Since the start of the pandemic, the Federal Reserve and Washington DC policymakers have injected unprecedented amounts of liquidity into the US economy. In recent weeks, clients have unsurprisingly asked the professionals at WT Wealth Management about inflation. Knowing how to understand inflation is important, especially for retirees, as anything that would impact purchasing power could also impact retirement lifestyle.

Old school Wall Street veterans, economists, and academics usually believe that injecting easy money into the US economy, combined with low-interest rates, leads to inflation.

But let's take a look back at the Fed Funds rate (defined as the interest rate at which banks lend uncollateralized, overnight funds to each other) to see what we can learn. During the financial crisis of 2008 & 2009, the Federal Reserve brought the Fed Funds Rate to 0.25%. It stayed there from 2008 until 2015 when it was moved 0.25% higher. Over those seven years, the average inflation rate was 1.39%. So, where was the predicted inflation after seven years of near-zero interest rates? It's a good question we'll answer later.

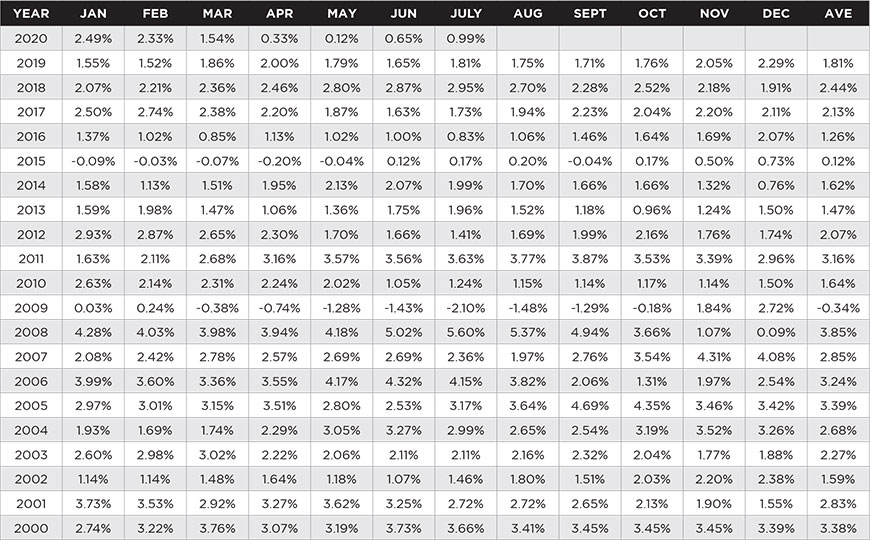

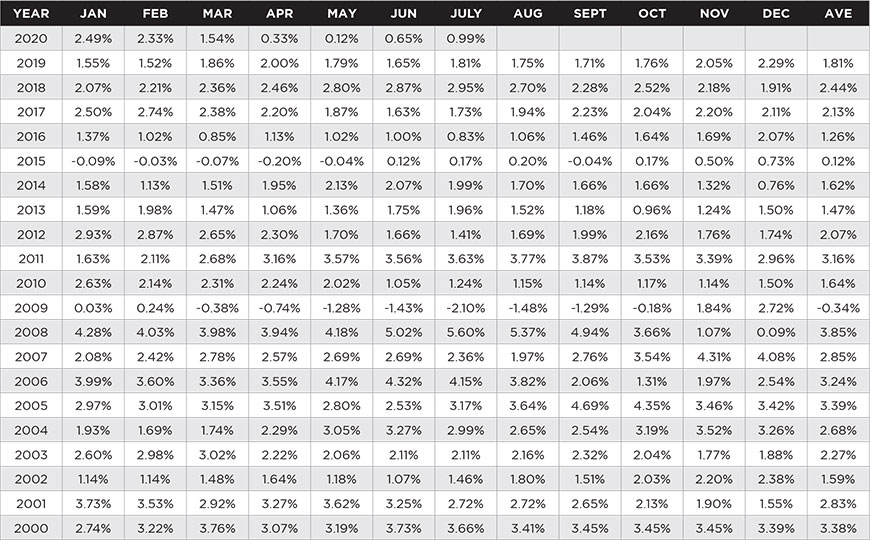

Inflation 2000-2020 (1)

Since that first rate increase in December of 2015, the Fed moved rates higher a total of nine times over the next three years in an effort to "normalize" interest rates and finally reached a range of 2.25% to 2.50% by December of 2018. Because the Fed Funds rate since 1990 averaged 4%, many would consider the entire period from December of 2008 through December of 2018 to be an easy monetary policy stance period.

(2) However, from 2009 through 2019 the average inflation rate remained still very low at 1.58%.

