"Live long and prosper," is something we've all heard before and aspire to achieve. But when many Americans consider their potential life span, they're faced with a nagging concern: What happens if they live longer than their money? At WT Wealth Management we have many clients in their 80s and several in their 90s. Modern medicine and strong genetics can allow someone to live 20, 25 and even 30 years in retirement.

Unfortunately, many retirement savers have been conditioned to think only about saving a magical lump sum, say $1 million, from which they can withdraw money each month in retirement. Generally, too little attention is paid to also calculating how much actual income they'll need each month to live their expected retirement lifestyle. In fact, a recent survey of 3,119 adults by the Alliance for Lifetime Income, shows that a mere 28% of non-retired Americans have made an effort to determine their likely monthly income needs in retirement.

(1) That planning gap can lead to an unfortunate situation where money saved will not last through retirement.

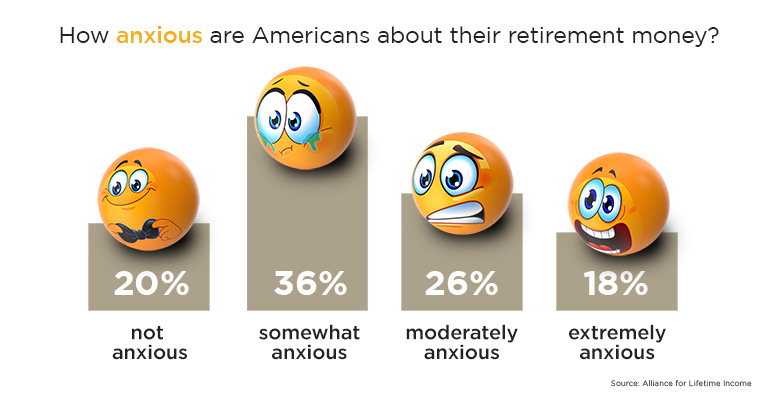

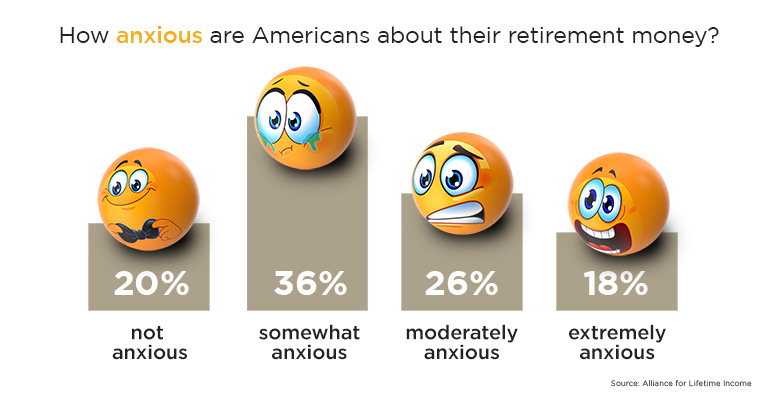

If pre-retirees don't know their income requirements, how will they know if they've saved enough to last throughout life? It's no wonder the Alliance for Lifetime Income survey shows that 80% of Americans are anxious about their retirement money and whether it will last through retirement.

Your household is a business and you should produce and analyze with your advisor a household P&L (aka a budget) twice a year. Understand clearly how much comes in, and from where, and how much goes out, and on what. When you have more coming in than going out, your household is solvent and can fund retirement savings with the excess. When you have more going out than coming in, your household is insolvent and your retirement plans are hindered. Successful retirement planning is a conscious and intentional action and time is one of the plan's most critical variables. The sooner you start a conscious retirement plan, the greater potential you have to achieve your objective. The best time to start is a long time ago. The second best time is today.

Spending In Retirement

Many pre-retirees we have worked with believe they will be more adaptable to change and understand that some sacrifices will need to be made to make their money last during retirement.

