If 2020 was the year that upended personal lives, workplaces, and how we view health and safety, it may also become known as the year we reached another tipping point in how we invest.

ESG (Environmental, Social and corporate Governance) investing, also known as "sustainable investing", refers to investments that seek positive returns, while taking into consideration the operating structure and behaviors of a business and its long-term beneficial impact on society and the environment (or at least a standard of "do no harm").

(1)

ESG Causes

Following are examples of ESG causes:

Environmental risks created by business activities have actual or potential negative impact on air, land, water, ecosystems and human health. Company activities considered ESG factors include managing resources and preventing pollution, reducing emissions and climate impact, and environmental reporting or disclosure.

Social risks refer to the impact that companies can have on society. These include company programs such as promoting health and safety, encouraging labor-management relations, protecting human rights and focusing on product integrity.

Governance risks concern the way companies are run. It could include corporate brand independence and diversity, corporate risk management, excessive executive compensation, increasing diversity and accountability of the board, protecting shareholders and their rights, and reporting and disclosing information.

(1)

What is the Appeal of ESG Investing?

Many investors are not only interested in the financial outcomes of their investments, but also in the impact of their investments and the role their assets can have in promoting global issues.

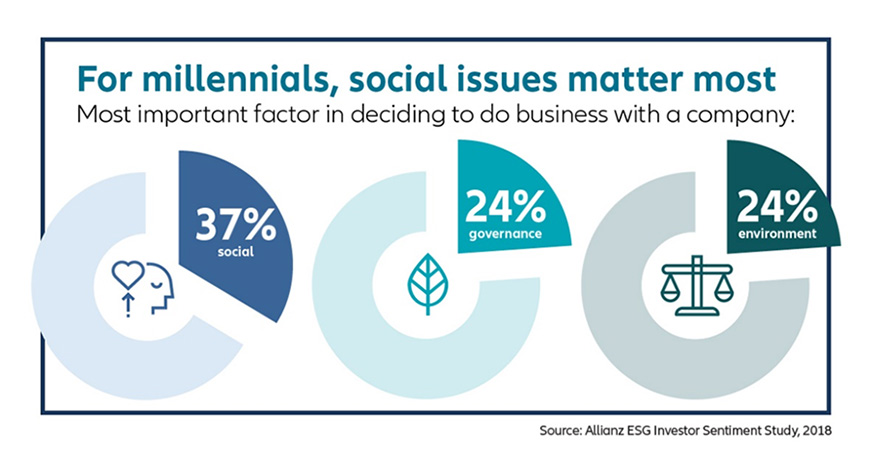

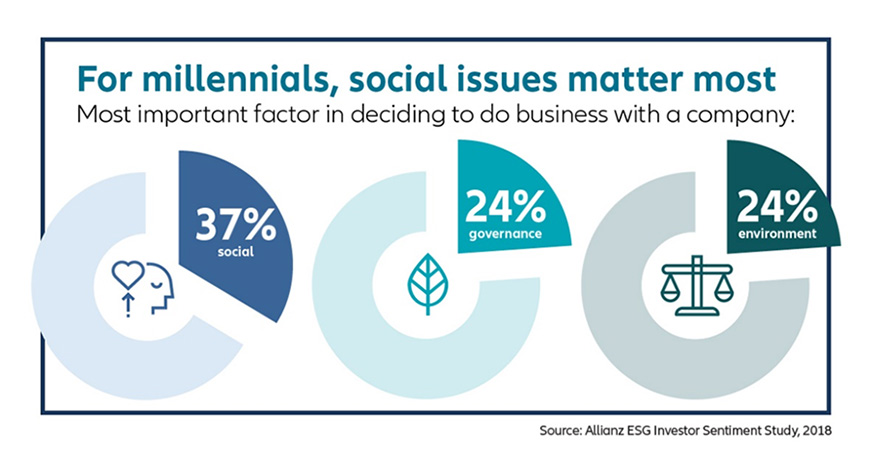

According to the 2006 Cone Millennial Cause Study, millennials (i.e., those born during the 1981 to 1996 time period) are more likely to trust a company or purchase a company's products when the company has a reputation of being socially or environmentally responsible. Half of those surveyed are more likely to turn down a product or service from a company perceived to be socially or environmentally irresponsible.

(2)

The Study also shows that 61% of millennials feel personally responsible for making a difference in the world. This civic-minded generation, which is 78 million strong, not only believes it is their responsibility to make the world a better place, they believe companies have a responsibility to join them in this effort.

