One of the economy's biggest news stories of late has been about one of its smallest components: the computer chip (often referred to as semiconductors). As technology has become the driver in nearly every aspect of our modern lives, the computer chip has become as important a "staple" as toothpaste, Q-tips and toilet paper. And shoppers are feeling it.

The ongoing semiconductor shortage is creating headaches for manufacturing, retailers and consumers alike. While this problem might be easy to dismiss as a short-lived after effect of the Covid-19 pandemic, summer 2021 is nearly over and supply chain relief is still pending.

The Covid-19 pandemic spurred unprecedented demand for consumer electronics. In the first wave people purchased computers, monitors and other gear required to work and learn remotely from home. Then, Covid-19's second wave in the Fall 2020 was accompanied by a surge in home entertainment as game consoles, TVs, smartphones and tablets flew off the shelves.

A challenge to manufacturing

Most innovative technologies adopted by consumers today rely on semiconductors. Simple examples from your home include smart door locks, home security systems, thermostats, faucets and coffee makers. In fact, over the coming years we expect nearly every household appliance to have Wi-Fi integration and smart technology powered by semiconductors. Very few "daily use" items don't rely on semiconductors: think smart phones, watches, tablets, gaming devices and even automobiles.

It is important to keep in mind the long-term, exponential increase in semiconductor demand over the next decade, which will make the sector a high-growth investible industry for years to come. That being said, there are short-term supply-chain obstacles impacting chipmaker earnings and productivity today.

To better understand the current situation, let's look at two areas of prolific chip shortage.

The Auto Industry

Production cuts in the auto industry and empty dealer parking lots have grabbed recent headlines. In the first half of 2021, Japanese carmakers reportedly reduced production by 500,000 units. And it is estimated that carmakers worldwide could lose $61 billion as a result of the chip shortage in 2021.

Modern vehicles are increasingly reliant on semiconductors for advanced brakes, electronic components, steering systems and infotainment. So missing chips can easily stall production. Some carmakers have even resorted to manufacturing cars without chips and storing them in inventory as they await these critical ingredients.

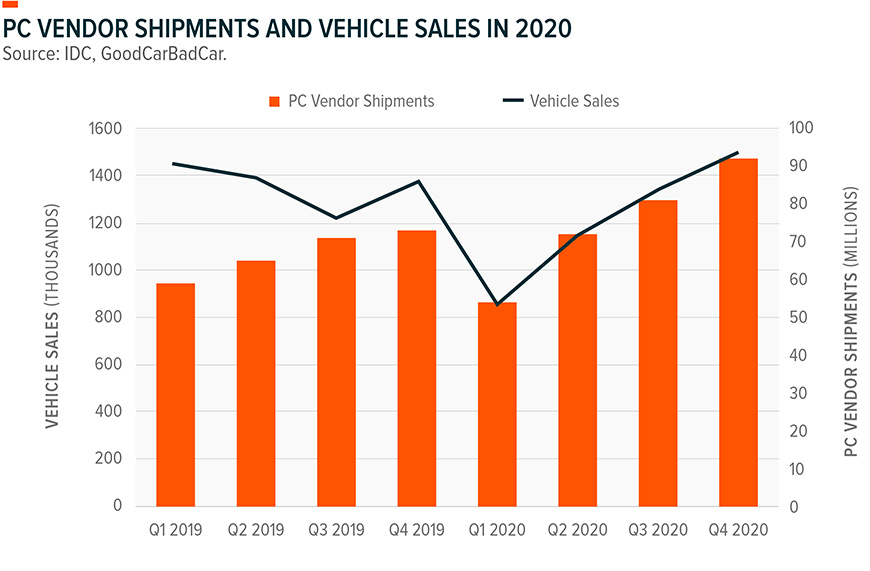

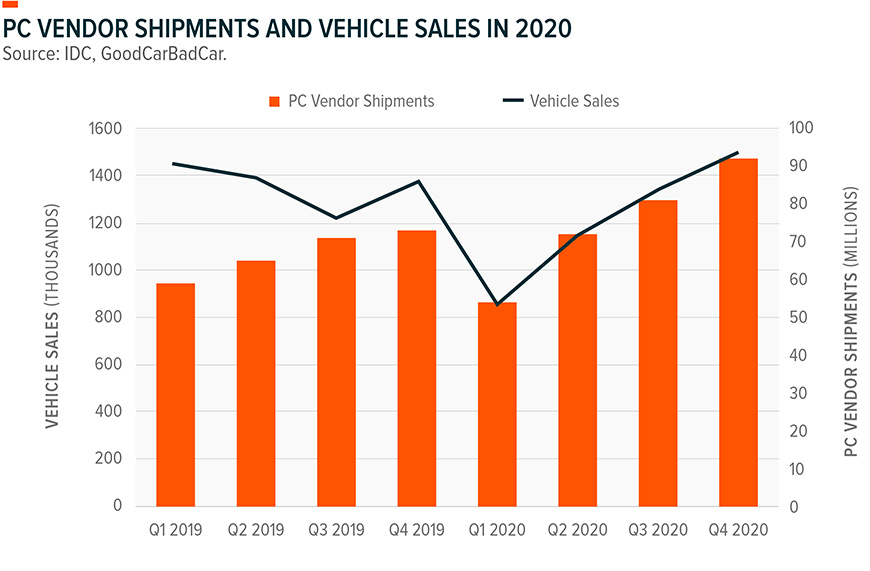

(1)

While some analysts believe the chip shortage is due primarily to electronics manufacturers buying more chips, that's only part of the story. Another reason for the shortage is the fact that automakers canceled orders last year in the midst of the Covid-19 pandemic. When auto plants shut down, automakers reduced costs by delaying chip orders. That turned out to be a mistake when other industries were eager to accept the chips. Plus, as the impacts of the pandemic waned, stronger-than-expected demand for new vehicles outpaced production ability. The industry has yet to catch up.

