What is cryptocurrency? How best to say this? You know that feeling when your teenager asks for help on a school assignment and you quickly realize that you might be in over your head? We have to admit up front that even after researching and writing this White Paper, we're still not sure we fully understand all the ins and outs of cryptocurrency. With that encouraging disclosure in place, let's get right to it.

Cryptocurrencies, or virtual currencies, are digital means of exchange created and used by private individuals or corporations. As opposed to traditional "fiat" currencies, cryptocurrencies are generally not regulated by national governments and are considered alternative currencies – mediums of financial exchange that exist outside the bounds of traditional monetary policy. Cryptocurrencies have value not by the backing of gold or a nation, but by the result of supply and demand and what investors (speculators) are willing to pay. Finite supply, ease of use, social adoption, anonymity, security, and lack of confidence in the fiscal responsibility of national governments and central banks are all contributing factors to the value of cryptocurrencies.

Cryptocurrencies are one application of the relatively new technology known as blockchain. Blockchain, in its essence, is simply a type of electronic database. Where traditional databases utilize spreadsheet-type structures to organize data, blockchain works, as the name implies, by storing information in "blocks" and "chaining" them together. The key advantage of blockchain is that the chaining process creates a transaction ledger that is validated by multiple independent sources and is irreversible. Besides cryptocurrency, blockchain technology is being developed in other areas, such as supply chains, healthcare, property records, smart contracts (i.e., contracts established with specific conditions that, once met, will automatically execute), and even voting.

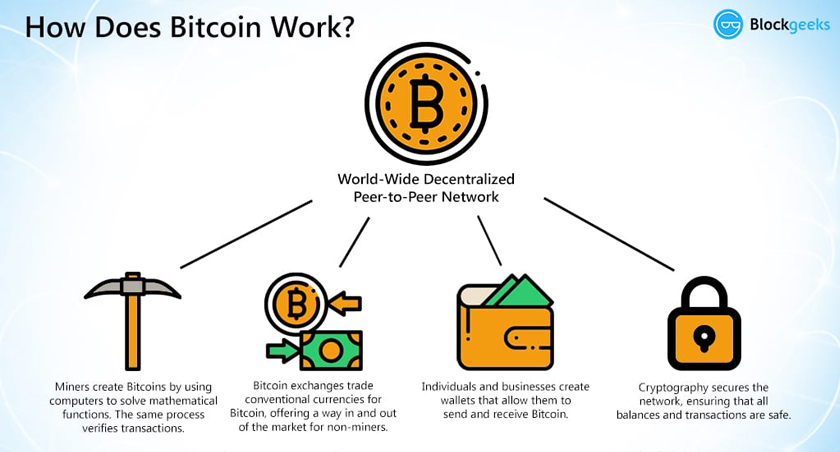

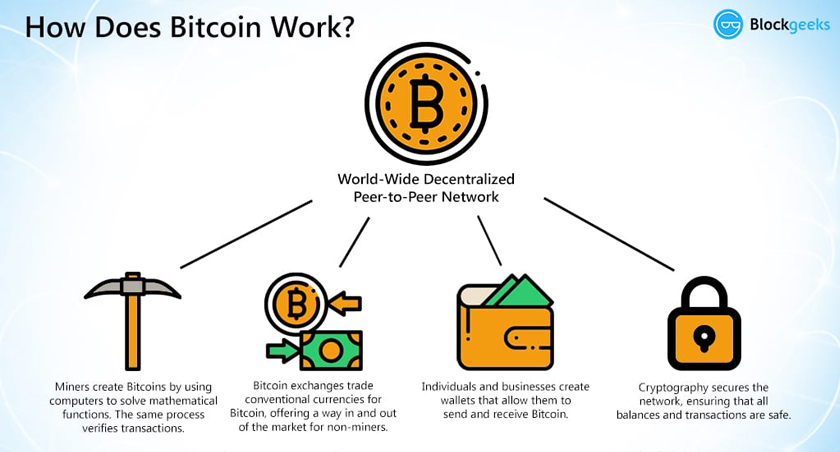

(1)

Although there are hundreds of cryptocurrencies in active use today, Bitcoin is the preeminent cryptocurrency and most widely accepted around the globe. It is controlled by a decentralized network of users and many proponents feel it is the closest cryptocurrency equivalent to traditional, state-minted currencies.