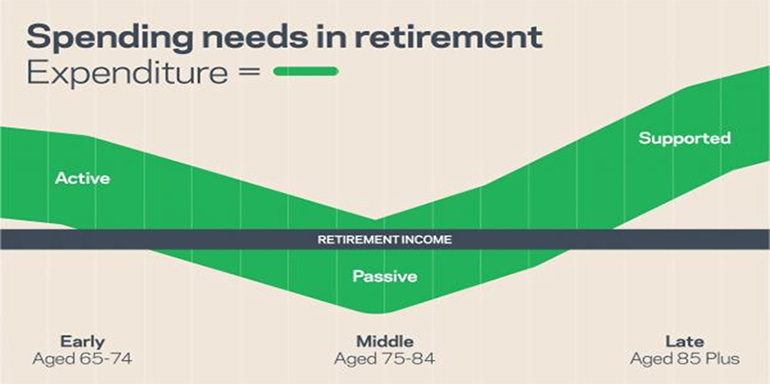

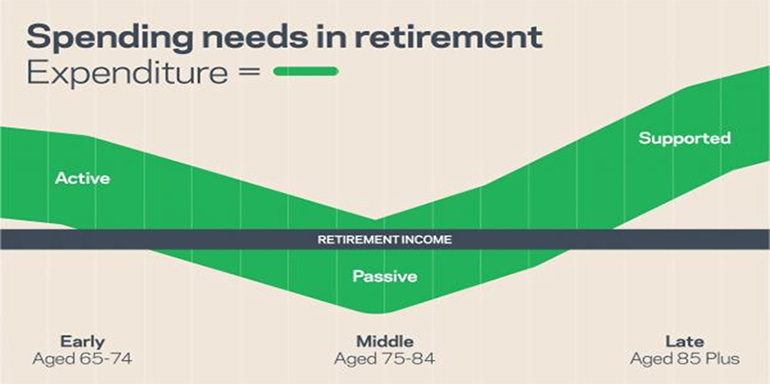

Experience shows that retirement spending doesn't always follow a straight path. Instead it's more of a U-shaped curve: spend more money in the "active" years of retirement as you tackle bucket list items, gradually decrease spending in the "passive" years of retirement as age and health issues arise, and then increase spending again toward the "supported" end of our lives, primarily due to rising health care costs.

The Bottom Line

We each should be calculating our estimated discretionary and nondiscretionary expenses in retirement, all while anticipating living a longer life.

While spending on restaurants and travel are technically discretionary expenses, they are nevertheless a staple of retirement living for most Americans. After all, these are the experiences many retirees have worked their entire lives to enjoy. Simply eliminating discretionary expenses is not a sustainable retirement plan.

When it comes to non-discretionary spending, understanding the rising costs of health care is a critical factor. A July 2019 study sponsored by the National Association of Plan Advisors found that a healthy 65-year-old couple retiring in 2019 is projected to spend $369,000 in today's dollars ($551,000 in future dollars) on health care over their lifetime. In addition, expenses at age 85 are estimated to be 250% higher than at age 65.

The study further estimates that a healthy 67-year-old retired couple is projected to spend 39% of their pre-tax Social Security benefit on health care in 2019 (based on an average couple's combined monthly Social Security benefit of $2,200).

(2)

Other non-discretionary costs — housing, transportation and food, for example — have a significant impact on the cash flow of many retirees. Even if one's home is paid for, the costs of utilities, maintenance and unplanned home repairs are not insignificant factors to consider.

