"A new report by Bank of America Securities (a.k.a. Merrill Lynch) has been met with great fanfare in the investment industry. The headline is that the conventional wisdom of investing 60% of your portfolio in stocks and 40% in bonds may no longer be viable."

(A)

Is this true? Is one of the most time-tested and oft-used models in the investment industry no longer investable? As recently as 10 years ago many "experts" claimed that the only asset allocation model anyone ever needed was the 60/40 allocation, which has clearly stood the test of time.

According to Vanguard, a portfolio invested 60% in stocks and 40% in bonds generated a compound annual return of 8.6% going back to 1926.

(B) That's a stretch that includes the Great Depression, World War II, the stagflation of 1970s, the tech bubble and bust, and the 2008 meltdown. It's a very compelling result, especially considering that equities have returned only slightly more than 10% over the same period of time.

(C)

So what has changed? The long answer is everything and the short answer is interest rates.

Even in the last 20 years we have seen the 60/40 model returns slow from the previously mentioned back-tested results from 1929 of 8.6%. "The average return for a 60/40 has declined to about 6% over the most recent 20 years and Morgan Stanley forecasts just a 2.8% average annual return over the next 10 years for a 60/40 portfolio."

(D) The cause? Interest rates are generationally low and many economists predict rates could remain at these levels for up to 5 years.

(D)

The 60/40 Asset Allocation Model

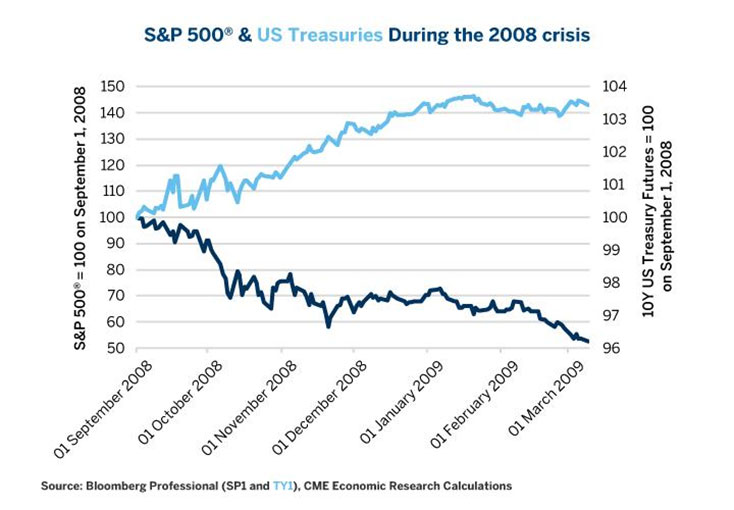

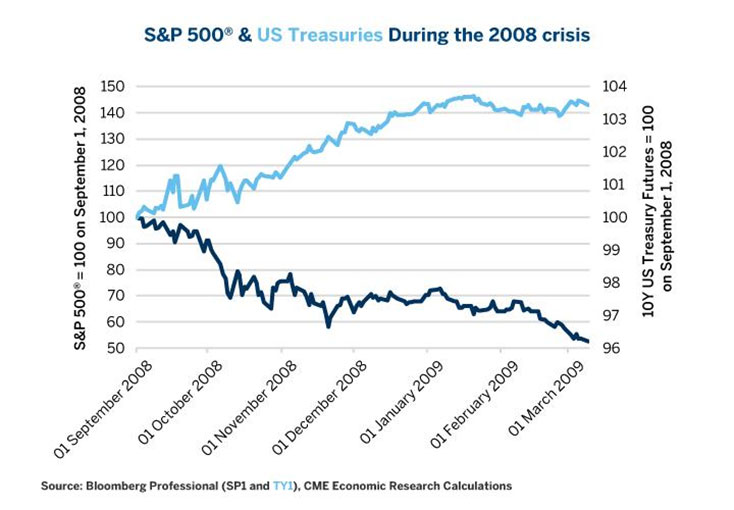

To understand the real risk to the 60/40 strategy, it's first helpful to understand the dynamics that have made the portfolio such a winner over time. One of the performance drivers is that in short time periods, bonds and stocks tend to move inversely to each other.

When investors are bullish on risky assets, they tend to sell out of less risky assets like treasuries and corporate bonds. Conversely, when investors are fearful and stocks are struggling, they find safety in bonds, which benefit from increased buying (pulling prices higher) and from interest rate cuts from the Federal Reserve.

