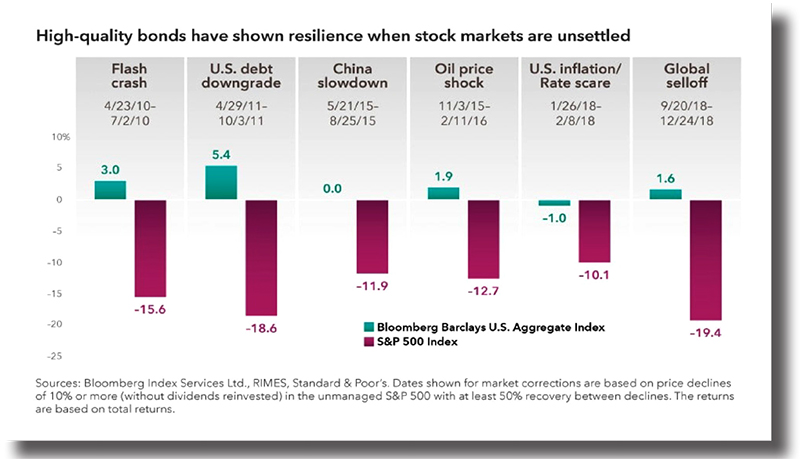

Stocks are important building blocks of a diversified portfolio, but bonds can provide an essential counterbalance.

That's because bonds typically have low correlation to the stock market, meaning that they have tended to zig

when the stock market zags.

Though bonds may not be able to match the growth potential of stocks, they have often shown resilience in

past equity declines. For example, U.S. core bonds were flat or positive in five of the last six corrections.

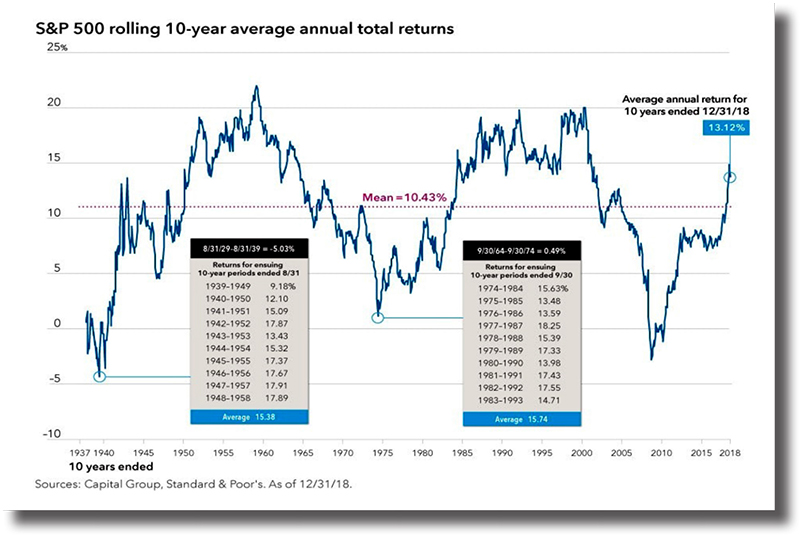

7. The market tends to reward long-term investors.

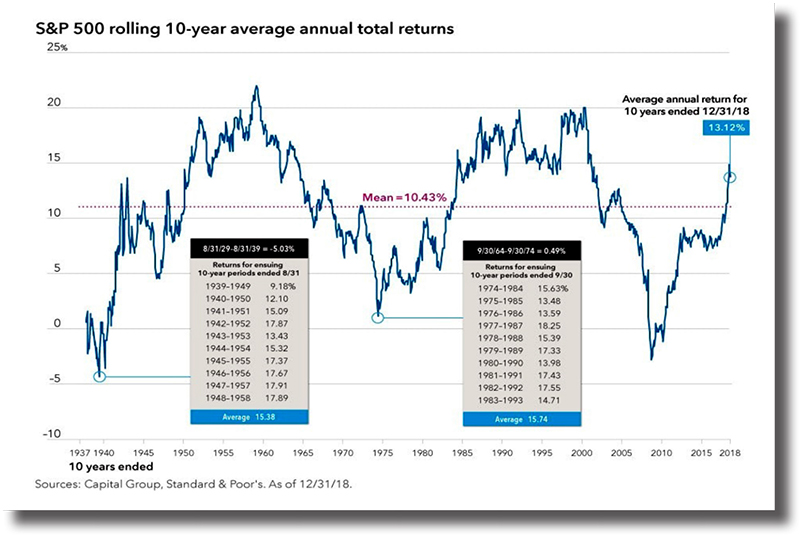

Is it reasonable to expect 30% returns every year? Of course not. If stocks have moved lower in recent weeks,

you shouldn't expect that to be the start of a long-term trend either. Behavioral economics tells us recent

events carry an outsized influence on our perceptions and decisions.

