Key Takeaways

- Negative interest rates are a recently-developed and unconventional monetary policy tool.

- Negative interest rates are a drastic measure revealing that policymakers fear a risk

of a deflationary spiral.

Negative Interest Rates in Theory

If you watch CNBC or read the Wall Street Journal it would be nearly impossible to not hear something about negative interest rates.

In the simplest sense, negative interest rates mean banks would pay money each month to park their money at the central bank - a reversal of how banking typically works. Usually deposits are rewarded rather than penalized. Banks are left with two options: 1) pass negative interest costs to customers by charging for deposits,

(1) which is a tough sell to the consumer market or 2) put their money to work through loans and investments, which is what the central bank is aiming for.

Let's look at the math. An annualized 2% interest rate on a $100 deposit means that the saver receives $2 after one full year for a new deposit total of $102. We're all familiar with this result. On the other hand, a -2% interest rate means the saver pays the bank $2 after a year of having the $100 deposited at that financial institution. As a result, the saver would have $98 after the first full year, which is highly counterintuitive and unusual.

While seemingly inconceivable, there may be times when central banks run out of policy options to stimulate the economy and turn to the desperate measure of negative interest rates like we have witnessed in Europe and Japan.

Negative Interest Rates in Practice

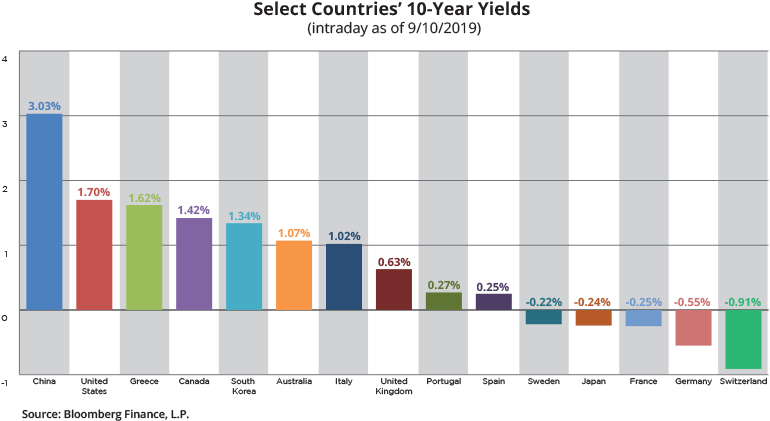

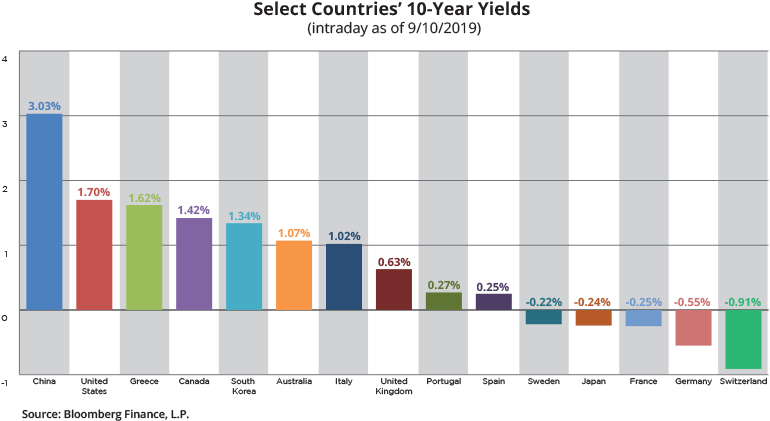

Negative interest rates are an unconventional monetary policy tool. They were first deployed by Sweden's central bank in July 2009 when the bank cut its overnight deposit rate to -0.25%. The European Central Bank (ECB) followed in June 2014 when it lowered its deposit rate to -0.1%. Since then, other developed countries like Denmark, Germany and Japan have chosen to implement negative interest rates, resulting in $15 trillion worth of government debt carrying negative yields in 2019, according to Deutsche Bank.

(2)

Most economists agree that negative interest rates are a drastic measure that indicates a country is at risk of falling into a deflationary spiral. What is deflation and why would what appears to be a good thing (lower prices) actually be a bad thing? In uncertain economic times, people and businesses tend to hold on to their cash while they wait for the economy to improve. However, this behavior can weaken the economy further, as a lack of spending causes decreased GDP, lower corporate profits, subsequent job losses, which reinforces people's fears, giving them even more incentive to hoard cash and reduce spending. As spending slows, prices drop (deflation) creating further incentive for people to wait on purchases as prices steadily fall. This is precisely the deflationary spiral that European policymakers are trying to avoid with negative interest rate stimulus. The effect that an artificially low interest rate has on an economy could be emotionally harmful to its people. People are smart, they will ask "are things really this bad" and curtail their spending.

By charging European banks to hold reserves at the European Central Bank, policymakers hope to encourage banks to lend more. In "theory", negative interest rates should help to stimulate economic activity and stave off deflation as banks should prefer to lend money to borrowers and earn at least some interest as opposed to being charged to hold their money at a central bank.