This historical inverse correlation between bonds and equities dampens volatility for the 60/40 portfolio and has produced compelling returns. This chart from the 2008/2009 financial crisis clearly depicts this inverse relationship and the benefits of asset class diversification between U.S. Treasuries and Equities.

However, with yields on corporate bonds and Treasuries near all-time lows, the chorus of naysayers toward the 60/40 portfolio has grown considerably. The criticism is based on the very reasonable basis that an investor will not be paid very much to hold bonds in the current market and there isn't much room left for capital appreciation out of those bonds since interest rates are near zero.

Digging Deeper into the 40% Allocation -- Bond Math

Bond math, as far as the household investor is concerned, consists of three basic variables that produce one basic result. First, the variables:

- Coupon rate (i.e., the annual interest rate being paid on the bond),

- Price (i.e., what an investor has to pay to purchase the bond) and

- Maturity (i.e., how long is the term of the bond, in other words, when do you get your money back).

These variables combine to produce one basic result: current yield (i.e., what return are you actually receiving in your portfolio). After all the bond math is done, current yield very closely reflects current interest rates for the various bond types and maturities.

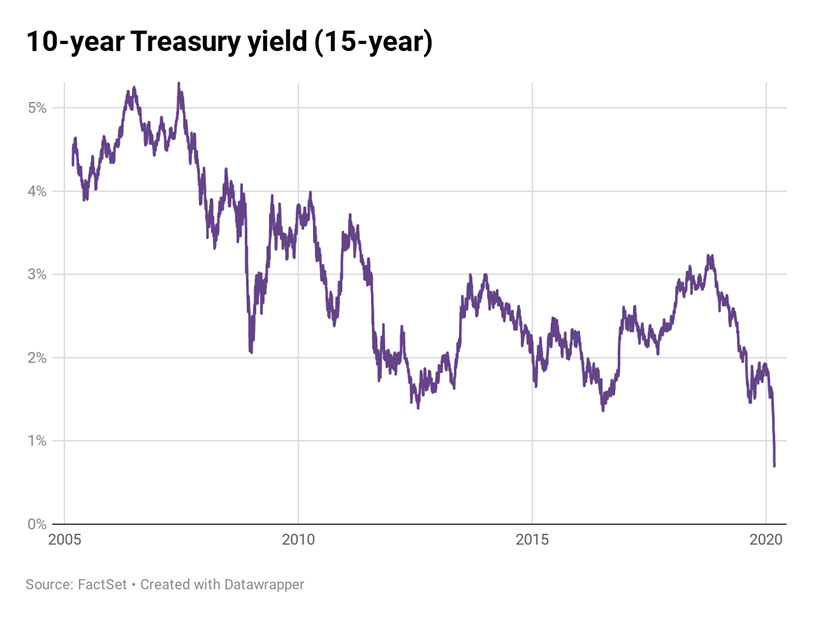

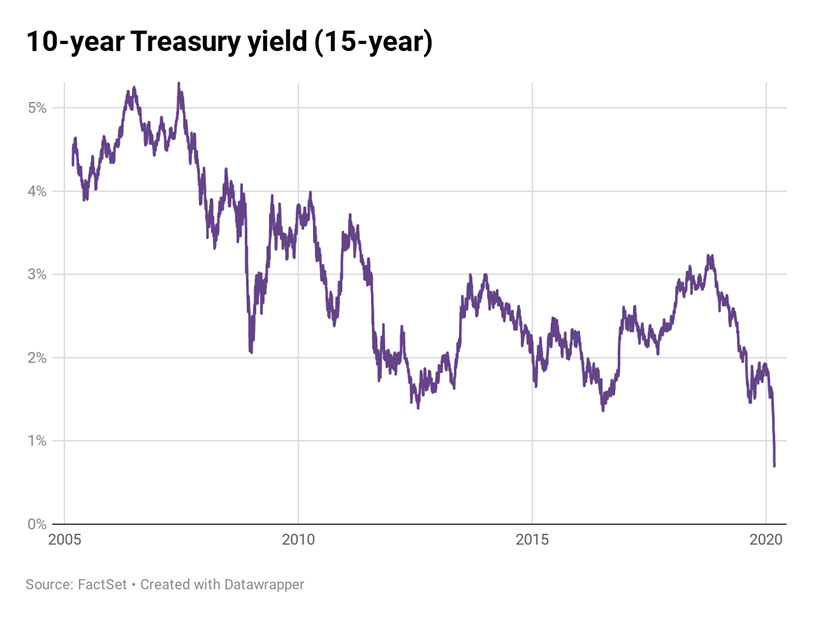

When you invest in a low interest rate environment, you have greater risk that rates will go up before they go down any further. When interest rates rise, bond prices go down (conversely, when interest rates go down bond prices go up). This chart clearly shows the inverse relationship.