Developing an Income Plan

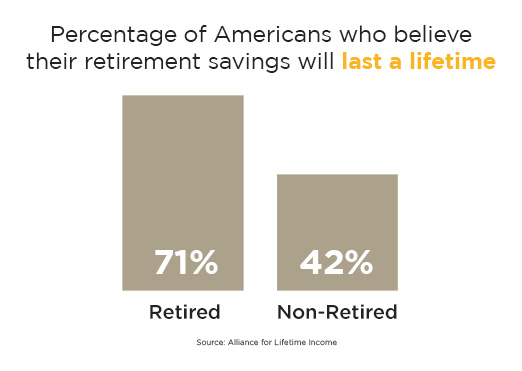

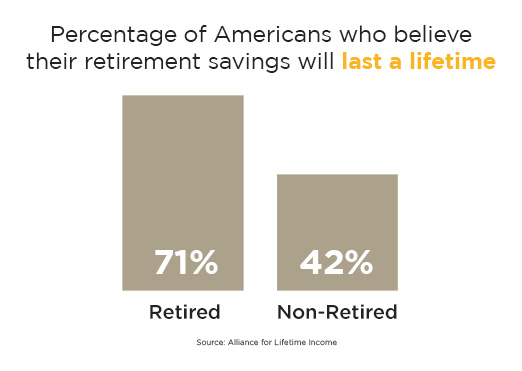

Only 42% of non-retired Americans believe their savings and sources of income will last their lifetime, according to the Protected Lifetime Income Index study by the Alliance for Lifetime Income.

(1) This backs up statistics from the same study that reveal running out of money in retirement is the number one fear. And there's good reason for that concern; 22% of Americans have under $5,000 saved for retirement and 15% have nothing saved at all.

(3)

The world our parents and grandparents knew has changed and today, 63% of Americans are unprotected for retirement, meaning they have no guaranteed source of protected lifetime income — such as a pension or annuity — other than Social Security. A recent World Economic Forum report estimates that a 65-year-old American today could outlive their retirement savings within nine years.

(4)

One of the reasons many Americans experience an income shortfall in retirement is because, when preparing for retirement, they follow a retirement savings plan when they should be following a retirement income plan (and then saving to meet the requirements of that plan).

Regardless of how you have saved for retirement thus far, a first step in developing an income plan should be to make a realistic budget based on your financial obligations and lifestyle interests in retirement (discretionary and nondiscretionary). Then account for your various sources of income (e.g., social security, withdrawals from retirement savings, income producing assets, other forms of investment income, some type of work, etc.). You can find a

Retirement Budget Template on our website. Since Social Security, on average, only covers about 40% of pre-retirement income, this income planning exercise will likely reveal a gap in guaranteed income for many of us. Equally important is considering the real possibility that you may live 20, 30 or more years in retirement.

Know how much you can safely withdraw from your retirement accounts

How long your retirement savings last depends on two primary factors: How much you've saved and how quickly you take money out of your accounts. The income plan introduced previously addresses how much you've saved. So let's talk now about how to intelligently withdraw from savings in retirement.

One common rule of thumb for withdrawals, called the 4% rule, says you can withdraw 4% of your account balance in your first year of retirement and then increase your withdrawal rate to allow for inflation each year. So a retiree with a $1 million portfolio could safely take out $40,000 in year one under this guideline. The 4% rule also doesn't respond to changes in your investment portfolio's value if short-term investments don't perform as expected and there isn't a sufficient time horizon to recover.

The safest withdrawal strategy is to only take out investment gains and leave your principal balance alone. Unfortunately, this approach doesn't work for many people because they simply don't have enough gains (either because the principal balance is too small or investment performance is lacking) to provide a reasonable income without withdrawing at least some portion of the principal balance.

Look for ways to cut costs as a senior

If you're already in retirement, or if you're addressing a savings gap in your retirement income plan, another solid option to make your savings last is to withdraw as little as you can from your retirement savings.

While you don't want to drastically compromise your quality of life, if you're worried you'll outlast your savings, then making some big changes could be necessary. And making those changes today is important in order to avoid taking out too much money too early, which makes it even harder for your savings to last.

Cost saving ideas to consider include moving to an area with a lower cost of living, downsizing to a smaller home or condo, or switching from a two-car to a one-car household. Each change could individually make a big difference in the amount you need to live on. When combined, they can become powerful.

You can take action today to make sure you don't outlive your savings

Whether you're already a senior or are still working and saving for retirement, you don't have to just accept the possibility you might outlive your savings. You can make a conscious and intentional plan for the future and then also make the concrete changes necessary to ensure your money lasts longer. The key is to act as soon as you know you'll have a shortfall, because the longer you wait, the less savings you'll be able to accumulate or retain.