Over the past decade, there has been an ongoing struggle to regulate inflation and move it towards the Fed's medium-term target of 2%. Many economists live with the persistent fear that if some moderate level of inflation is not present in the US economy, deflation could occur. Price erosion is far worse than inflation, as it would immediately decrease consumer sentiment. Spending would decline, because consumers would hope to be able to pay less for something in the future than they would today. They inevitably would put off spending on consumer items, both large and small, and a recession would surely follow.

What is the Federal Reserve's Inflation Target?

The Federal Reserve believes that a 2% annual inflation rate over the long-term is the best way to maintain maximum employment and price stability. Higher rates of inflation over time erode purchasing power as wage inflation always lags price inflation. Conversely, deflation would lead to the previously mentioned unstable or falling prices, and create a weaker economy. Consumer spending would be deferred, with wages potentially falling, as employers struggle to maintain profitability. Either of these extremes would create a need for additional economic policy intervention.

The fact that 2% has been the Fed's inflation target in the past doesn't mean that it will be the goal indefinitely. There has been a recent debate on this topic. The low growth rates in the last years have the agency, and even central bankers in Great Britain, Europe, and Japan re-thinking their inflation goals. Some believe that raising the inflation target to 3% or 4% will give more room for nominal interest rates to rise without stifling economic growth.

What the Future Holds for U.S. Inflation

Talk of the Fed and other central banks raising their inflation targets is still a debate topic today. The truth is that just getting and keeping inflation at the current 2% target seems a difficult enough task. That being said, Federal Reserve officials seem determined to get the inflation rate above their 2% long-term target.

As recently as December, New York Fed President John C. Williams stated that labor figures appear to indicate "full employment," and he expects both wage gains and inflation to rebound in the coming year. Then the pandemic hit and everything changed.

At the beginning of this paper, we asked the question: "where was the predicted inflation from 2008 to 2015 after seven years of near-zero interest rates?" In our opinion, technology has streamlined many industries and has automated or made more efficient many daily personal and business tasks. That phenomenon has become a driver of the low inflation we have been experiencing in the past 15 years. Inflationary tendencies in our day have been tempered by improving technology efficiencies.

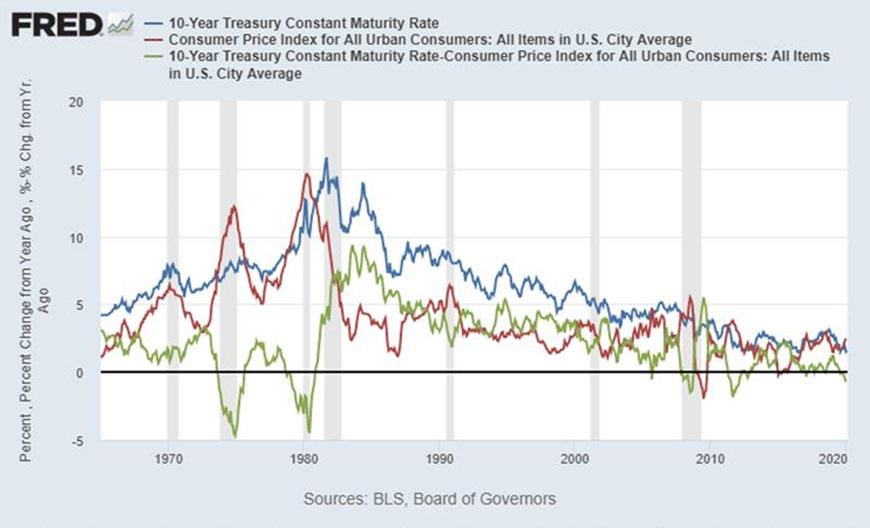

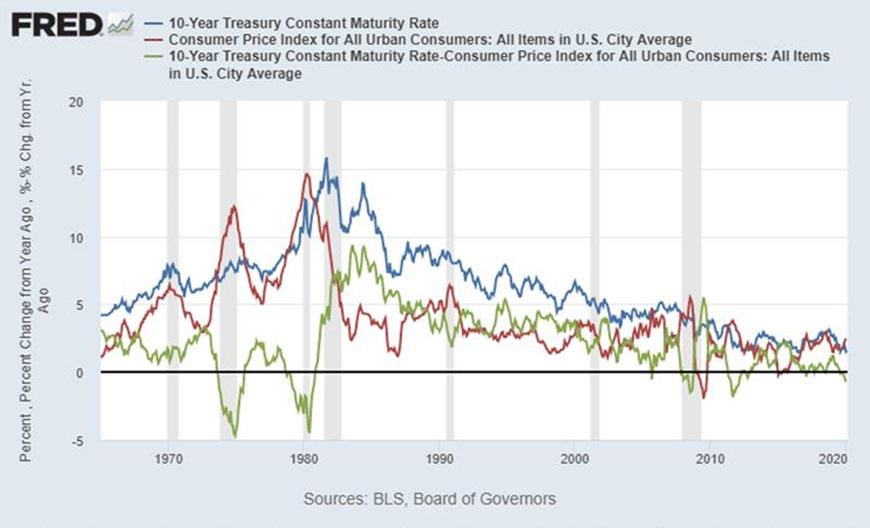

In the chart below, history shows that a low interest rate environment (blue line) indeed need not be accompanied by high inflation (red line). As rates have declined steadily lower since the early 1980's, inflation has also declined.