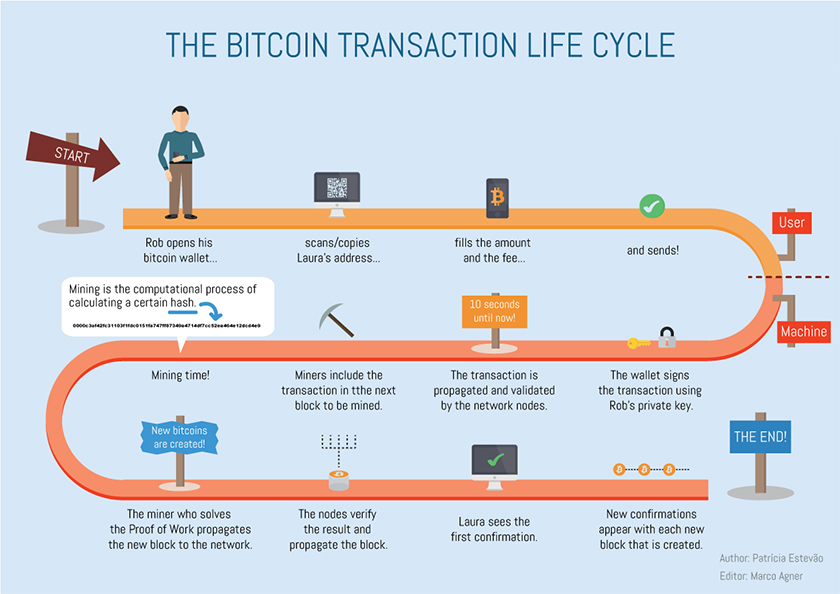

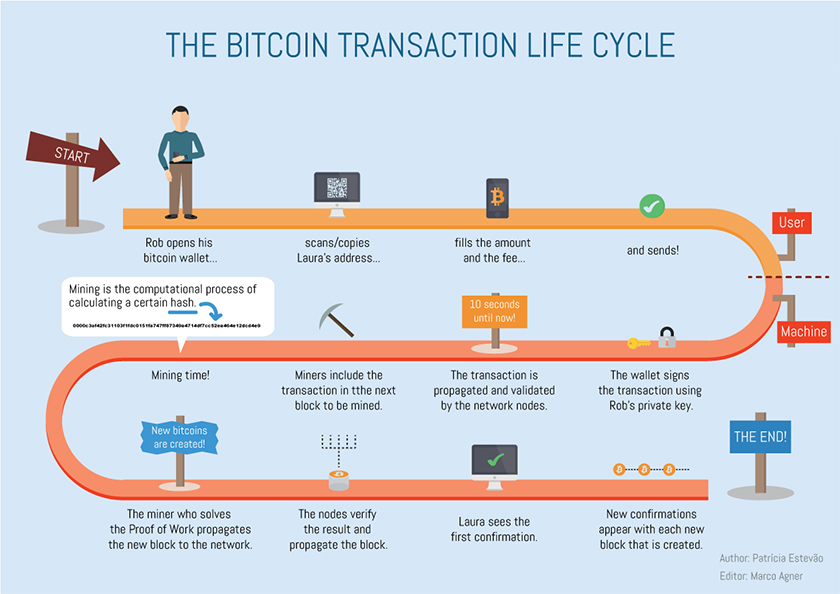

(2)

Bitcoin and the Modern Cryptocurrency Boom

Bitcoin was first outlined in a 2008 white paper published by "Satoshi Nakamoto". Some of the mystique surrounding Bitcoin is that nobody knows who or what Nakamoto is. Shortly thereafter, in early 2009, Nakamoto released Bitcoin to the public, and a group of enthusiastic supporters began mining and exchanging the currency. By late 2010, the first of what would eventually be dozens of similar cryptocurrencies – including popular alternatives like Litecoin – began appearing in digital wallets.

(3)

Finite Supply

Most cryptocurrencies are characterized by finite supply. Their source codes contain instructions outlining the precise number of units that will ever exist. Over time, it becomes more difficult for miners to produce cryptocurrency units, as the upper limit is reached and new currency ceases to be minted altogether.

The finite supply of cryptocurrencies makes them inherently scarce – more akin to finite supplies of gold and other precious metals than national currencies, which can theoretically be produced in unlimited supply by central banks. Bitcoin reduces the rate at which it can be mined by half approximately every four years, as a means to effectively lower the growth rate of the supply.