WT Wealth Management has an iRetire Tool that can help us understand your current position. Identifying how to make up retirement funding shortfalls is simple as there are only three inputs: working longer, save more or invest more aggressively. The hard part is implementing the plan. We encourage you to sit with your financial advisor and start the game plan for the retirement lifestyle you have always envisioned.

Sources:

(1)Alliance Protected Lifetime Income Index Study

(2)Investor News | Retirement Plan Advisors

(3)Survey: Most Americans wouldn’t cover a $1K emergency with savings

(4)Retirees will outlive their savings by a decade

WT Wealth Management is an SEC registered investment adviser, with in excess of $100 million in assets under management

(AUM) with offices in Flagstaff, Scottsdale, Sedona and Tucson, AZ along with Jackson Hole, WY and Las Vegas, NV.

WT Wealth Management is a manager of Separately Managed Accounts (SMAs). With SMAs, performance can vary widely

from investor to investor as each portfolio is individually constructed and managed. Asset allocation weightings are

determined based on a wide array of economic and market conditions the day the funds are invested. In an SMA, each

investor may own individual Exchange Traded Funds (ETFs), individual equities or mutual funds. As the manager we have

the freedom and flexibility to tailor the portfolio to address an individual investor's personal risk tolerance and investment

objectives - thus making the account "separate" and distinct from all others we manage.

An investment with WT Wealth Management is not insured or guaranteed by the Federal Deposit Insurance Corporation

(FDIC) or any other government agency.

Any opinions expressed are the opinions of WT Wealth Management and its associates only. Information offered is neither

an offer to buy or sell securities nor should it be interpreted as personal financial advice. Always seek out the advice of

a qualified investment professional before deciding to invest. Investing in stocks, bonds, mutual funds and ETFs carries

certain specific risks and part or all of an account's value can be lost.

In addition to the normal risks associated with investing, narrowly focused investments, investments in smaller companies,

sector and/or thematic ETFs and investments in single countries typically exhibit higher volatility. International, Emerging

Market and Frontier Market ETFs, mutual funds and individual securities may involve risk of capital loss from unfavorable

fluctuations in currency values, from differences in generally accepted accounting principles or from economic or political

instability that other nations experience. Individual bonds, bond mutual funds and bond ETFs will typically decrease in

value as interest rates rise. A portion of a municipal bond fund's income may be subject to federal or state income taxes or

the alternative minimum tax. Capital gains (short and long-term), if any, are subject to capital gains tax.

Diversification and asset allocation may not protect against market risk or investment losses. At WT Wealth Management, we

strongly suggest having a personal financial plan in place before making any investment decisions including understanding

personal risk tolerance, having clearly outlined investment objectives and a clearly defined investment time horizon.

WT Wealth Management may only transact business in those states in which it is registered, or qualifies for an exemption

or exclusion from registration requirements. Individualized responses to persons that involve either the effecting of

transactions in securities, or the rendering of personalized investment advice for compensation, will not be made without

registration or exemption. WT Wealth Management's website is limited to the dissemination of general information

pertaining to its advisory services, together with access to additional investment-related information, publications, and

links.

Accordingly, the publication of WT Wealth Management's website should not be construed by any consumer and/or

prospective client as WT Wealth Management's solicitation to effect, or attempt to effect transactions in securities, or the

rendering of personalized investment advice for compensation, over the internet. Any subsequent, direct communication

by WT Wealth Management with a prospective client shall be conducted by a representative that is either registered or

qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

A copy of WT Wealth Management's current written disclosure statement discussing WT Wealth Management's registrations,

business operations, services, and fees is available at the SEC's investment adviser public information website (www.

adviserinfo.sec.gov) or from WT Wealth Management directly.

WT Wealth Management does not make any representations or warranties as to the accuracy, timeliness, suitability,

completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to WT Wealth

Management's web site or incorporated therein, and takes no responsibility therefor. All such information is provided solely

for convenience purposes and all users thereof should be guided accordingly.