Embracing The Role of REITs

In Diversified Investment Portfolios

When a new client chooses WT Wealth Management, one of our favorite things is getting to see their portfolio

as constructed by their previous advisor. It's just like seeing how your neighbor decorated their house when

you both have the same floor plan.

One thing we have consistently seen is that REITs, Real Estate Investment Trusts, are a much underrepresented

part of most clients' investment portfolios. This is somewhat surprising considering:

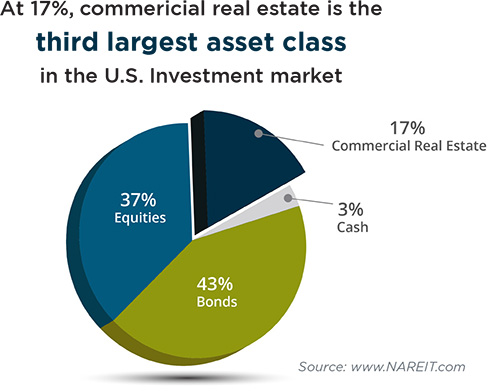

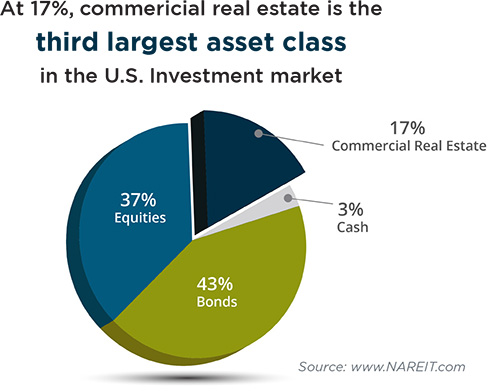

- Real estate is a fundamental asset class (along with stocks, bonds and cash)

- REITs are an effective, liquid, and low-cost means of investing in the real estate asset class

- REITs provide diversification in a well balanced portfolio

Since nearly all WT Wealth Management clients hold REITs as one component of their diversified portfolio, we

felt it was a good time to provide some basic educational material on the subject.

Why real estate?

Real Estate Investment Trusts (REITs) have unique characteristics that may make them attractive to both

income and growth investors. REITs trade like stocks and can fluctuate in price, but they also pay out a large

part of their income in the form of dividends.

REITs may be used to help provide income in conservative portfolios or long-term growth in more aggressive

portfolios. Some portion of every portfolio may be appropriately allocated to REITs for a broad range of

investor types.

As outlined on the website of the National Association of Real Estate Investment Trusts (

www.NAREIT.com),

REITs of all types collectively own more than $3 trillion in gross real estate assets across the U.S., with stock exchange

listed REITs owning approximately $2 trillion in assets. U.S. listed REITs have an equity market

capitalization of more than $1 trillion.

Just like everything in the field of investments today, offerings have become numerous and highly specialized.

There are ETFs that offer allocations to a variety of individual REITs. For example, Vanguard's and iShare's REIT

offerings have 181 and 114 holdings, respectively. There are also sector REITs where we can provide our clients

exposure in a wide variety of diversified REITs that focus on Data Centers, Healthcare, Retail, Self-Storage,

Residential, Commercial, Warehouse, Cell Phone Towers, Lodging and Resorts, Office Buildings, Farms, Timber

and even Highway Billboards.

Since most investors are already heavily allocated to real estate due to home ownership, REITs need only be a

small component of a diversified portfolio.

Reasons to invest in REITs

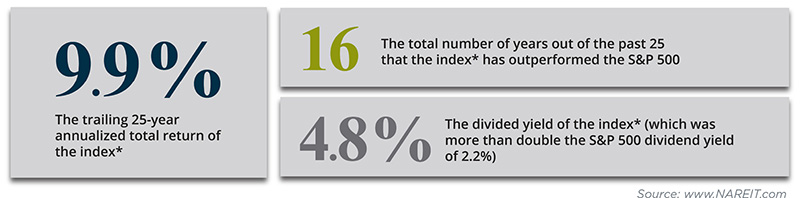

REITs historically have delivered competitive total returns, based on high, steady dividend income and long-term

capital appreciation. Their comparatively low correlation with other assets also makes them an excellent

portfolio diversifier that can help reduce overall portfolio risk and increase returns.