Other key findings include:

- 83% of Americans will trust a company more if it is socially/environmentally responsible

- 74% of Americans are more likely to pay attention to a company's message when they see that the company has a deep commitment to a cause

- 56% would refuse to work for an irresponsible corporation

ESG investing Doesn't Mean Accepting Lower Returns or Additional Risk

A 2019 white paper produced by the Morgan Stanley Institute for Sustainable Investing compared the performance of sustainable funds to traditional funds and found that from 2004 to 2018, the total returns of sustainable mutual and exchange-traded funds were similar to those of traditional funds.

The same Morgan Stanley study found, during turbulent markets such as in 2008, 2009, 2015 and 2018, that traditional funds had significantly larger downside deviation than sustainable funds, meaning traditional funds had a higher potential for loss.

(3)

Performance During Coronavirus

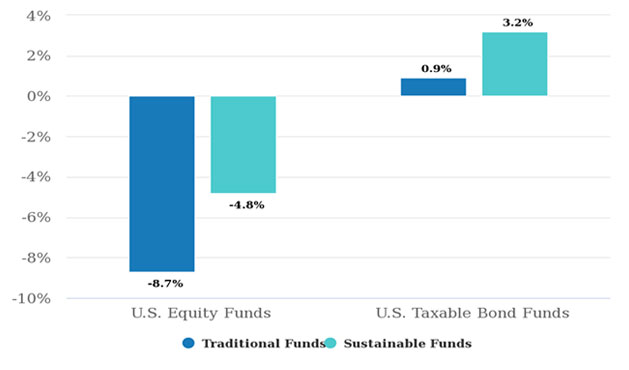

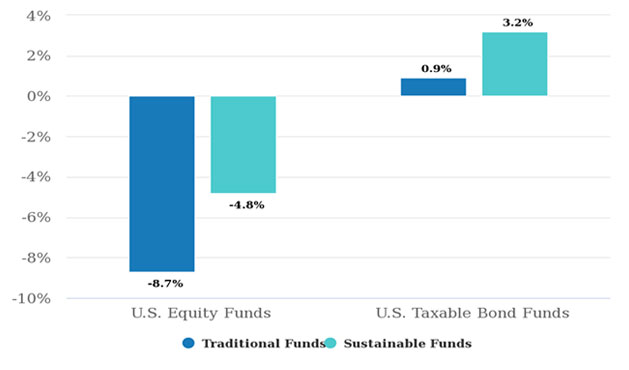

Sustainable funds outperformed traditional peer funds and reduced investment risk during coronavirus, according to a similar 2020 report from Morgan Stanley.

(4)

An analysis of more than 1,800 U.S. mutual funds and exchange-traded funds (ETFs) shows that while the coronavirus pandemic induced a global recession and months of severe market volatility in the first half of 2020, sustainable equity funds weathered the period better than portfolios without an ESG focus a median of 3.9% in the first six months of the year (-8.7% for traditional funds versus -4.8% for sustainable funds).

During the same period, sustainable taxable bond funds beat their non-ESG counterparts by a median of 2.3% (0.9% for traditional bond funds versus 3.2% for sustainable bond funds).

January 1st to June 30th 2020 Median Returns

Source: Morgan Stanley

Outperformance Is Increasing Interest in ESG Investing

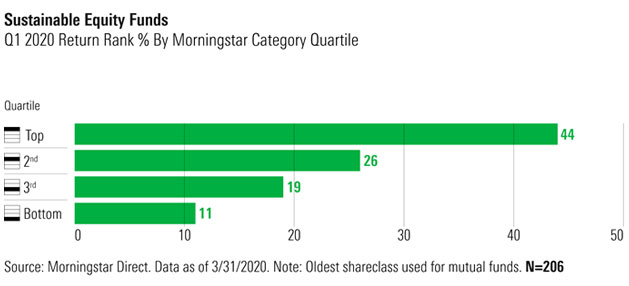

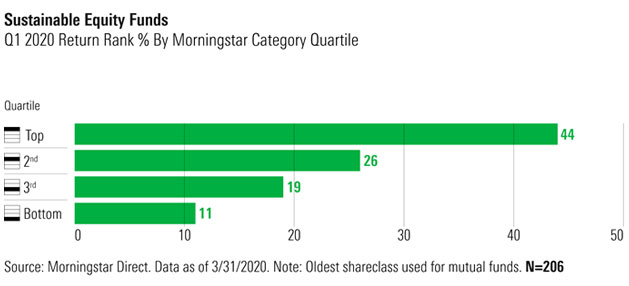

A strong relative performance in the first quarter of 2020 and heightened awareness about social issues is shining a spotlight on ESG investing.