Negative rates charged by a central bank could theoretically carry over to deposit accounts and be passed on to consumers. However, there is also nothing to stop typical savers/depositors from withdrawing their money and stuffing the physical cash in mattresses. At least that way they wouldn't be losing money. While the initial threat could be a potential run on banks, the resulting drain of cash from the banking system could lead to a rise in interest rates—the exact opposite of what negative interest rates are supposed to achieve for the economy.

(3)

The Bottom Line

While negative interest rates may seem like a "Hail Mary", this has not prevented a number of the world's central banks from adopting them. We can only ask ourselves what could be next.

Globally, interest rates are at low levels never imagined a few years ago. And negative interest rates are uncharted ground. Most of the research we have reviewed predicts that negative rates "could" result in income inequality growth and social instability could follow. Excessively low interest rates support bloated asset valuation levels, favor the rich over the poor, favor the renter over the investor, encourage leverage and stock buybacks over capital expenditure and business investment.

We do not believe negative rates will lead to increased economic activity. They have a poor track record so far. Instead European and other countries should look at why growth is stagnant and what can be done to spur economic activity organically and not mechanically.

Sources:

(1)www.investopedia.com/terms/n/negative-interest-rate.asp

(2)www.cnbc.com/2019/08/07/bizarro-bonds-negative-yielding-debt-in-the-world-balloons-to-15-trillion.html

(3)www.thebalance.com/understanding-bank-runs-315793

WT Wealth Management is an SEC registered investment adviser, with in excess of $100 million in assets under management

(AUM) with offices in Flagstaff, Scottsdale, Sedona and Tucson, AZ along with Jackson Hole, WY and Las Vegas, NV.

WT Wealth Management is a manager of Separately Managed Accounts (SMAs). With SMAs, performance can vary widely

from investor to investor as each portfolio is individually constructed and managed. Asset allocation weightings are

determined based on a wide array of economic and market conditions the day the funds are invested. In an SMA, each

investor may own individual Exchange Traded Funds (ETFs), individual equities or mutual funds. As the manager we have

the freedom and flexibility to tailor the portfolio to address an individual investor's personal risk tolerance and investment

objectives - thus making the account "separate" and distinct from all others we manage.

An investment with WT Wealth Management is not insured or guaranteed by the Federal Deposit Insurance Corporation

(FDIC) or any other government agency.

Any opinions expressed are the opinions of WT Wealth Management and its associates only. Information offered is neither

an offer to buy or sell securities nor should it be interpreted as personal financial advice. Always seek out the advice of

a qualified investment professional before deciding to invest. Investing in stocks, bonds, mutual funds and ETFs carries

certain specific risks and part or all of an account's value can be lost.

In addition to the normal risks associated with investing, narrowly focused investments, investments in smaller companies,

sector and/or thematic ETFs and investments in single countries typically exhibit higher volatility. International, Emerging

Market and Frontier Market ETFs, mutual funds and individual securities may involve risk of capital loss from unfavorable

fluctuations in currency values, from differences in generally accepted accounting principles or from economic or political

instability that other nations experience. Individual bonds, bond mutual funds and bond ETFs will typically decrease in

value as interest rates rise. A portion of a municipal bond fund's income may be subject to federal or state income taxes or

the alternative minimum tax. Capital gains (short and long-term), if any, are subject to capital gains tax.

Diversification and asset allocation may not protect against market risk or investment losses. At WT Wealth Management, we

strongly suggest having a personal financial plan in place before making any investment decisions including understanding

personal risk tolerance, having clearly outlined investment objectives and a clearly defined investment time horizon.

WT Wealth Management may only transact business in those states in which it is registered, or qualifies for an exemption

or exclusion from registration requirements. Individualized responses to persons that involve either the effecting of

transactions in securities, or the rendering of personalized investment advice for compensation, will not be made without

registration or exemption. WT Wealth Management's website is limited to the dissemination of general information

pertaining to its advisory services, together with access to additional investment-related information, publications, and

links.

Accordingly, the publication of WT Wealth Management's website should not be construed by any consumer and/or

prospective client as WT Wealth Management's solicitation to effect, or attempt to effect transactions in securities, or the

rendering of personalized investment advice for compensation, over the internet. Any subsequent, direct communication

by WT Wealth Management with a prospective client shall be conducted by a representative that is either registered or

qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

A copy of WT Wealth Management's current written disclosure statement discussing WT Wealth Management's registrations,

business operations, services, and fees is available at the SEC's investment adviser public information website (www.

adviserinfo.sec.gov) or from WT Wealth Management directly.

WT Wealth Management does not make any representations or warranties as to the accuracy, timeliness, suitability,

completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to WT Wealth

Management's web site or incorporated therein, and takes no responsibility therefor. All such information is provided solely

for convenience purposes and all users thereof should be guided accordingly.