In our opinion, at WT Wealth Management, the point of having REITs in a portfolio is not necessarily to beat or

challenge stock market returns. Some compelling reasons are:

Diversification. REITs follow a different cycle than stocks. REITs follow the real estate cycle is which is typically

longer (18 years) than the economic business cycle (4-5 years on average). So when stocks suffer in a recession,

REITs may outperform, providing diversification for your portfolio.

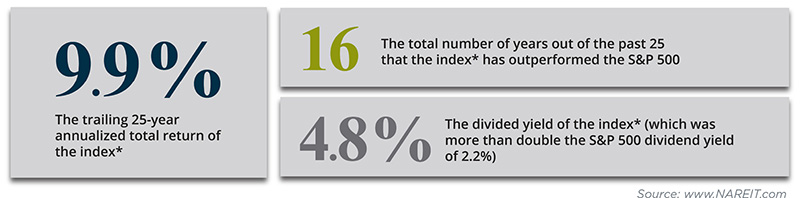

Higher yields. In addition to providing diversification, REITs may provide higher yields – or cash dividends.

Since a REIT must distribute at least 90% of its taxable income to shareholders annually, REITs generally have

a higher distribution of income than stocks. In fact, the NAREIT All REITs Index has a dividend yield of 4.8%

compared to 2.2% for the S&P 500 index. This enhanced income stream is attractive to nearly all investors and

makes REITs particularly attractive in retirement accounts.

Inflation hedge. REITs provide an inflation hedge, a known benefit of real estate assets in general. As inflation

rises, rents and leases tend to rise as well.

Performance: Stocks, Bonds, Bills, and REITs

A 25-year examination of REITs vs the S&P 500 through December 31, 2018 shows some interesting results.

Dividends and principal invested in REITs, like equities, are not guaranteed. REITs typically provide high

dividends plus the potential for moderate, long-term capital appreciation.

Risks of Investing in REITs

Like any investment, we always look for the downside in any asset class. REITs are not bulletproof.

REITs only have 10% of annual profits to use for growth. 90% of profits must be distributed to investors. So in order for REITs to grow, they must constantly seek additional investments to cover capital expenditures and expand their portfolio.

REITs are susceptible to the macroeconomic environment. The Great Recession of 2008 is a good example

of that. Market statistics show that REITs were down 48% in 2008 (recovered by 37% in 2009). A market

downturn leads to decreased spending in retail shops, lower demand for office space, and property devaluation

in general. This, in turn, hampers the performance of REITs.

Publicly traded REITs can be volatile in the short term and exhibit similar behaviors to stocks. So these may

not be appropriate for investors who want a more even-keeled ride.