Of course, ESG funds lost money during the market selloff, but they lost less than the broader market during that time, according to a Morningstar report.

(5) During the first quarter, the returns of 70 percent of sustainable equity funds ranked in the top halves of their categories, and 44 percent ranked in their category's best quartile, the firm said.

Social Issues Becoming More Important

The impact of the global economic shutdown, brought about by the pandemic, threw millions out of work in the U.S., producing one of the highest unemployment rates in recent memory. This led to a focus on workplace issues, including safety, flexibility and healthcare. Concurrently, the murder of George Floyd and protests over systemic racism brought a new awareness of racial diversity and equal opportunity and treatment - or too often the lack thereof.

A July 2020 BNP Paribas Asset Management survey about ESG considerations during the COVID-19 crisis indicated that social issues are gaining prominence among investors and social considerations need to be taken into account in investment decision-making. The survey showed that 81% of respondents already take ESG considerations into account in all or part of their portfolios, with a further 16% planning to do so. The leading reasons were to positively impact society or the environment (80%), reduce risk (58%) and meet stakeholder needs (47%).

(6)

A company that delivers stellar stock performance, but pollutes the environment, treats its staff poorly, or does not employ a diversified workforce reflecting its market demography, is a stock that investors are increasingly choosing to shun.

Conclusion

The growth of ESG investment can be attributed to a number of factors, but ultimately it is the individual investor, of whatever background, demanding that investment managers put their money to work, not only to deliver strong risk adjusted returns, but also to 'do good'. Investors are now choosing to invest in companies that reflect their values and goals.

At WT Wealth Management, we believe that ESG considerations are beginning to differentiate companies to a much greater extent than they have in the past. In our opinion, as we move into the future, winners and losers will be determined not only by short-term results reflected on corporate balance sheets, but also in the longer-term context of environmental, labor, and social standards, as well as corporate governance practices.

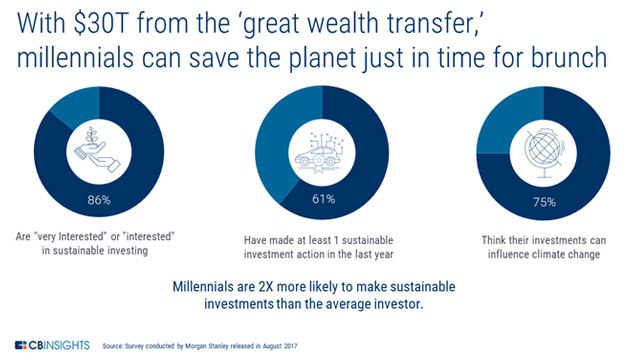

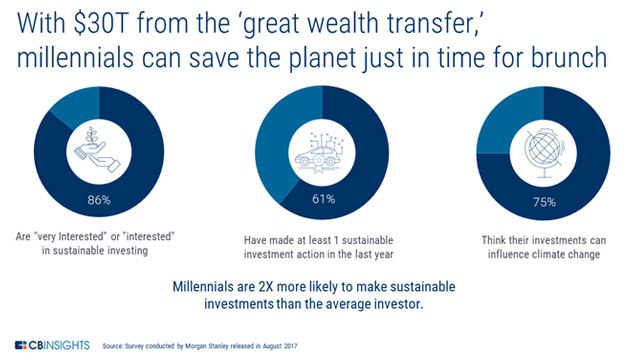

During the pandemic, stay-at-home orders around the world, combined with the economic pain unleashed by COVID-19, have resulted in more forced family togetherness. The growing dialogue between parents and their children has naturally flowed into discussions about estate planning, planned giving and family philanthropy as a means to enact real societal changes. ESG investing may serve as a bridge between Boomers who are desperately trying to hold on to their youthful dreams of making the world a better place and their children who want to ensure that their actions, including their investments, are aligned with their values. Ultimately, this may create a powerful intergenerational vision for the family's investments.

The entire financial services industry expects an enormous transfer of wealth from Boomers to their children in the next 15 years. We expect this transfer to fuel the growth in ESG investing over the next several decades.