Most investors have never seen a long period of time when interest rates only move higher. However, it is becoming more likely as rates hover near zero. Since the Federal Reserve appears unwilling to make US interest rates negative, as many European and Asian countries have done, it will be nearly impossible for bond interest rates to go much lower. So we'll consider where we are today as the generational low for interest rates.

If rates stay the same (or inch even slightly lower), your bond portfolio will retain its value or increase slightly. However, the rate of growth will be low, since your return will basically be your coupon interest rate on 40% of your portfolio and that could be well under 2%, more likely 1-1.5%.

(A)

We could go back as far as 1981 when the 10-year treasury yielded over 15% or even 1994 when it reached 8%, but let's just look back 15 years ago when the yield of the benchmark 10-year treasury oscillated between 4 & 5%. On the surface, 5% may not get many investors excited but when you can get 50% of the return of the long-term historical average of the S&P 500 in 40% of your portfolio it's easier to understand why a 60/40 portfolio would produce a satisfying result.

What that means is that in today's generationally-low bond interest market there is a big, gaping hole where reasonable returns on bonds used to be. In the 60/40 model that hole is 40% of your portfolio.

Digging Deeper into the 60% Allocation -- Stock Math

The long-term historical return of the S&P 500 with dividends is roughly 10%. About 2% of that total return is attributable to dividends, so with the advent of tech companies in the S&P 500 we'll likely see less dividends in the future compared to the past. The S&P 500 never got truly cheap during the coronavirus bear market. Yes, the market dropped 35% in record time, which brought it down to something closer to "fair value." But at no point did it ever approach anything close to the lows seen in previous bear markets. Furthermore, those lows were short-lived. The market ripped higher in April and May and from November 15th of 2019 to November 15th of 2020 the S&P 500 stands 18% higher.

Historical comparisons should always be taken with a grain of salt.

Interest rates are lower today, which means that, all else being equal, stock prices are expected to be higher. The S&P 500 is also more dominated by tech companies that should, all else being equal, trade at higher valuations than long-standing industrial firms. However, expecting the S&P 500 to continue producing an average return with dividends of 10% over the next decade seems like a real stretch. The gas in the 60/40 portfolio is more likely to be watered down than in the past, which will drag on overall returns of this component of the 60/40 portfolio.

Possible Future Outcomes -- The 60/40 Model

The 10-year Treasury today yields 0.95%. A more diversified basket of bonds, such as the U.S. Aggregate Bond Index (ETF: AGG) yields a little better at 2.45%. We'll be generous and use that as our return assumption for bonds. As we said above, expecting the average historical S&P 500 return with dividends to remain at 10% is probably over optimistic. So let's be realistic and use 9% as our return assumption for stocks.

If we invest 40% of the portfolio in bonds, yielding 2.45%, and 60% of the portfolio in stocks, returning 9.00%, that produces a projected portfolio return of 6.38% (2.45%*.40=0.98% plus 9.00%*.60=5.40%) - not all that bad assuming the S&P 500 can maintain a 9% average return in a COVID world with an administration change in the White House.

However, Blackrock is projecting the forward-looking 10-year annualized return for US Equities and Aggregate Bonds to be 5.80% and 0.08% respectively. This performance would produce a traditional 60/40 portfolio annualized return of just 3.51% over the next decade (0.08% x .40 = 0.03% plus 5.80% x .60 = 3.48%).

(E)

When you take into account inflation eroding your spending power, taxes taking a slice of the pie and compensation to your financial advisor, you can begin to understand why we believe that the 60/40 portfolio is challenged, or at least on life-support for the next decade. In our opinion, there's not enough meat on the bone for the risk an investor is taking.

Summary

The point of this paper is a wake-up call, prompting you to visit with your financial advisor to review your asset allocation model. In addition to discussing volatility and risk, really delve into what your return requirements are to live the retirement you have always envisioned.

If your retirement planning projections "need" an 8% return to meet your target (ask your advisor about our tool - iRetire), you might need to consider investing more aggressively into a 70/30 or even an 80/20 asset allocation model.

Other options you can discuss with your financial advisor include being a little more creative in your equity allocations. You can leave a good chunk of your investments in a 60/40 portfolio but also carve out some space in the equity portion for more active strategies, seek out higher growth rate industries like technology, increase allocations to potentially alpha-adding thematic/sector investing or even alternative investments.