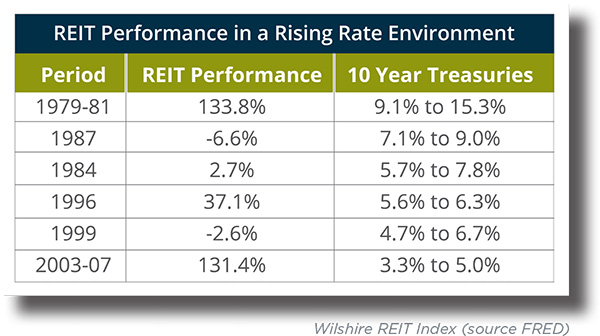

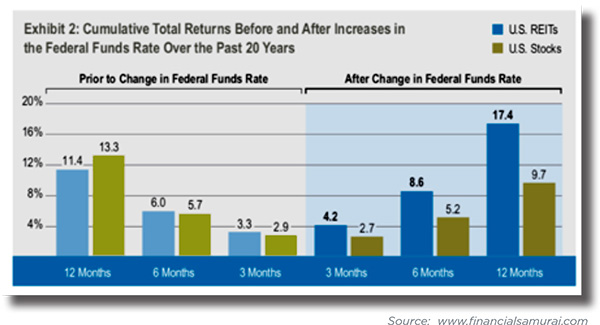

REIT Responsiveness to Interest Rates

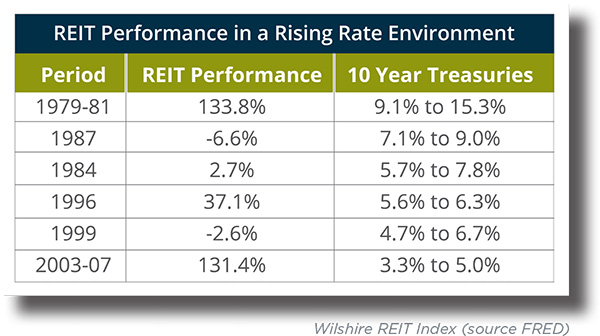

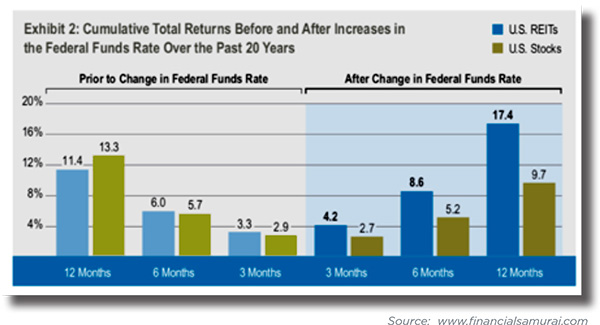

One might expect that rising interest rates would increase borrowing costs of a REIT and depress the present

value of future cash flow, making REITs inversely sensitive to changes in interest rates. However evidence has

shown this is not always the case. In a study from 1979 to 2007, there were 6 separate periods when the

10-year U.S. Treasury yield increased by at least 75 basis points. REITs as a group declined in only two of those

periods and generated positive returns in four of these periods.

One possible explanation for this counter-intuitive performance is that periods of rising interest rates are

generally correlated with an improving economic backdrop, which increases demand for commercial real

estate and subsequent cash flow. The positive impact of an improving economy may prove stronger than the

negative impact of rising interest rates. That being said, certain REIT sectors do tend to be more sensitive to

interest rates: strip malls, health care, and senior living.

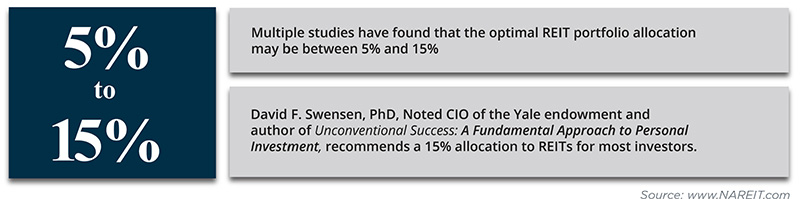

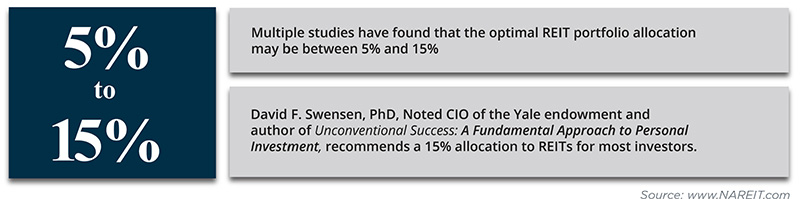

Guidelines for setting portfolio allocations

What is an appropriate REIT allocation? The answer will vary based on each investor's goals, risk tolerance and

investment horizon, but here are some guidelines that can help:

As we said earlier, since most investors already own a home, they are already heavily allocated to real estate.

So WT Wealth Management generally recommends a REIT allocation in the investment portfolio on the lower

end of the above range.

Overall, WT Wealth Management believes it is a good idea to include REITs as part of any well-diversified

portfolio. REITS offer compelling risk-adjusted returns and solid yields through their required dividends.

REITs are a simple and convenient way to indirectly invest in real estate. REITs, on average, offer higher yields

than corporate stocks and are a good hedge against inflation.