It's always important to maintain a long-term perspective, but especially when markets are declining. Although

stocks rise and fall in the short-term, they've tended to reward investors over longer periods of time. Even

including downturns, the S&P 500's average annual return over all 10-year periods from 1937 to 2018 was

10.43%.

It's natural for emotions to bubble up during periods of volatility. That's why smart investors, like our clients,

choose to work with professionals who have seen the ups and downs of a variety of financial markets. Such

professionals take a more disciplined, unemotional, and measured approach to portfolio management.

At WT Wealth Management we continually strive to educate our clients in an effort to remove the fear of

market declines. In the last 18 months we have seen both exploding bull markets and scary market sell-offs.

However, it is important to stay focused on these seven fundamentals and understand that it is possible for

investments to perform well, even through turmoil.

Being a successful investor isn't measured in weeks or months but in years and decades.

WT Wealth Management is an SEC registered investment adviser, with in excess of $100 million in assets under management (AUM) with offices in Flagstaff, Scottsdale, Sedona and Tucson, AZ along with Jackson Hole, WY and Las Vegas, NV.

WT Wealth Management is a manager of Separately Managed Accounts (SMAs). With SMAs, performance can vary widely from investor to investor as each portfolio is individually constructed and managed. Asset allocation weightings are determined based on a wide array of economic and market conditions the day the funds are invested. In an SMA, each investor may own individual Exchange Traded Funds (ETFs), individual equities or mutual funds. As the manager we have the freedom and flexibility to tailor the portfolio to address an individual investor’s personal risk tolerance and investment objectives – thus making the account “separate” and distinct from all others we manage.

An investment with WT Wealth Management is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

Any opinions expressed are the opinions of WT Wealth Management and its associates only. Information offered is neither an offer to buy or sell securities nor should it be interpreted as personal financial advice. Always seek out the advice of a qualified investment professional before deciding to invest. Investing in stocks, bonds, mutual funds and ETFs carries certain specific risks and part or all of an account’s value can be lost.

In addition to the normal risks associated with investing, narrowly focused investments, investments in smaller companies, sector and/or thematic ETFs and investments in single countries typically exhibit higher volatility. International, Emerging Market and Frontier Market ETFs, mutual funds and individual securities may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles or from economic or political instability that other nations experience. Individual bonds, bond mutual funds and bond ETFs will typically decrease in value as interest rates rise. A portion of a municipal bond fund’s income may be subject to federal or state income taxes or the alternative minimum tax. Capital gains (short and long-term), if any, are subject to capital gains tax.

Diversification and asset allocation may not protect against market risk or investment losses. At WT Wealth Management, we strongly suggest having a personal financial plan in place before making any investment decisions including understanding personal risk tolerance, having clearly outlined investment objectives and a clearly defined investment time horizon.

WT Wealth Management may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Individualized responses to persons that involve either the effecting of transactions in securities, or the rendering of personalized investment advice for compensation, will not be made without registration or exemption. WT Wealth Management’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

Accordingly, the publication of WT Wealth Management’s website should not be construed by any consumer and/or prospective client as WT Wealth Management’s solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the internet. Any subsequent, direct communication by WT Wealth Management with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

A copy of WT Wealth Management’s current written disclosure statement discussing WT Wealth Management’s registrations, business operations, services, and fees is available at the SEC’s investment adviser public information website (www. adviserinfo.sec.gov) or from WT Wealth Management directly.

WT Wealth Management does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to WT Wealth Management’s web site or incorporated therein, and takes no responsibility therefor. All such information is provided solely for convenience purposes and all users thereof should be guided accordingly.

Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, “Bloomberg”). Barclays® is a trademark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2018 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.