WT Wealth Management offers several ESG alternatives to our established models. Please do not hesitate to reach out to your advisor if you would like to learn more about ESG investing as part of your overall portfolio. We look forward to hearing from you.

SOURCES:

(1)https://en.wikipedia.org/wiki/Environmental,_social_and_corporate_governance

(2)https://economictimes.indiatimes.com/topic/The-Cone-Millennial-Cause-Study

(3)https://www.morganstanley.com/what-we-do/institute-for-sustainable-investing

(4)https://www.morganstanley.com/press-releases/morgan-stanley-sustainable-reality-report-reveals-sustainable-fu/

(5)https://www.morningstar.com/articles/976361/sustainable-funds-weather-the-first-quarter-better-than-conventional-funds

(6)https://mediaroom-en.bnpparibas-am.com/news/bnp-paribas-asset-management-survey-shows-covid-19-prompts-rise-in-social-considerations-within-investment-decision-making-8e57-0fb7a.html

WT Wealth Management is an SEC registered investment adviser, with in excess of $100 million in assets under management

(AUM) with offices in Flagstaff, Scottsdale, Sedona and Tucson, AZ along with Jackson Hole, WY and Las Vegas, NV.

WT Wealth Management is a manager of Separately Managed Accounts (SMAs). With SMAs, performance can vary widely

from investor to investor as each portfolio is individually constructed and managed. Asset allocation weightings are

determined based on a wide array of economic and market conditions the day the funds are invested. In an SMA, each

investor may own individual Exchange Traded Funds (ETFs), individual equities or mutual funds. As the manager we have

the freedom and flexibility to tailor the portfolio to address an individual investor's personal risk tolerance and investment

objectives - thus making the account "separate" and distinct from all others we manage.

An investment with WT Wealth Management is not insured or guaranteed by the Federal Deposit Insurance Corporation

(FDIC) or any other government agency.

Any opinions expressed are the opinions of WT Wealth Management and its associates only. Information offered is neither

an offer to buy or sell securities nor should it be interpreted as personal financial advice. Always seek out the advice of

a qualified investment professional before deciding to invest. Investing in stocks, bonds, mutual funds and ETFs carries

certain specific risks and part or all of an account's value can be lost.

In addition to the normal risks associated with investing, narrowly focused investments, investments in smaller companies,

sector and/or thematic ETFs and investments in single countries typically exhibit higher volatility. International, Emerging

Market and Frontier Market ETFs, mutual funds and individual securities may involve risk of capital loss from unfavorable

fluctuations in currency values, from differences in generally accepted accounting principles or from economic or political

instability that other nations experience. Individual bonds, bond mutual funds and bond ETFs will typically decrease in

value as interest rates rise. A portion of a municipal bond fund's income may be subject to federal or state income taxes or

the alternative minimum tax. Capital gains (short and long-term), if any, are subject to capital gains tax.

Diversification and asset allocation may not protect against market risk or investment losses. At WT Wealth Management, we

strongly suggest having a personal financial plan in place before making any investment decisions including understanding

personal risk tolerance, having clearly outlined investment objectives and a clearly defined investment time horizon.

WT Wealth Management may only transact business in those states in which it is registered, or qualifies for an exemption

or exclusion from registration requirements. Individualized responses to persons that involve either the effecting of

transactions in securities, or the rendering of personalized investment advice for compensation, will not be made without

registration or exemption. WT Wealth Management's website is limited to the dissemination of general information

pertaining to its advisory services, together with access to additional investment-related information, publications, and

links.

Accordingly, the publication of WT Wealth Management's website should not be construed by any consumer and/or

prospective client as WT Wealth Management's solicitation to effect, or attempt to effect transactions in securities, or the

rendering of personalized investment advice for compensation, over the internet. Any subsequent, direct communication

by WT Wealth Management with a prospective client shall be conducted by a representative that is either registered or

qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

A copy of WT Wealth Management's current written disclosure statement discussing WT Wealth Management's registrations,

business operations, services, and fees is available at the SEC's investment adviser public information website (www.

adviserinfo.sec.gov) or from WT Wealth Management directly.

WT Wealth Management does not make any representations or warranties as to the accuracy, timeliness, suitability,

completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to WT Wealth

Management's web site or incorporated therein, and takes no responsibility therefor. All such information is provided solely

for convenience purposes and all users thereof should be guided accordingly.