Miners

The cryptocurrency world adopted the term "miners" to reflect the fact that their digital work literally creates wealth in the form of brand-new cryptocurrency units. (Much like traditional mining produces new precious metals or gems.) From small DIY operations by individuals in their own homes to large scale server farms owned by private mining collectives, miners use vast amounts of computing capacity to solve mathematical functions built into each cryptocurrency's source code to unlock or create new blockchains of cryptocurrency. Each newly mined blockchain copy comes with a two-part monetary reward: a fixed number of newly minted cryptocurrency units and a variable number of existing cryptocurrency units collected from transaction fees charged to buyers.

Using the same highly technical computing power and techniques, miners also verify the completeness, accuracy, and security of a cryptocurrency's blockchain transactions, thus serving as record-keepers for cryptocurrency communities and indirect arbiters of the cryptocurrency's value.

Wallets

Bitcoin units are stored in "wallets" – an industry term that means secure cloud storage locations with special information confirming the individual ownership of the Bitcoin units contained therein. Bitcoin users can then transact (buy and sell) out of their wallets.

"Wallet Services" are Bitcoin exchanges, online marketplaces, and specialized websites that exist solely to store Bitcoin wallets. Wallet services, such as the well-known Coinbase, theoretically protect against the theft of Bitcoin units from wallets and facilitate buy and sell transaction out of those wallets. However, cybersecurity is a significant issue in the cryptocurrency world. The largest and most notorious Bitcoin hack involved wallets held by a Japanese Bitcoin exchange that shut down after hackers stole hundreds of millions of dollars in Bitcoin from its supposedly secure servers.

Investing in Cryptocurrency

But how does the regular guy invest in the cryptocurrency movement? Cryptocurrencies can be bought and sold through crypto exchanges (Wallets), such as Coinbase, or payment services such as PayPal, which securely store your coins and provide a marketplace to transact with other crypto currency holders, for a fee.

Alternatively, Bitcoin ETFs might soon be available in the U.S. The new chairman of the Securities and Exchange Commission, Gary Gensler, has taught courses on cryptocurrency and many see him as crypto-friendly. The first Bitcoin ETF in North America, the Toronto-listed ETF (BTCC), has amassed roughly $1 billion in assets since its February 2021 launch. Several large, U.S.-based institutions (Fidelity, Van Eck and other ETF sponsors) are seeking regulatory approval for Bitcoin ETFs.

(4) Bitcoin ETFs would provide access to investors looking to add cryptocurrency exposure to a diversified investment portfolio.

Final Word

Cryptocurrency is an exciting concept with the power to fundamentally alter global finance forever. Although, cryptocurrencies remain a technological and practical work in progress, dozens of merchants now view Bitcoin as a legitimate payment method. Given the volatility of Bitcoin prices, many merchants that accept Bitcoin payments attempt to manage risk by immediately converting them into US dollars, making the practical use of Bitcoin more akin to exchanging your Chuck E Cheese tokens for a prize before heading home. However, some high-profile companies, such as Tesla, retain Bitcoin payments and have even used excess cash reserves to purchase large investments in it (although Tesla's recent decision to no longer accept Bitcoin payments highlights the uncertainty that still surrounds cryptocurrency as a form of payment).

Cryptocurrency users, and non-users intrigued by cryptocurrency's promise, need to remain ever mindful of the concept's practical limitations. Any claims that a particular cryptocurrency confers total anonymity or immunity from legal accountability are worthy of deep skepticism, as are claims that individual cryptocurrencies represent foolproof investment opportunities or inflation hedges.

The Investment Committee at WT Wealth Management has had numerous discussions on how and when to invest in cryptocurrencies. We, like you, are intrigued by the rapid development of this new market. Our evaluations focus primarily on determining whether crypto is truly a currency (comparable to the U.S. dollar or the Japanese yen), a hard asset hedge against inflation (like Gold) or simply a speculative asset (which can have a place in a diversified portfolio). In short, we are watching and waiting for clearer signs of regulatory approval and protection and the development of more traditional investment mechanisms before proceeding with cryptocurrency holdings in client accounts.

SOURCES:

- Blockchain Definition: What You Need to Know

investopedia.com

- Cryptocurrency

wikipedia.org

- A brief history on Bitcoin & Cryptocurrencies

ledger.com

- First Bitcoin ETF in North America Hits $1 Billion in Assets

bloomberg.com