Historically, REITs have performed well and add a bit of diversification from the equities market. REITs have a

unique set of attributes that make them perform differently than stocks and bonds. Reduced overall portfolio

volatility and competitive returns make REITs an attractive combination.

As always, we hope you found this discussion of REITs educational and worth the read. White Papers are

fundamental in our effort to educate our clients. Informed and empowered investors make the best investors.

Sources:

REIT Resources for Financial Professionals

www.nareit.com

Will Rising Rates Hurt REIT Performance?

www.awealthofcommonsense.com

How Rising Interest Rates Affect REIT Price Performance: Not As Bad As You Think.

www.financialsamurai.com

WT Wealth Management is an SEC registered investment adviser, with in excess of $100 million in assets under management

(AUM) with offices in Flagstaff, Scottsdale, Sedona and Tucson, AZ along with Jackson Hole, WY and Las Vegas, NV.

WT Wealth Management is a manager of Separately Managed Accounts (SMAs). With SMAs, performance can vary widely

from investor to investor as each portfolio is individually constructed and managed. Asset allocation weightings are

determined based on a wide array of economic and market conditions the day the funds are invested. In an SMA, each

investor may own individual Exchange Traded Funds (ETFs), individual equities or mutual funds. As the manager we have

the freedom and flexibility to tailor the portfolio to address an individual investor's personal risk tolerance and investment

objectives - thus making the account "separate" and distinct from all others we manage.

An investment with WT Wealth Management is not insured or guaranteed by the Federal Deposit Insurance Corporation

(FDIC) or any other government agency.

Any opinions expressed are the opinions of WT Wealth Management and its associates only. Information offered is neither

an offer to buy or sell securities nor should it be interpreted as personal financial advice. Always seek out the advice of

a qualified investment professional before deciding to invest. Investing in stocks, bonds, mutual funds and ETFs carries

certain specific risks and part or all of an account's value can be lost.

In addition to the normal risks associated with investing, narrowly focused investments, investments in smaller companies,

sector and/or thematic ETFs and investments in single countries typically exhibit higher volatility. International, Emerging

Market and Frontier Market ETFs, mutual funds and individual securities may involve risk of capital loss from unfavorable

fluctuations in currency values, from differences in generally accepted accounting principles or from economic or political

instability that other nations experience. Individual bonds, bond mutual funds and bond ETFs will typically decrease in

value as interest rates rise. A portion of a municipal bond fund's income may be subject to federal or state income taxes or

the alternative minimum tax. Capital gains (short and long-term), if any, are subject to capital gains tax.

Diversification and asset allocation may not protect against market risk or investment losses. At WT Wealth Management, we

strongly suggest having a personal financial plan in place before making any investment decisions including understanding

personal risk tolerance, having clearly outlined investment objectives and a clearly defined investment time horizon.

WT Wealth Management may only transact business in those states in which it is registered, or qualifies for an exemption

or exclusion from registration requirements. Individualized responses to persons that involve either the effecting of

transactions in securities, or the rendering of personalized investment advice for compensation, will not be made without

registration or exemption. WT Wealth Management's website is limited to the dissemination of general information

pertaining to its advisory services, together with access to additional investment-related information, publications, and

links.

Accordingly, the publication of WT Wealth Management's website should not be construed by any consumer and/or

prospective client as WT Wealth Management's solicitation to effect, or attempt to effect transactions in securities, or the

rendering of personalized investment advice for compensation, over the internet. Any subsequent, direct communication

by WT Wealth Management with a prospective client shall be conducted by a representative that is either registered or

qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

A copy of WT Wealth Management's current written disclosure statement discussing WT Wealth Management's registrations,

business operations, services, and fees is available at the SEC's investment adviser public information website (www.

adviserinfo.sec.gov) or from WT Wealth Management directly.

WT Wealth Management does not make any representations or warranties as to the accuracy, timeliness, suitability,

completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to WT Wealth

Management's web site or incorporated therein, and takes no responsibility therefor. All such information is provided solely

for convenience purposes and all users thereof should be guided accordingly.