You'll see in the chart below that chip shipments correlate very closely with vehicle sales in the auto-industry.

5G

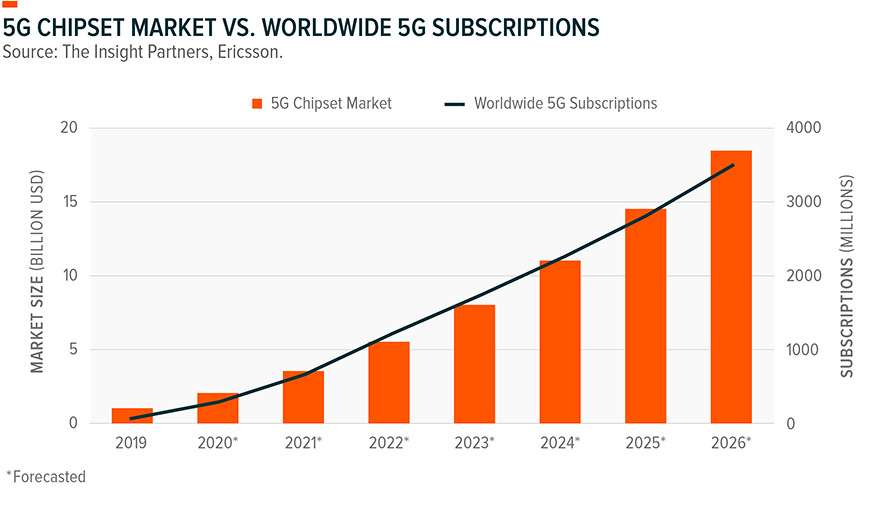

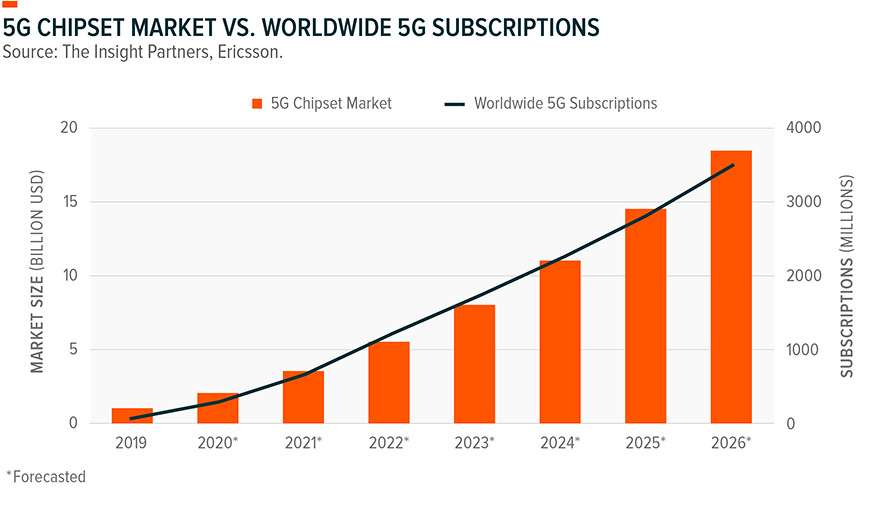

Plans to rollout 5G mobile-phone technology are already noticeably impacting computer chip demand. The higher data rates made possible by 5G are expected to be a driver of demand for advanced semiconductors. You can see in the chart below the linear correlation between chips and 5G subscriptions.

The shortage of semiconductors could create headwinds for 5G in the short run, but the actions of chipmakers suggest they believe these headwinds will not last long. Apple, which in April reported a blowout first quarter of $111 billion in revenue, told analysts it didn't have enough new iPhone supply to meet demand. However, more recently, CEO Tim Cook told Reuters that "semiconductors are very tight, but we are hopeful supplies will catch up to demand later in 2021."

(2)

Conclusion

The current trends in demand for semiconductor are indicative of the rapid pace of digitalization and the rise of disruptive, technology-focused innovations. The wide-reaching impact of the chip shortage across subindustries is a testament to how ubiquitous semiconductors have become.

(3)

The good news is that supply chains and manufacturing capabilities always catch up to meet economic demand. Currently chip manufactures around the world are increasing manufacturing capabilities to meet the projected demands of the next decade and beyond.

And that's a good reason why many of WT Wealth Management's investment strategies hold an allocation to semiconductors. We talk consistently to our clients about technology staples. Something as small as a computer chip has now become as fundamental as the more traditional staples you find in your bathroom.

Toothpaste, Q-tips, toilet paper and semiconductors... I bet you never thought you would hear that combination in the same investment white paper.

SOURCES:

- https://www.freep.com/story/money/cars/2021/06/15/car-chip-shortage-2021/7688773002/

- https://apple.slashdot.org/?issue=20210209

- https://en.yna.co.kr/view/AEN20200830001500320