The apparent results are counterintuitive to the long-standing opinion that lower rates -- and thus borrowing costs -- could increase both the consumer and business appetite to take on debt with the end result being increased prices (i.e. inflation).

In addition, it does not appear that a decade of low interest rates and "quantitative easing" programs from the Federal Reserve after the 2008-09 financial crisis and, what was then, the largest government bailout of the financial service and banking industry ($700 billion) resulted in measurable price increases to consumers.

Is inflation a fear?

At WT Wealth Management, we have a moderate near-term or medium-term fear of inflation. We are taking a wait and see approach.

The current unemployment rate is in the low/mid-teens, and there is a slow recovery for many businesses in the hospitality, food, and travel industries. We feel inflation is worth watching due to the unprecedented amount of stimulus. However, until we see some actual rise in inflation rates, we will assume the low inflation trend will continue.

SOURCES:

(1)https://inflationdata.com/Inflation/Inflation_Rate/HistoricalInflation.aspx

(2)http://www.fedprimerate.com/fedfundsrate/federal_funds_rate_history.htm

WT Wealth Management is an SEC registered investment adviser, with in excess of $100 million in assets under management

(AUM) with offices in Flagstaff, Scottsdale, Sedona and Tucson, AZ along with Jackson Hole, WY and Las Vegas, NV.

WT Wealth Management is a manager of Separately Managed Accounts (SMAs). With SMAs, performance can vary widely

from investor to investor as each portfolio is individually constructed and managed. Asset allocation weightings are

determined based on a wide array of economic and market conditions the day the funds are invested. In an SMA, each

investor may own individual Exchange Traded Funds (ETFs), individual equities or mutual funds. As the manager we have

the freedom and flexibility to tailor the portfolio to address an individual investor's personal risk tolerance and investment

objectives - thus making the account "separate" and distinct from all others we manage.

An investment with WT Wealth Management is not insured or guaranteed by the Federal Deposit Insurance Corporation

(FDIC) or any other government agency.

Any opinions expressed are the opinions of WT Wealth Management and its associates only. Information offered is neither

an offer to buy or sell securities nor should it be interpreted as personal financial advice. Always seek out the advice of

a qualified investment professional before deciding to invest. Investing in stocks, bonds, mutual funds and ETFs carries

certain specific risks and part or all of an account's value can be lost.

In addition to the normal risks associated with investing, narrowly focused investments, investments in smaller companies,

sector and/or thematic ETFs and investments in single countries typically exhibit higher volatility. International, Emerging

Market and Frontier Market ETFs, mutual funds and individual securities may involve risk of capital loss from unfavorable

fluctuations in currency values, from differences in generally accepted accounting principles or from economic or political

instability that other nations experience. Individual bonds, bond mutual funds and bond ETFs will typically decrease in

value as interest rates rise. A portion of a municipal bond fund's income may be subject to federal or state income taxes or

the alternative minimum tax. Capital gains (short and long-term), if any, are subject to capital gains tax.

Diversification and asset allocation may not protect against market risk or investment losses. At WT Wealth Management, we

strongly suggest having a personal financial plan in place before making any investment decisions including understanding

personal risk tolerance, having clearly outlined investment objectives and a clearly defined investment time horizon.

WT Wealth Management may only transact business in those states in which it is registered, or qualifies for an exemption

or exclusion from registration requirements. Individualized responses to persons that involve either the effecting of

transactions in securities, or the rendering of personalized investment advice for compensation, will not be made without

registration or exemption. WT Wealth Management's website is limited to the dissemination of general information

pertaining to its advisory services, together with access to additional investment-related information, publications, and

links.

Accordingly, the publication of WT Wealth Management's website should not be construed by any consumer and/or

prospective client as WT Wealth Management's solicitation to effect, or attempt to effect transactions in securities, or the

rendering of personalized investment advice for compensation, over the internet. Any subsequent, direct communication

by WT Wealth Management with a prospective client shall be conducted by a representative that is either registered or

qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

A copy of WT Wealth Management's current written disclosure statement discussing WT Wealth Management's registrations,

business operations, services, and fees is available at the SEC's investment adviser public information website (www.

adviserinfo.sec.gov) or from WT Wealth Management directly.

WT Wealth Management does not make any representations or warranties as to the accuracy, timeliness, suitability,

completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to WT Wealth

Management's web site or incorporated therein, and takes no responsibility therefor. All such information is provided solely

for convenience purposes and all users thereof should be guided accordingly.