But no matter the time period or the circumstances, one of the "riskiest" thing an investor can ever do is carry on as if nothing has changed. Things do change. Things are changing. Whether or not the 60/40 portfolio is dead, it's certainly not priced to deliver the returns many investors, and even advisors, have become accustomed to over the last several decades.

At WT Wealth Management, we generally adopt an optimistic outlook, and when we err it's usually on the side of being too optimistic. But the numbers here are pretty straightforward. It's just math. And 2+2 is always 4.

SOURCES:

(A) https://www.forbes.com/sites/robisbitts2/2019/10/18/bank-of-america-says-60-40-portfolios-are-dead-theyre-right/#6838e423991a

(B) https://personal.vanguard.com/us/insights/saving-investing/model-portfolio-allocations

(C) https://www.investopedia.com/ask/answers/042415/what-average-annual-return-sp-500.asp

(D) https://www.investopedia.com/why-morgan-stanley-says-the-60-40-portfolio-is-doomed-4775352#

(E) https://www.blackrock.com/us/individual

WT Wealth Management is an SEC registered investment adviser, with in excess of $100 million in assets under management

(AUM) with offices in Flagstaff, Scottsdale, Sedona and Tucson, AZ along with Jackson Hole, WY and Las Vegas, NV.

WT Wealth Management is a manager of Separately Managed Accounts (SMAs). With SMAs, performance can vary widely

from investor to investor as each portfolio is individually constructed and managed. Asset allocation weightings are

determined based on a wide array of economic and market conditions the day the funds are invested. In an SMA, each

investor may own individual Exchange Traded Funds (ETFs), individual equities or mutual funds. As the manager we have

the freedom and flexibility to tailor the portfolio to address an individual investor's personal risk tolerance and investment

objectives - thus making the account "separate" and distinct from all others we manage.

An investment with WT Wealth Management is not insured or guaranteed by the Federal Deposit Insurance Corporation

(FDIC) or any other government agency.

Any opinions expressed are the opinions of WT Wealth Management and its associates only. Information offered is neither

an offer to buy or sell securities nor should it be interpreted as personal financial advice. Always seek out the advice of

a qualified investment professional before deciding to invest. Investing in stocks, bonds, mutual funds and ETFs carries

certain specific risks and part or all of an account's value can be lost.

In addition to the normal risks associated with investing, narrowly focused investments, investments in smaller companies,

sector and/or thematic ETFs and investments in single countries typically exhibit higher volatility. International, Emerging

Market and Frontier Market ETFs, mutual funds and individual securities may involve risk of capital loss from unfavorable

fluctuations in currency values, from differences in generally accepted accounting principles or from economic or political

instability that other nations experience. Individual bonds, bond mutual funds and bond ETFs will typically decrease in

value as interest rates rise. A portion of a municipal bond fund's income may be subject to federal or state income taxes or

the alternative minimum tax. Capital gains (short and long-term), if any, are subject to capital gains tax.

Diversification and asset allocation may not protect against market risk or investment losses. At WT Wealth Management, we

strongly suggest having a personal financial plan in place before making any investment decisions including understanding

personal risk tolerance, having clearly outlined investment objectives and a clearly defined investment time horizon.

WT Wealth Management may only transact business in those states in which it is registered, or qualifies for an exemption

or exclusion from registration requirements. Individualized responses to persons that involve either the effecting of

transactions in securities, or the rendering of personalized investment advice for compensation, will not be made without

registration or exemption. WT Wealth Management's website is limited to the dissemination of general information

pertaining to its advisory services, together with access to additional investment-related information, publications, and

links.

Accordingly, the publication of WT Wealth Management's website should not be construed by any consumer and/or

prospective client as WT Wealth Management's solicitation to effect, or attempt to effect transactions in securities, or the

rendering of personalized investment advice for compensation, over the internet. Any subsequent, direct communication

by WT Wealth Management with a prospective client shall be conducted by a representative that is either registered or

qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

A copy of WT Wealth Management's current written disclosure statement discussing WT Wealth Management's registrations,

business operations, services, and fees is available at the SEC's investment adviser public information website (www.

adviserinfo.sec.gov) or from WT Wealth Management directly.

WT Wealth Management does not make any representations or warranties as to the accuracy, timeliness, suitability,

completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to WT Wealth

Management's web site or incorporated therein, and takes no responsibility therefor. All such information is provided solely

for convenience purposes and all users thereof should be guided accordingly.